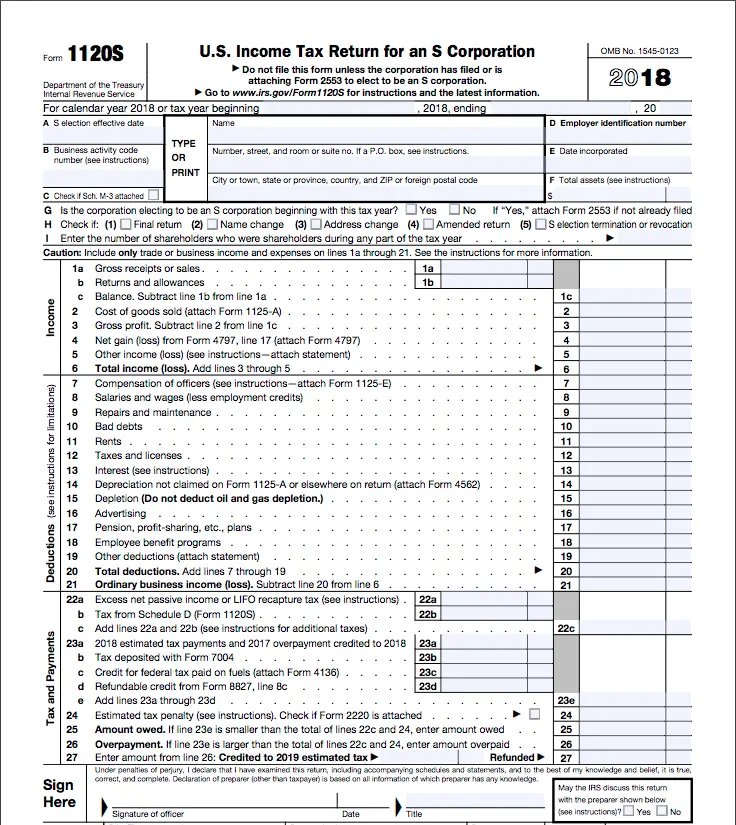

2018 Form 1120S

2018 Form 1120S - Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Income tax return for an s corporation) is available in turbotax business. For steps to amend the return. For calendar year corporations, the due date is march 15, 2018. When you first start a return in turbotax business, you'll be asked. Web section 1120s of the irs form 1120s deals with taxes and payments. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web form 1120s (u.s. Ad easy, fast, secure & free to try! (for shareholder's use only) department of the treasury.

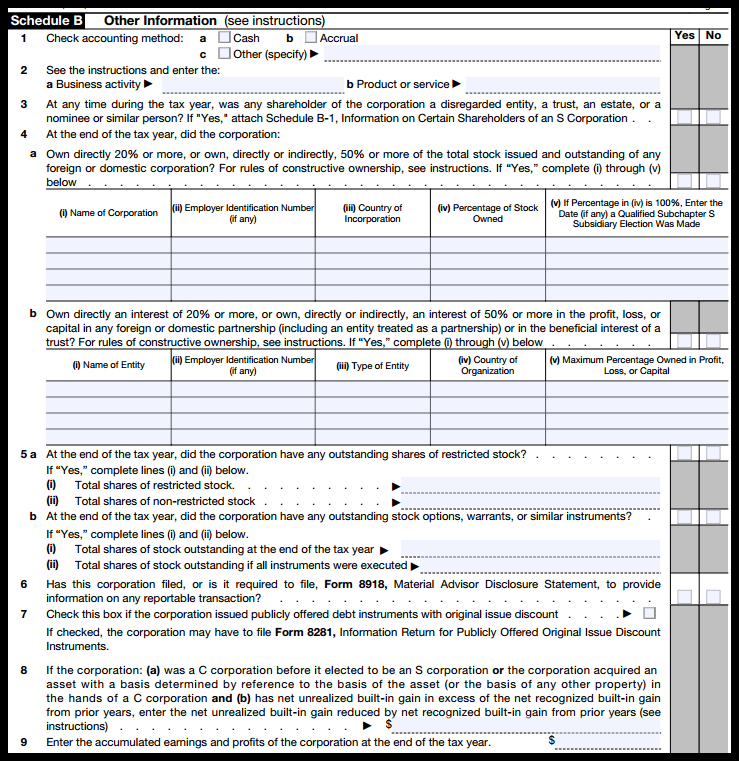

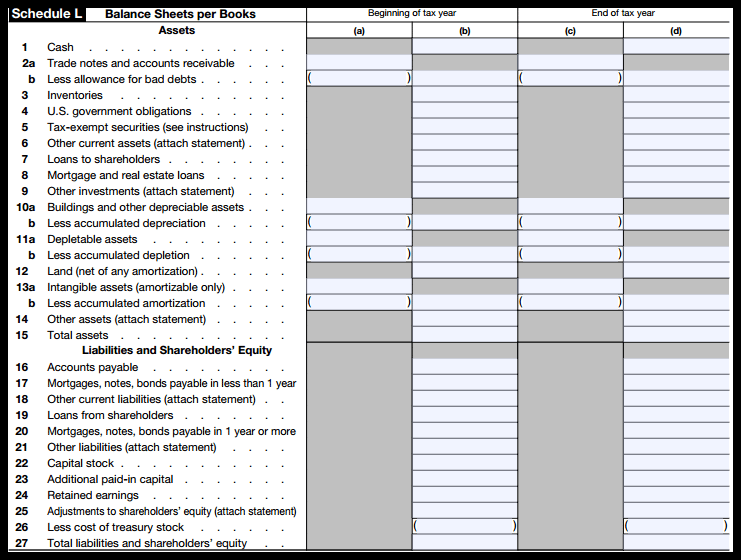

2 schedule b other information (see instructions) 1. Web form 1120s (u.s. For calendar year corporations, the due date is march 15, 2018. For steps to amend the return. Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Open the originally filed return. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web see the instructions and enter the: Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits, and other information. (for shareholder's use only) department of the treasury.

Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Ad easy, fast, secure & free to try! Business activity b product or service at the end of the tax year, did the corporation own, directly or indirectly, 50% or more of the voting stock of. (for shareholder's use only) department of the treasury. Open the originally filed return. Rather the profit reported on the s. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web see the instructions and enter the: When you first start a return in turbotax business, you'll be asked. Complete, edit or print tax forms instantly.

2018 form 1120s k1 Fill Online, Printable, Fillable Blank form

Web form 1120s (u.s. Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The form.

IRS Form 1120S Definition, Download, & 1120S Instructions

Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The form should not be filed unless. Web section 1120s of the irs form 1120s deals with taxes and payments. (for shareholder's use only) department of the treasury. Web see the instructions and enter the:

IRS Form 1120S Definition, Download & Filing Instructions

Web section 1120s of the irs form 1120s deals with taxes and payments. For steps to amend the return. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Rather the profit reported on the s. Open the originally filed return.

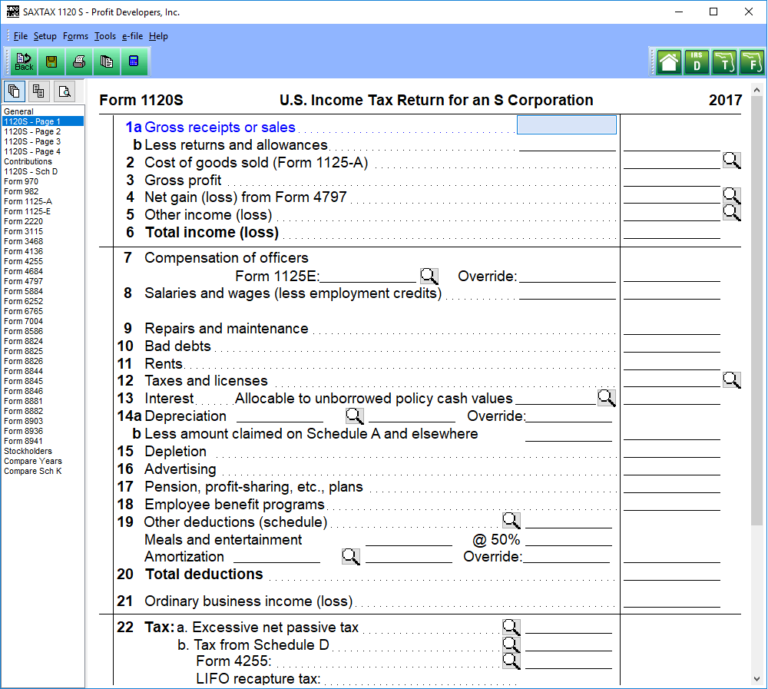

1120S Program SAXTAX

Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Ad easy, fast, secure & free to try! Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits,.

2018 Form 1120 Federal Corporation Tax Return YouTube

Open the originally filed return. For calendar year corporations, the due date is march 15, 2018. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The.

What Tax Form Does An Llc File

For steps to amend the return. Web section 1120s of the irs form 1120s deals with taxes and payments. Web see the instructions and enter the: For calendar year corporations, the due date is march 15, 2018. Income tax return for an s corporation) is available in turbotax business.

Fill Free fillable form 1120s u.s. tax return for an s

2 schedule b other information (see instructions) 1. Open the originally filed return. Ad easy, fast, secure & free to try! Web form 1120s (u.s. Web see the instructions and enter the:

IRS Form 1120S Definition, Download & Filing Instructions

Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The form should not be filed unless. Web see the instructions and enter the: Complete, edit or print tax forms instantly. When you first start a return in turbotax business, you'll be asked.

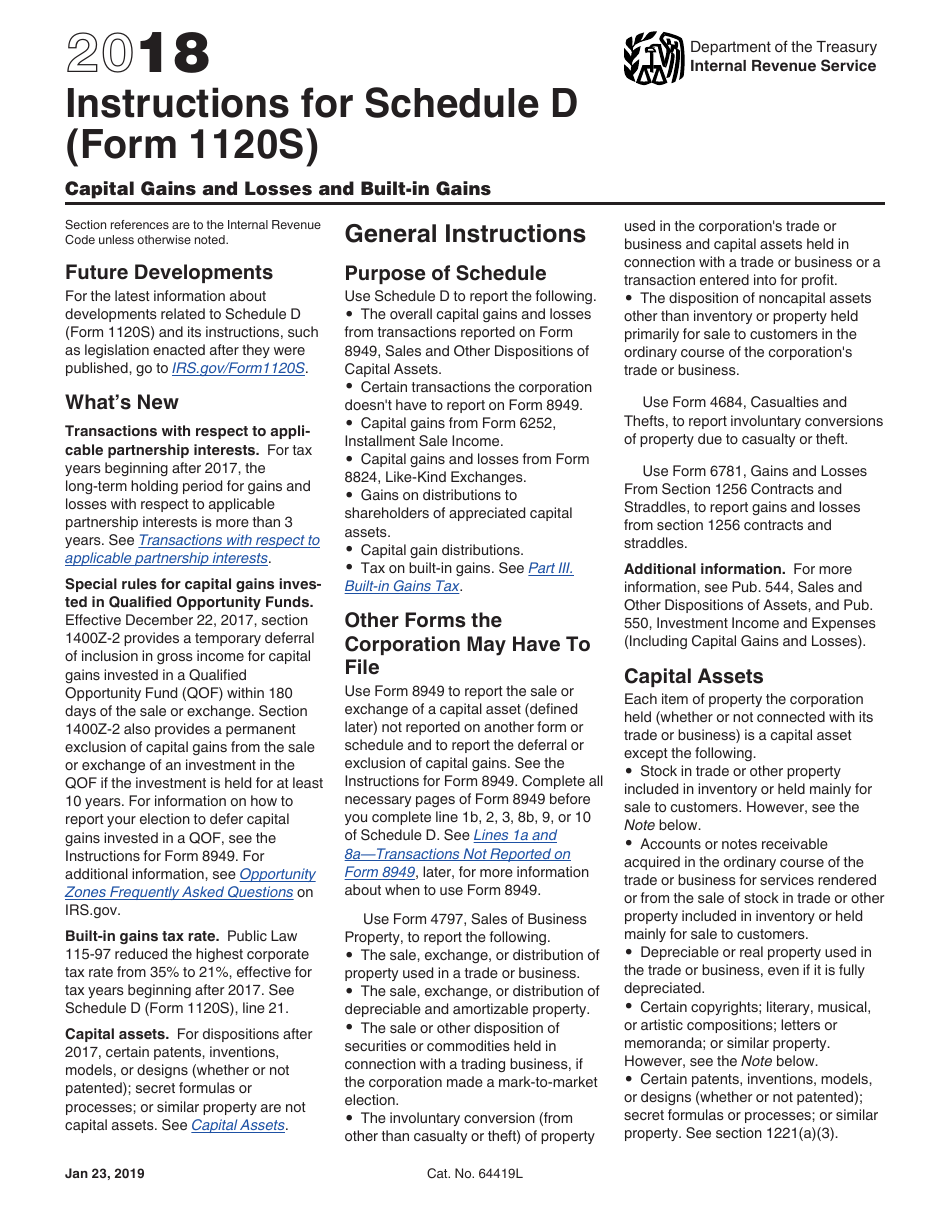

Download Instructions for IRS Form 1120S Schedule D Capital Gains and

Open the originally filed return. Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Get ready for tax season deadlines by completing any required tax forms today. (for shareholder's use only) department of the.

Fill Free fillable form 1120s u.s. tax return for an s

Web section 1120s of the irs form 1120s deals with taxes and payments. Get ready for tax season deadlines by completing any required tax forms today. Open the originally filed return. For steps to amend the return. Rather the profit reported on the s.

2 Schedule B Other Information (See Instructions) 1.

Complete, edit or print tax forms instantly. For calendar year corporations, the due date is march 15, 2018. Web generally, an s corporation must file form 1120s by the 15th day of the 3rd month after the end of its tax year. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try!

When You First Start A Return In Turbotax Business, You'll Be Asked.

Get ready for tax season deadlines by completing any required tax forms today. Web form 1120s (2018) is used by s corporations to report their income, gains, losses, deductions, credits, and other information. Income tax return for an s corporation) is available in turbotax business. For steps to amend the return.

Web Form 1120S (U.s.

(for shareholder's use only) department of the treasury. Web see the instructions and enter the: Web for taxable years beginning on or after january 1, 2014, the irs allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file schedule. Business activity b product or service at the end of the tax year, did the corporation own, directly or indirectly, 50% or more of the voting stock of.

Rather The Profit Reported On The S.

Web section 1120s of the irs form 1120s deals with taxes and payments. The form should not be filed unless. Ad easy, fast, secure & free to try! Open the originally filed return.