2022 Form 8812 Instructions

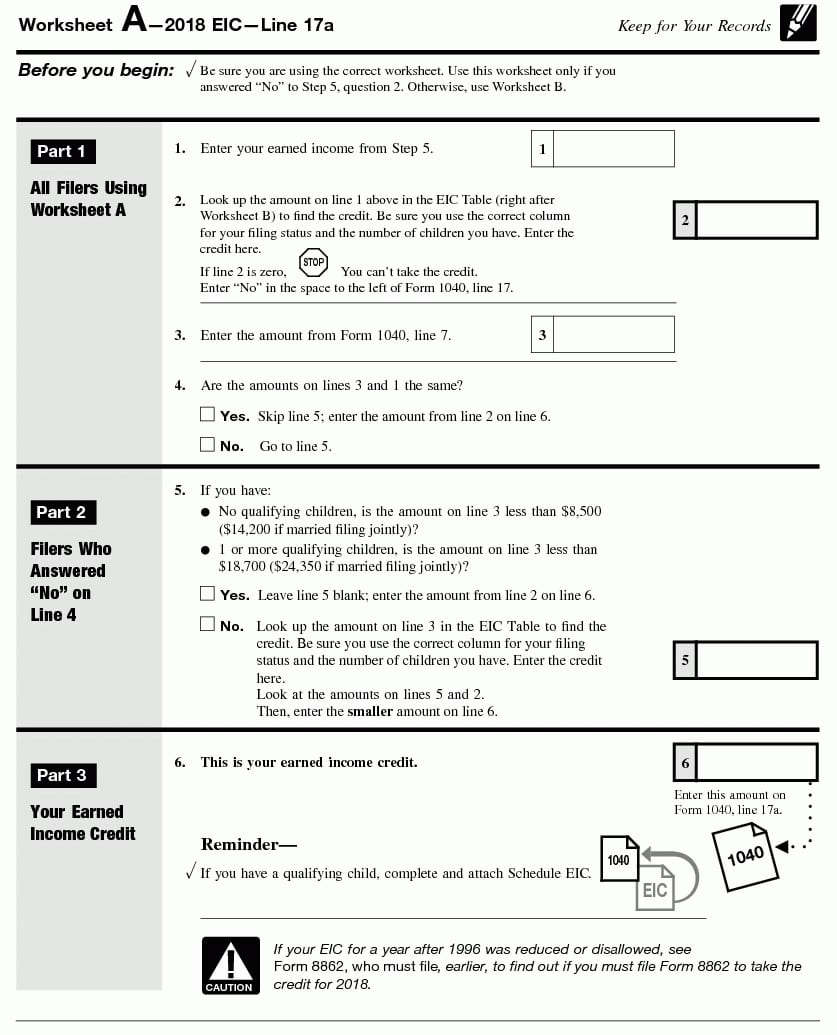

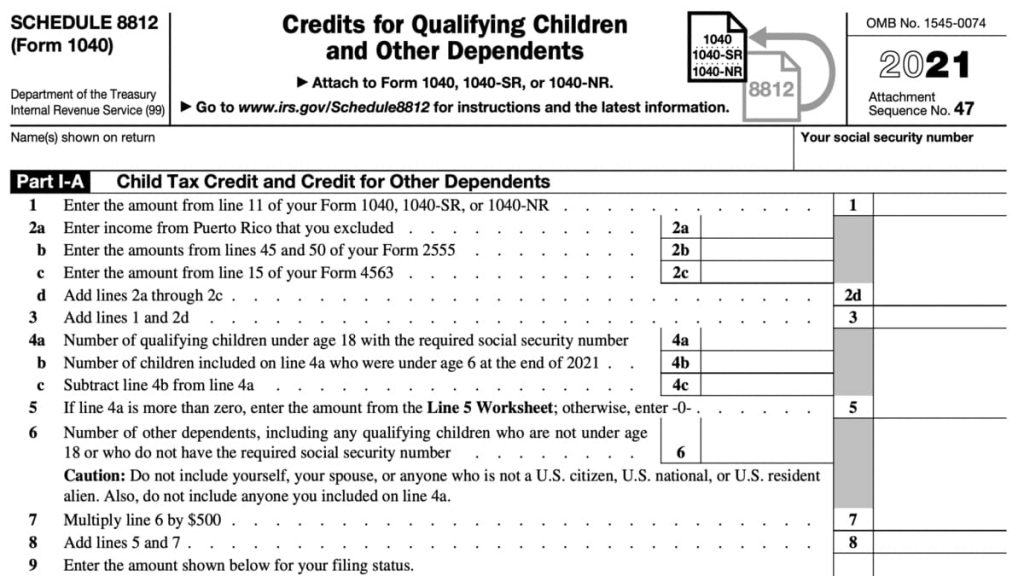

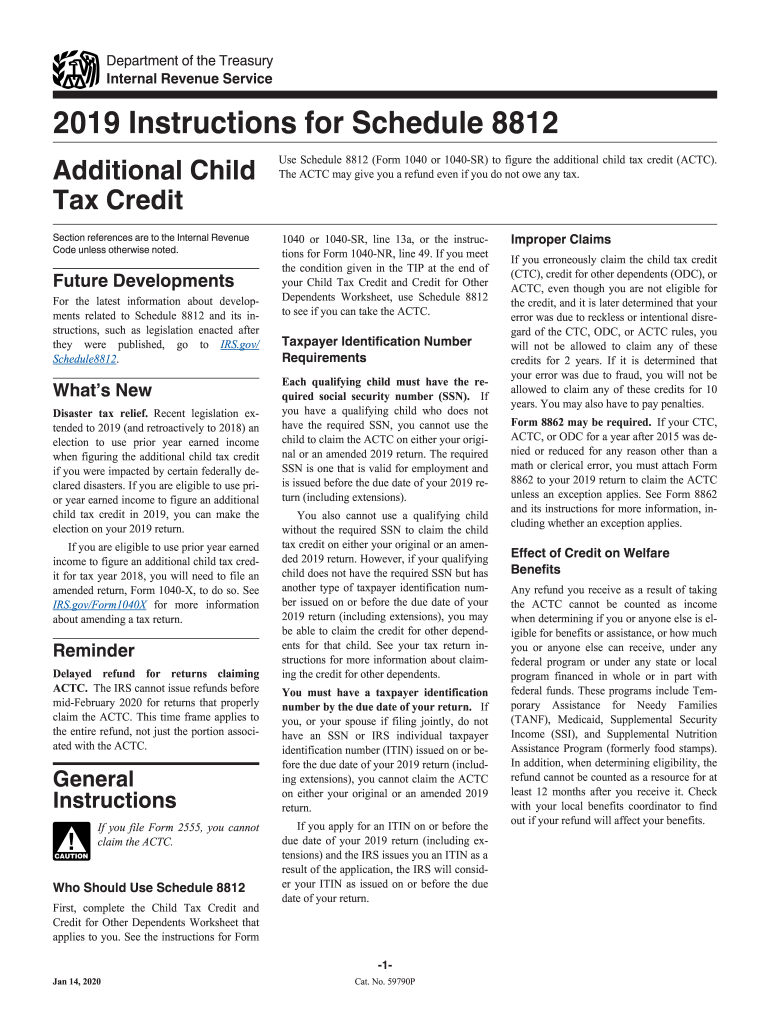

2022 Form 8812 Instructions - Web you'll use form 8812 to calculate your additional child tax credit. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. Sign it in a few clicks draw. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. For 2022, there are two parts to this form: You can download or print current or. The child tax credit is a partially refundable. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Should be completed by all filers to claim the basic. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. For 2022, there are two parts to this form: Web irs instructions for form 8812. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents. Web get the instructions to file schedule 8812 here from the irs website. The child tax credit is a partially refundable. You can download or print current or.

You can download or print current or. Claim your child tax credit along with your other credits for. Sign it in a few clicks draw. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents. Choose the correct version of the editable pdf. Or form 1040nr, line 7c; Should be completed by all filers to claim the basic. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web you'll use form 8812 to calculate your additional child tax credit.

Fillable Form 8812 Additional Child Tax Credit printable pdf download

January 2021) additional child use schedule 8812 (form 1040) to figure the additional child tax credit. Choose the correct version of the editable pdf. Web irs instructions for form 8812. The child tax credit is a partially refundable. Web get the instructions to file schedule 8812 here from the irs website.

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

Web for instructions and the latest information. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead. Web if you completed schedule 8812, enter the amount from line.

Qualified Dividends And Capital Gains Worksheet 2018 —

Claim your child tax credit along with your other credits for. Web solved • by turbotax • 3264 • updated january 25, 2023. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. Should be completed by all filers to claim the basic. January 2021) additional child use schedule 8812.

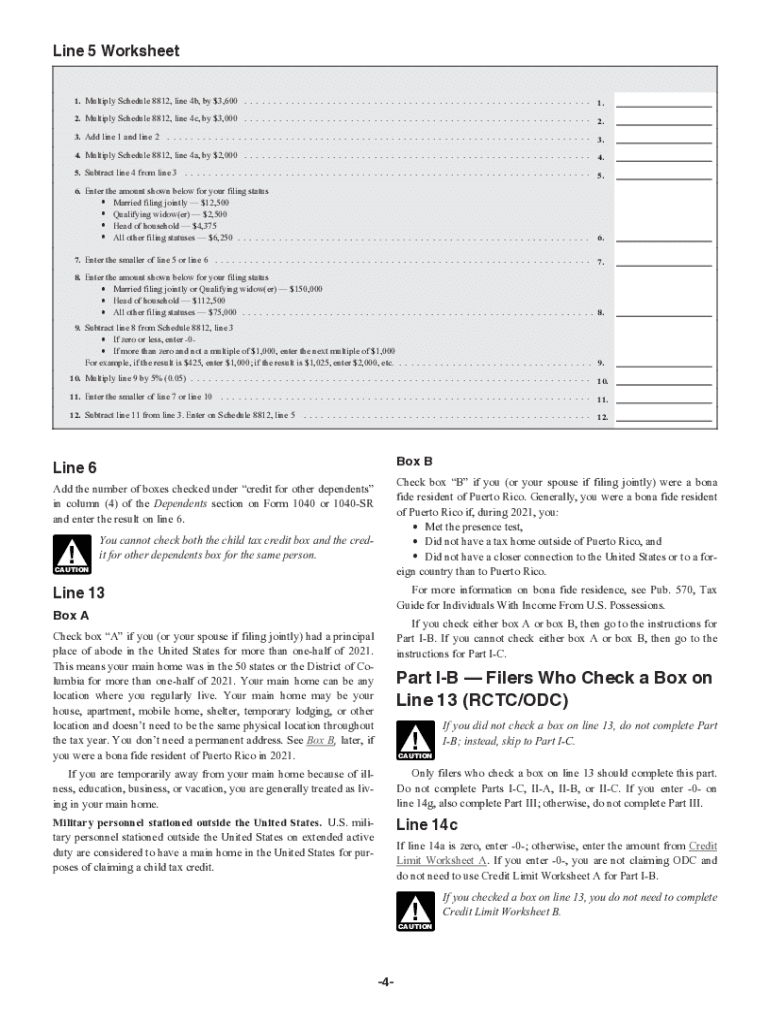

Form 8812 Line 5 Worksheet

Web irs instructions for form 8812. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. Web for more information on the child tax credit for 2021, please refer to form 8812.

Form 8812Additional Child Tax Credit

You can download or print current or. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Or form 1040nr, line 7c; Sign it in a few clicks draw. Web solved • by turbotax • 3264 • updated january 25, 2023.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. Web for instructions and the latest information. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. Or form 1040nr, line 7c; The child tax credit is a partially.

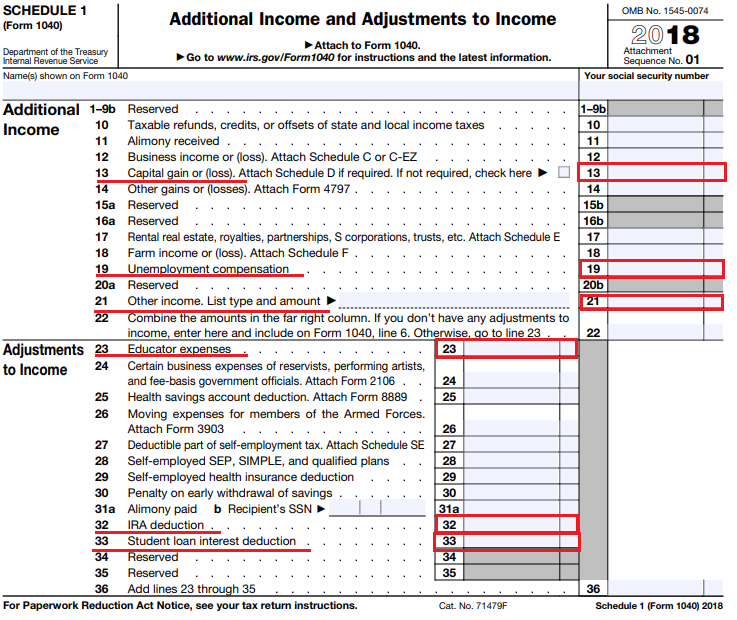

Did Or Will You File A Schedule 1 With Your 2018 Tax 2021 Tax Forms

Web if you completed schedule 8812, enter the amount from line 18a of that form. For tax years 2020 and prior: Web solved • by turbotax • 3264 • updated january 25, 2023. Should be completed by all filers to claim the basic. For 2022, there are two parts to this form:

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Web irs instructions for form 8812. Claim your child tax credit along with your other credits for. Sign it in a few clicks draw. Web solved • by turbotax • 3264 • updated january 25, 2023. Web you'll use form 8812 to calculate your additional child tax credit.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Claim your child tax credit along with your other credits for. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web internal revenue service 2020 instructions for schedule 8812 (rev. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line.

IRS 1040 Schedule 8812 Instructions 2012 Fill out Tax Template Online

Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Claim your child tax credit along with your other credits for. Web the schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the.

From July 2021 To December 2021, Taxpayers May Have Received An Advance Payment Of The Child Tax Credit Equal To 50%.

Web get the instructions to file schedule 8812 here from the irs website. The child tax credit is a partially refundable. Should be completed by all filers to claim the basic. Choose the correct version of the editable pdf.

Web Use Part I Of Schedule 8812 To Document That Any Child For Whom You Entered An Itin On Form 1040, Line 6C;

Web solved • by turbotax • 3264 • updated january 25, 2023. For 2022, there are two parts to this form: Web if you completed schedule 8812, enter the amount from line 18a of that form. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.

Web You Should Complete File Irs Schedule 8812 (Form 1040) When You Complete Your Irs Tax Forms Each Year.

Web you'll use form 8812 to calculate your additional child tax credit. Web internal revenue service 2020 instructions for schedule 8812 (rev. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. If you’re looking for a simpler version, read our instructions to file schedule 8812 instead.

Claim Your Child Tax Credit Along With Your Other Credits For.

You can download or print current or. If you did not complete schedule 8812, refer to the earned income chart and related worksheet in the. Web for instructions and the latest information. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions.