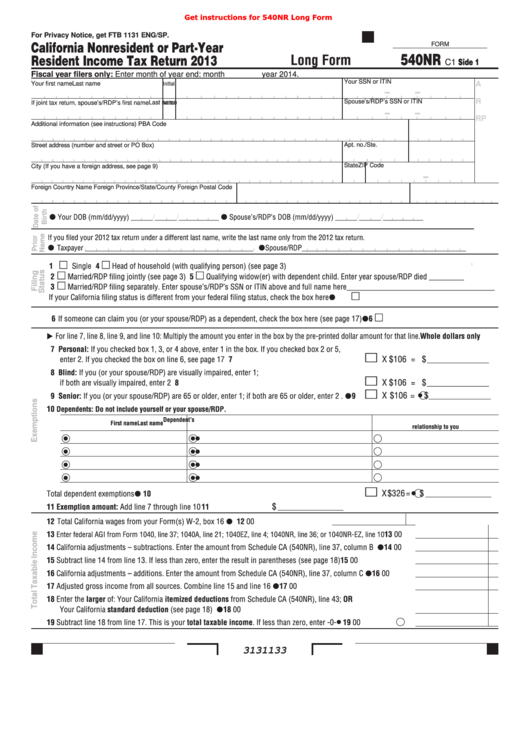

540 Nr Form

540 Nr Form - Your first name initial last. Add line 104 and line 120. Web enter on line 1, column b the earnings included in federal income that are exempt for california. Web complete your federal income tax return (form 1040, u.s. Ca taxable income from schedule ca (540nr), part iv, line 5. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Web enter on line 1, column b the earnings included in federal income that are exempt for california. Web (540nr), part iv, line 1. We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Web 1122 ocean drive san diego 05/22/1989 √ questions?

Add line 104 and line 120. Complete all lines that apply to you and your. Enter month of year end: Web california form 540nr check here if this is an amended return. Multiply line 35 by line 36. Web enter on line 1, column b the earnings included in federal income that are exempt for california. This form is for income earned in tax year 2022, with tax returns due in. Web complete your federal income tax return (form 1040, u.s. Web up to $40 cash back easily complete a printable irs ca ftb 540nr long form 2020 online. Attach form ftb 3504, enrolled tribal member certification, to form 540nr.

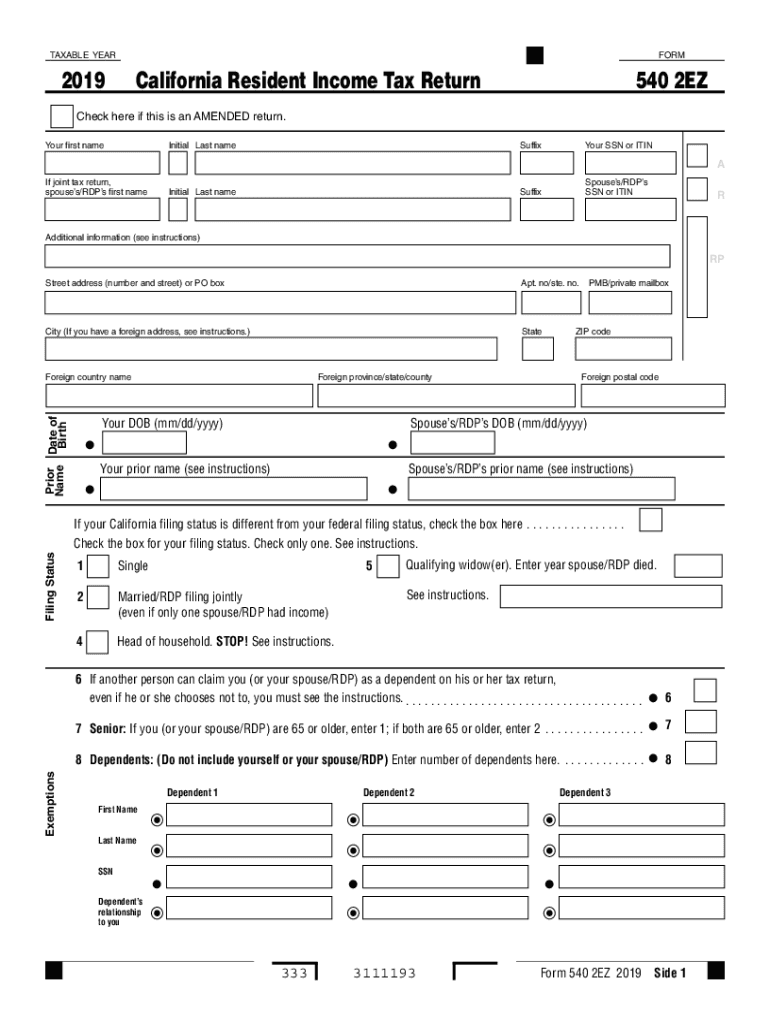

Multiply line 35 by line 36. Web complete your federal income tax return (form 1040, u.s. It covers the most common credits and is also the most used tax form for california residents. Get ready for this year's tax season quickly and safely with pdffiller! Enter month of year end: This form is for income earned in tax year 2022, with tax returns due in. Web enter on line 1, column b the earnings included in federal income that are exempt for california. Web up to $40 cash back easily complete a printable irs ca ftb 540nr long form 2020 online. We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Web complete your federal income tax return (form 1040, u.s.

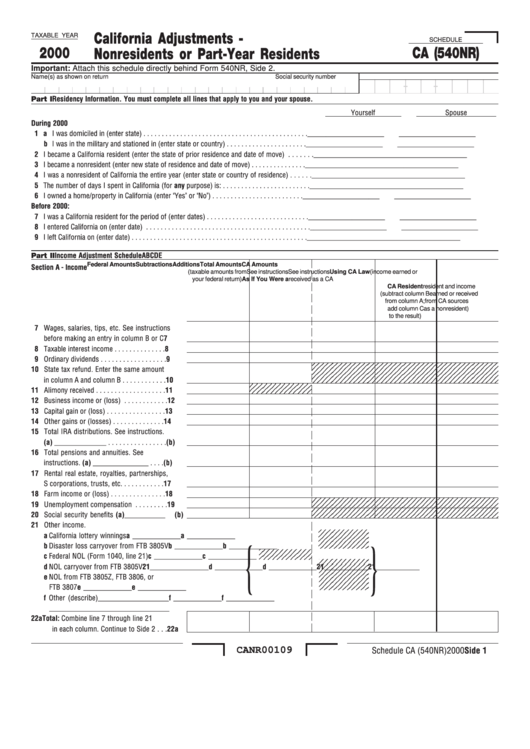

Schedule Ca 540Nr Fill Out and Sign Printable PDF Template signNow

Web complete your federal income tax return (form 1040, u.s. Web short form 540nr 2018. Ca tax before exemption credits. Enter month of year end: We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr).

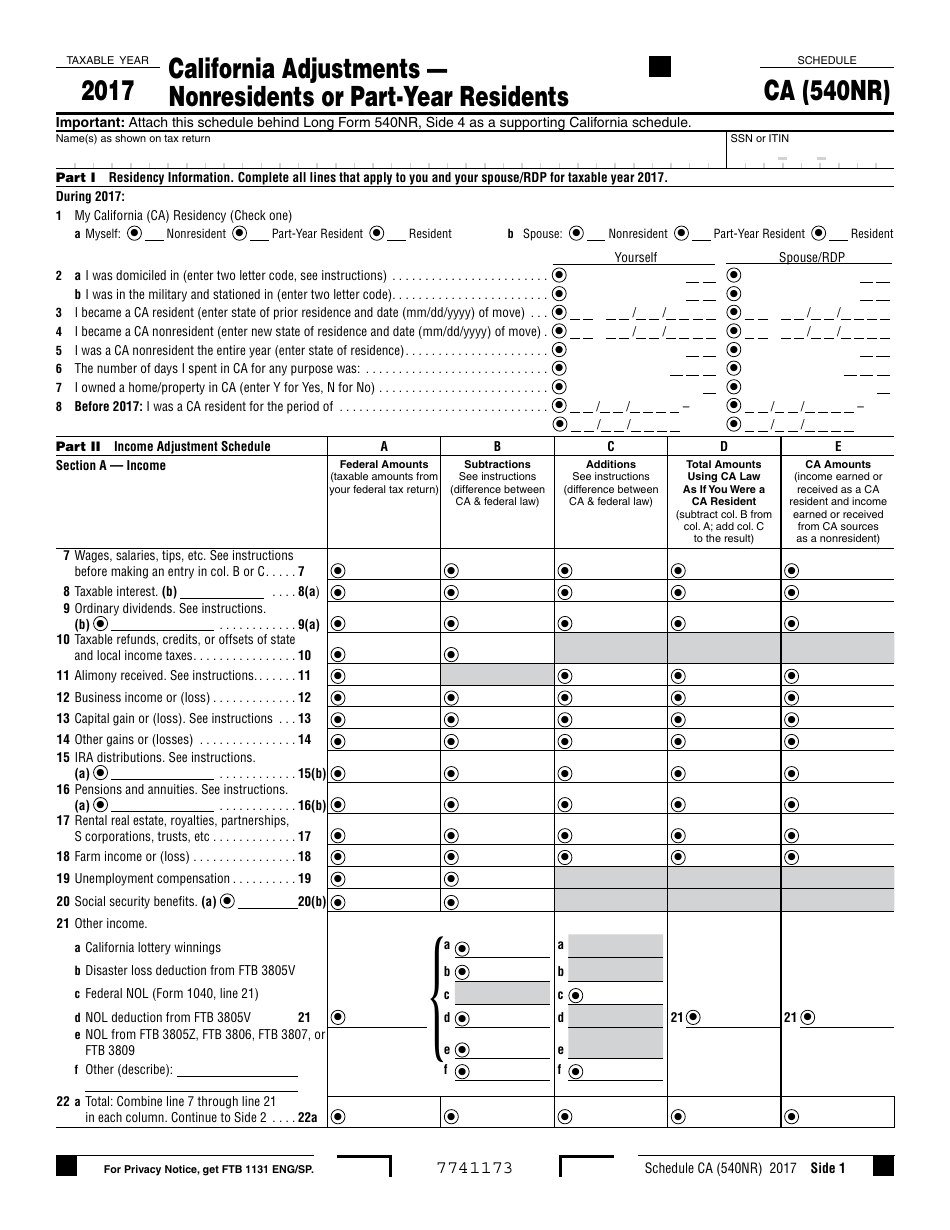

Schedule Ca (540nr) California Adjustments Nonresidents Or Part

Attach this schedule behind form 540nr, side 5 as a supporting california schedule. This form is for income earned in tax year 2022, with tax returns due in. Your first nameinitial last namesuffixyour ssn or itin a if. Multiply line 35 by line 36. Attach form ftb 3504, enrolled tribal member certification, to form.

Form 540 2EZ California Tax Return Form 540 2EZ California

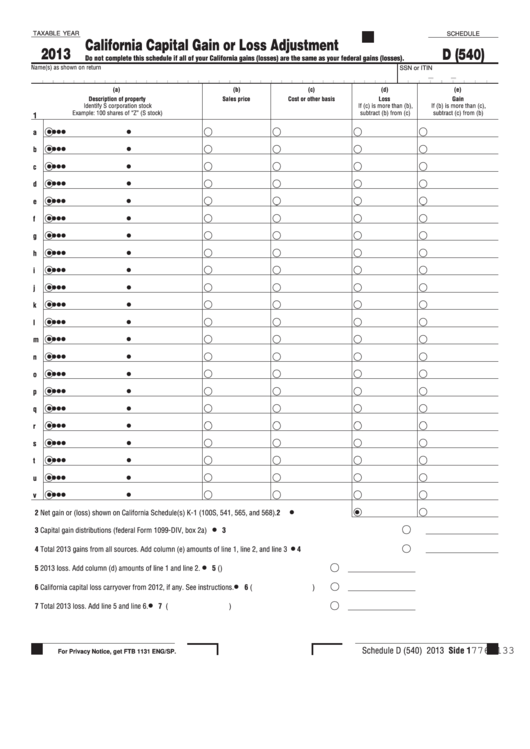

Ca taxable income from schedule ca (540nr), part iv, line 5. Web 1122 ocean drive san diego 05/22/1989 √ questions? Enter month of year end: Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Franchise tax board, po box 942867,.

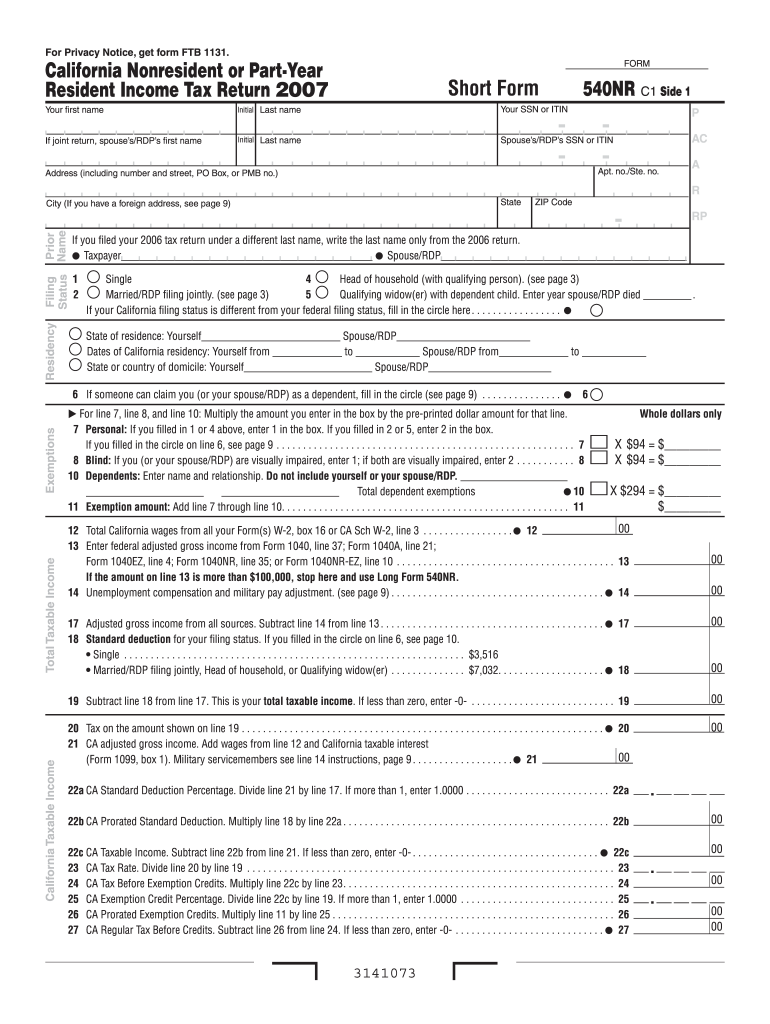

CA FTB 540NR Short 2018 Fill out Tax Template Online US Legal Forms

Web 1122 ocean drive san diego 05/22/1989 √ questions? Web enter on line 1, column b the earnings included in federal income that are exempt for california. Get ready for this year's tax season quickly and safely with pdffiller! Attach form ftb 3504, enrolled tribal member certification, to form 540nr. Web short form 540nr 2018.

Top 22 California Ftb Form 540 Templates free to download in PDF format

Ca tax before exemption credits. Web we need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr) sandy eggo citizen of pandoraarrived in california on 7/1/2020spent the. Web enter on line 1, column b the earnings included in federal income that are exempt for california. Web 1122 ocean drive san diego 05/22/1989 √ questions? Attach.

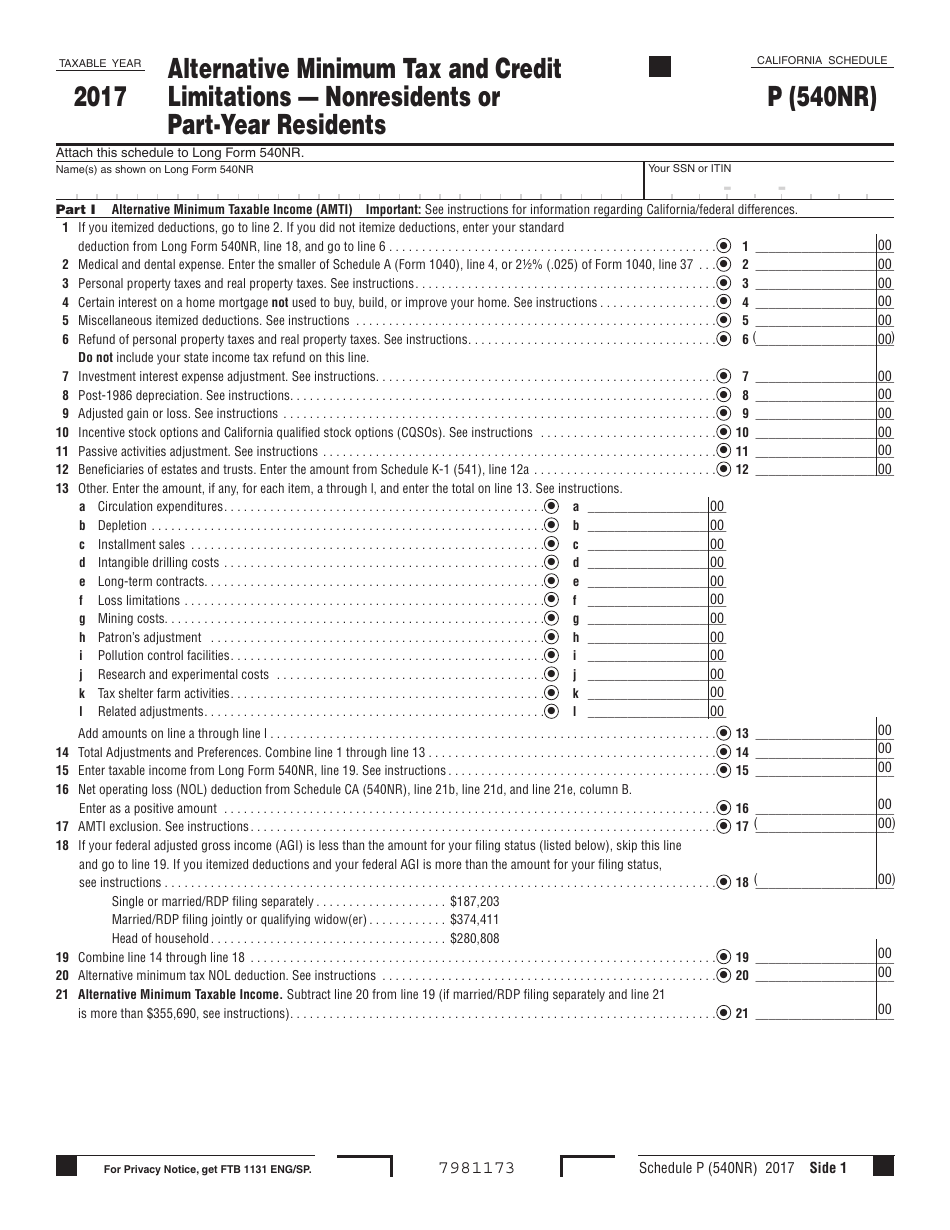

Form 540NR Schedule P Download Printable PDF or Fill Online Alternative

Your first name initial last. Enter month of year end: Your first nameinitial last namesuffixyour ssn or itin a if. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Web up to $40 cash back easily complete a printable irs ca ftb 540nr long form 2020 online.

CA FTB 540NR Short 2018 Fill out Tax Template Online US Legal Forms

We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Attach form ftb 3504, enrolled tribal member certification, to form. Web short form 540nr 2018. Web enter on line 1, column b the earnings included in federal income that are exempt for california. Web complete your federal income tax return (form 1040, u.s.

Form 540NR Schedule CA Download Fillable PDF or Fill Online California

Add line 104 and line 120. Web (540nr), part iv, line 1. Web complete your federal income tax return (form 1040, u.s. Attach form ftb 3504, enrolled tribal member certification, to form. Your first name initial last.

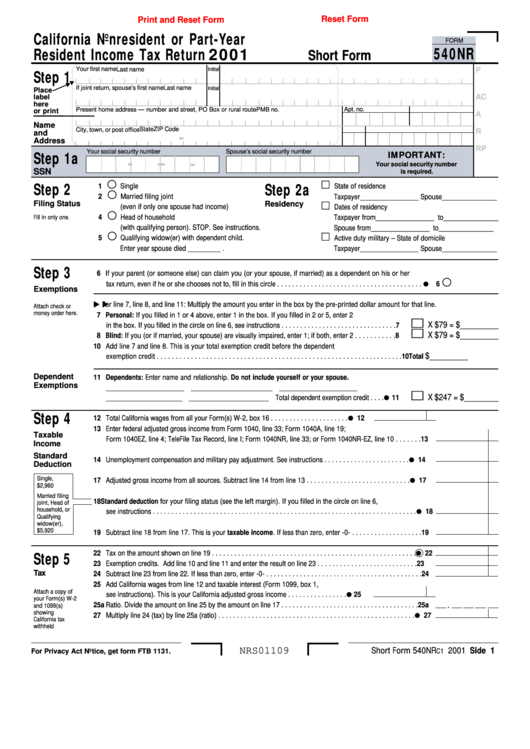

Fillable Form 540nr California Nonresident Or PartYear Resident

Web 1122 ocean drive san diego 05/22/1989 √ questions? Add line 104 and line 120. Complete all lines that apply to you and your. This form is for income earned in tax year 2022, with tax returns due in. Multiply line 35 by line 36.

Fillable Form 540nr California Nonresident Or PartYear Resident

Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Enter month of year end: Ca taxable income from schedule ca (540nr), part iv, line 5. Multiply line 35 by line 36. Attach this schedule behind form 540nr, side 5 as a supporting california schedule.

Ca Tax Before Exemption Credits.

Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Complete all lines that apply to you and your. Enter month of year end: Web enter on line 1, column b the earnings included in federal income that are exempt for california.

Web 333 3131203 Form 540Nr 2020 Side 1 63 • • • • • Filing Status 6 If Someone Can Claim You (Or Your Spouse/Rdp) As A Dependent, Check The Box Here.

Web california form 540nr check here if this is an amended return. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Ca taxable income from schedule ca (540nr), part iv, line 5. Multiply line 35 by line 36.

Web California Form 540Nr Fiscal Year Filers Only:

Web complete your federal income tax return (form 1040, u.s. Web we need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr) sandy eggo citizen of pandoraarrived in california on 7/1/2020spent the. We need to fill out schedule ca(540nr) before we can continue see handout schedule ca (540nr). Attach form ftb 3504, enrolled tribal member certification, to form 540nr.

Web Short Form 540Nr 2018.

Web enter on line 1, column b the earnings included in federal income that are exempt for california. Attach form ftb 3504, enrolled tribal member certification, to form. Your first nameinitial last namesuffixyour ssn or itin a if. Complete all lines that apply to you and your.