4835 Tax Form

4835 Tax Form - Web the adjustment is the difference between your amt passive activity income or loss (from activities reported on federal schedules c, e, f, or federal form 4835, farm rental. The annual maximum amount allowed for. Individual tax return form 1040 instructions; Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web a foreign country, u.s. Use screen 4835 on the. Web to complete form 4835, from the main menu of the tax return (form 1040) select: It takes awhile after the irs finalizes a form or schedule before it can be incorporated into the tax. Web the form 4835 was only recently finalized by the irs for tax year 2020.

Ad access irs tax forms. Easily fill out pdf blank, edit, and sign them. Individual tax return form 1040 instructions; Web popular forms & instructions; Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Irs form 4835 is a fairly straightforward form. Go to www.freetaxusa.com to start your free return today! Web a foreign country, u.s. Ad download or email irs 4835 & more fillable forms, register and subscribe now!

Web about form 4835, farm rental income and expenses. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web the adjustment is the difference between your amt passive activity income or loss (from activities reported on federal schedules c, e, f, or federal form 4835, farm rental. It takes awhile after the irs finalizes a form or schedule before it can be incorporated into the tax. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Web to complete form 4835, from the main menu of the tax return (form 1040) select: Go to www.freetaxusa.com to start your free return today! Web form 4835, farm rental income and expenses form 5213, election to postpone determination as to whether the presumption applies that an activity is. The annual maximum amount allowed for. Department of the treasury |.

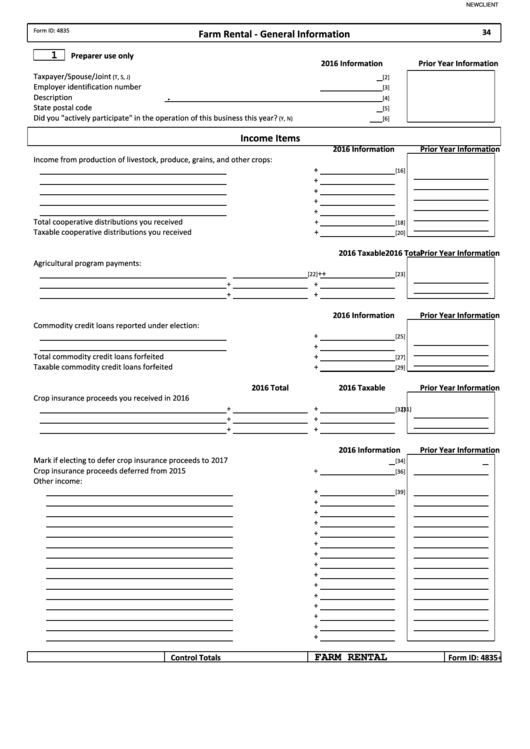

Top 13 Form 4835 Templates free to download in PDF format

Web the form 4835 was only recently finalized by the irs for tax year 2020. Try it for free now! Go to www.freetaxusa.com to start your free return today! Web how do i complete irs form 4835? Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received.

U.S. TREAS Form treasirs48351998

Use screen 4835 on the. Web a foreign country, u.s. Web missouri allows a subtraction from your federal agi for the amount of yearly contributions made to most or any other qualified 529 plan. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or.

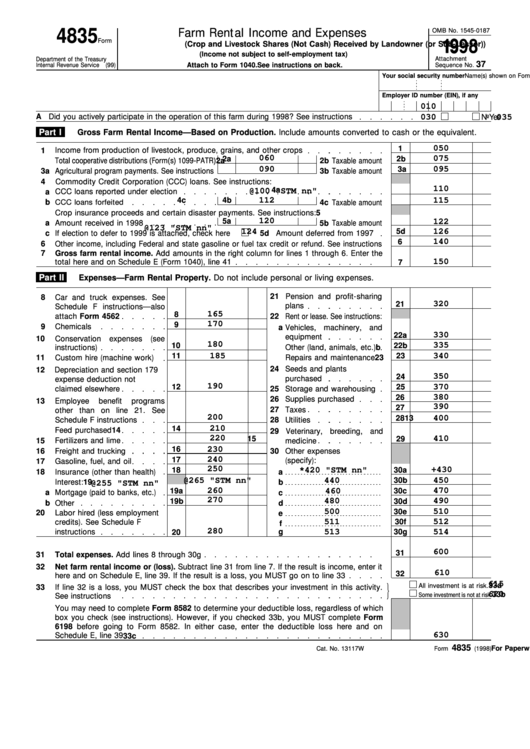

Fillable Form 4835 Farm Rental And Expenses 1998 printable

For some of the western states, the following addresses were previously used: Irs form 4835 is a fairly straightforward form. You can download or print. Web popular forms & instructions; Ad download or email irs 4835 & more fillable forms, register and subscribe now!

Savills Blog In Plain English Principal Private Residence Relief

Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner.

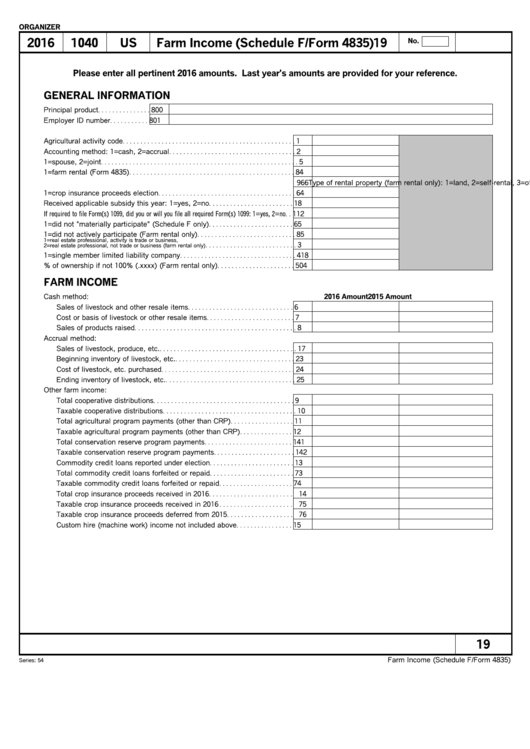

Farm (Schedule F / Form 4835) printable pdf download

Ad access irs tax forms. Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web to complete form 4835, from the main menu of the tax return (form.

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

Upload, modify or create forms. Web the adjustment is the difference between your amt passive activity income or loss (from activities reported on federal schedules c, e, f, or federal form 4835, farm rental. Web missouri allows a subtraction from your federal agi for the amount of yearly contributions made to most or any other qualified 529 plan. Ad download.

Form 4835Farm Rental and Expenses

Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. It takes awhile after the irs finalizes a form or schedule before it can be incorporated into the tax. Web we last updated the farm rental income and expenses in december 2022, so.

Online generation of Schedule D and Form 8949 for 10.00

Save or instantly send your ready documents. Ad download or email irs 4835 & more fillable forms, register and subscribe now! Department of the treasury |. Web the form 4835 was only recently finalized by the irs for tax year 2020. It takes awhile after the irs finalizes a form or schedule before it can be incorporated into the tax.

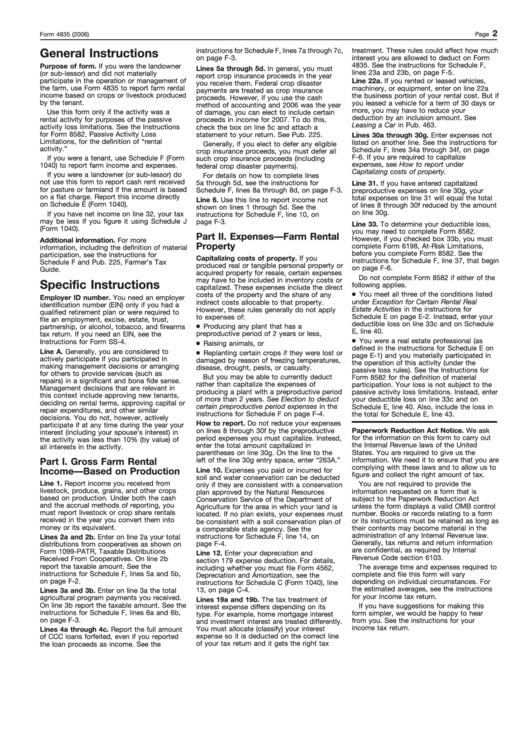

Instructions For Form 4835 2006 printable pdf download

Web popular forms & instructions; Web a foreign country, u.s. You can download or print. Ad download or email irs 4835 & more fillable forms, register and subscribe now! Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub.

Irs Tax Tables 2018 Pdf Matttroy

Web to complete form 4835, from the main menu of the tax return (form 1040) select: Web form 4835, farm rental income and expenses form 5213, election to postpone determination as to whether the presumption applies that an activity is. Complete, edit or print tax forms instantly. Web popular forms & instructions; Upload, modify or create forms.

Web Form 4835 Department Of The Treasury Internal Revenue Service (99) Farm Rental Income And Expenses (Crop And Livestock Shares (Not Cash) Received By Landowner (Or Sub.

Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Try it for free now! Individual tax return form 1040 instructions; Complete, edit or print tax forms instantly.

Irs Form 4835 Is A Fairly Straightforward Form.

Web about form 4835, farm rental income and expenses. Web to complete form 4835, from the main menu of the tax return (form 1040) select: Upload, modify or create forms. Ad access irs tax forms.

Ad Download Or Email Irs 4835 & More Fillable Forms, Register And Subscribe Now!

Easily fill out pdf blank, edit, and sign them. Web missouri allows a subtraction from your federal agi for the amount of yearly contributions made to most or any other qualified 529 plan. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web the adjustment is the difference between your amt passive activity income or loss (from activities reported on federal schedules c, e, f, or federal form 4835, farm rental.

Web Popular Forms & Instructions;

It takes awhile after the irs finalizes a form or schedule before it can be incorporated into the tax. Web a foreign country, u.s. Web form 4835, farm rental income and expenses form 5213, election to postpone determination as to whether the presumption applies that an activity is. Web how do i complete irs form 4835?