Get Crypto.com Tax Form

Get Crypto.com Tax Form - Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web how to get crypto.com tax forms __________________________________________________ new project channel:. Web to report your crypto tax to the irs, follow 5 steps: Billion could have driven a lot of. We’re excited to share that u.s. Your net capital gain or loss should then be reported on. Web input your tax data into the online tax software. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. Web jan 26, 2022. Select the tax settings you’d like to generate your tax reports.

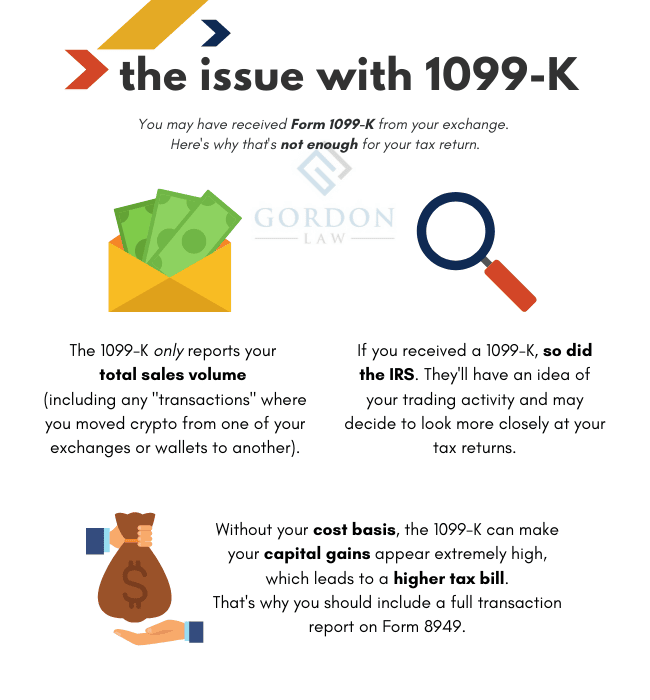

Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. However, many crypto exchanges don’t provide a 1099, leaving you with work to. We’re excited to share that u.s. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Web starting 2019 tax year, on schedule 1, you have to answer the question, “at any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web to report your crypto tax to the irs, follow 5 steps: Web what tax form should i use to report cryptocurrency? In the u.s., cryptocurrency disposals are reported on form 8949. Web how to get crypto.com tax forms __________________________________________________ new project channel:.

You might need any of these crypto. You may refer to this section on how to set up your tax. In the u.s., cryptocurrency disposals are reported on form 8949. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Billion could have driven a lot of. Web get crypto tax is a website for generating cryptocurrency tax forms. Web input your tax data into the online tax software. Web two forms are the stars of the show: Web review and confirm click on each transaction to view how capital gains and losses were calculated generate report reports can be exported in multiple formats that. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable).

How To Pick The Best Crypto Tax Software

Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). In the u.s., cryptocurrency disposals are reported on form 8949. You need to know your capital gains, losses, income and expenses. The platform is entirely free of charge and can be used by anyone. Select the.

Crypto Tax Tutorial (Done in 5 Minutes) YouTube

Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web get crypto tax is a website for generating cryptocurrency tax forms. We’re excited to share that u.s. Your net capital gain or loss should then be reported on. Web what tax form should i use to report cryptocurrency?

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Register your account in crypto.com tax step 2: Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. If you earned more than $600 in crypto, we’re required to report your transactions to the..

Tax Introduces New Features

Web what tax form should i use to report cryptocurrency? Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Billion could have driven a lot.

Crypto Tax Guide 101 on Cheddar

Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. You need to know your capital gains, losses, income and expenses. Web get crypto tax is a website for generating cryptocurrency tax.

Crypto Taxes Basic example YouTube

Web two forms are the stars of the show: Web review and confirm click on each transaction to view how capital gains and losses were calculated generate report reports can be exported in multiple formats that. However, many crypto exchanges don’t provide a 1099, leaving you with work to. Web get crypto tax is a website for generating cryptocurrency tax.

Basics of Crypto Taxes Ebook Donnelly Tax Law

Billion could have driven a lot of. You need to know your capital gains, losses, income and expenses. Web two forms are the stars of the show: You might need any of these crypto. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021.

Crypto Tax YouTube

Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web how to get crypto.com tax forms __________________________________________________ new project channel:. Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Web to report your crypto tax to the irs,.

How To Get Tax Forms 🔴 YouTube

Web input your tax data into the online tax software. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. The platform is entirely.

How crypto traders are avoiding taxes with a lending loophole VentureBeat

Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Select the tax settings you’d like to generate your tax reports. We’re excited to share that u.s. The.

The Standard Form 1040 Tax Return Now Asks Whether You Engaged In Any Virtual Currency Transactions During The Year.

We’re excited to share that u.s. You might need any of these crypto. Web jan 26, 2022. Web get crypto tax is a website for generating cryptocurrency tax forms.

Web You Should Expect To Receive The Following Irs Tax Forms From Cryptocurrency Exchanges And Similar Platforms Before January 31, 2021.

Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web two forms are the stars of the show: The platform is entirely free of charge and can be used by anyone. Register your account in crypto.com tax step 2:

Web Starting 2019 Tax Year, On Schedule 1, You Have To Answer The Question, “At Any Time During 2019, Did You Receive, Sell, Send, Exchange, Or Otherwise Acquire Any.

Calculate your crypto gains and losses complete irs form 8949 include your totals from 8949 on form. Billion could have driven a lot of. Web review and confirm click on each transaction to view how capital gains and losses were calculated generate report reports can be exported in multiple formats that. If you earned more than $600 in crypto, we’re required to report your transactions to the.

In The U.s., Cryptocurrency Disposals Are Reported On Form 8949.

Your net capital gain or loss should then be reported on. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Web to report your crypto tax to the irs, follow 5 steps: Typically, if you expect a.