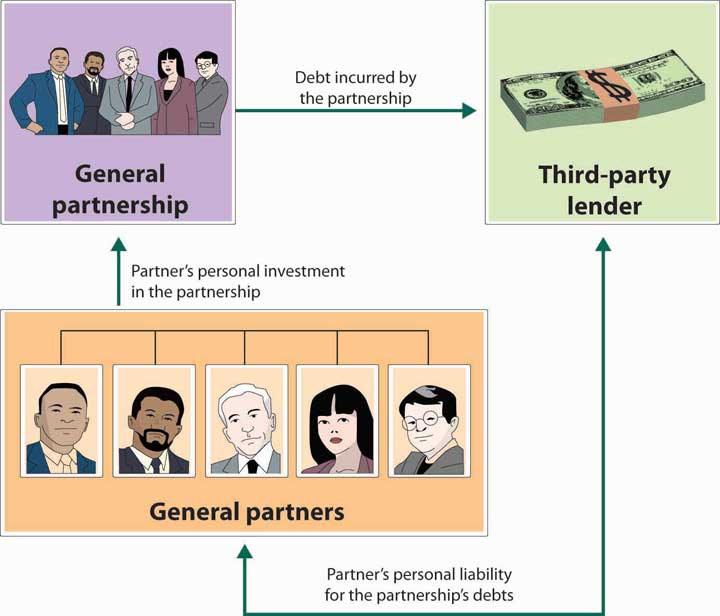

3 Individuals Form A Partnership

3 Individuals Form A Partnership - Web first you want to know the profits of the three ppl. If the profits are $1,500, how. If the profits are $4,800, how much. Web three individuals form a partnership and agree to divide the profits equally. X invests $4,500, y invests $3,500 and z invests $2,000. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Select “a noncitizen authorized to work until;” and. Previously, because the income from the. Web in the scenario where three individuals form a partnership and agree to divide the profits equally, the amount each person receives may differ if their initial investments vary. So:4800/3=1600then u make an equation with proportions:

X invests $9,000,y invests $7,000,z invests $4,000. Previously, because the income from the. Web first you want to know the profits of the three ppl. Web up to 25% cash back 1. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. So:4800/3=1600then u make an equation with proportions: If the profits are $1,500, how much less. Web if an llc has at least two members and is classified as a partnership, it generally must file form 1065, u.s. X invests $4,500, y invests $3,500 and z invests $2,000. Three individuals form a partnership and agree to divide the profits equally.

X invests $4,500, y invests $3,500 and z invests $2,000. If the profits are $1,500, how much less. Web it supplements the information provided in the instructions for form 1065, u. Ad free partnership agreement in minutes. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in the partnership’s capital, profits. Previously, because the income from the. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web three individuals form a partnership and agree to divide the profits equally. It does not require forming a business entity with the state. Web first you want to know the profits of the three ppl.

Partnership Formation Individuals with No Existing Business YouTube

Web if an llc has at least two members and is classified as a partnership, it generally must file form 1065, u.s. Web three individuals form a partnership and agree to divide the profits equally. Web it supplements the information provided in the instructions for form 1065, u. If the profits are $1,500, how much less. After all, you’re going.

4.3 Partnership Exploring Business

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If the profits are $1,500, how. Choose your partners when it comes to starting a partnership, you have to choose your partner (s) wisely. It does not.

7.1 Recognize How Individuals Form Societies and How Individuals Are

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web three individuals form a partnership and agree to divide the profits equally. Web similarly, a u.s. Partnerships don’t pay federal income. Web up to 25% cash back 1.

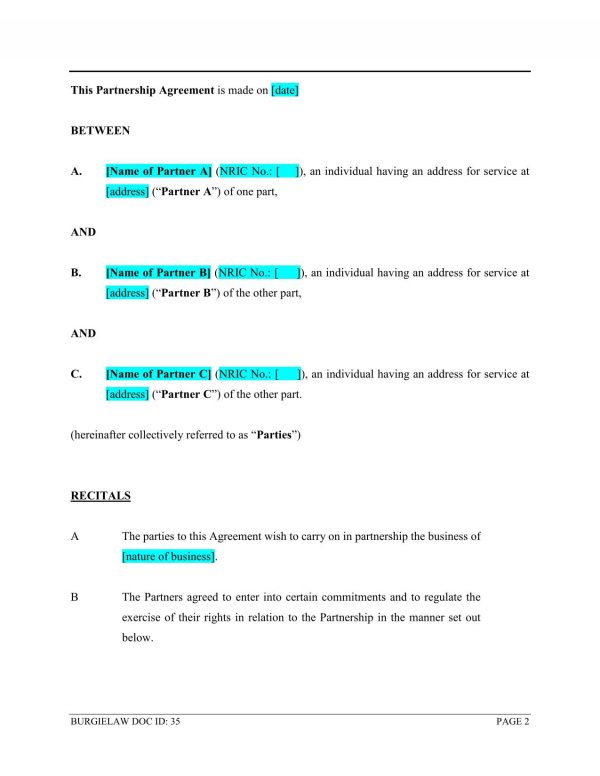

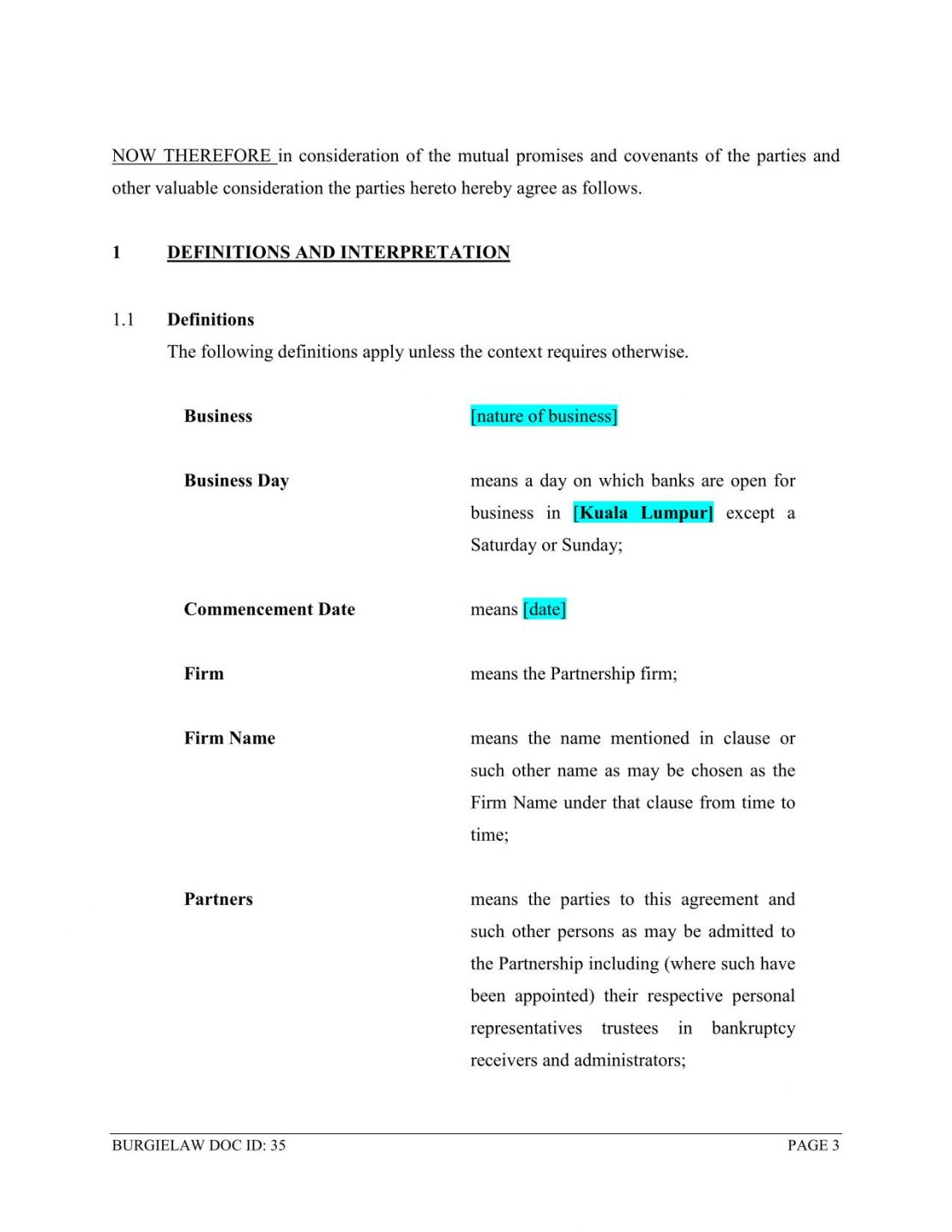

Business Partnership Agreement Template BurgieLaw

If the profits are $1,500, how. X invests $9,000,y invests $7,000,z invests $4,000. General partnership a general partnership is the most basic form of partnership. Three individuals form a partnership and agree to divide the profits equally. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in the.

Learn How to Form a Partnership Using These 10 Steps

Three individuals form a partnership and agree to divide the profits equally. X invests $9,000,y invests $7,000,z invests $4,000. Web three individuals form a partnership and agree to divide the profits equally. Web three individuals form a partnership and agree to divide the profits equally. An unincorporated organization with two or more members is generally classified as a partnership for.

Business Partnership Agreement Template BurgieLaw

General partnership a general partnership is the most basic form of partnership. Web similarly, a u.s. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) X invests $4,500, y invests $3,500 and z invests $2,000. Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than.

Role of Joint Sector Industries in Developing the Economy of India

An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. X invests $4,500, y invests $3,500 and z invests $2,000. Web similarly, a u.s. Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. Web if an llc has at least.

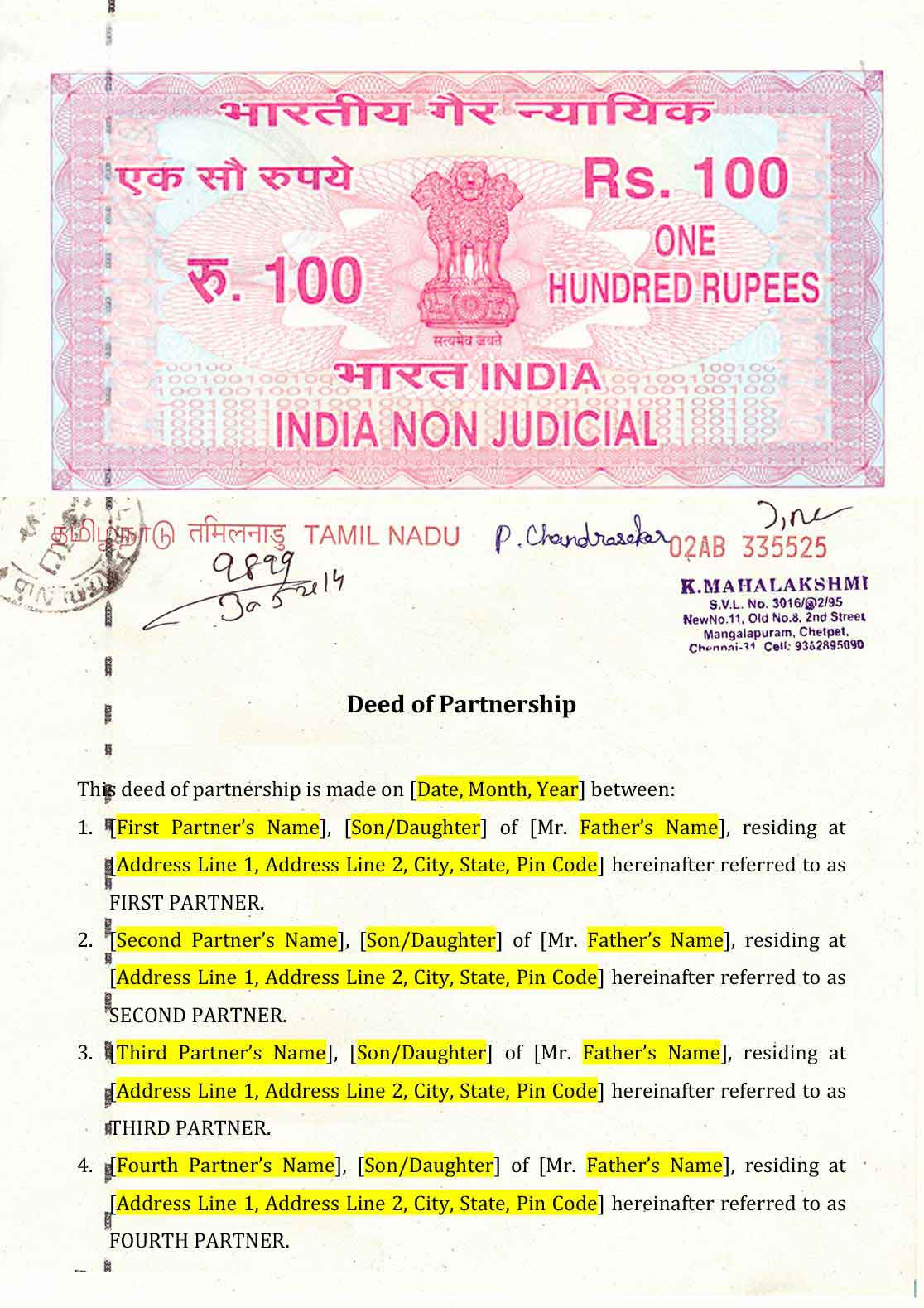

Partnership Deed format in India

Web in section 1, new employees presenting an ead automatically extended by an individual notice must: Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. Ad answer simple questions to make a partnership agreement on any device in minutes. X invests $9,000,y invests $7,000,z invests $4,000. If the profits are $.

Limited Partnership (Example, Advantages) vs General Partnership

Web three individuals form a partnership and agree to divide the profits equally. If the profits are $. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web in the scenario where three individuals form a partnership and agree to divide the profits equally, the amount each person receives may differ.

Status And FOAM Forms Partnership To Explore Greater Geospatial

Web it supplements the information provided in the instructions for form 1065, u. Web first you want to know the profits of the three ppl. Section 1224, of the taxpayer relief act of 1997, requires partnerships with more than. X invests $4,500, y invests $3,500 and z invests $2,000. If the profits are $.

So:4800/3=1600Then U Make An Equation With Proportions:

If the profits are $4,800, how much. Web three individuals form a partnership and agree to divide the profits equally. X invests $9,000,y invests $7,000,z invests $4,000. Web three individuals form a partnership and agree to divide the profits equally.

Web It Supplements The Information Provided In The Instructions For Form 1065, U.

An unincorporated organization with two or more members is generally classified as a partnership for federal tax purposes if its members carry on a trade,. Easily customize your partnership agreement. Legally binding, free to save & print. X invests $4,500, y invests $3,500 and z invests $2,000.

Previously, Because The Income From The.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If the profits are $. If the profits are $1,500, how much less. Web accounting questions and answers.

Web In Section 1, New Employees Presenting An Ead Automatically Extended By An Individual Notice Must:

Which partnerships are required to file returns electronically? Web first you want to know the profits of the three ppl. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. A, b and c, three individuals, form a general partnership by contributing the following property in exchange for equal 1/3 interests in.