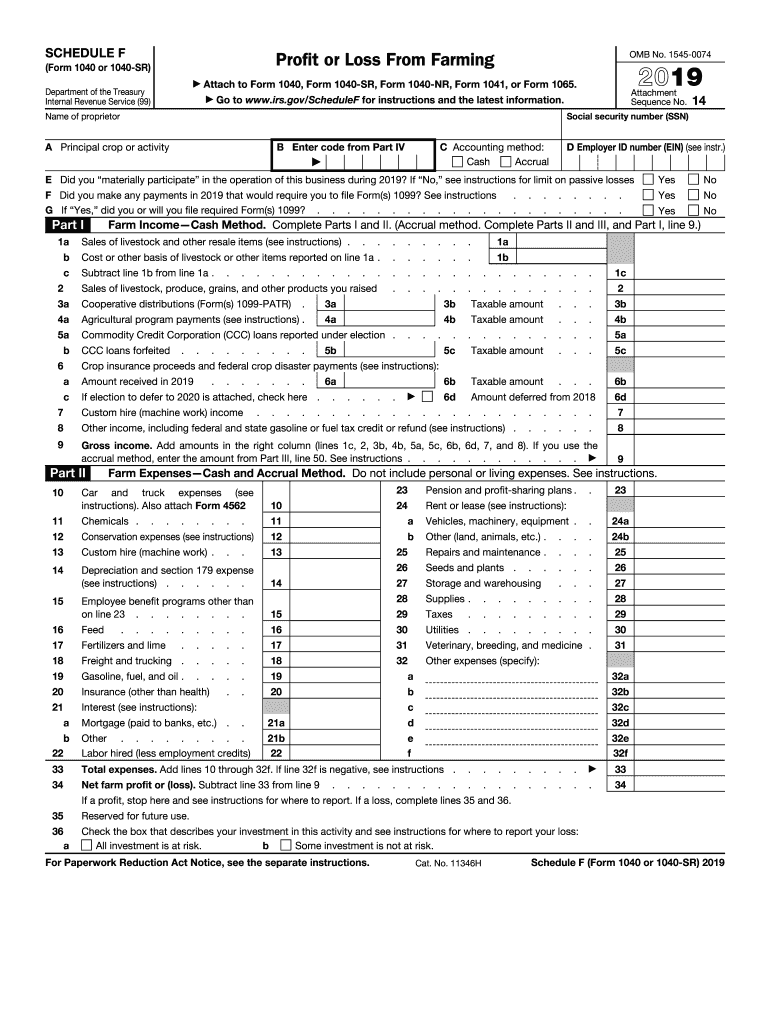

1040 Schedule F Form

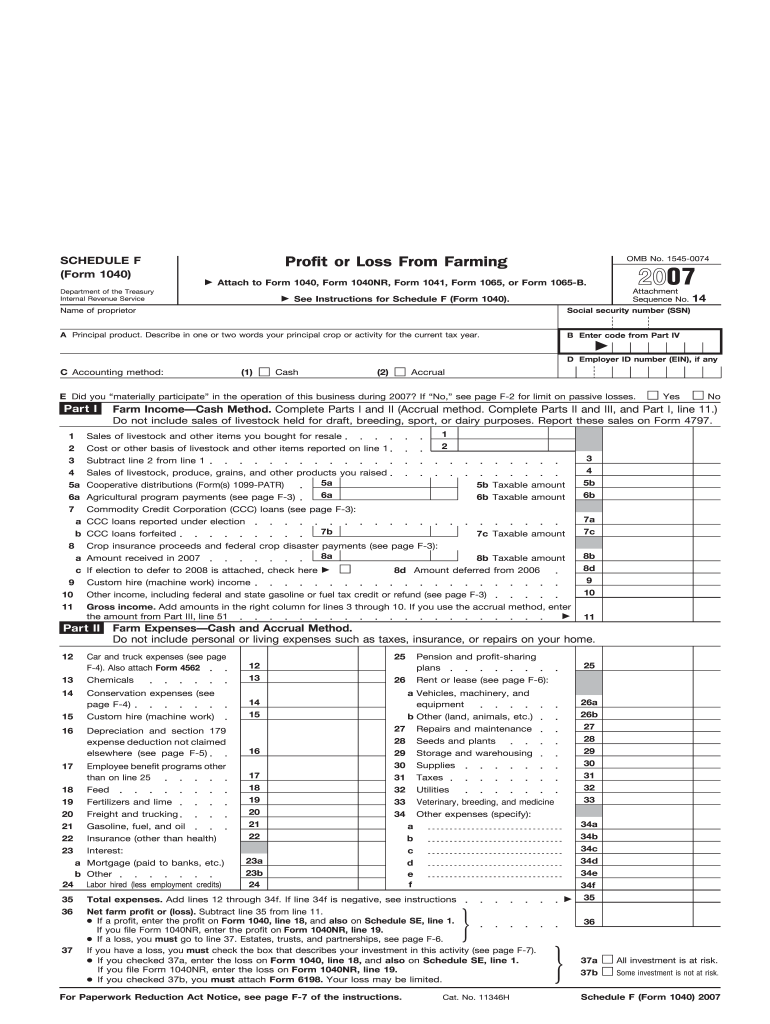

1040 Schedule F Form - Web use schedule f (form 1040) to report farm income and expenses. Web recorded on a form 1040 schedule f: 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line 34 of the worksheet to. Attach to your form il. • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. If you have a profit or a loss, it gets. This form should be filed alongside form. / tax year ending illinois department of revenue. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Web use schedule f (form 1040) to report farm income and expenses.

Web use schedule f (form 1040) to report farm income and expenses. Someone may have a farm and someone may have a farm and produce farm income, but not qualify as a. Web recorded on a form 1040 schedule f: Attach to your form il. This form should be filed alongside form. Profit or loss from farming. From farming your farming activity may subject you. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. Web file your schedule f with the appropriate forms: This form is for income earned in tax year 2022, with tax returns due.

This form is for income earned in tax year 2022, with tax returns due. Web use schedule f (form 1040) to report farm income and expenses. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Your farming activity may subject you to state and. Your farming activity may subject you to state and. Web file your schedule f with the appropriate forms: Someone may have a farm and someone may have a farm and produce farm income, but not qualify as a. From farming your farming activity may subject you. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line 34 of the worksheet to.

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Net profits are subject to self. • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. Web form 1040 schedule f is a tax form used by the united states internal revenue service (irs) for reporting farm income and expenses. Web we last updated the profit or loss from farming in december 2022, so this.

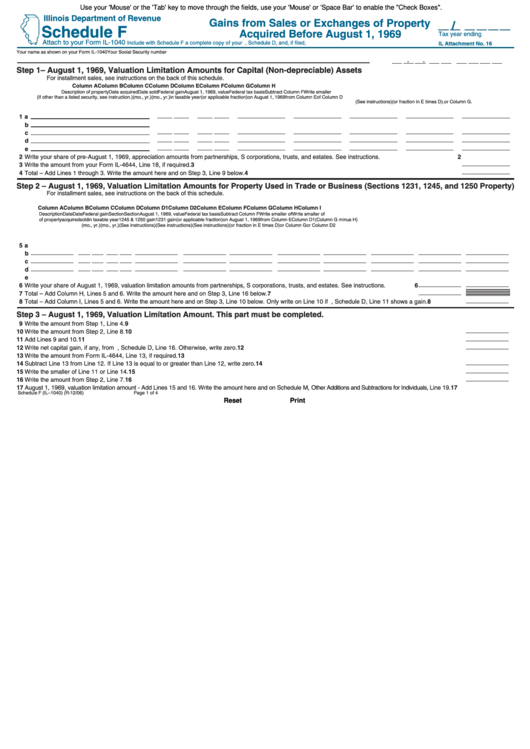

Fillable Form Il1040 Schedule F Gains From Sales Or Exchanges Of

Your farming activity may subject you to state and. / tax year ending illinois department of revenue. Your farming activity may subject you to state and. Web file your schedule f with the appropriate forms: Web recorded on a form 1040 schedule f:

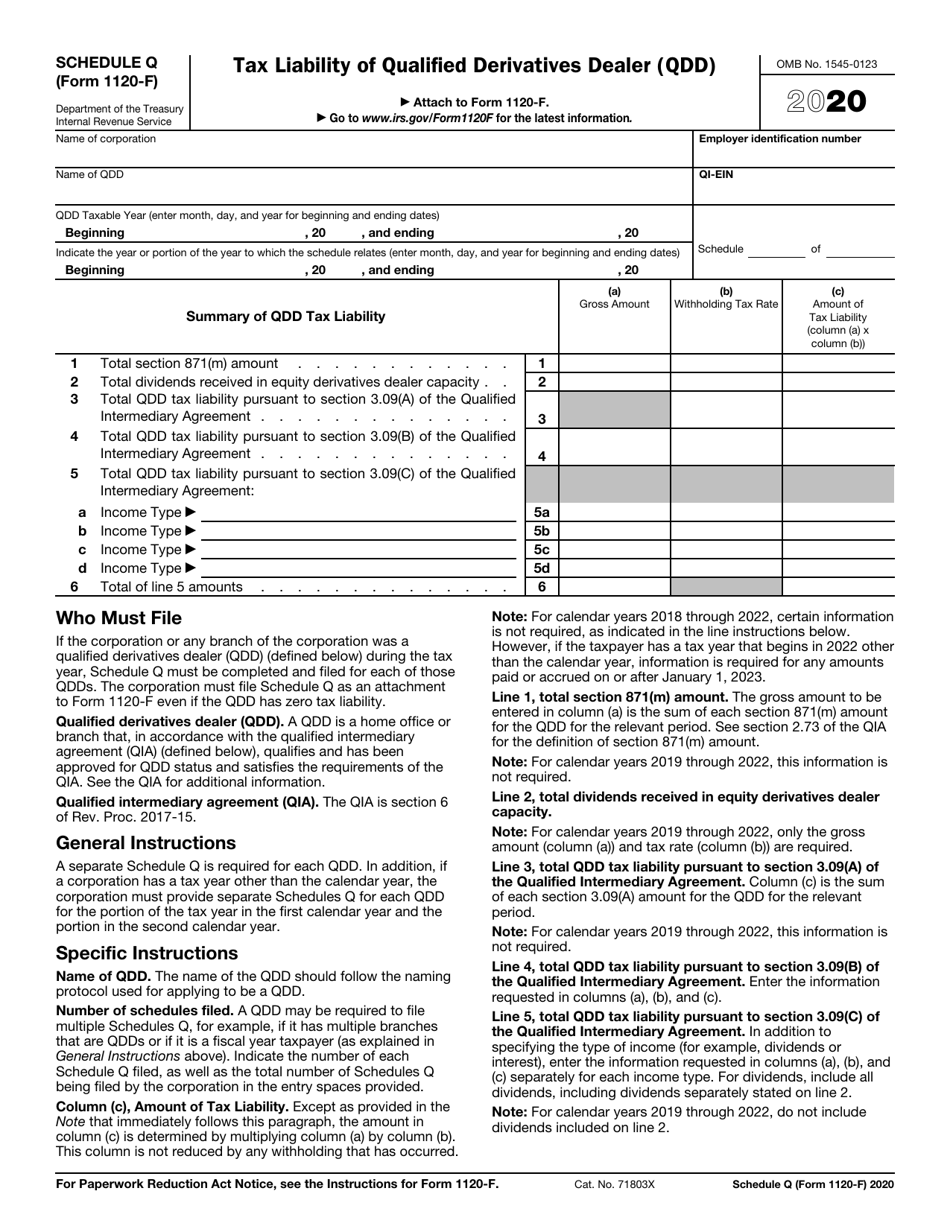

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Web do not file schedule f (form 1040) to report the following. Net profits are subject to self. Profit or loss from farming. Attach to your form il. Web use schedule f (form 1040) to report farm income and expenses.

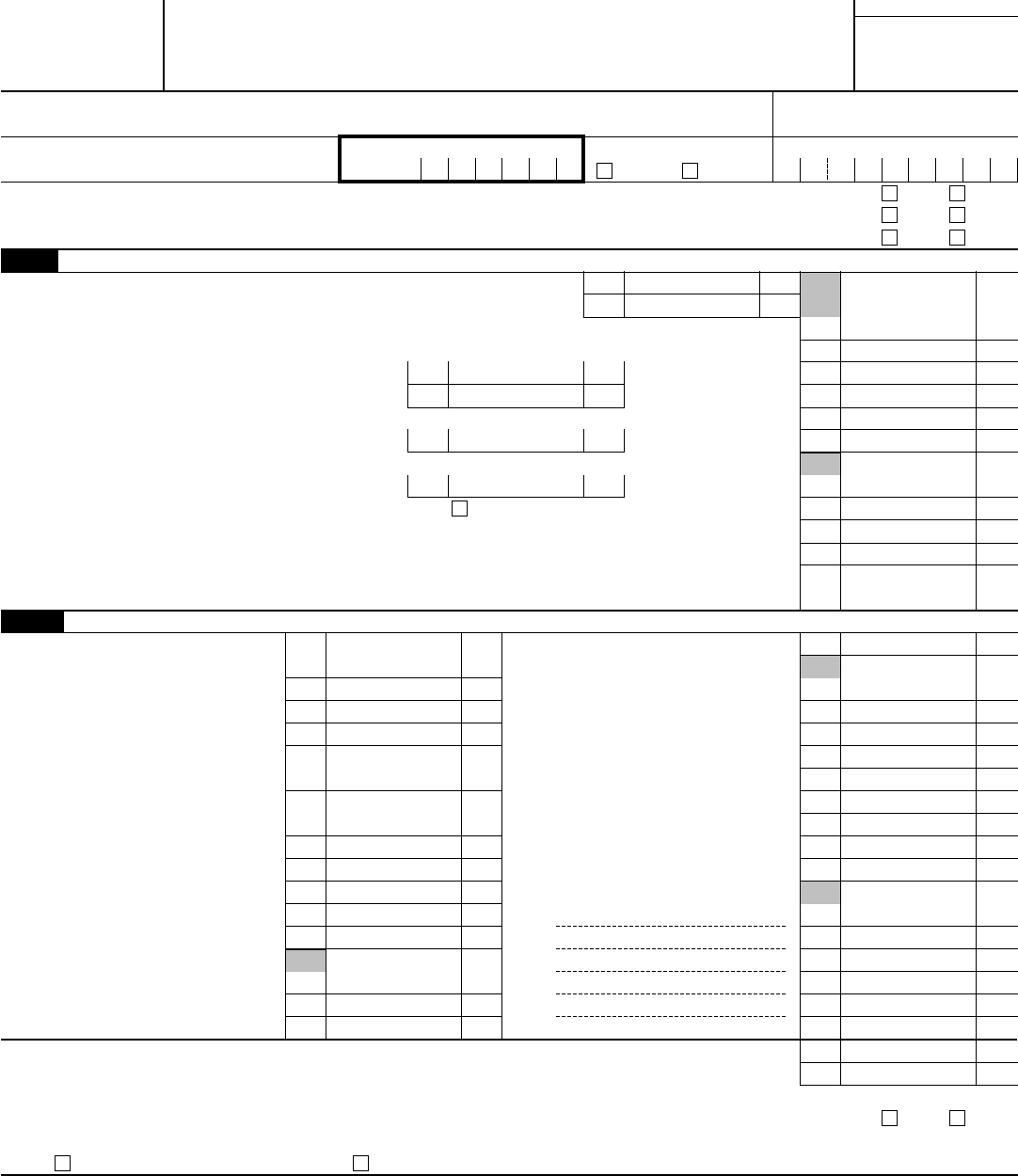

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

Your farming activity may subject you to state and. This form is for income earned in tax year 2022, with tax returns due. Your farming activity may subject you to state and. / tax year ending illinois department of revenue. Web use schedule f (form 1040) to report farm income and expenses.

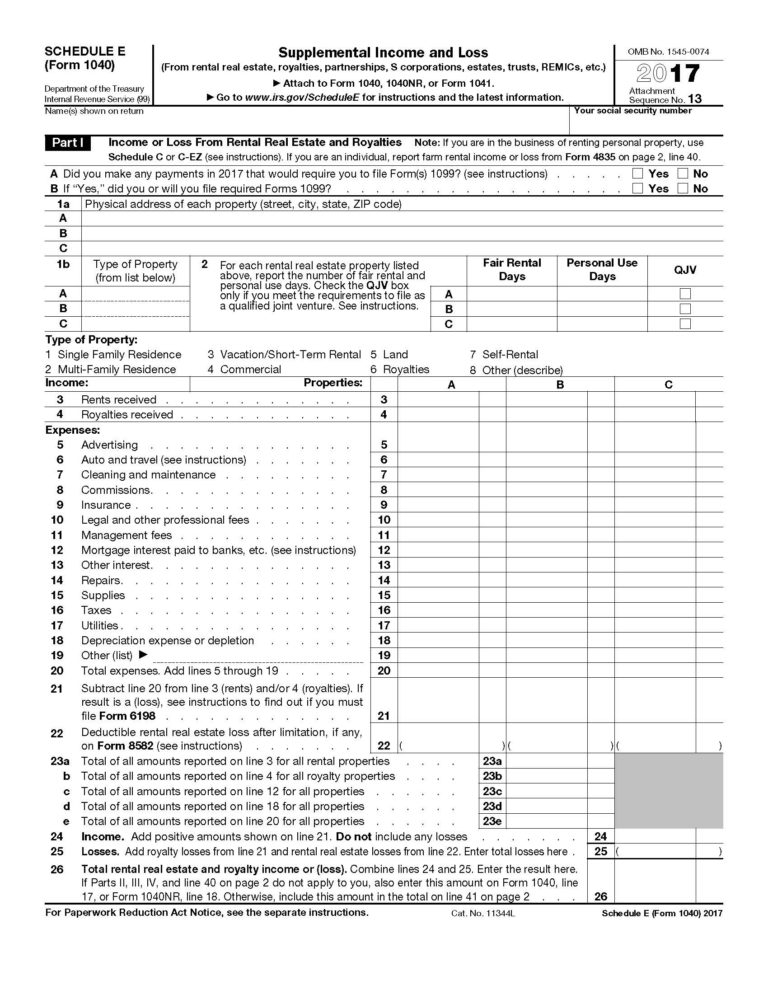

2017 Irs Tax Form 1040 Schedule E Supplement And 2021 Tax

Web new 1040 form for older adults. Profit or loss from farming. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Net profits are subject to self. Someone may have a farm and someone may have a farm and produce.

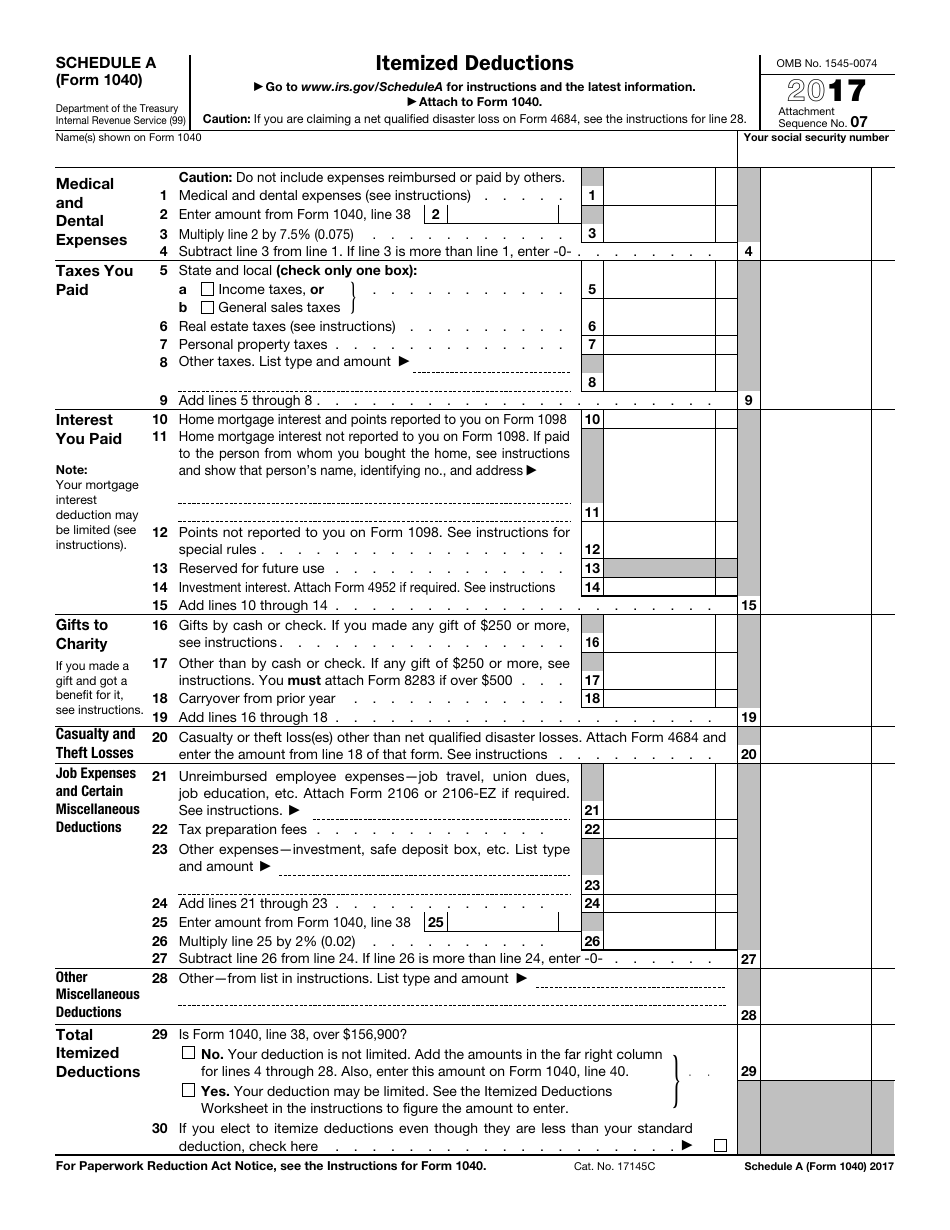

IRS Form 1040 Schedule A Download Fillable PDF or Fill Online Itemized

Net profits are subject to self. Your farming activity may subject you to state and. 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line 34 of the worksheet to. Web once the worksheet is completed, irs pub. Your farming activity may subject you to state and.

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Net profits are subject to self. You can download or print. Web new 1040 form for older adults. Someone may have a farm and someone may have a farm and produce farm income, but not qualify as a. Web use schedule f (form 1040) to report farm income and expenses.

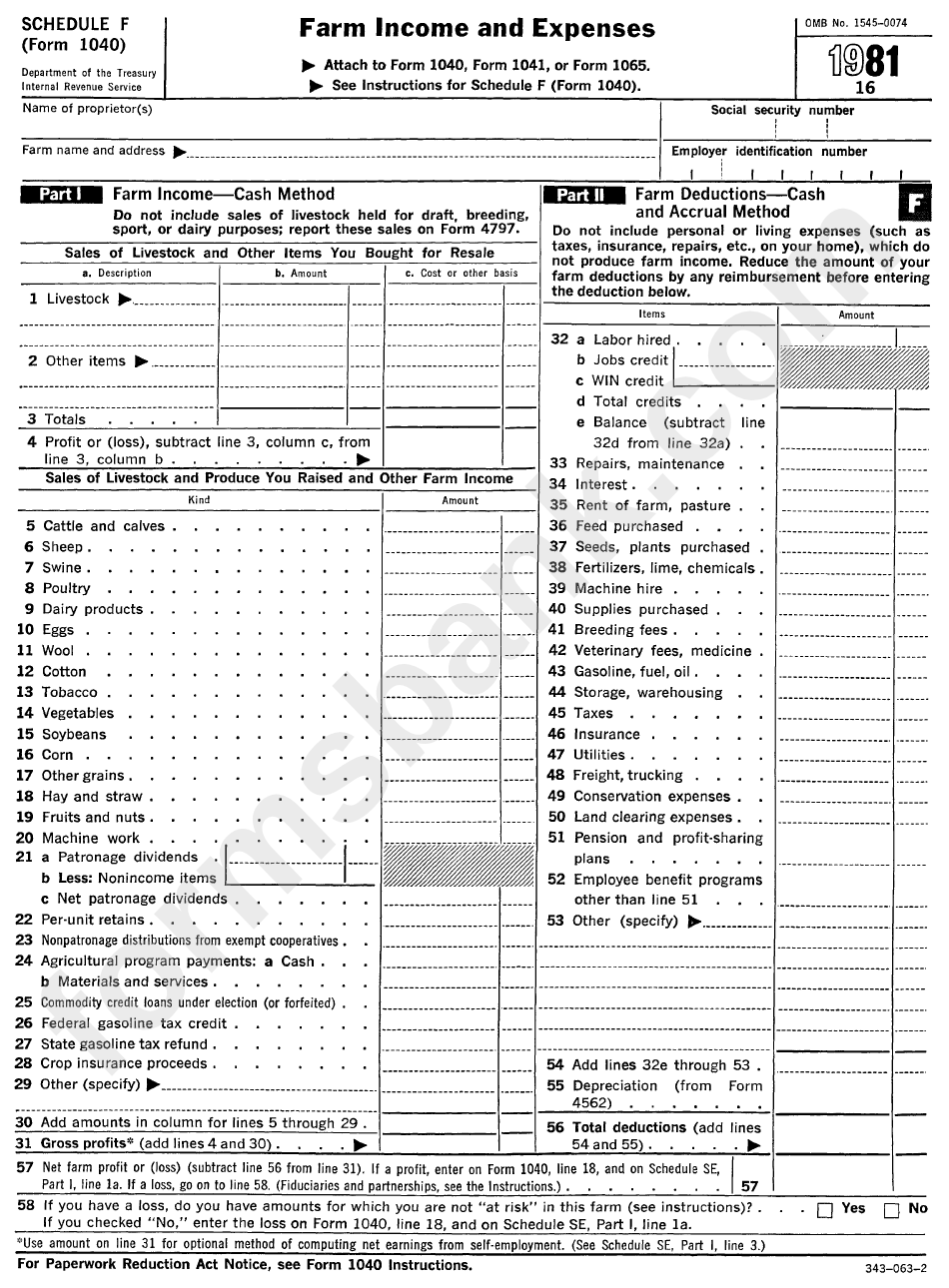

Schedule F (Form 1040) Farm Tax Expenses 1981 printable pdf

Web do not file schedule f (form 1040) to report the following. From farming your farming activity may subject you. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. 587 states if you file schedule f (form 1040), report your entire deduction for business use.

Fill Free fillable F1040sf Accessible 2019 Schedule F (Form 1040 or

/ tax year ending illinois department of revenue. Net profits are subject to self. Web new 1040 form for older adults. 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line 34 of the worksheet to. Web schedule f ultimately computes the net farming profit or loss that gets reported.

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

Web recorded on a form 1040 schedule f: Your farming activity may subject you to state and. From farming your farming activity may subject you. Web form 1040 schedule f is a tax form used by the united states internal revenue service (irs) for reporting farm income and expenses. Someone may have a farm and someone may have a farm.

Web Form 1040 Schedule F Is A Tax Form Used By The United States Internal Revenue Service (Irs) For Reporting Farm Income And Expenses.

The irs has released a new tax filing form for people 65 and older. This form is for income earned in tax year 2022, with tax returns due. Your farming activity may subject you to state and. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022.

Web Schedule F Ultimately Computes The Net Farming Profit Or Loss That Gets Reported On The Designated Line Of Your 1040.

Your farming activity may subject you to state and. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. Web we last updated federal 1040 (schedule f) in december 2022 from the federal internal revenue service. Web new 1040 form for older adults.

587 States If You File Schedule F (Form 1040), Report Your Entire Deduction For Business Use Of The Home (Line 34 Of The Worksheet To.

Web recorded on a form 1040 schedule f: Net profits are subject to self. This form should be filed alongside form. Web file your schedule f with the appropriate forms:

From Farming Your Farming Activity May Subject You.

It is designed to be a. Web use schedule f (form 1040) to report farm income and expenses. • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. Attach to your form il.