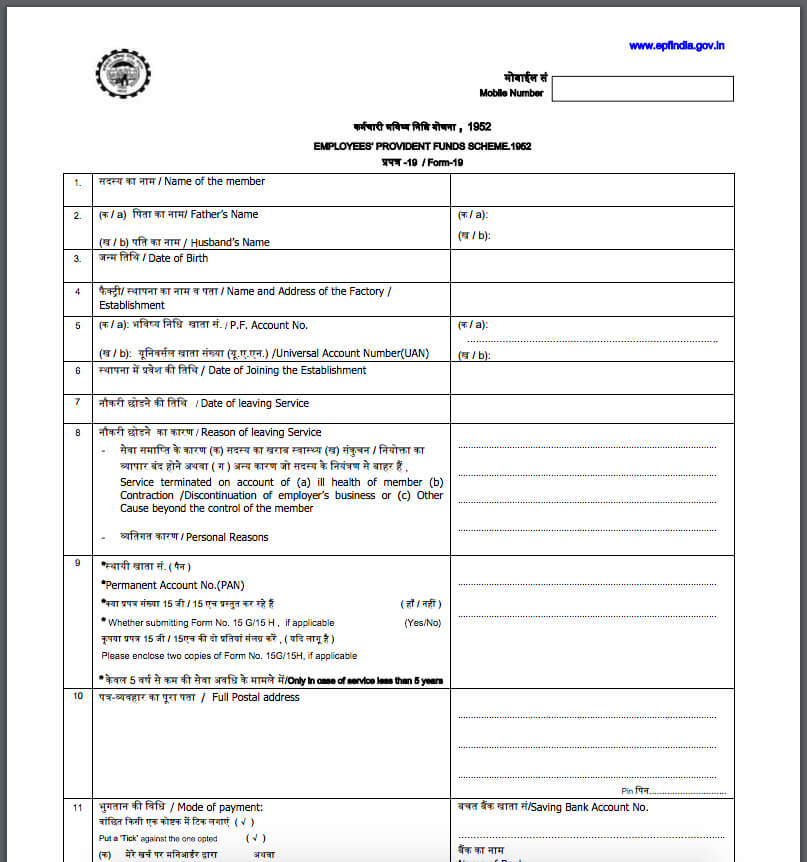

19 Pf Form

19 Pf Form - Settlement of my provident fund account. Thus, this form is also known as pf withdrawal form 19. Dates of job entry and leave. Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Web 2019 irs tax forms, schedules. Read on to know how to fill form 19 for the final pf settlement in a simple way. On the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ed67(e)”. Call today(0261)2311521, +91 8000011521, +91. Web pf claim form 19 can indeed be submitted using the pf a/c no. Every employee with a pf a/c is advised to combine their accounts by establishing a uan.

Web pf claim form 19 can indeed be submitted using the pf a/c no. Web 2019 irs tax forms, schedules. Applicable for employees whose aadhaar number and bank account details are available on the uan portal. In case of the death of the member, the family members/nominee/legal heir should apply through form. Home (current) about us newsroom join us blog category gold rate business loans money management accounting and inventory Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Education credits (american opportunity and lifetime learning credits) from jan. Kindly do not paste revenue stamp in case of payments through neft / electronic mode. Web the epf form 19 is also known as composite claim form. सदस्य का िाम / name of the member.

Settlement of my provident fund account. The form can be filled both online (at epf member portal) as well as offline. Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Web 2019 irs tax forms, schedules. Every employee with a pf a/c is advised to combine their accounts by establishing a uan. Employees must fill their complete details in the new form 11 and must have an active uan. The employee has to provide his mobile number for final settlement. The first two options can be put to use at the time of leaving employment for the sake of retirement or even otherwise. Log in to your uan account using at the epf member portal step 2: Applicable for employees whose aadhaar number and bank account details are available on the uan portal.

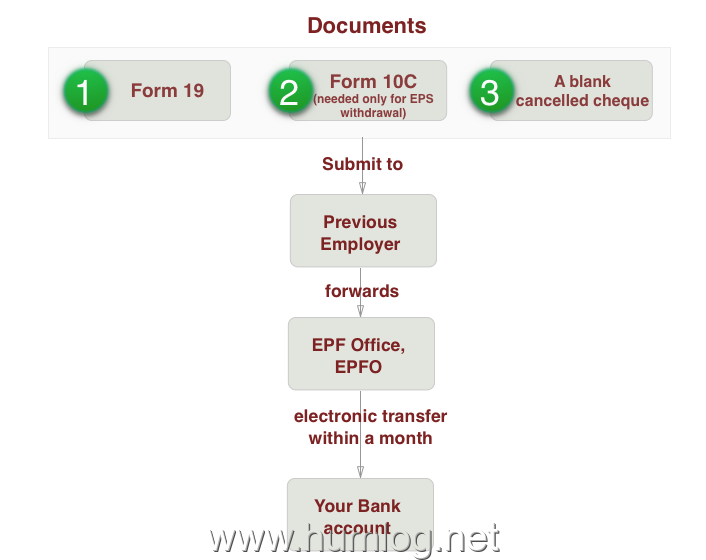

PF Form 19 & 10C Money Order Cheque

In case of the death of the member, the family members/nominee/legal heir should apply through form. Web epf withdrawal form 19 can be filled only after two months of leaving the job or on retirement. Go to www.irs.gov/form990pf for instructions and the latest information. Bank account number and ifsc code ( it must correspond to the same account used by.

Pf Withdrawal Form 10c In English sydneydwnload

Go to www.irs.gov/form990pf for instructions and the latest information. Start date and end date of employment Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Under the ‘online services’ tab, click on ‘claim (form 31, 19, 10c & 10d) step 3: Only those employees who have.

EPF Form 19 How to Fill for Final PF Settlement Online

Web pf claim form 19 can indeed be submitted using the pf a/c no. Dates of job entry and leave. Log in to your uan account using at the epf member portal step 2: Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. The first two options.

KNOWLEDGE BLOG ON "INDIAN LABOUR LAW AND HUMAN RESOURCE" ADVOCATE

To withdraw pension amount employees need to submit pf form 10c. Home (current) about us newsroom join us blog category gold rate business loans money management accounting and inventory Under the ‘online services’ tab, click on ‘claim (form 31, 19, 10c & 10d) step 3: Web using pf claim form 19, employees can apply for an advance or withdrawal of.

PF Withdrawal Form 19 Sample Cheque Payments

Call today(0261)2311521, +91 8000011521, +91. It is only applicable to employees who do not have a universal account number (uan). Web the epf form 19 is also known as composite claim form. Employees must fill their complete details in the new form 11 and must have an active uan. On the next screen that opens, enter the last 4 digits.

PF Form 19

When individual wishes to withdraw the epf funds as the last settlement, he or she will fill out form 19. Web claim form 19 pf is only for employees who do not have a uan. Employees are eligible to claim pf amount after 2 months from the date of exit. Bank account number and ifsc code (must be the same.

Samplepf Withdrawl Forms 19 Cheque Banking

Every employee with a pf a/c is advised to combine their accounts by establishing a uan. Account number for the provident fund. The reason for applying for an advance or withdrawal of pf can be any of the following: Web the epf form 19 is also known as composite claim form. Web epf form no.

KNOWLEDGE BLOG ON "INDIAN LABOUR LAW AND HUMAN RESOURCE" ADVOCATE

It is also possible to file pf claim form 19 without a uan by simply stating the pf. The form can be filled both online (at epf member portal) as well as offline. Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. Pf form no 19 can.

PF Form 19 & 10C (Speciman Copy) Money Order Cheque

Web 2019 irs tax forms, schedules. Every employee with a pf a/c is advised to combine their accounts by establishing a uan. When individual wishes to withdraw the epf funds as the last settlement, he or she will fill out form 19. Dates of job entry and leave. Here are some things to remember while filing epf form 19:

PF Form 19

Web employees’ provident fund scheme 1952 form 19 for claiming final settlement from provident fund instructions who can apply: Start date and end date of employment Thus, this form is also known as pf withdrawal form 19. Bank account number and ifsc code (must be the same account as one's current employer's account) 15g/15h form. Read on to know how.

Pf Settlement Pension Withdrawal Benefits (Only If The Service Is Less That 10 Years) Pf Part Withdrawal Pf Settlement

Employees are eligible to claim pf amount after 2 months from the date of exit. Bank account number and ifsc code (must be the same account as one's current employer's account) 15g/15h form. Members of the fund after leaving service under conditions mentioned against 3 below. Web claim form 19 pf is only for employees who do not have a uan.

Here Are Some Things To Remember While Filing Epf Form 19:

Pf form no 19 can be filed without a uan, and the member will only have to mention his/her pf account number. Following are the two types of form 19: Under the ‘online services’ tab, click on ‘claim (form 31, 19, 10c & 10d) step 3: To withdraw pension amount employees need to submit pf form 10c.

Web Epf Withdrawal Form 19 Can Be Filled Only After Two Months Of Leaving The Job Or On Retirement.

The employee has to provide his mobile number for final settlement. Go to www.irs.gov/form990pf for instructions and the latest information. Applicable for employees whose aadhaar number and bank account details are available on the uan portal. Start date and end date of employment

Log In To Your Uan Account Using At The Epf Member Portal Step 2:

On the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ed67(e)”. Web when can you use pf form 19? Read on to know how to fill form 19 for the final pf settlement in a simple way. Call today(0261)2311521, +91 8000011521, +91.