Form Ct-1040Nr/Py 2022

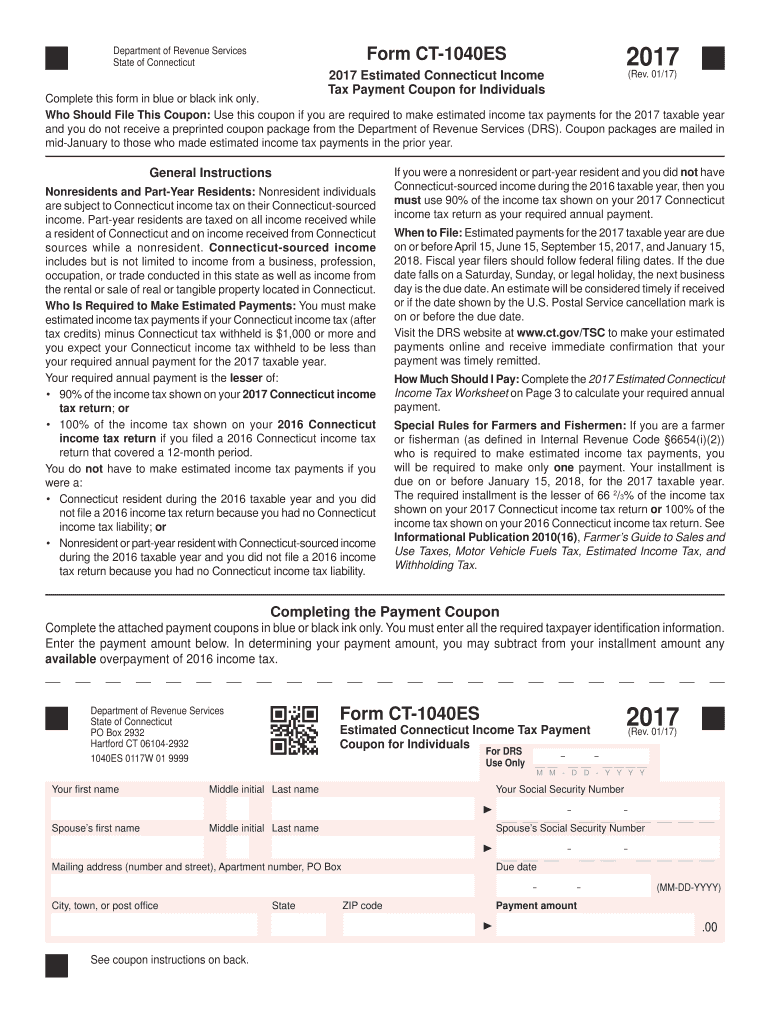

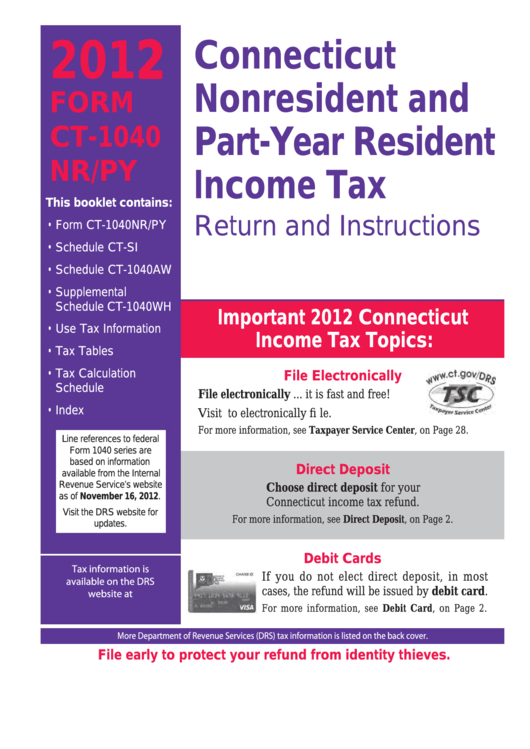

Form Ct-1040Nr/Py 2022 - This amount is considered a tax payment and will be credited against your. This form is most often used by individuals who have lived and/or worked in multiple. Web department of revenue services state of connecticut (rev. Nonresident alien income tax return. We last updated the nonresident/part. Web form 1040, line 11, or federal form 1040‑sr, line 11. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it,. • form ct‑1040nr/py • schedule ct‑si • schedule. The connecticut department of revenue services.

Web 2022 form ct‑1040, line 20b; We last updated the nonresident/part. This form is most often used by individuals who have lived and/or worked in multiple. The connecticut department of revenue services. Sign it in a few clicks draw your signature, type it,. Estimated payments for the 2022 taxable year. Nonresident alien income tax return. This booklet contains information or instructions for the following forms and schedules: Web use 90% of the income tax shown on your 2022 connecticut income tax return as your required annual payment. This amount is considered a tax payment and will be credited against your.

This booklet contains information or instructions for the following forms and schedules: With your return, mail the return with your payment to: • form ct‑1040nr/py • schedule ct‑si • schedule. Web department of revenue services state of connecticut (rev. Irs use only—do not write or. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Estimated payments for the 2022 taxable year. Web 2022 form ct‑1040, line 20b; Nonresident alien income tax return. We last updated the nonresident/part.

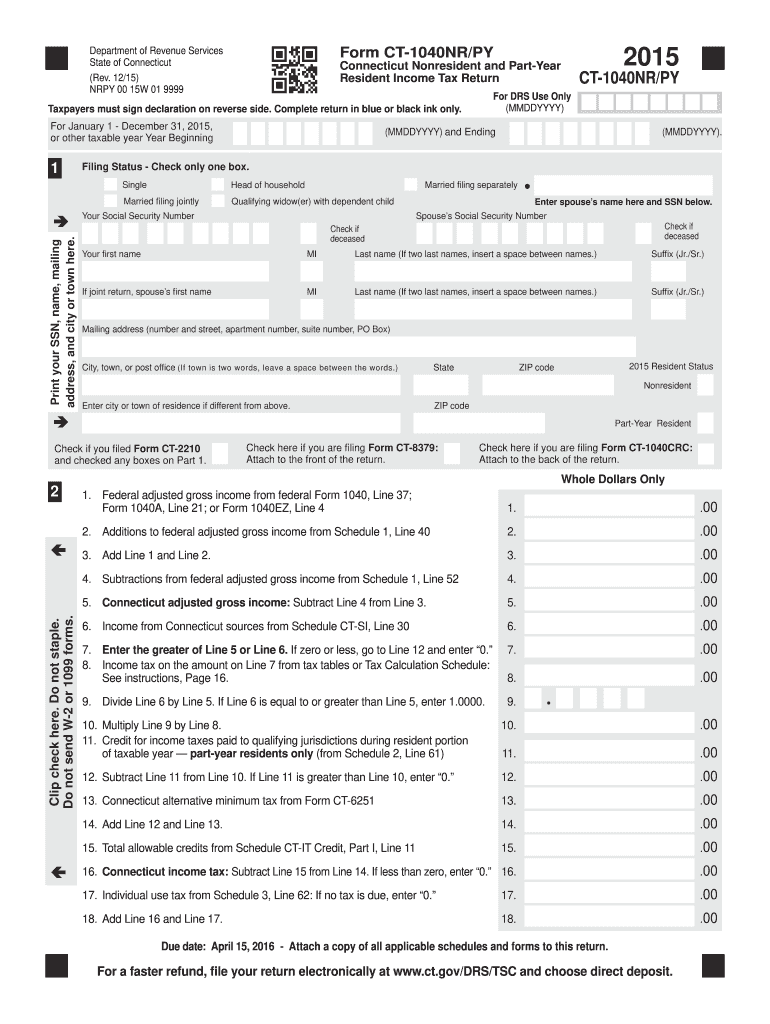

2015 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

The connecticut department of revenue services. Web form 1040, line 11, or federal form 1040‑sr, line 11. Nonresident alien income tax return. Web 2022 form ct‑1040, line 20b; This form is most often used by individuals who have lived and/or worked in multiple.

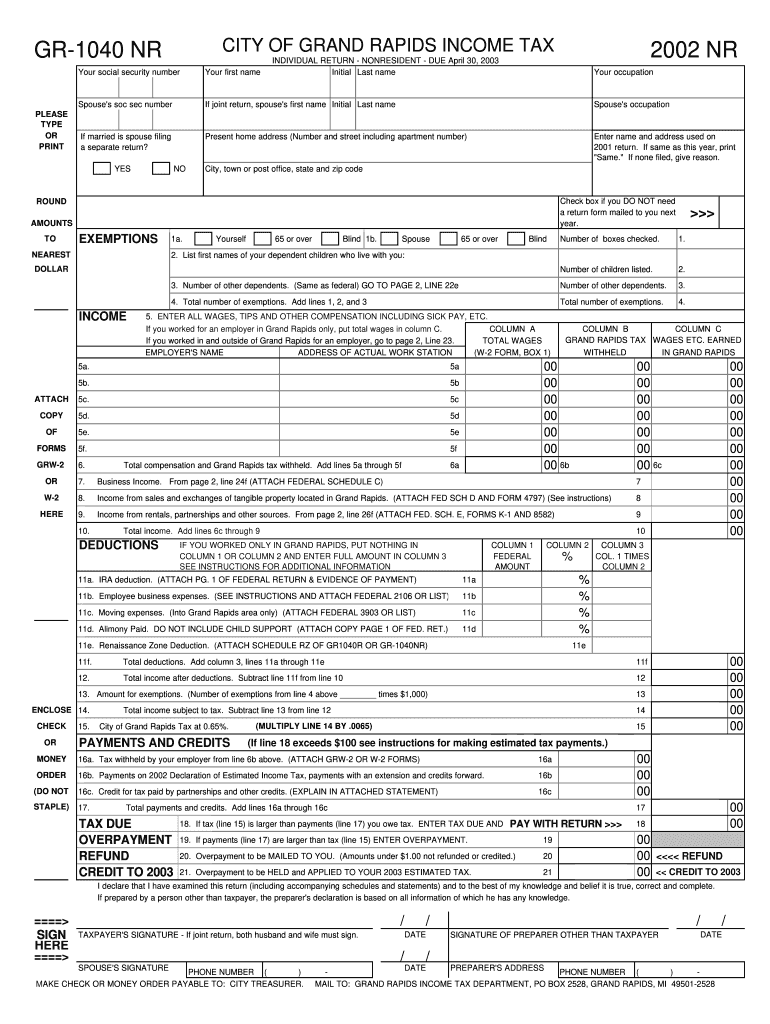

Gr 1040nr Fill Out and Sign Printable PDF Template signNow

• form ct‑1040nr/py • schedule ct‑si • schedule. Nonresident alien income tax return. Sign it in a few clicks draw your signature, type it,. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web file now with turbotax.

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Web file now with turbotax. • form ct‑1040nr/py • schedule ct‑si • schedule. We last updated the nonresident/part. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. With your return, mail the return with your payment to:

IRS 1040 Schedule 3 20202022 Fill and Sign Printable Template

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web 2022 form ct‑1040, line 20b; This form is most often used by individuals who have lived and/or worked in multiple. The connecticut department of revenue services. Sign it in a few clicks draw your signature, type it,.

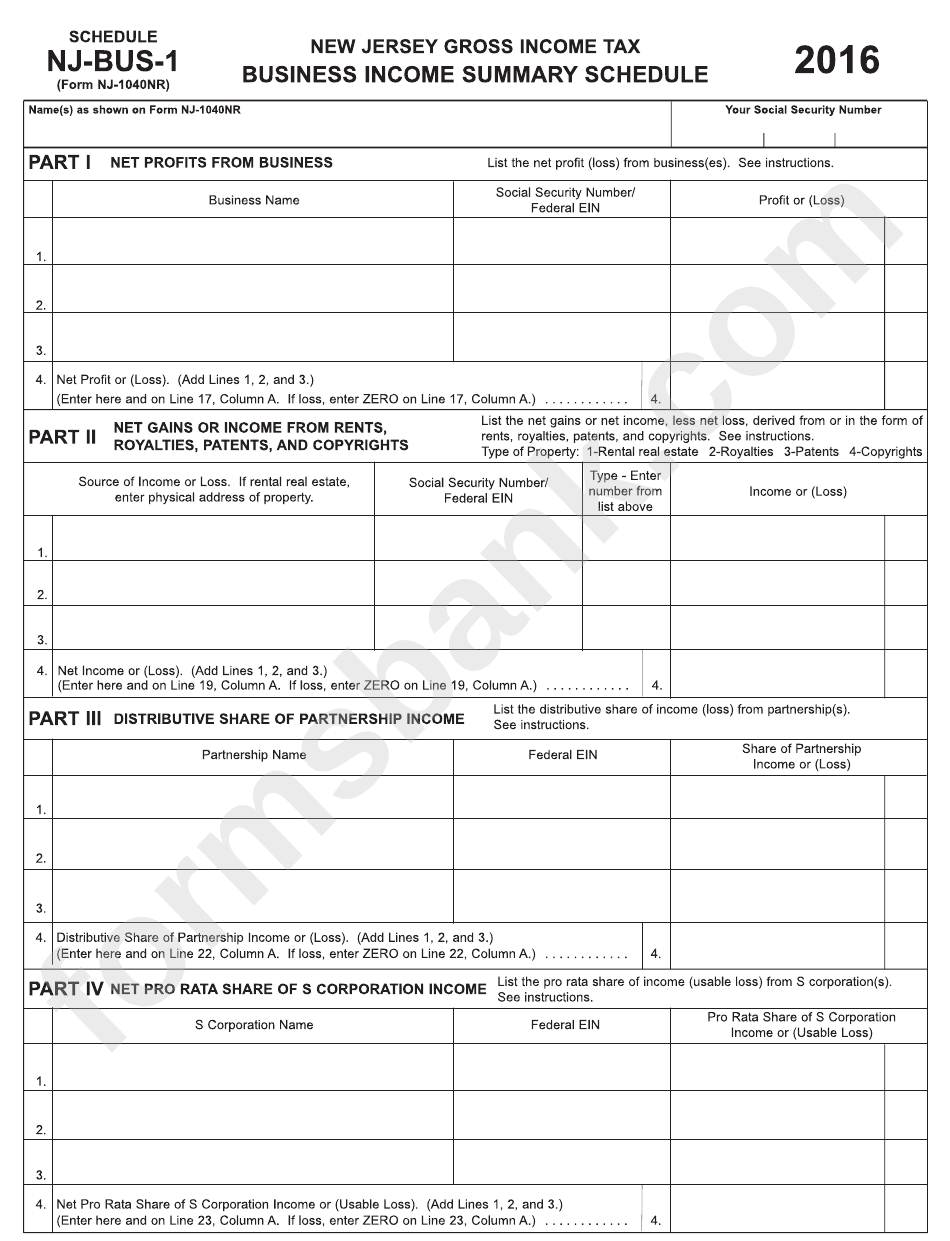

Fillable Form Nj1040nr NonResident Tax Return 2016

This form is most often used by individuals who have lived and/or worked in multiple. • form ct‑1040nr/py • schedule ct‑si • schedule. We last updated the nonresident/part. Web file now with turbotax. This amount is considered a tax payment and will be credited against your.

CT DRS Schedule CT1041 K1 2019 Fill and Sign Printable Template

Web use 90% of the income tax shown on your 2022 connecticut income tax return as your required annual payment. Estimated payments for the 2022 taxable year. This amount is considered a tax payment and will be credited against your. This form is most often used by individuals who have lived and/or worked in multiple. • form ct‑1040nr/py • schedule.

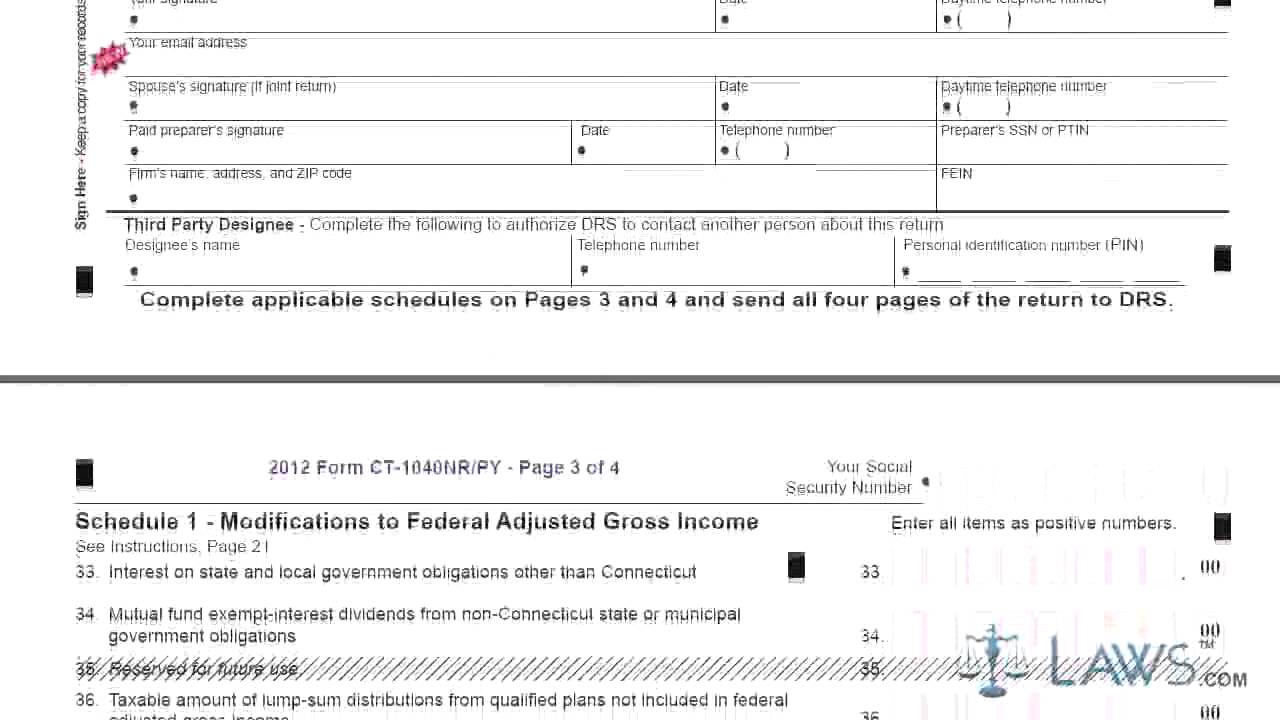

Form CT 1040NR PY Connecticut Nonresident and Part Year Resident

This booklet contains information or instructions for the following forms and schedules: Sign it in a few clicks draw your signature, type it,. Web 2022 form ct‑1040, line 20b; We last updated the nonresident/part. • form ct‑1040nr/py • schedule ct‑si • schedule.

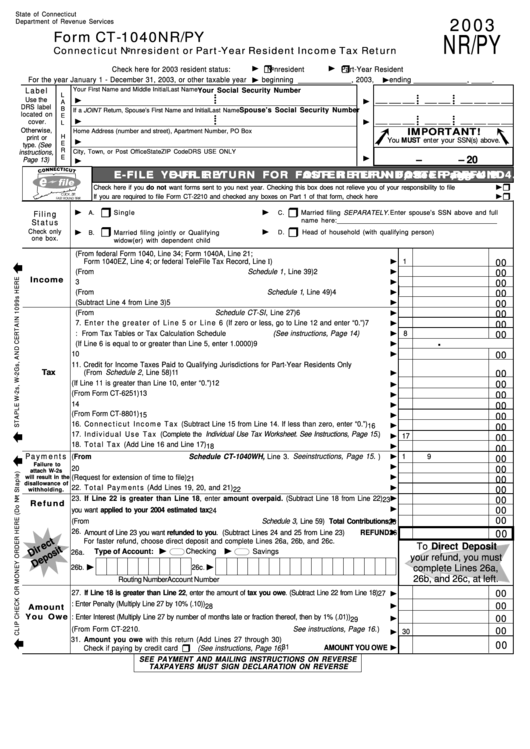

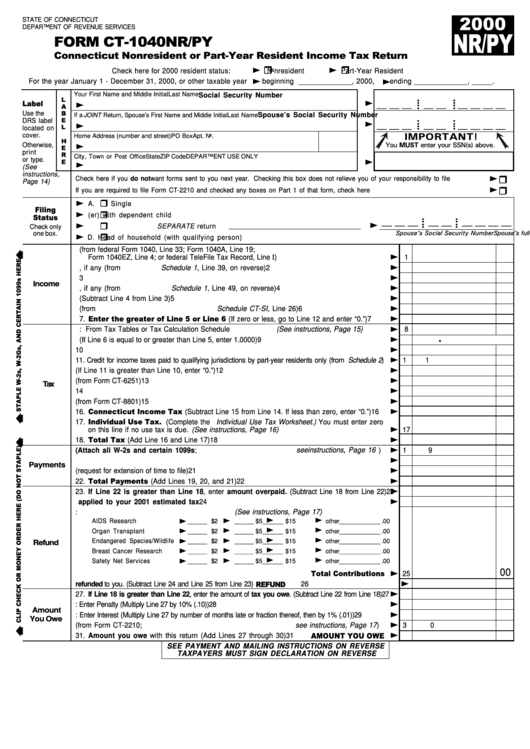

Form Ct1040nr/py Nonresident Or PartYear Resident Tax Return

Sign it in a few clicks draw your signature, type it,. Web use 90% of the income tax shown on your 2022 connecticut income tax return as your required annual payment. • form ct‑1040nr/py • schedule ct‑si • schedule. With your return, mail the return with your payment to: Irs use only—do not write or.

Form Ct1040nr/py Nonresident And PartYear Resident Tax

We last updated the nonresident/part. Sign it in a few clicks draw your signature, type it,. • form ct‑1040nr/py • schedule ct‑si • schedule. Irs use only—do not write or. Web 2022 form ct‑1040, line 20b;

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

Sign it in a few clicks draw your signature, type it,. We last updated the nonresident/part. • form ct‑1040nr/py • schedule ct‑si • schedule. This booklet contains information or instructions for the following forms and schedules: Web use 90% of the income tax shown on your 2022 connecticut income tax return as your required annual payment.

Web File Now With Turbotax.

• form ct‑1040nr/py • schedule ct‑si • schedule. Irs use only—do not write or. This booklet contains information or instructions for the following forms and schedules: Web use 90% of the income tax shown on your 2022 connecticut income tax return as your required annual payment.

Web 2022 Form Ct‑1040, Line 20B;

Nonresident alien income tax return. With your return, mail the return with your payment to: The connecticut department of revenue services. Estimated payments for the 2022 taxable year.

We Last Updated The Nonresident/Part.

Sign it in a few clicks draw your signature, type it,. Web department of revenue services state of connecticut (rev. This form is most often used by individuals who have lived and/or worked in multiple. Web form 1040, line 11, or federal form 1040‑sr, line 11.

Edit Your Form Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

This amount is considered a tax payment and will be credited against your.