1040 Ss Tax Form

1040 Ss Tax Form - Complete, edit or print tax forms instantly. More than $44,000, up to 85 percent of your benefits may be taxable. Complete, edit or print tax forms instantly. For some of the western states, the following addresses were previously used: To get this automatic extension, you. Web popular forms & instructions; Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Department of the treasury |. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security. For taxpayers that are bona fide residents of puerto.

Web for the year jan. Department of the treasury |. Web other form 1040 tables & reports. Complete, edit or print tax forms instantly. Request for taxpayer identification number (tin) and certification. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the. Tax payments to report include federal income tax withholding, excess. Web individual tax return form 1040 instructions; Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and.

Individual tax return form 1040 instructions; Complete, edit or print tax forms instantly. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia—even if you don’t live in the. To get this automatic extension, you. Request for taxpayer identification number (tin) and certification. Volunteers should remind veterans to mail their form 1040x to the irs address provided within one. Individual tax return form 1040 instructions; Web for the year jan. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

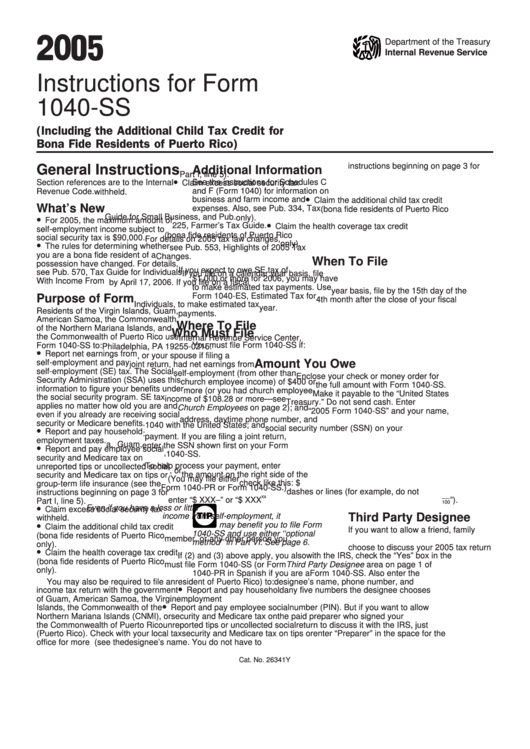

Instructions for IRS Form 1040ss U.S. Selfemployment Tax Return

Web other form 1040 tables & reports. For instructions and the latest information. For taxpayers that are bona fide residents of puerto. Complete, edit or print tax forms instantly. To get this automatic extension, you.

Instructions For Form 1040Ss U.s. SelfEmployment Tax Return

Individual tax return form 1040 instructions; Department of the treasury |. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security. Volunteers should remind veterans to mail their form 1040x to the irs address provided within one. To get this.

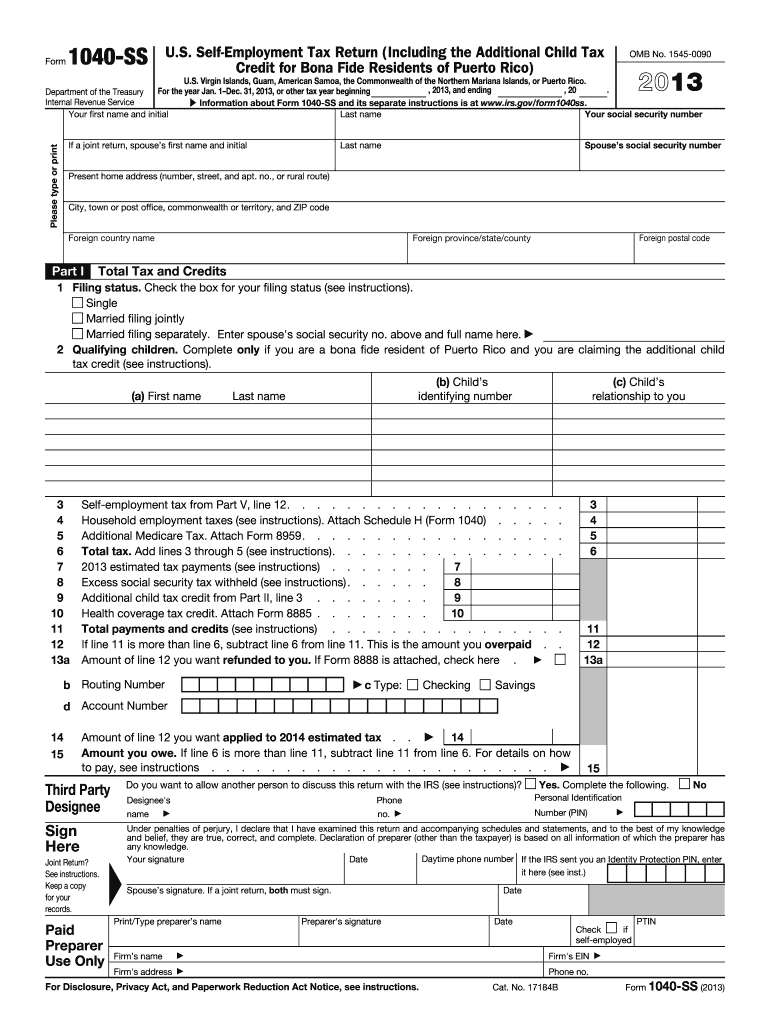

2013 Form IRS 1040SS Fill Online, Printable, Fillable, Blank PDFfiller

Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Department of the treasury |. Web popular forms & instructions; 31, 2020, or other tax year beginning , 2020, and ending , 20. Individual income tax returns (annual soi bulletin article & tables) individual income tax rates.

worksheet. 1040 Worksheet. Worksheet Fun Worksheet Study Site

Individual tax return form 1040 instructions; Complete, edit or print tax forms instantly. Individual tax return form 1040 instructions; Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Complete, edit or print tax forms instantly.

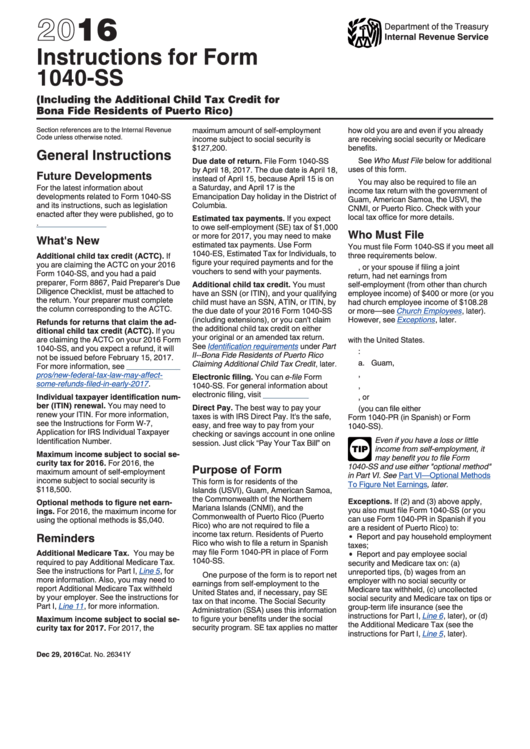

Instructions For Form 1040Ss U.s. SelfEmployment Tax Return

For some of the western states, the following addresses were previously used: Web individual tax return form 1040 instructions; Web for the year jan. Web other form 1040 tables & reports. Individual tax return form 1040 instructions;

Instructions For Form 1040Ss printable pdf download

Web popular forms & instructions; Individual tax return form 1040 instructions; Individual tax return form 1040 instructions; Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Volunteers should remind veterans to mail their form 1040x to the irs address provided within one.

Form 1040SS U.S. SelfEmployment Tax Return Form (2014) Free Download

Web popular forms & instructions; Web other form 1040 tables & reports. Request for taxpayer identification number (tin) and certification. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Individual tax return form 1040 instructions;

Formulario 1040SR Declaración de impuestos de los Estados Unidos para

Web popular forms & instructions; 31, 2020, or other tax year beginning , 2020, and ending , 20. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Individual tax return form 1040 instructions; Web between $32,000 and $44,000, you may.

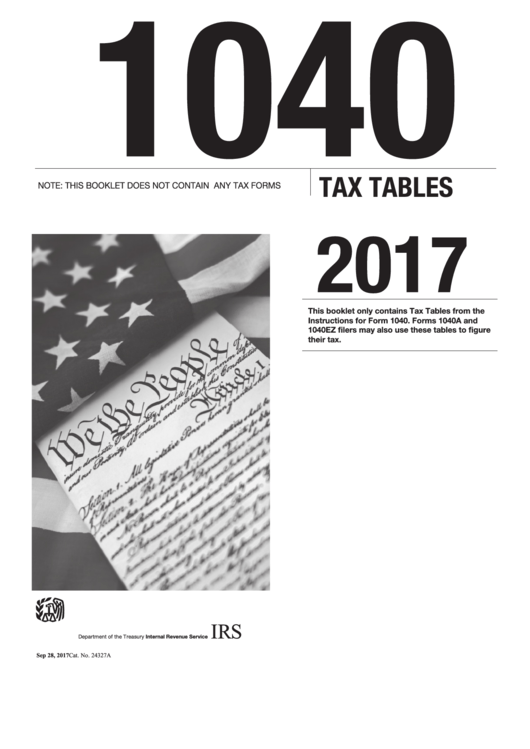

Form 1040 Tax Tables 2017 printable pdf download

Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Department of the treasury |. Tax payments to report include federal income tax withholding, excess. Web popular forms & instructions; Web popular forms & instructions;

1040 (2017) Internal Revenue Service

More than $44,000, up to 85 percent of your benefits may be taxable. Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. For some of the western states, the following addresses were previously used: Web other form 1040 tables & reports. Department of the treasury |.

Individual Income Tax Returns (Annual Soi Bulletin Article & Tables) Individual Income Tax Rates.

To get this automatic extension, you. Web popular forms & instructions; Web individual tax return form 1040 instructions; For some of the western states, the following addresses were previously used:

The Due Date Is April 18, Instead Of April 15, Because Of The Emancipation Day Holiday In The District Of Columbia—Even If You Don’t Live In The.

Web you'll report tax payments you already made on lines 25 through 32 of your 2022 form 1040. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Request for taxpayer identification number (tin) and certification. Volunteers should remind veterans to mail their form 1040x to the irs address provided within one.

For Taxpayers That Are Bona Fide Residents Of Puerto.

Complete, edit or print tax forms instantly. For instructions and the latest information. 31, 2020, or other tax year beginning , 2020, and ending , 20. Web popular forms & instructions;

Web Other Form 1040 Tables & Reports.

Individual tax return form 1040 instructions; Individual tax return form 1040 instructions; More than $44,000, up to 85 percent of your benefits may be taxable. Department of the treasury |.