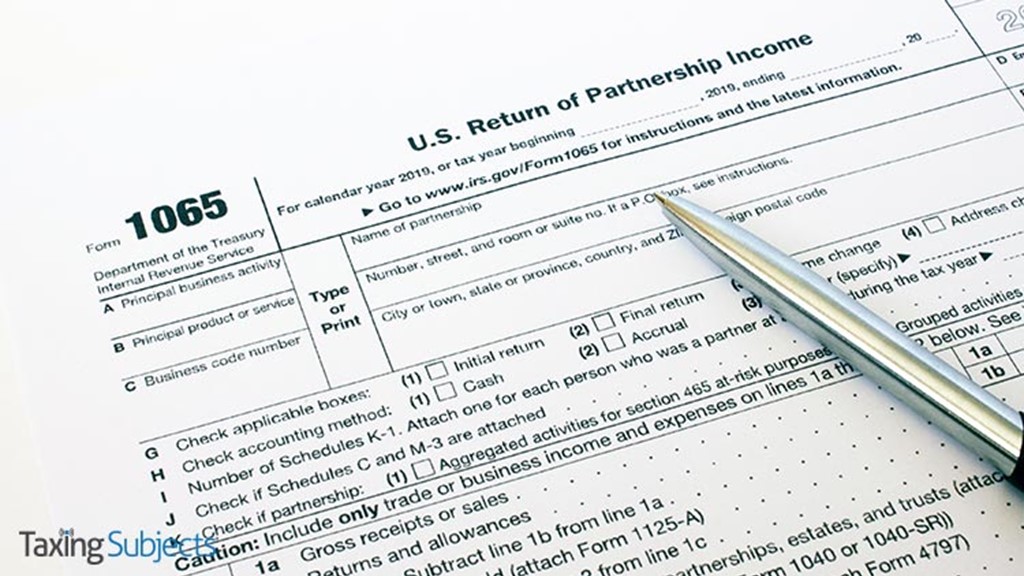

1065 Form Instructions

1065 Form Instructions - It is the partner's responsibility to consider and apply any applicable limitations. Use the following internal revenue service center address: Web where to file your taxes for form 1065. Department of the treasury internal revenue service. Or getting income from u.s. For calendar year 2022, or tax year beginning. For instructions and the latest information. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year are:

See limitations on losses, deductions, and credits, later, for more information. Use the following internal revenue service center address: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Or getting income from u.s. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the Web where to file your taxes for form 1065. It is the partner's responsibility to consider and apply any applicable limitations. Web a 1065 form is the annual us tax return filed by partnerships. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web form 1065 is the first step for paying taxes on income earned by the partnership.

See limitations on losses, deductions, and credits, later, for more information. If the partnership's principal business, office, or agency is located in: For instructions and the latest information. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the Department of the treasury internal revenue service. Return of partnership income, including recent updates, related forms and instructions on how to file. Use the following internal revenue service center address: For calendar year 2022, or tax year beginning. Web information about form 1065, u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

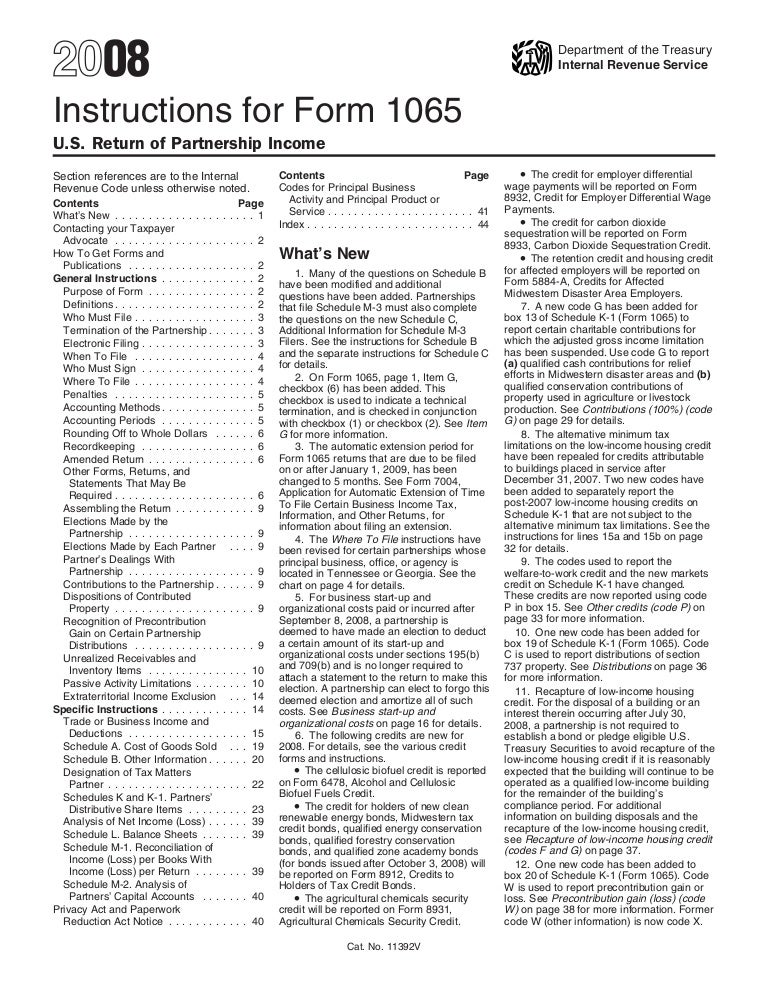

2014 form 1065 instructions

Use the following internal revenue service center address: It is the partner's responsibility to consider and apply any applicable limitations. Web where to file your taxes for form 1065. Return of partnership income, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service.

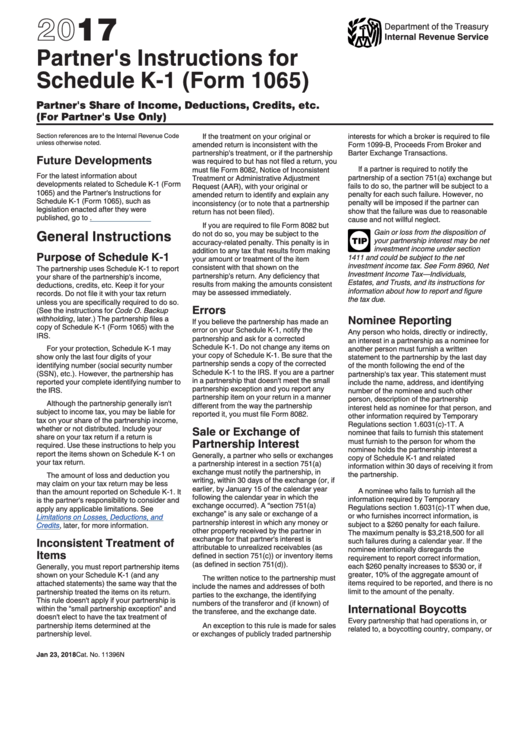

Irs Form 1065 K 1 Instructions Universal Network

See limitations on losses, deductions, and credits, later, for more information. Web form 1065 is the first step for paying taxes on income earned by the partnership. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income, including recent updates, related forms and instructions on.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year are: It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs..

schedule k1 Taxing Subjects

Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in: It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Use the following internal revenue service center address: Department of the treasury internal revenue service.

Inst 1065Instructions for Form 1065, U.S. Return of Partnership Inco…

Or getting income from u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. And the total assets at the end of the tax year are: Web information about form 1065, u.s.

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

For calendar year 2022, or tax year beginning. Department of the treasury internal revenue service. Return of partnership income, including recent updates, related forms and instructions on how to file. Web information about form 1065, u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

Web form 1065 is the first step for paying taxes on income earned by the partnership. Web where to file your taxes for form 1065. Web information about form 1065, u.s. Use the following internal revenue service center address: If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the

Form 1065 Instructions Limited Liability Partnership Partnership

Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in: For instructions and the latest information. For calendar year 2022, or tax year beginning. See limitations on losses, deductions, and credits, later, for more information.

Llc Tax Form 1065 Universal Network

Web information about form 1065, u.s. Web where to file your taxes for form 1065. Department of the treasury internal revenue service. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Or getting income from u.s.

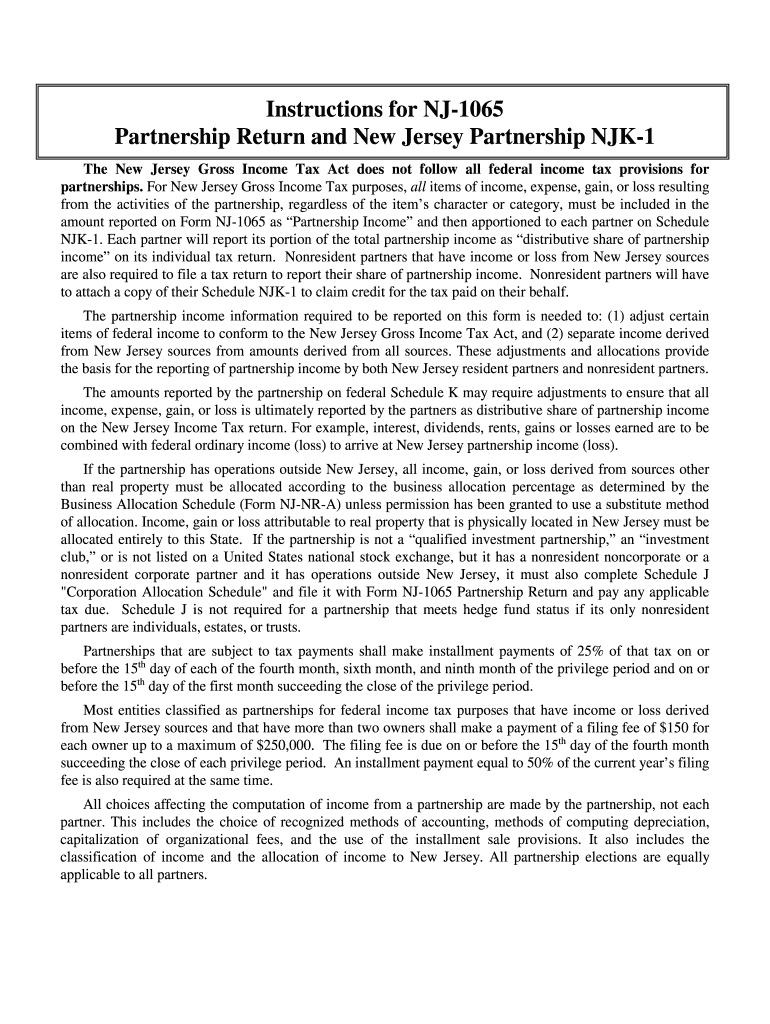

2018 Form NJ NJ1065 Instructions Fill Online, Printable, Fillable

Web information about form 1065, u.s. Web where to file your taxes for form 1065. Web form 1065 is the first step for paying taxes on income earned by the partnership. For instructions and the latest information. It is the partner's responsibility to consider and apply any applicable limitations.

See Limitations On Losses, Deductions, And Credits, Later, For More Information.

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the Or getting income from u.s. It is the partner's responsibility to consider and apply any applicable limitations.

Web Form 1065 Is The First Step For Paying Taxes On Income Earned By The Partnership.

Web a 1065 form is the annual us tax return filed by partnerships. For instructions and the latest information. And the total assets at the end of the tax year are: Web information about form 1065, u.s.

Web Where To File Your Taxes For Form 1065.

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Return of partnership income, including recent updates, related forms and instructions on how to file. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Department of the treasury internal revenue service.

Use The Following Internal Revenue Service Center Address:

If the partnership's principal business, office, or agency is located in: For calendar year 2022, or tax year beginning.