2021 Form 8995 Instructions

2021 Form 8995 Instructions - Register and subscribe now to work on your irs form 8995 & more fillable forms. Department of the treasury internal revenue service. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web electing small business trusts (esbt). Attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Complete, edit or print tax forms instantly. When attached to the esbt tax.

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. When attached to the esbt tax. Register and subscribe now to work on your irs form 8995 & more fillable forms. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The form 8995 used to. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. A go to www.irs.gov/form8995a for. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041.

Department of the treasury internal revenue service. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. When attached to the esbt tax. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The form 8995 used to. Register and subscribe now to work on your irs form 8995 & more fillable forms.

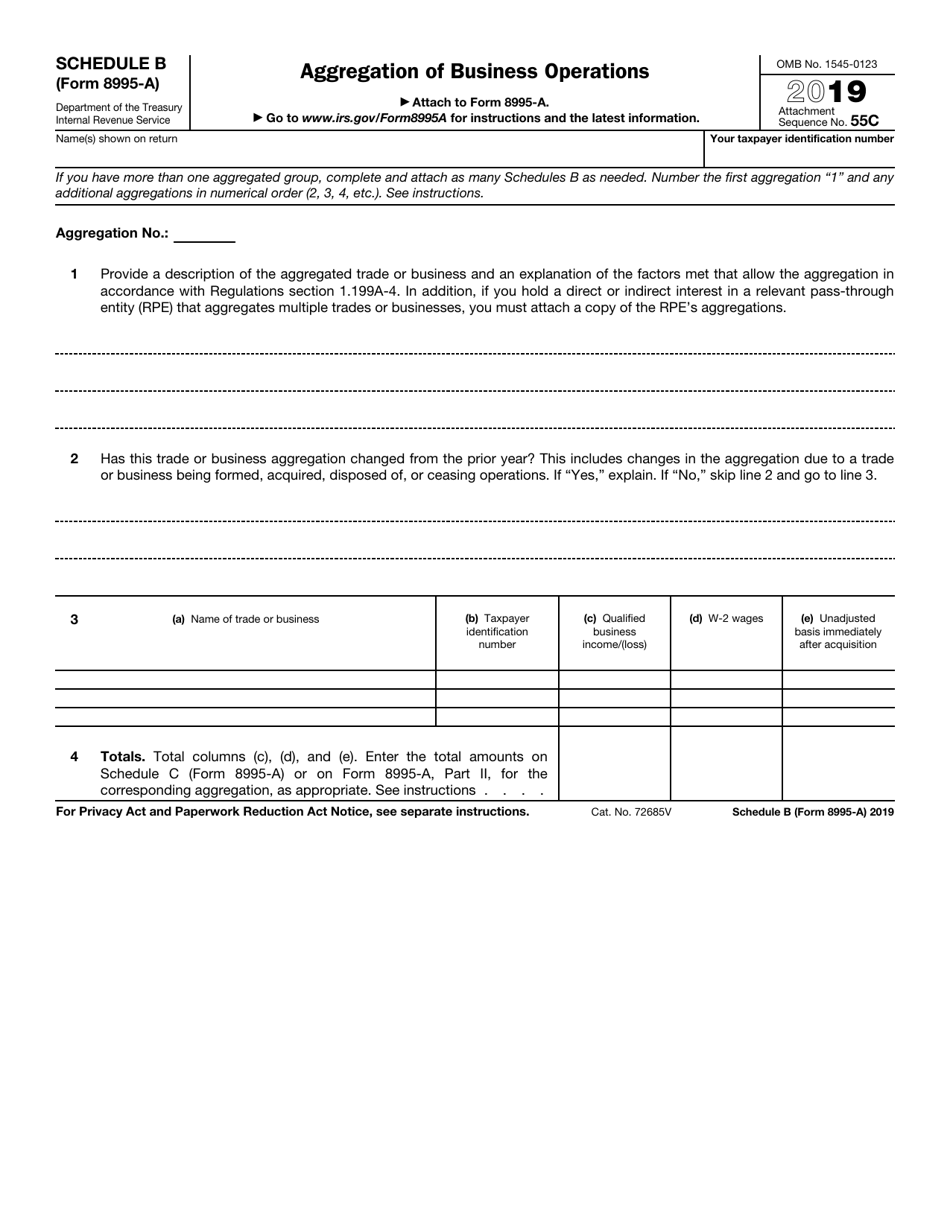

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Department of the treasury internal revenue service. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate..

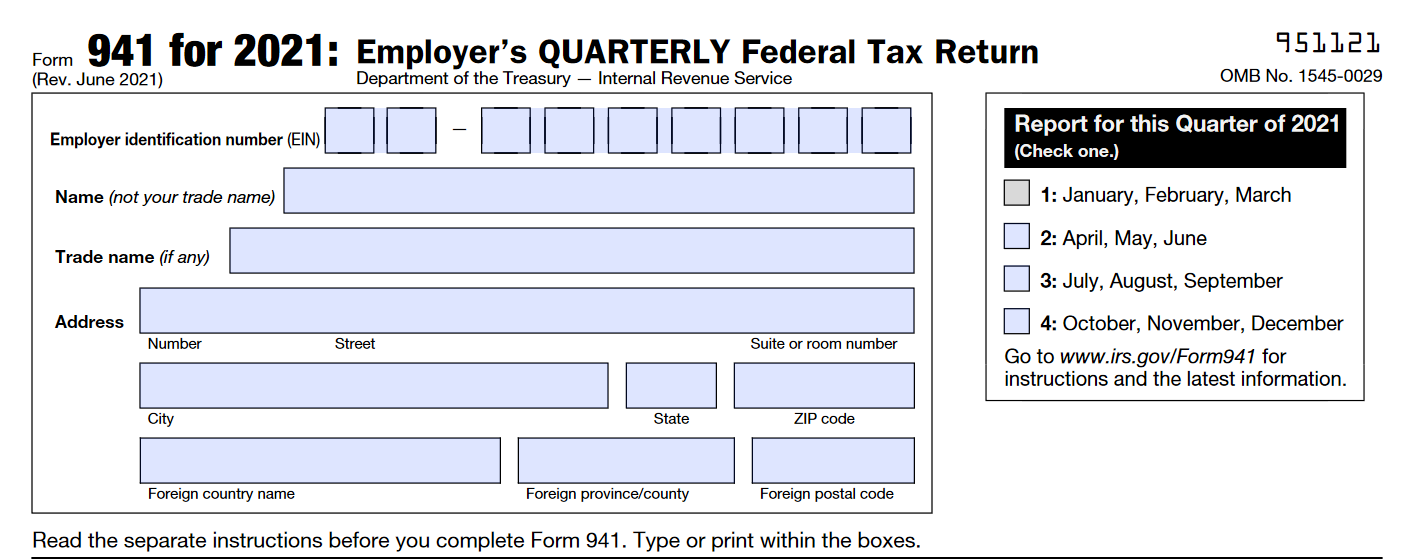

IRS Form 941 Instructions for 2021 How to fill out Form 941

The form 8995 used to. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web electing small.

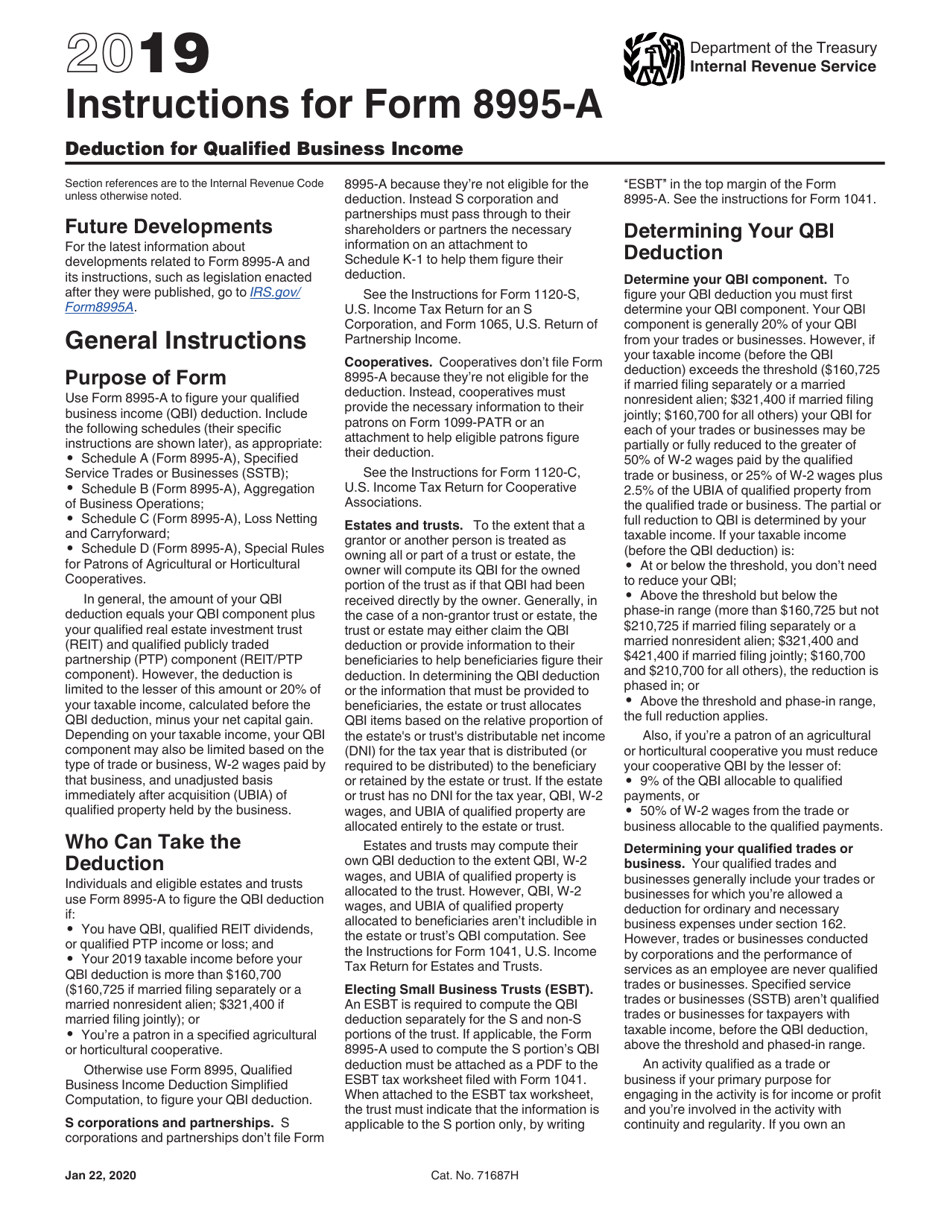

2020 Form IRS Instructions 8995 Fill Online, Printable, Fillable, Blank

Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web electing small business trusts (esbt). Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Register and subscribe now to work on your irs form 8995.

2210 Form 2021 IRS Forms Zrivo

Complete, edit or print tax forms instantly. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web the qualified business income deduction (qbi) is intended to reduce the tax rate.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web electing small business trusts (esbt). Web form 8995 department of the treasury internal revenue service qualified business.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. A go to www.irs.gov/form8995a for. Web electing small business.

8995 Fill out & sign online DocHub

Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Attach to your tax return. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Web electing small business trusts (esbt). Web the qualified business.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

A go to www.irs.gov/form8995a for. Attach to your tax return. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041..

WHERE DO WE ENTER FORM 8995 QUALIFIED BUSINESS DEDUCTION LOSS

Register and subscribe now to work on your irs form 8995 & more fillable forms. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified.

Download Instructions for IRS Form 8995A Deduction for Qualified

The form 8995 used to. Complete, edit or print tax forms instantly. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Register and subscribe now to work on your irs form 8995 & more fillable forms. Department of the treasury internal revenue service.

Complete, Edit Or Print Tax Forms Instantly.

The form 8995 used to. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service.

Attach To Your Tax Return.

When attached to the esbt tax. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return.

A Go To Www.irs.gov/Form8995A For.

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web electing small business trusts (esbt). Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Register and subscribe now to work on your irs form 8995 & more fillable forms.