1099 Nec Form 2021 Pdf

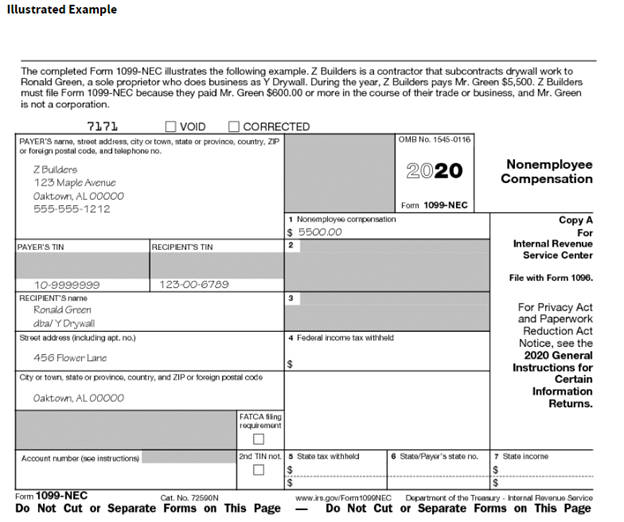

1099 Nec Form 2021 Pdf - Box 13 is now checkbox to report the foreign account tax compliance act (fatca) filing requirement. For internal revenue service center. For internal revenue service center. Copy a for internal revenue service center. 2020 general instructions for certain information returns. New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox; File with the irs by february 28 (march 31, if filing electronically). Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. Additional envelopes or forms may be needed. Ip 2021(12) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2021 is january 31, 2022.

Web if those regulations are issued and effective for 2021 tax returns required to be filed in 2022, we will post an article at www.irs.gov/form1099 explaining the change. For internal revenue service center. State of connecticut department of revenue services. 2021 general instructions for certain information returns. 2020 general instructions for certain information returns. Due to this change, a new envelope will be required for distributing recipient copies. For privacy act and paperwork reduction act notice, see the. The 2021 calendar year comes with changes to business owners’ taxes. Web for tax year 2022, here are the due dates for each form. For 2023, you are required to:

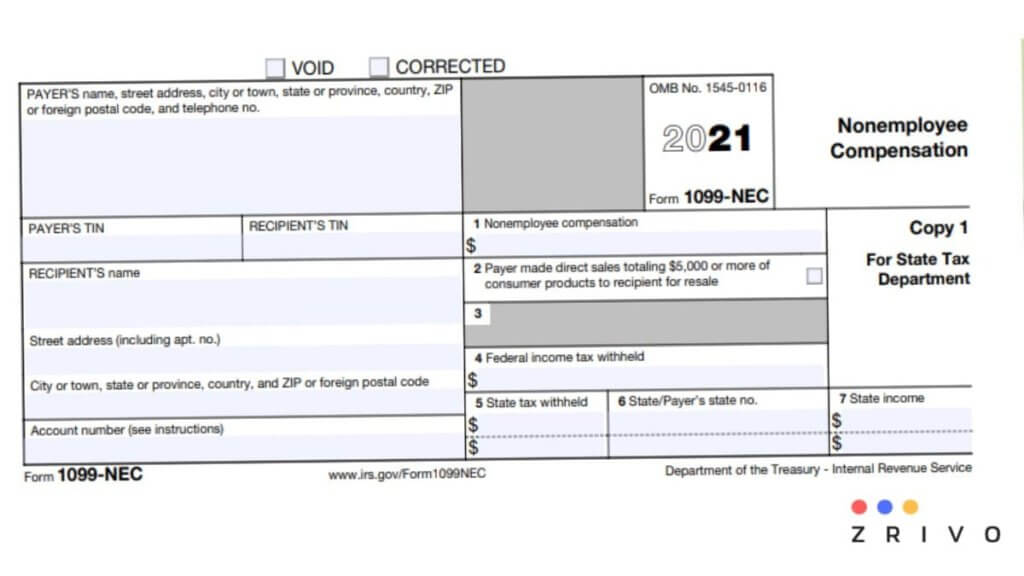

This form is used to report payments made to independent contractors and other nonemployees for services performed. It means the payer can either use 1099 misc box 7 or form 1099 nec box 2 to report direct sales. Web what's new for 2021. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. We encourage you to prepare early. Box 13 is now checkbox to report the foreign account tax compliance act (fatca) filing requirement. For privacy act and paperwork reduction act notice, see the. State of connecticut department of revenue services. Web recommended the business to use 1099 nec box 2 to report direct sales. March 31, 2021 for electronic submissions.

1099NEC Instructions

State of connecticut department of revenue services. Web recommended the business to use 1099 nec box 2 to report direct sales. March 31, 2021 for electronic submissions. This form is used to report payments made to independent contractors and other nonemployees for services performed. It means the payer can either use 1099 misc box 7 or form 1099 nec box.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web what's new for 2021. Due to this change, a new envelope will be required for distributing recipient copies. 2020 general instructions for certain information returns. Form resized so now it can fit up to 3 per page February 28, 2021 for paper.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

For privacy act and paperwork reduction act notice, see the. The 2021 calendar year comes with changes to business owners’ taxes. For internal revenue service center. Web follow this straightforward guide to edit 1099 2021 printable in pdf format online free of charge: You may request an extension to file electronically by submitting ftb form 6274a.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

March 31, 2021 for electronic submissions. 2021 general instructions for certain information returns. For internal revenue service center. For internal revenue service center. Web recommended the business to use 1099 nec box 2 to report direct sales.

What Is Form 1099NEC?

If the payer made direct sales of consumer products on resale in the 2021 tax year, then the taxpayer can file “1099 nec box”. Due to this change, a new envelope will be required for distributing recipient copies. Create a free account, set a strong password, and go through email verification to start working on your templates. Web if those.

Preparing for 2020 NonEmployee Compensation Form 1099NEC

Ip 2021(12) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2021 is january 31, 2022. New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox; For 2023, you are required to: Web recommended the business to use 1099 nec box 2 to.

What To Do With A 1099 from Coinbase or Another Exchange TokenTax

This form is used to report payments made to independent contractors and other nonemployees for services performed. File with the irs by february 28 (march 31, if filing electronically). February 28, 2021 for paper. Web if those regulations are issued and effective for 2021 tax returns required to be filed in 2022, we will post an article at www.irs.gov/form1099 explaining.

1099 NEC Form 2022

For internal revenue service center. New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox; We encourage you to prepare early. 2020 general instructions for certain information returns. Due to this change, a new envelope will be required for distributing recipient copies.

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

Does new 1099 nec reflect any change in. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. We encourage you to prepare early. For internal revenue service center. February 28, 2021 for paper.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

It means the payer can either use 1099 misc box 7 or form 1099 nec box 2 to report direct sales. Web what's new for 2021. For 2020, the due date is: February 28, 2021 for paper. The 2021 calendar year comes with changes to business owners’ taxes.

File With The Irs By February 28 (March 31, If Filing Electronically).

Box 13 is now checkbox to report the foreign account tax compliance act (fatca) filing requirement. 2020 general instructions for certain information returns. You may request an extension to file electronically by submitting ftb form 6274a. Additional envelopes or forms may be needed.

Copy A For Internal Revenue Service Center.

Current general instructions for certain information returns. 2021 general instructions for certain information returns. March 31, 2021 for electronic submissions. For internal revenue service center.

The 2021 Calendar Year Comes With Changes To Business Owners’ Taxes.

This form is used to report payments made to independent contractors and other nonemployees for services performed. For privacy act and paperwork reduction act notice, see the. Create a free account, set a strong password, and go through email verification to start working on your templates. We encourage you to prepare early.

February 28, 2021 For Paper.

Ip 2021(12) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2021 is january 31, 2022. It means the payer can either use 1099 misc box 7 or form 1099 nec box 2 to report direct sales. For internal revenue service center. Until regulations are issued, however, the number remains at 250, as reflected in these instructions.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)