2020 Form 8863

2020 Form 8863 - About form 8863, education credits (american opportunity and lifetime learning credits) | internal revenue service Web due date of their 2020 return (including extensions) educational institution's ein you must provide the educational institution's employer identification number (ein) on your form 8863. Web regardless of who files, there are some limits to who can file form 8863. The lifetime learning credit cannot be claimed if you make more than $69,000 if filing as single or $138,000 if filing jointly. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Form 8863 fillable can be completed online or printed out as a pdf and mailed to the irs. This credit equals 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses paid for each eligible student. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee. Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites.

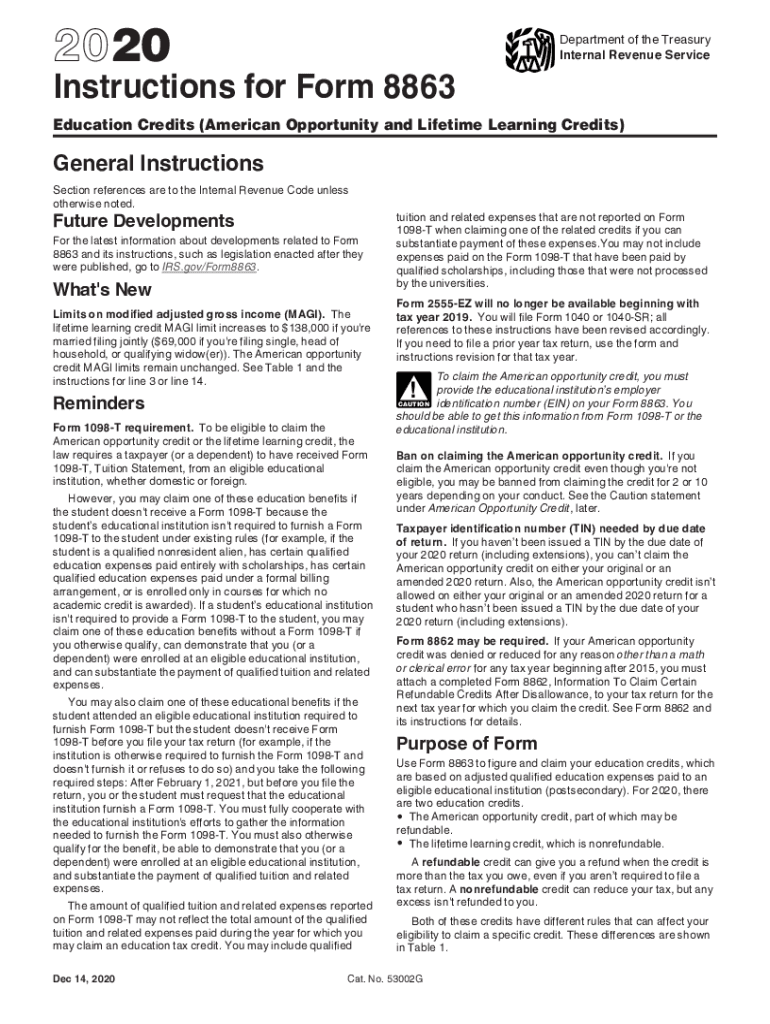

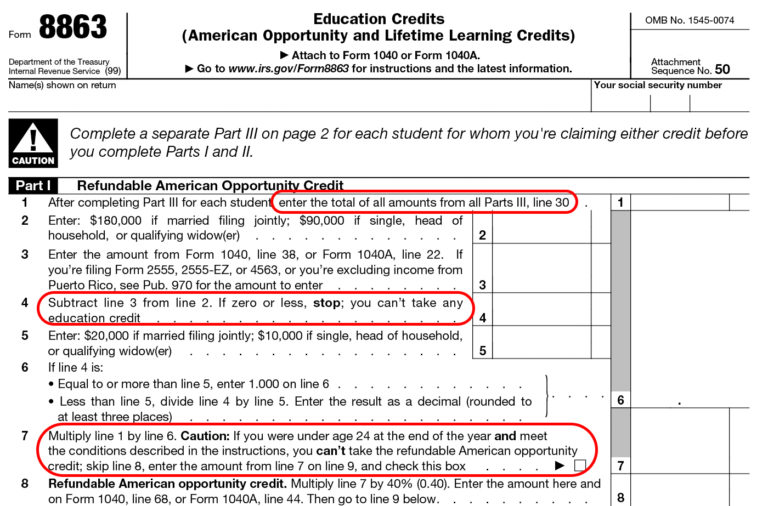

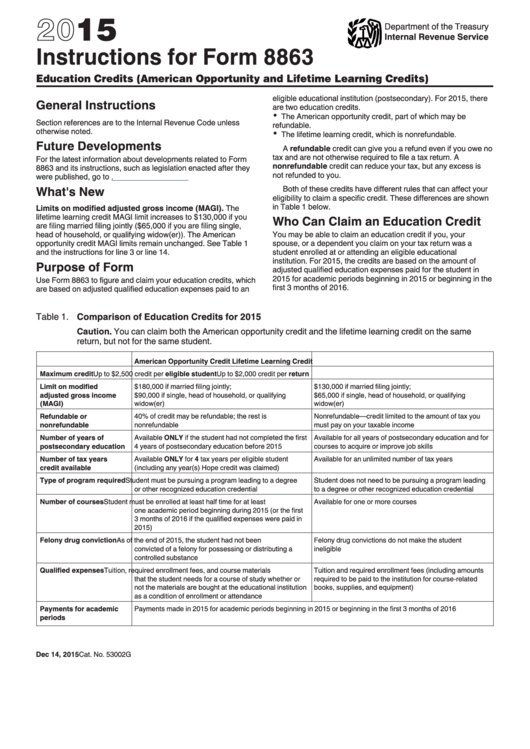

You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a Who can claim an education credit. If the taxpayer was under age 24 at the end of the year and certain conditions apply, they may not qualify to receive the refundable portion of the american opportunity credit. The american opportunity credit, part. Go to www.irs.gov/form8863 for instructions and the latest information. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for tax year 2022. Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code unless otherwise noted. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web the due date to file the 8863 tax form for 2022 is april 15, 2023.

Up to 40% of that credit may be refundable. Follow the simple instructions below: You can claim these expenses for yourself, your spouse, or a qualified dependent. Department of the treasury internal revenue service. There are two education credits: Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code unless otherwise noted. For 2022, there are two education credits. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. This includes the american opportunity credit (aotc) and the lifetime learning credit (llc). Offer valid for returns filed 5/1/ /31/2020.

Tax Computation Worksheet 2020 Master of Documents

Form 8863 fillable can be completed online or printed out as a pdf and mailed to the irs. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. About form 8863, education credits (american opportunity and lifetime learning credits) | internal revenue service Offer valid.

Understanding IRS Form 8863 Do I Qualify for American Opportunity

Department of the treasury internal revenue service. Web american opportunity credit vs. There are two education credits. Up to 40% of that credit may be refundable. Web what is irs form 8863?

Instructions For Form 8863 Instructions For Form 8863, Education

There are two education credits. The american opportunity credit, part of which may be refundable. 50 name(s) shown on return Get your online template and fill it in using progressive features. Up to 40% of that credit may be refundable.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code unless otherwise noted. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated.

Form 8863 Instructions Information On The Education 1040 Form Printable

No cash value and void if transferred or where prohibited. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for tax year 2022. The tax credit is calculated by applying 100 percent of the first $2,000 in expenses plus 25 percent of.

MW My 2004 Federal and State Tax Returns

This credit equals 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses paid for each eligible student. Web 2020 form 8863 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 103 votes how to fill out and sign form 8863 online? Up to 40% of that.

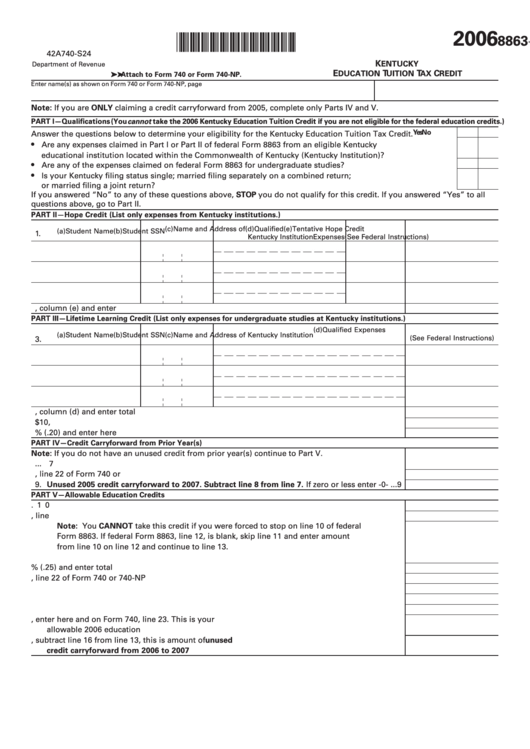

Form 8863K Education Tuition Tax Credit printable pdf download

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Enjoy smart fillable fields and interactivity. The maximum modified adjusted gross income (magi) for claiming the aoc is $180,000 if your filing status is married filing jointly, or $90,000 if. You can claim these.

Understanding IRS Form 8863 Do I Qualify for American Opportunity

Web regardless of who files, there are some limits to who can file form 8863. Web due date of their 2020 return (including extensions) educational institution's ein you must provide the educational institution's employer identification number (ein) on your form 8863. Web american opportunity credit vs. About form 8863, education credits (american opportunity and lifetime learning credits) | internal revenue.

Instructions For Form 8863 Education Credits (american Opportunity And

The american opportunity credit, part of which may be refundable. This credit equals 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses paid for each eligible student. Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal.

IRS Form 8917 Full Guide to Understanding Tuition and Fees Deduction

The education credits are designed to offset updated for current information. This credit equals 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses paid for each eligible student. The american opportunity credit provides up to $2,500 in tax credit value per eligible student. For 2022, there are two education credits. Web regardless of who files,.

Web If Sharon Were To File Form 8863 For 2020, She Would Check “Yes” For Part Iii, Line 23, And Would Be Eligible To Claim Only The Lifetime Learning Credit If She Meets All Other Requirements.

Enter the amount from form 8863, line 18. You cannot claim the american opportunity credit if you make more than $90,000 if filing as single or $180,000 if filing jointly. Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Web regardless of who files, there are some limits to who can file form 8863.

50 Name(S) Shown On Return

Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code unless otherwise noted. The maximum modified adjusted gross income (magi) for claiming the aoc is $180,000 if your filing status is married filing jointly, or $90,000 if. The education credits are designed to offset updated for current information. Irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit.

Offer Valid For Returns Filed 5/1/ /31/2020.

Web what is form 8863? Follow the simple instructions below: Web form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Go to www.irs.gov/form8863 for instructions and the latest information.

The American Opportunity Credit Provides Up To $2,500 In Tax Credit Value Per Eligible Student.

About form 8863, education credits (american opportunity and lifetime learning credits) | internal revenue service For 2022, there are two education credits. If the return is not complete by 5/31, a $99 fee. Web american opportunity credit vs.