2022 Form 943

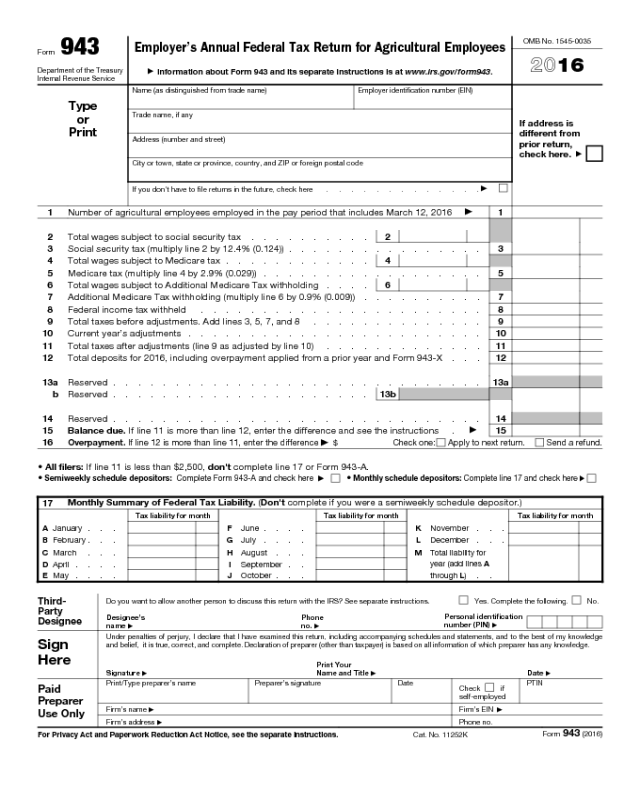

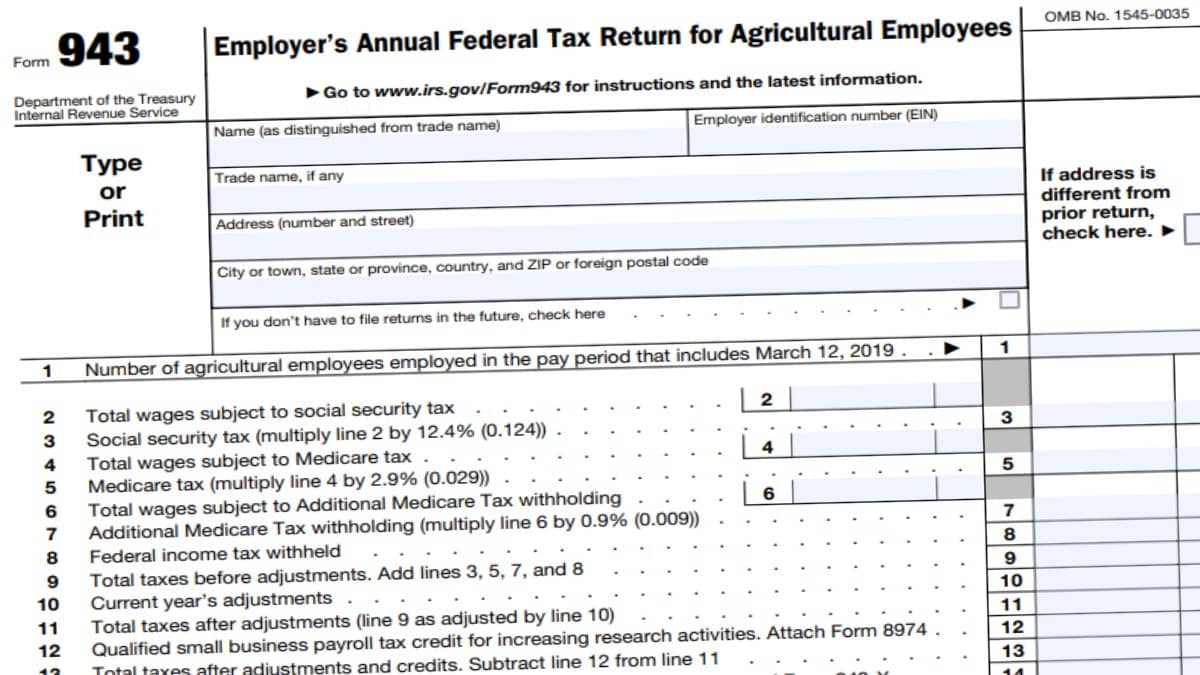

2022 Form 943 - Edit, sign or email irs 943 & more fillable forms, register and subscribe now! As of june 21, 2022, all new u.s. The instructions include three worksheets, two of which cover qualified sick and. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Nonrefundable portion of cobra premium assistance credit* (form 943, line 12e) *line 15c can only be used if correcting a 2021 or. Web address as shown on form 943. About form 943, employer's annual federal tax return for agricultural employees. Web form 943, is the employer’s annual federal tax return for agricultural employees.

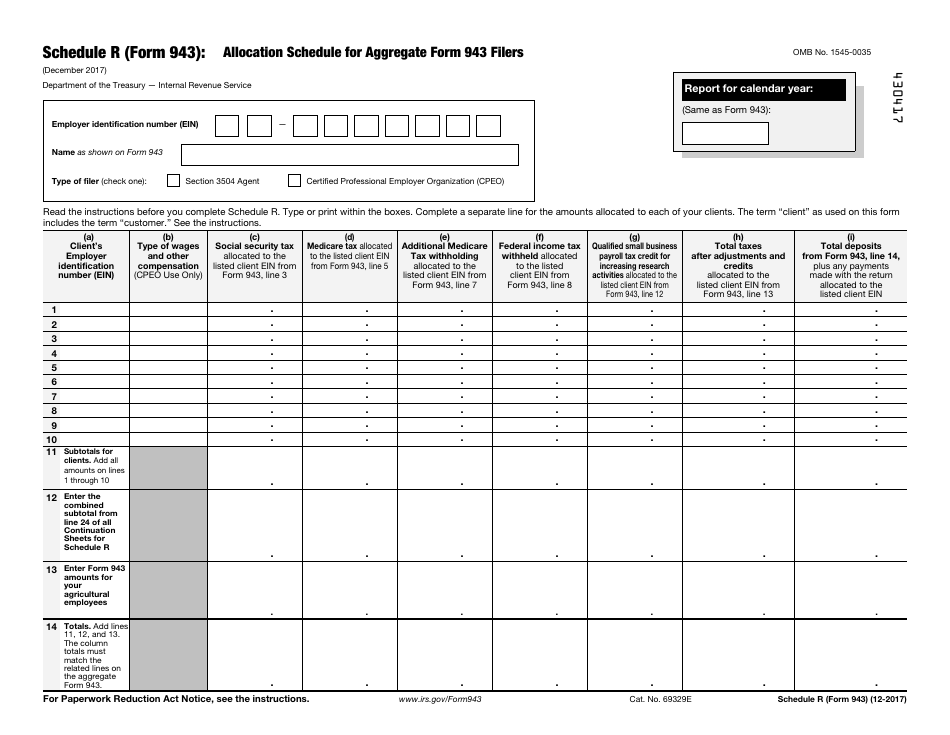

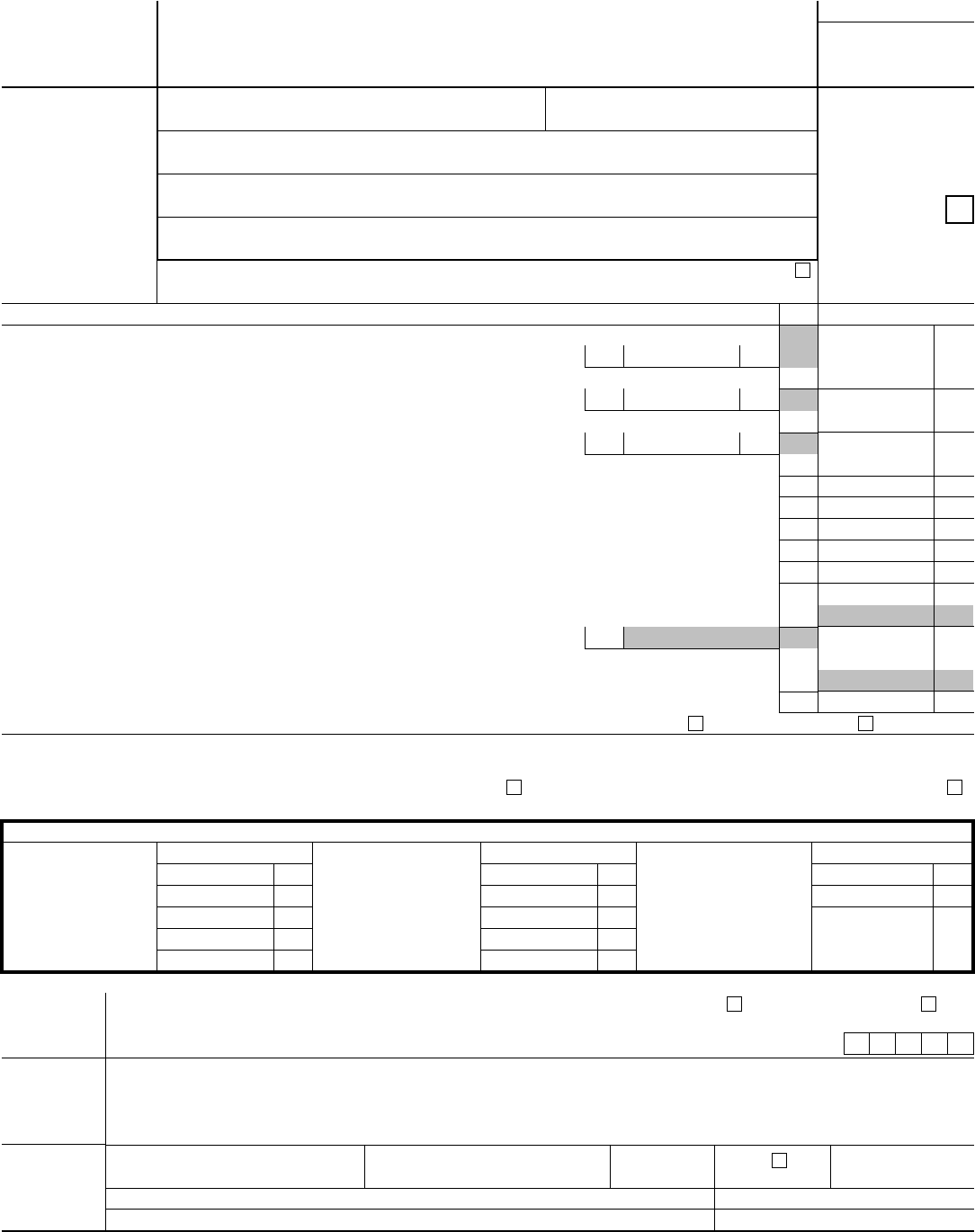

Web irs form 943 for agricultural businesses is now supported in quickbooks online payroll. Web address as shown on form 943. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web a draft of the 2022 schedule r for form 943, employer’s annual federal tax return for agricultural employees, was released aug. 29 by the internal revenue. Web form 943, is the employer’s annual federal tax return for agricultural employees. In other words, it is a tax form used to report federal income tax, social. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Users of quickbooks online payroll.

As of june 21, 2022, all new u.s. Web for 2022, file form 943 by january 31, 2023. Web the 2022 draft schedule r (form 943) now designates lines l, r, t, x, and y as “reserved for future use.”. Web form 943, is the employer’s annual federal tax return for agricultural employees. The instructions include three worksheets, two of which cover qualified sick and. Web for 2022, the due date for filing form 943 is january 31, 2023. Ad access irs tax forms. R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. I am completing the following transaction with the missouri secretary of state’s office.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

In other words, it is a tax form used to report federal income tax, social. Form 940 must be filed with the irs annually to report federal. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web (form.

943 Form 2022 2023

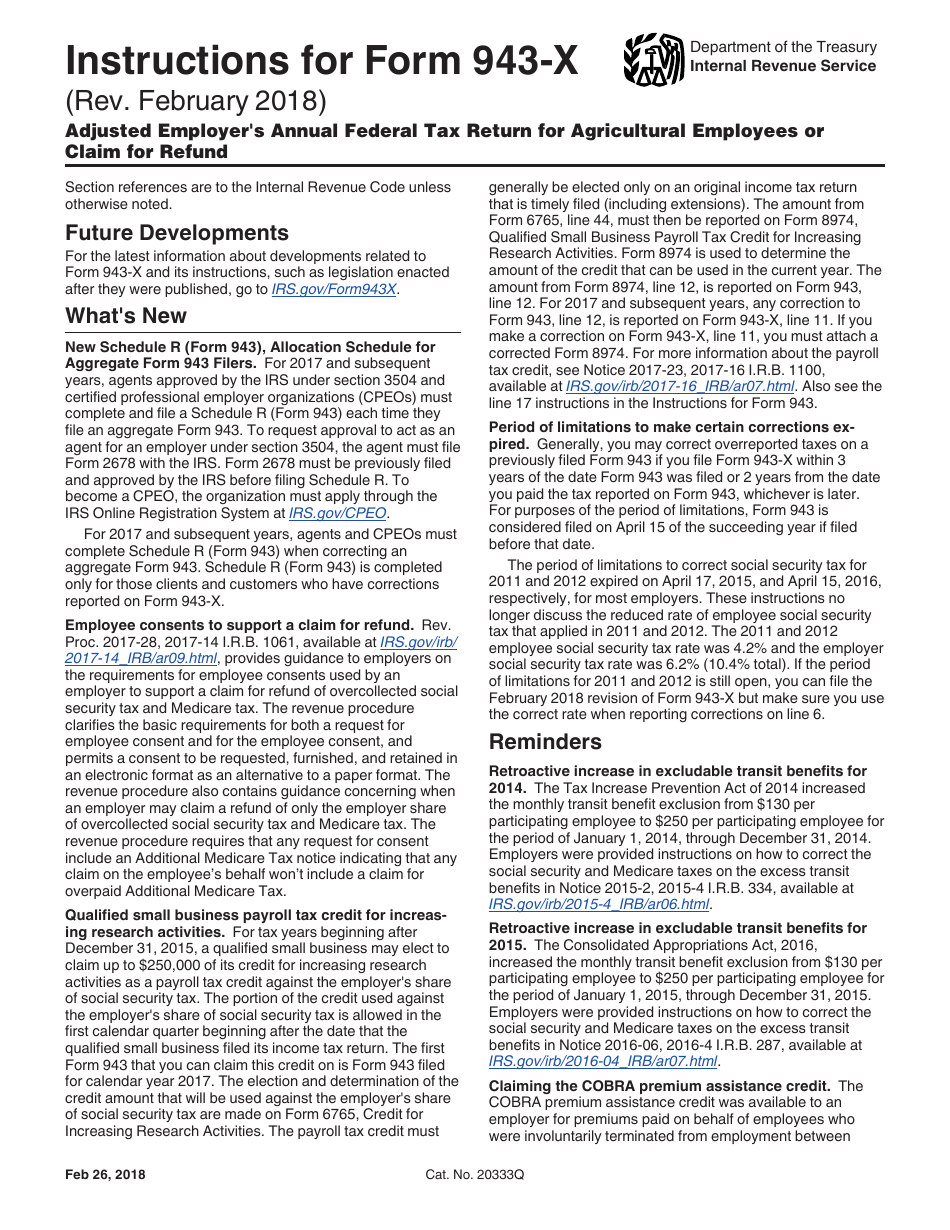

About form 943, employer's annual federal tax return for agricultural employees. In other words, it is a tax form used to report federal income tax, social. Nonrefundable portion of cobra premium assistance credit* (form 943, line 12e) *line 15c can only be used if correcting a 2021 or. These lines were formerly used to report amounts from form. The instructions.

IRS Form 943 Schedule R Download Fillable PDF or Fill Online Allocation

If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. These lines were formerly used to report amounts from form. Users of quickbooks online payroll. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2022

These lines were formerly used to report amounts from form. Web the deadline for filing the following annual payroll forms is january 31, 2023. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web in 2022 for leave taken after march 31, 2020, and before.

2021 More Gov Forms Fillable Printable Pdf Amp Forms Handypdf Gambaran

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. The due date to file form 943 for the tax year 2022 is january 31, 2023. Form 940 must be filed with the irs annually to report federal. If the deposits are made on time in.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Select the button get form to open it and start. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your..

Download Instructions for IRS Form 943X Adjusted Employer's Annual

Web the 2022 draft schedule r (form 943) now designates lines l, r, t, x, and y as “reserved for future use.”. Form 940 must be filed with the irs annually to report federal. R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. Web information about form 943, employer's annual federal tax return.

2018 form 943 fillable Fill out & sign online DocHub

Form 940 must be filed with the irs annually to report federal. Edit, sign or email irs 943 & more fillable forms, register and subscribe now! I am completing the following transaction with the missouri secretary of state’s office. Web for 2022, the due date for filing form 943 is january 31, 2023. Users of quickbooks online payroll.

943 Form 2022 2023

Users of quickbooks online payroll. Web form 943, is the employer’s annual federal tax return for agricultural employees. Ad access irs tax forms. Web for 2022, the due date for filing form 943 is january 31, 2023. Edit, sign or email irs 943 & more fillable forms, register and subscribe now!

Form 943 Edit, Fill, Sign Online Handypdf

Form 940 must be filed with the irs annually to report federal. Get ready for tax season deadlines by completing any required tax forms today. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web we last updated the employer's annual federal.

Web For 2022, The Due Date For Filing Form 943 Is January 31, 2023.

Web follow these tips to accurately and quickly fill in irs instruction 943. Nonrefundable portion of cobra premium assistance credit* (form 943, line 12e) *line 15c can only be used if correcting a 2021 or. The instructions include three worksheets, two of which cover qualified sick and. Complete, edit or print tax forms instantly.

Web Form 943, Is The Employer’s Annual Federal Tax Return For Agricultural Employees.

If you made deposits on time, in full payment of the taxes. Web when is form 943 due date for 2022 tax year? Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26, and 27, for the credit for qualified sick and family leave wages for leave taken after march 31, 2021,. Web the deadline for filing the following annual payroll forms is january 31, 2023.

Web We Last Updated The Employer's Annual Federal Tax Return For Agricultural Employees In February 2023, So This Is The Latest Version Of Form 943, Fully Updated For Tax Year 2022.

However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Ad access irs tax forms. Web the 2022 draft schedule r (form 943) now designates lines l, r, t, x, and y as “reserved for future use.”. In other words, it is a tax form used to report federal income tax, social.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

29 by the internal revenue. These lines were formerly used to report amounts from form. I am completing the following transaction with the missouri secretary of state’s office. Edit, sign or email irs 943 & more fillable forms, register and subscribe now!