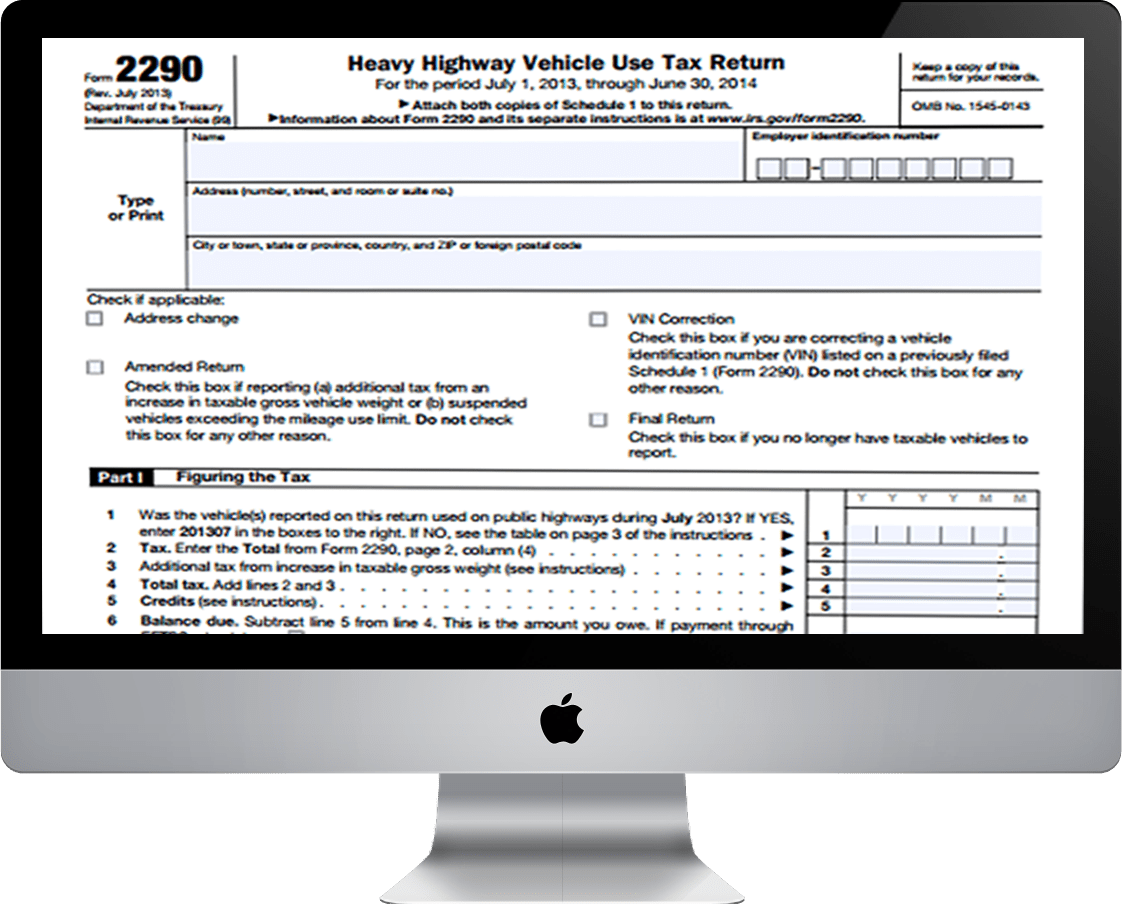

2290 Form Nc

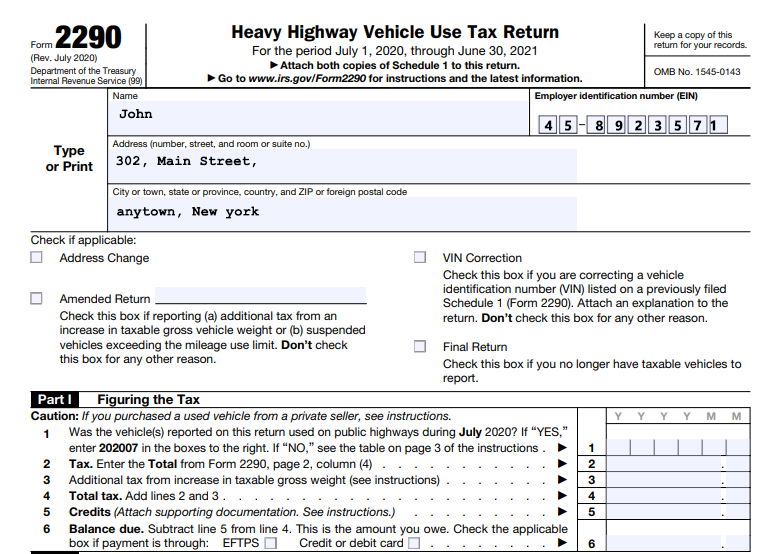

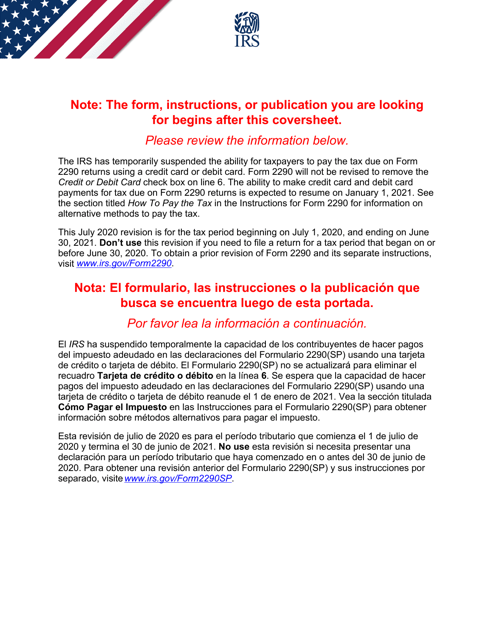

2290 Form Nc - Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. With full payment and that payment is not drawn from. If you are filing a form 2290 paper return: Ad file form 2290 for vehicles weighing 55,000 pounds or more. Do your truck tax online & have it efiled to the irs! Ad file form 2290 easily with eform2290.com. Easy, fast, secure & free to try. Figure and pay the tax due on highway motor vehicles used during the period with a. Web about form 2290, heavy highway vehicle use tax return. Use coupon code get20b & get 20% off.

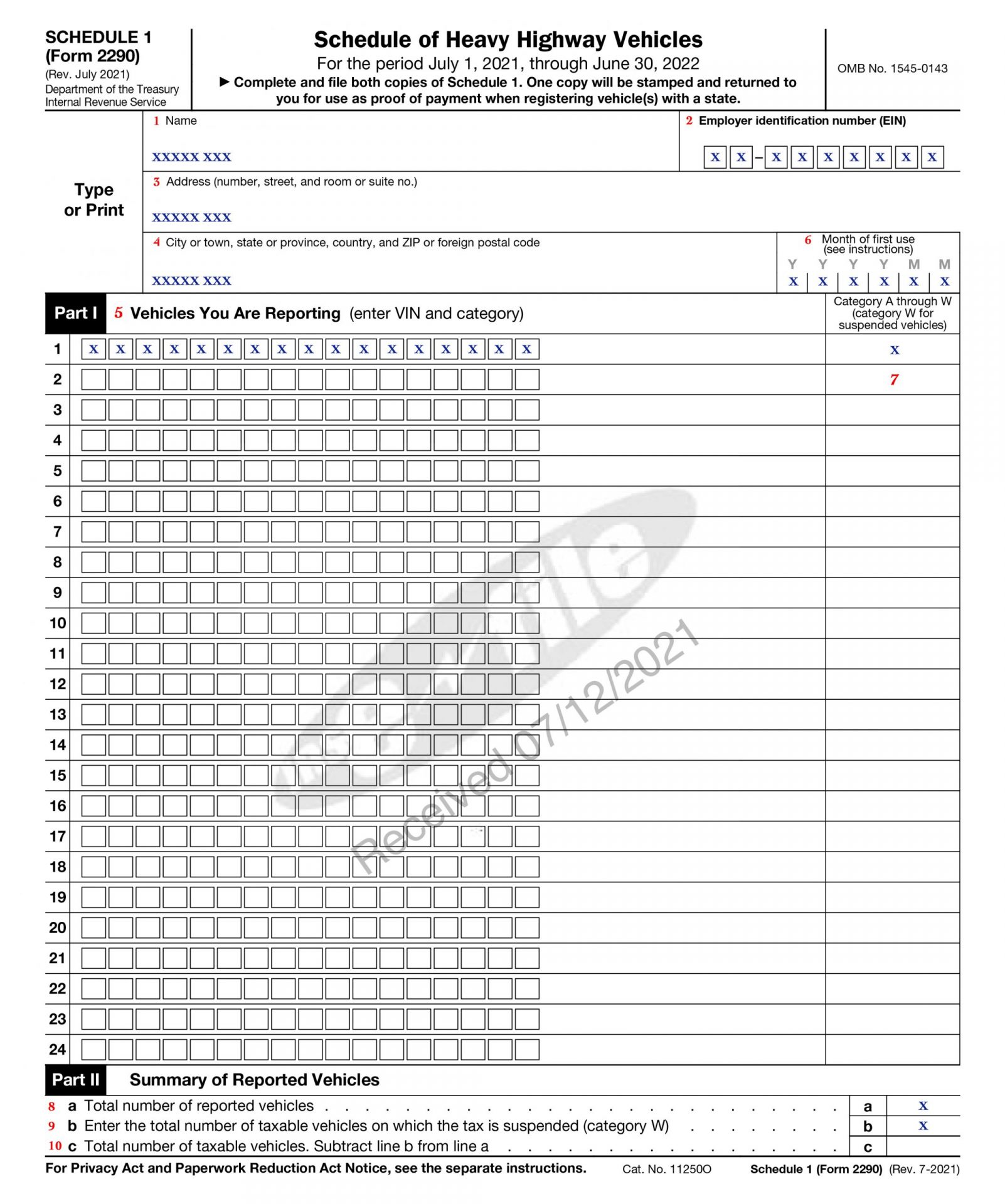

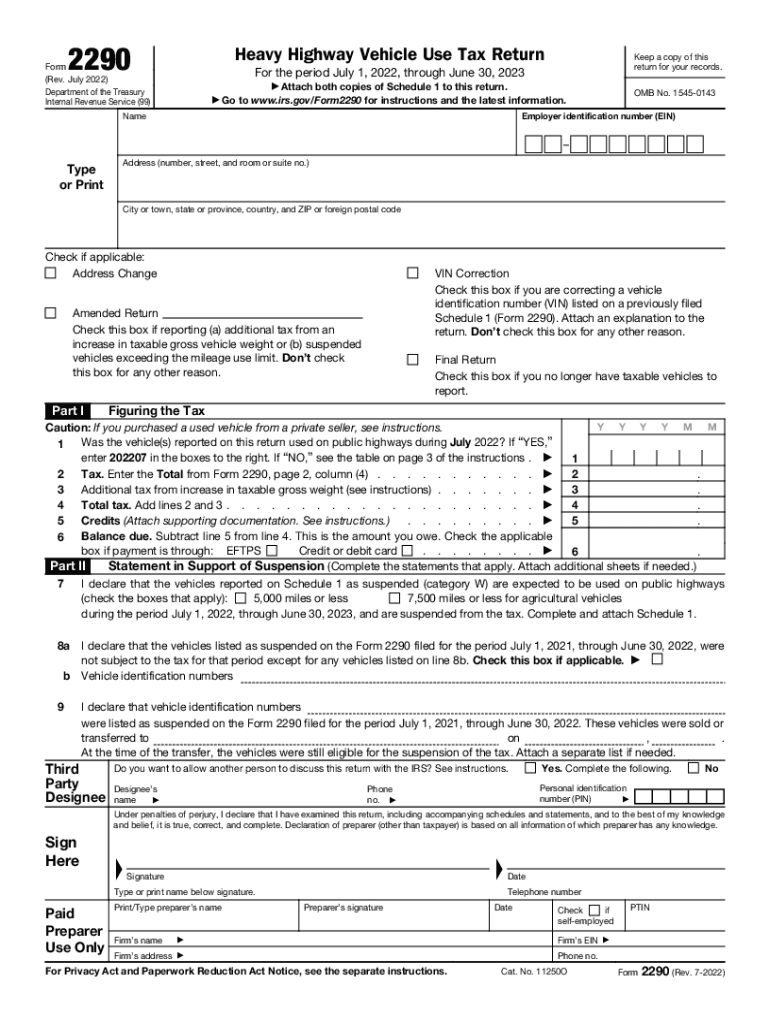

Web about form 2290, heavy highway vehicle use tax return. The tax year is for july 1, 20xx through. • vehicles with a taxable gross weight of 55,000. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with registered gross weight equal to or exceeding 55,000 pounds use public highways, the owners pay heavy. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web find out where to mail your completed form. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered,. Generally the 2290 taxes are reported from july and. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Do your truck tax online & have it efiled to the irs!

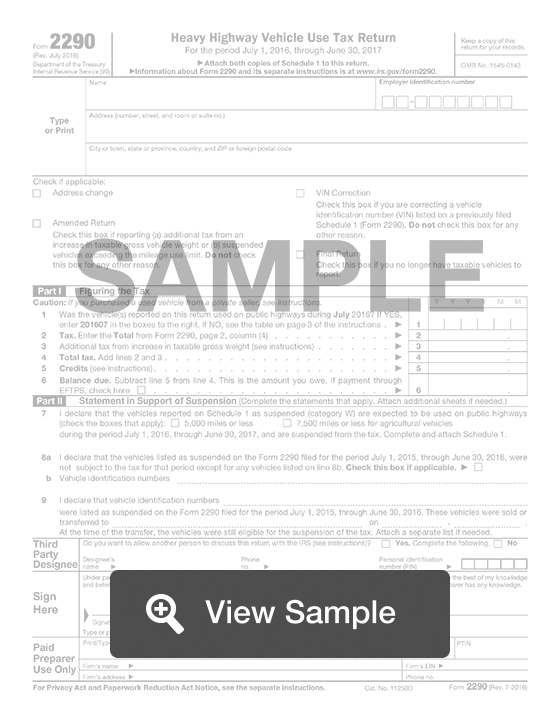

Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Must provide at least 3 from the. Generally the 2290 taxes are reported from july and. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Use coupon code get20b & get 20% off. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web • applicant must be able to demonstrate residency in north carolina or have an. We've been in the trucking business for over 67+ years. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Easy, fast, secure & free to try.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. July 2021) heavy highway vehicle use.

Ssurvivor Form 2290 Irs

Ad file form 2290 easily with eform2290.com. Web • applicant must be able to demonstrate residency in north carolina or have an. Must provide at least 3 from the. The tax year is for july 1, 20xx through. Ad file form 2290 for vehicles weighing 55,000 pounds or more.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

The tax year is for july 1, 20xx through june 30, 20xx. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered,. Ad file form 2290 easily with eform2290.com. Figure and pay the tax due on.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with registered gross weight equal to or exceeding 55,000.

20232024 Form 2290 Generator Fill, Create & Download 2290

If you are filing a form 2290 paper return: Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by.

√99以上 2290 form irs.gov 6319142290 form irs.gov

• filing is for taxable. • vehicles with a taxable gross weight of 55,000. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. Web find out where to mail your completed form. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with.

File 20222023 Form 2290 Electronically 2290 Schedule 1

We've been in the trucking business for over 67+ years. With full payment and that payment is not drawn from. • vehicles with a taxable gross weight of 55,000. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web • applicant must be able to demonstrate residency in north carolina or have an. Web find out where to mail your completed form. Ad file form 2290.

Form 2290 Rev July Heavy Highway Vehicle Use Tax Return Fill Out and

The tax year is for july 1, 20xx through. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Figure and pay the tax due on highway motor vehicles used during the period with a. With full payment and that payment is not drawn from. Use coupon code get20b & get 20% off.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Ad file form 2290 easily with eform2290.com. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web about form 2290, heavy highway vehicle use tax return. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Generally the 2290 taxes are reported from.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Must provide at least 3 from the. Use coupon code get20b & get 20% off. • filing is for taxable. The tax year is for july 1, 20xx through june 30, 20xx.

If You Are Filing A Form 2290 Paper Return:

Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. The tax year is for july 1, 20xx through. • vehicles with a taxable gross weight of 55,000. Web get schedule 1 in minutes file form 2290 now hvut when vehicles with registered gross weight equal to or exceeding 55,000 pounds use public highways, the owners pay heavy.

Figure And Pay The Tax Due On Highway Motor Vehicles Used During The Period With A.

Web find out where to mail your completed form. Ad file form 2290 easily with eform2290.com. Do your truck tax online & have it efiled to the irs! Ad file form 2290 for vehicles weighing 55,000 pounds or more.

We've Been In The Trucking Business For Over 67+ Years.

Web federal heavy vehicle use tax (form 2290) power of attorneys topics tax and tag together changes in cab cards irp office locations irp forms of payment questions. Generally the 2290 taxes are reported from july and. Web form 2290 filed listing tax suspended vehicles ± category w subsequent form 2290 filed must verify vehicle was used less than 5,000 miles if 5,000 miles exceeded, tax is due. Web • applicant must be able to demonstrate residency in north carolina or have an.