2021 Form 8880

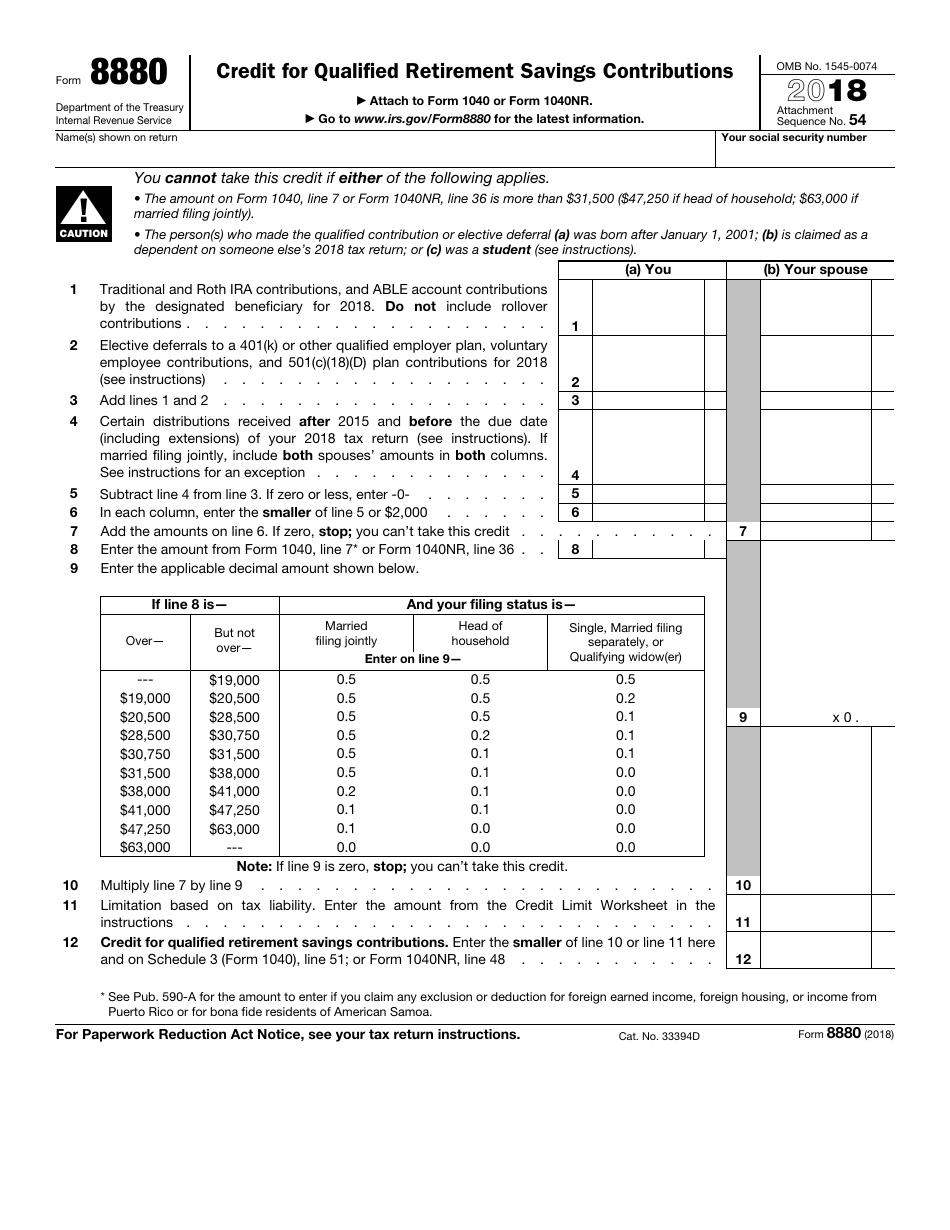

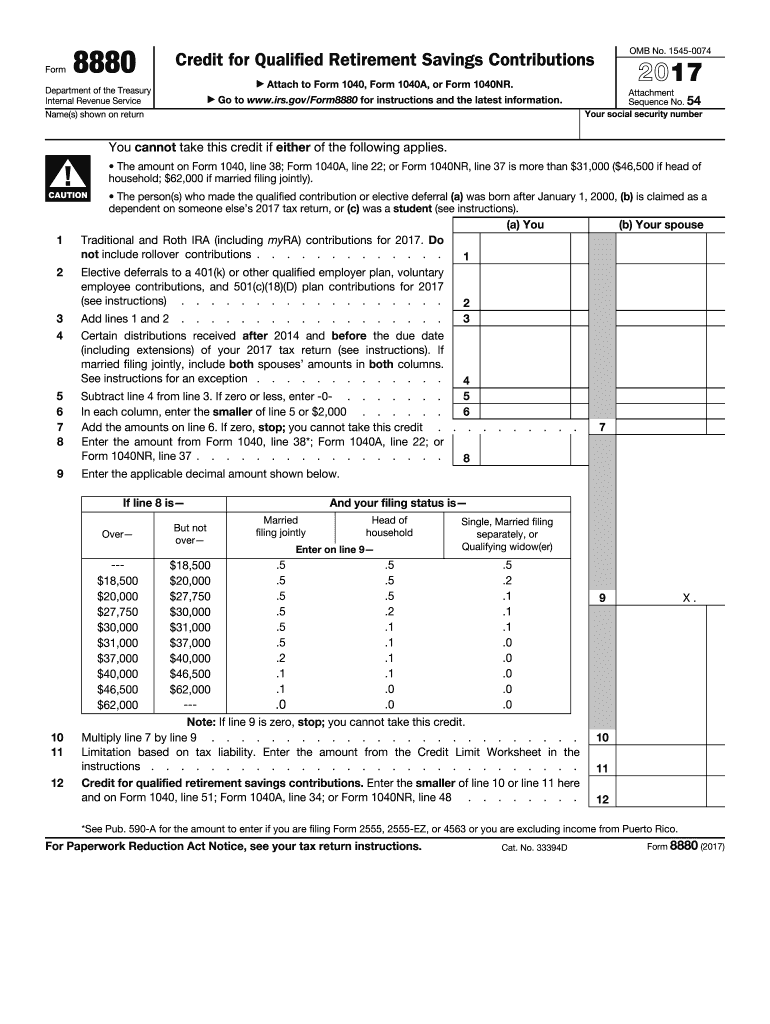

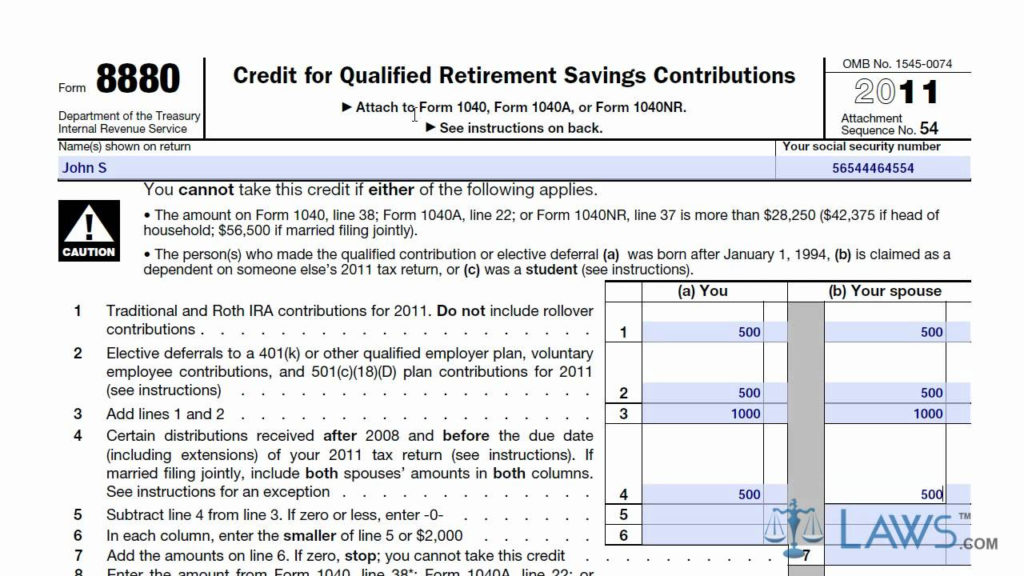

2021 Form 8880 - Web see form 8880, credit for qualified retirement savings contributions, for more information. Your social security number ! Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. To help determine eligibility, use the help of a tax professional at h&r block. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Eligible plans to which you can make contributions and claim the. Many people don’t take advantage of the credit simply because they don’t know anything about it. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements.

Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Many people don’t take advantage of the credit simply because they don’t know anything about it. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Go to www.irs.gov/form8880 for the latest information. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Web in order to claim the retirement savings credit, you must use irs form 8880. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income.

Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Contributions you make to a traditional or roth ira, Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. To help determine eligibility, use the help of a tax professional at h&r block. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Go to www.irs.gov/form8880 for the latest information.

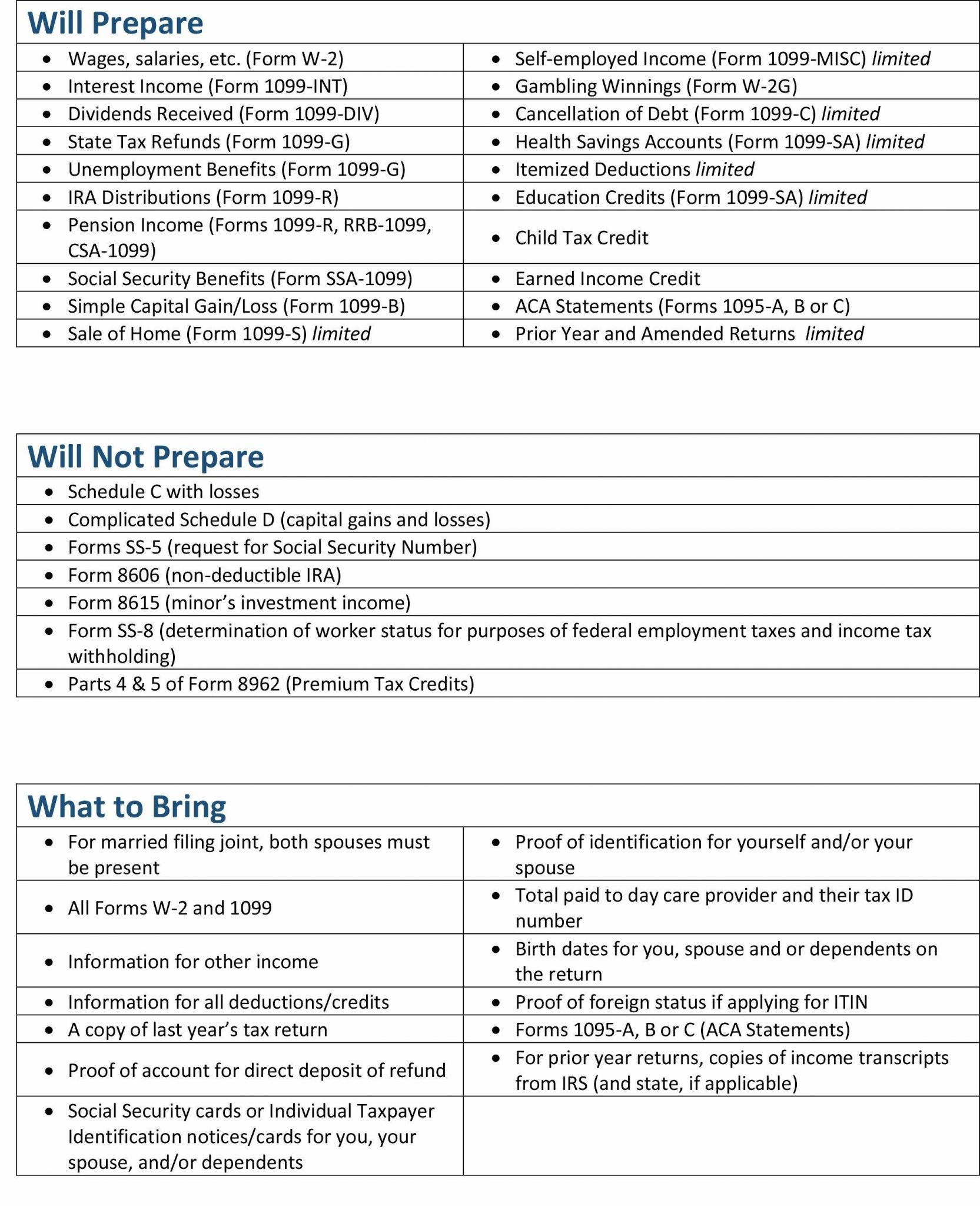

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. To help determine eligibility, use.

8880 Form Fill Out and Sign Printable PDF Template signNow

Contributions you make to a traditional or roth ira, Eligible plans to which you can make contributions and claim the. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy.

Taxable Social Security Worksheet 2021

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Depending on your adjusted gross income reported on your form 1040 series return, the.

Das IRSFormulars 8962 richtig ausfüllen PDF Editor PDF

Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Contributions you make to a traditional or roth ira, Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Go to www.irs.gov/form8880 for the latest information. Web see form 8880, credit for qualified.

Credit Limit Worksheet 8880 —

Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Eligible plans to which you can make contributions and claim the. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Elective deferrals to a 401(k) or other qualified.

Learn How To Fill The Form 8880 Credit For Qualified 2021 Tax Forms

Web in order to claim the retirement savings credit, you must use irs form 8880. Go to www.irs.gov/form8880 for the latest information. Contributions you make to a traditional or roth ira, Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Your social security number !

Credit Limit Worksheet 8880 —

Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and.

Application Form Turbo Tax

Many people don’t take advantage of the credit simply because they don’t know anything about it. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web in order to claim the retirement savings credit, you must use irs form 8880. Depending on your adjusted gross income reported on your form 1040 series return, the amount of.

Form 8802 Fillable and Editable PDF Template

Many people don’t take advantage of the credit simply because they don’t know anything about it. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Web in.

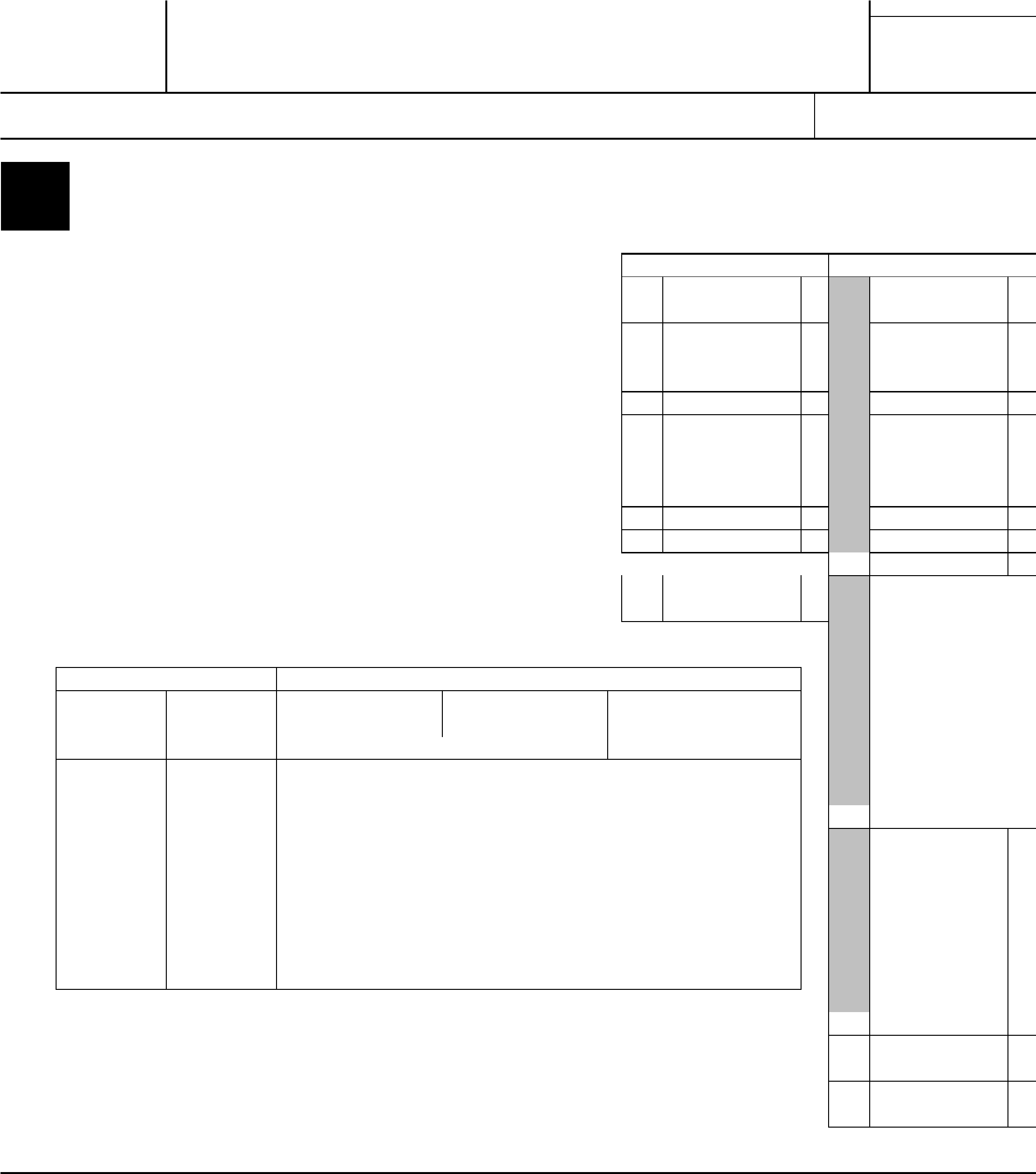

IRS Form 990 Heartland House

Go to www.irs.gov/form8880 for the latest information. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Eligible plans to which you can make contributions and claim the. Many.

Web Based On Form 8880, The Credit Percentage Is 50%, 20%, Or 10% Of The Eligible Contributions, Depending On Your Adjusted Gross Income.

Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Your social security number ! Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Eligible plans to which you can make contributions and claim the.

Many People Don’t Take Advantage Of The Credit Simply Because They Don’t Know Anything About It.

Web traditional and roth ira contributions, and able account contributions by the designated beneficiary for 2021. Do not include rollover contributions. Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee contributions, and 501(c)(18)(d) plan contributions for 2021 (see instructions). Contributions you make to a traditional or roth ira,

Form 8880 Is Used By Individuals To Figure The Amount, If Any, Of Their Retirement Savings Contributions Credit.

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web in order to claim the retirement savings credit, you must use irs form 8880. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Go to www.irs.gov/form8880 for the latest information.

Depending On Your Adjusted Gross Income Reported On Your Form 1040 Series Return, The Amount Of The Credit Is 50%, 20% Or 10% Of:

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. To help determine eligibility, use the help of a tax professional at h&r block. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans.