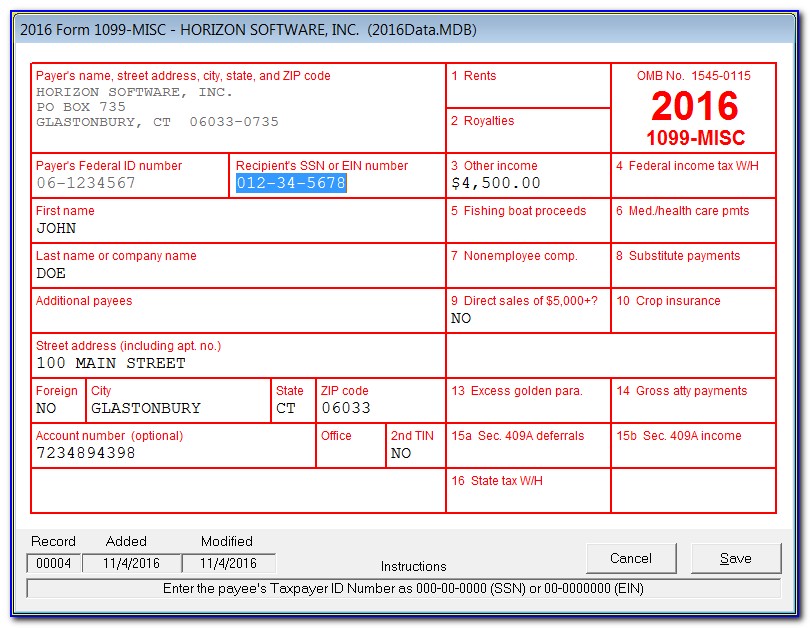

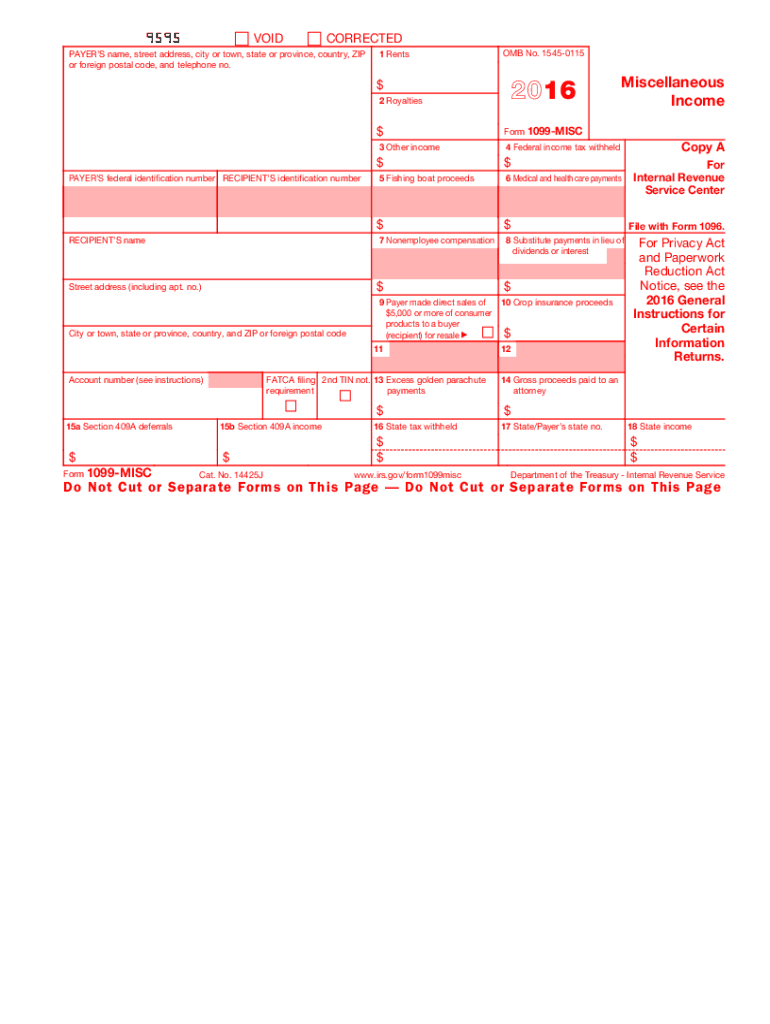

2016 Form 1099 Misc

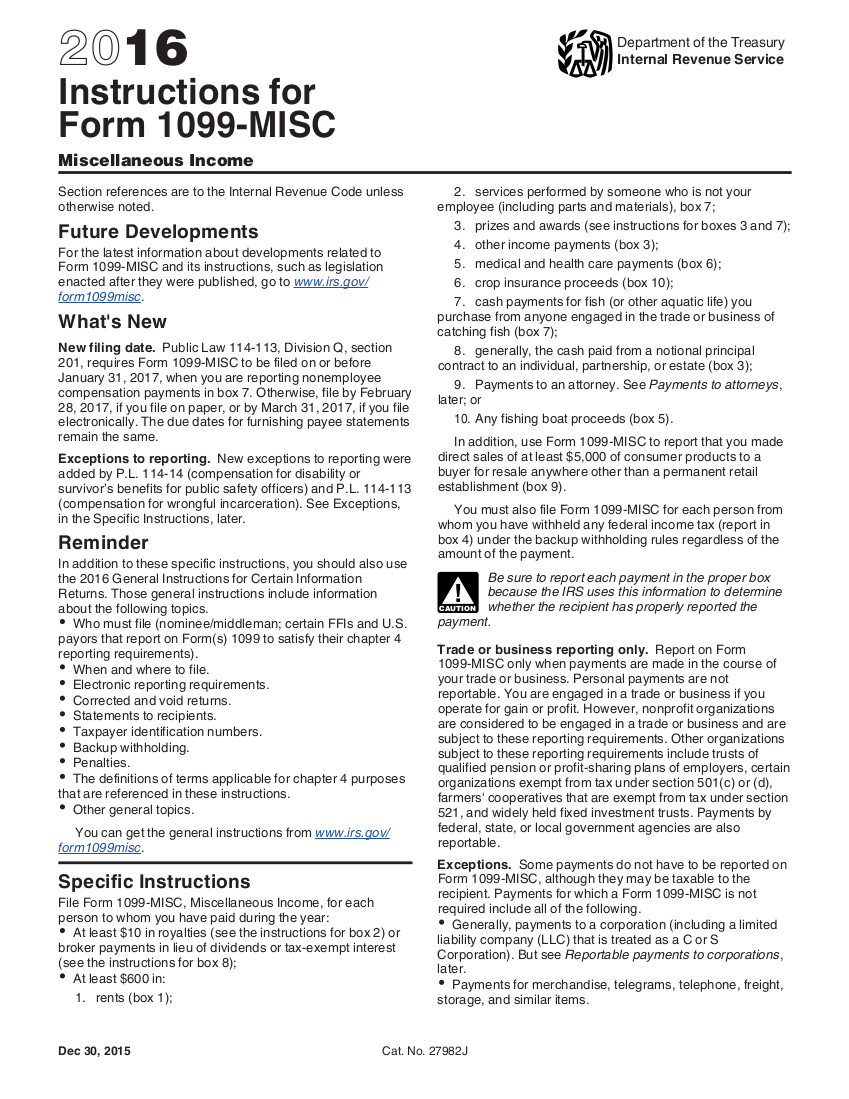

2016 Form 1099 Misc - Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. For your protection, this form may show only the last four digits of your social security number. 4 never miss important information: In addition to the money paid to non. Complete, edit or print tax forms instantly. At least $10 in royalties or broker payments in lieu of dividends or tax. At least $10 in royalties (see the instructions for box 2) or. 1 tips on how to make a fake paystub: Web the non employee compensation box was removed from the 1099 misc, and is now being handled with it's own separate form, the 1099 nec. Staples provides custom solutions to help organizations achieve their goals.

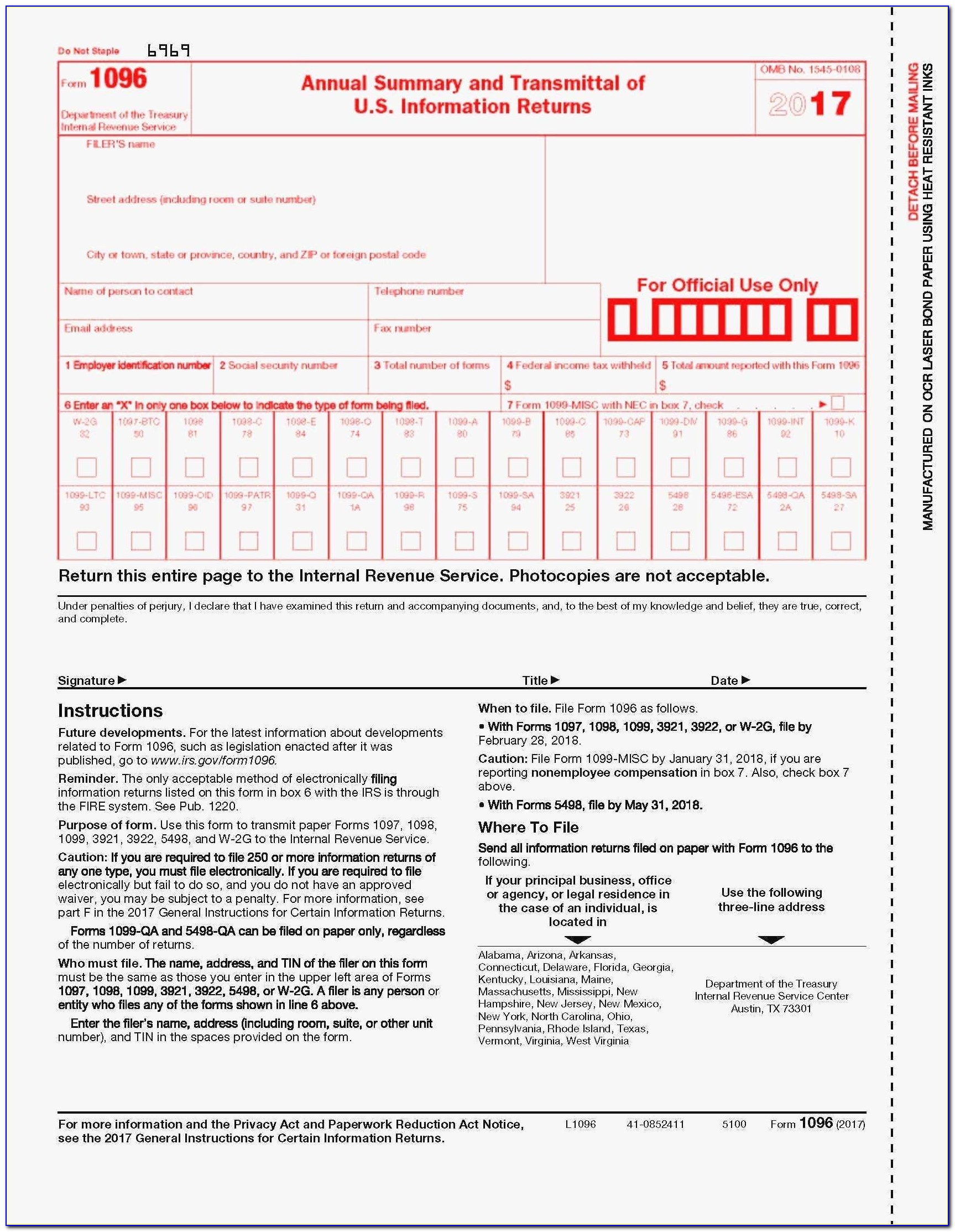

Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. How to create a 1099 misc 2016 tax form online? 2 the number of dollars should be exact: Complete, edit or print tax forms instantly. Web the non employee compensation box was removed from the 1099 misc, and is now being handled with it's own separate form, the 1099 nec. Also, check box 7 above. Ad discover a wide selection of 1099 tax forms at staples®. You don’t need to create a 1099 misc 2016 tax form, but use. At least $10 in royalties or broker payments in lieu of dividends or.

Complete, edit or print tax forms instantly. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. You don’t need to create a 1099 misc 2016 tax form, but use. Also, check box 7 above. At least $10 in royalties or broker payments in lieu of dividends or. • with forms 5498, file by may 31,. Web instructions for recipient recipient's taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number. How to create a 1099 misc 2016 tax form online? 4 never miss important information:

Free Downloadable 1099 Misc Form 2016 Universal Network

2 the number of dollars should be exact: Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. At least $10 in royalties or broker payments in lieu of dividends or tax. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving.

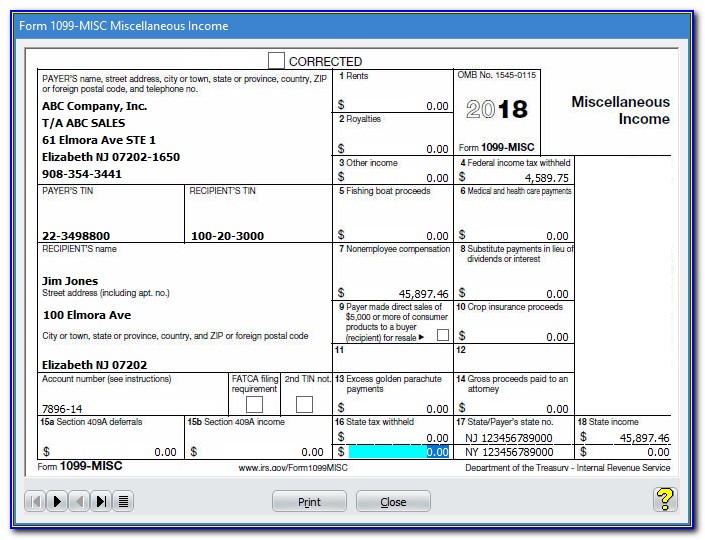

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

City or town state or province country and zip or foreign. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. In addition to the money paid to non. How to create a 1099 misc 2016 tax form online?

What is a 1099Misc Form? Financial Strategy Center

Ad discover a wide selection of 1099 tax forms at staples®. Also, check box 7 above. 4 never miss important information: Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. At least $10 in royalties or broker payments in lieu of dividends or.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. How to create a 1099 misc 2016 tax form online? Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. At least $10 in royalties (see the instructions for box 2) or.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

You don’t need to create a 1099 misc 2016 tax form, but use. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. Web checkpaystub.com has.

1099 (2016) Instructions Edit Forms Online PDFFormPro

Complete, edit or print tax forms instantly. In addition to the money paid to non. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. 1 tips on how to make a fake paystub: City or town state or province country and zip or foreign.

Printable 1099 Tax Form 2016 Form Resume Examples

Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. City or town state or province country and zip or foreign. In addition to the money paid to non. At least $10 in royalties or broker payments in lieu of.

IRS 1099MISC 2016 Fill and Sign Printable Template Online US Legal

Complete, edit or print tax forms instantly. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. 2 the number of dollars should be exact: Complete, edit or print tax forms instantly. At least $10 in royalties (see the instructions for box 2) or.

The Tax Times 2016 Form 1099's are FATCA Compliant

Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. At least $10 in royalties (see the instructions for box 2) or. Web the non employee compensation box was removed from the 1099 misc, and is now being handled with.

1099 Misc 2016 Fillable Form Free Universal Network

Complete, edit or print tax forms instantly. Staples provides custom solutions to help organizations achieve their goals. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016. Ad access irs tax forms. Complete, edit or print tax forms instantly.

4 Never Miss Important Information:

You don’t need to create a 1099 misc 2016 tax form, but use. City or town state or province country and zip or foreign. At least $10 in royalties or broker payments in lieu of dividends or tax. Web in accordance with the recently passed path act, these deadlines will be changing so the mailing and transmittal are both january 31 moving forward starting with tax year 2016.

Ad Access Irs Tax Forms.

1 tips on how to make a fake paystub: Complete, edit or print tax forms instantly. Ad discover a wide selection of 1099 tax forms at staples®. Web checkpaystub.com has fillable 1099 misc 2016 ready to use.

2 The Number Of Dollars Should Be Exact:

Also, check box 7 above. For your protection, this form may show only the last four digits of your social security number. In addition to the money paid to non. How to create a 1099 misc 2016 tax form online?

Web Specific Instructions Statements To Recipients Fatca Filing Requirement Check Box 2Nd Tin Not.

At least $10 in royalties or broker payments in lieu of dividends or. At least $10 in royalties (see the instructions for box 2) or. Web the non employee compensation box was removed from the 1099 misc, and is now being handled with it's own separate form, the 1099 nec. • with forms 5498, file by may 31,.