147C Form From Irs

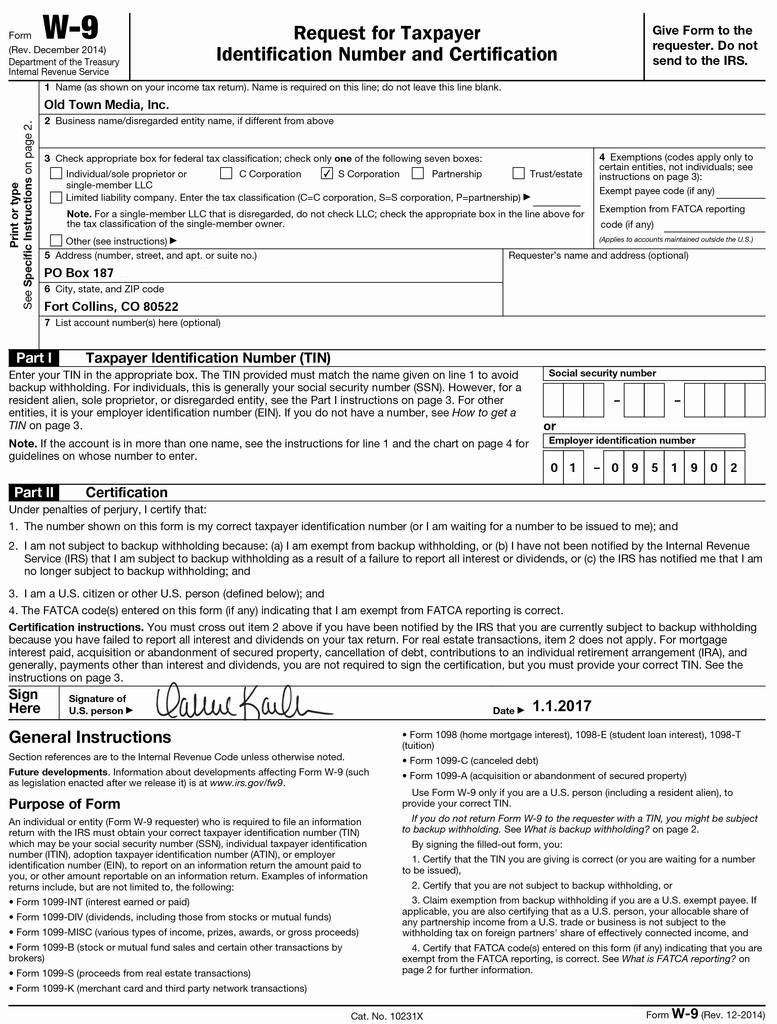

147C Form From Irs - The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web how do i get a form 147c from the irs? Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web did the irs make a typo on your ein letter and you need a new form? Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web the cp 575 and 147c are technically different letters, however, they are both official letters from the irs and can be used for all business matters.congratulations! The owner of a us llc sends this form to the irs in order to request. Your previously filed return should. Web the irs uses this form to verify the accuracy of the information reported on an employer?s ein application. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's.

Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or. Here’s how you request an ein verification letter (147c) the easiest way to get a copy. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web the irs uses this form to verify the accuracy of the information reported on an employer?s ein application. Your previously filed return should. Choose the template you will need from the collection of legal forms. Web employer's quarterly federal tax return. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web there is a solution if you don’t have possession of the ein confirmation letter. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.

The letter will confirm the employer name and ein connected with the. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web the cp 575 and 147c are technically different letters, however, they are both official letters from the irs and can be used for all business matters.congratulations! They are open monday through. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web there is a solution if you don’t have possession of the ein confirmation letter. Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or.

Irs Letter 147c Ein Previously Assigned

The owner of a us llc sends this form to the irs in order to request. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. This number reaches the irs business & specialty tax department,. Web the.

IRS FORM 147C PDF

Your previously filed return should. Here’s how you request an ein verification letter (147c) the easiest way to get a copy. The owner of a us llc sends this form to the irs in order to request. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested.

How can I get a copy of my EIN Verification Letter (147C) from the IRS

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web execute irs form 147c pdf in a couple of moments by simply following the instructions below: Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced.

irs letter 147c

The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web find a previously filed tax return for your existing entity (if you have filed a return).

Free Printable I 9 Forms Example Calendar Printable

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or. Web an irs letter 147c, also known as an ein verification letter, is.

IRS FORM 147C PDF

Web what is a 147c letter? Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or. Web execute irs form 147c pdf in a couple of moments by simply following the instructions below: Your previously filed return should. Web understanding your.

Irs Name Change Letter Sample Lovely Irs Ein Name Change Form Models

Web what is a 147c letter? Web execute irs form 147c pdf in a couple of moments by simply following the instructions below: The owner of a us llc sends this form to the irs in order to request. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web 147c form from the.

IRS FORM 147C

Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. They are open monday through. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web a wpd is required for all entities that have employees and are required to file.

Printable 147c Form 20202022 Fill and Sign Printable Template Online

Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. Web what is a 147c letter? Web the irs uses this form to verify the accuracy of the information reported on an employer?s ein application. Here’s how you.

Irs Letter 147c Sample

Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press.

Web Did The Irs Make A Typo On Your Ein Letter And You Need A New Form?

This number reaches the irs business & specialty tax department,. Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. The letter will confirm the employer name and ein connected with the.

Choose The Template You Will Need From The Collection Of Legal Forms.

Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. They are open monday through. Web the irs uses this form to verify the accuracy of the information reported on an employer?s ein application. Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or.

The Owner Of A Us Llc Sends This Form To The Irs In Order To Request.

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification. Web the cp 575 and 147c are technically different letters, however, they are both official letters from the irs and can be used for all business matters.congratulations! Web what is a 147c letter?

Your Previously Filed Return Should.

Web execute irs form 147c pdf in a couple of moments by simply following the instructions below: Web how do i get a form 147c from the irs? The business can contact the irs directly and request a replacement confirmation letter called a 147c. Here’s how you request an ein verification letter (147c) the easiest way to get a copy.