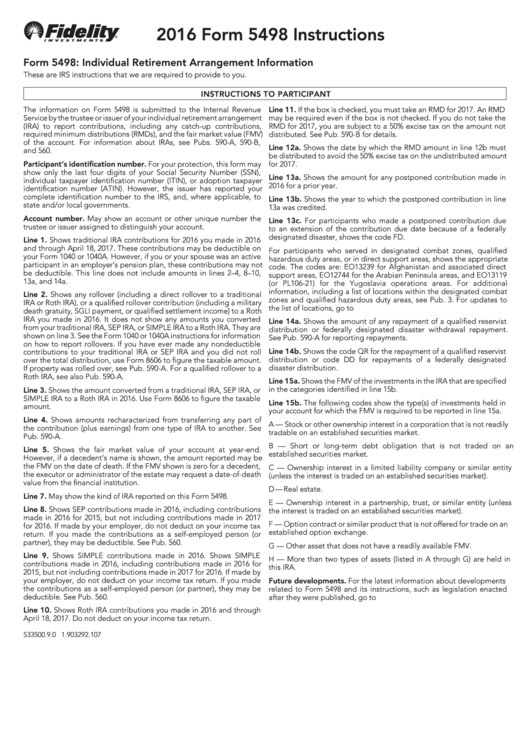

5498 Form Instructions

5498 Form Instructions - Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. If no reportable contributions were. Web form 5498 new repayment code. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. Complete, edit or print tax forms instantly. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web you must report contributions to any ira on form 5498. You don't need to enter information from your form 5498 (ira contribution information) into turbotax like you. Web solved•by turbotax•24127•updated april 05, 2023. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement.

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. See the instructions under boxes 1, 2, 3, 4, 8, 9, 10, 13a, and 14a, later. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web you must report contributions to any ira on form 5498. Complete ira contribution guide for 2023 it’s an important document used to report contributions to individual retirement accounts (iras). Web solved•by turbotax•24127•updated april 05, 2023. If no reportable contributions were. Web get now irs form 5498: Web instructions for participant the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira). Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement.

Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. Complete ira contribution guide for 2023 it’s an important document used to report contributions to individual retirement accounts (iras). Web instructions for participant the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira). Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. See the instructions for box 14a. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. You don't need to enter information from your form 5498 (ira contribution information) into turbotax like you. Web get now irs form 5498: Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Try it for free now!

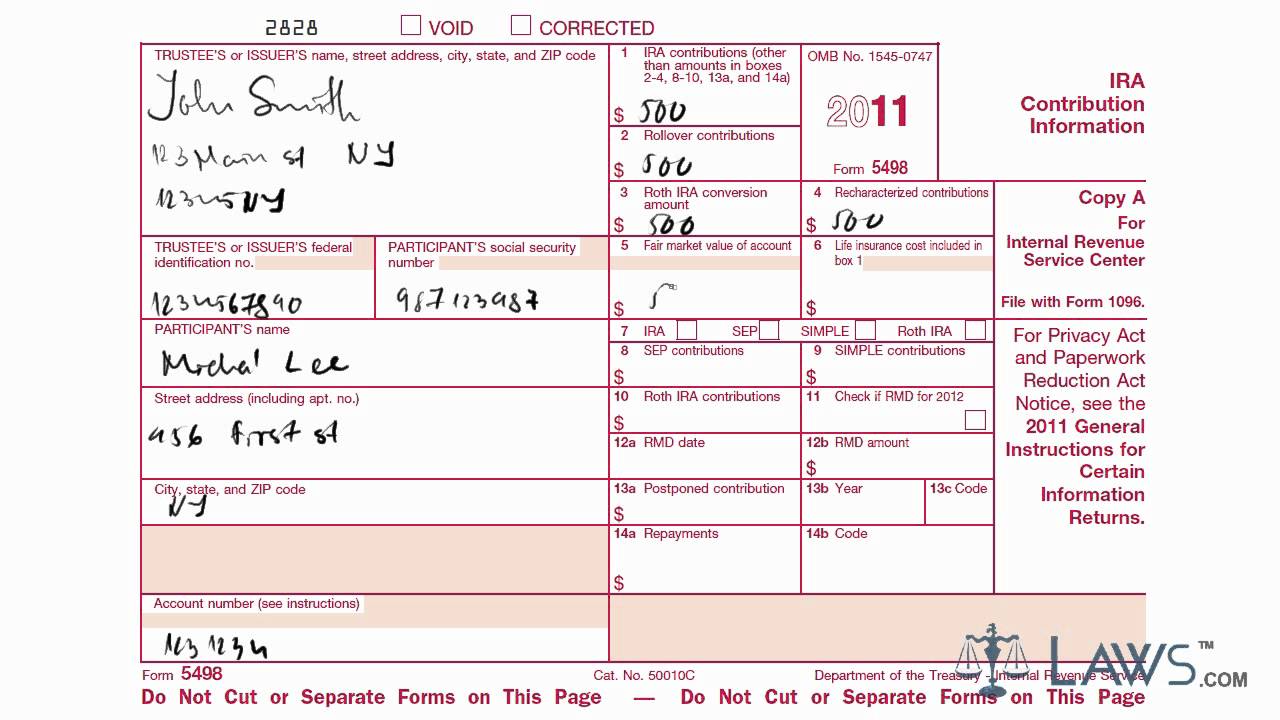

Form 5498 YouTube

See the instructions under boxes 1, 2, 3, 4, 8, 9, 10, 13a, and 14a, later. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. You don't need to enter information from your form 5498 (ira contribution information) into turbotax like.

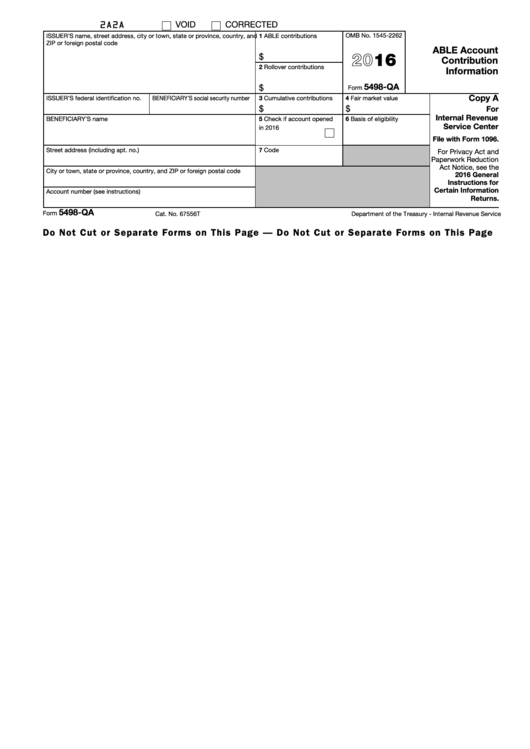

Roth Ira Form For Taxes Universal Network

Web the purpose of form 5498 is to inform you that you made contributions to your ira, sep, or simple plan during the tax year, and whether you must begin. If no reportable contributions were. Web instructions for participant the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement.

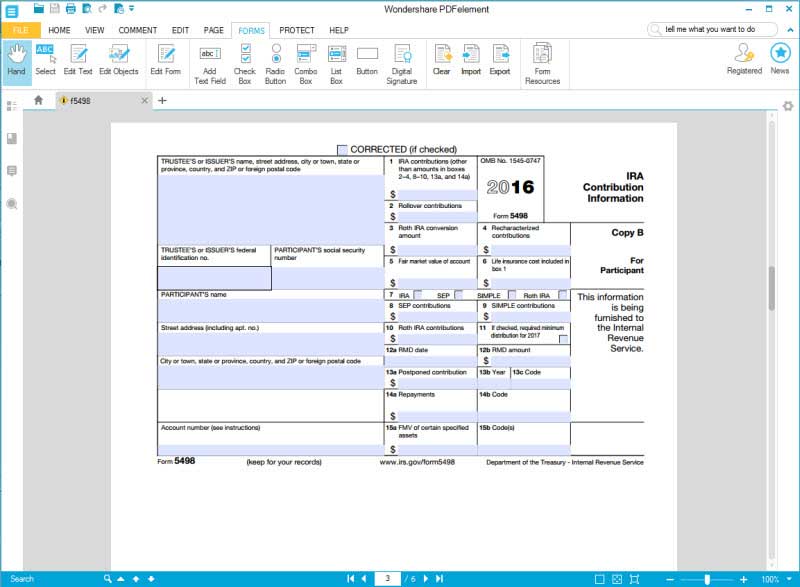

An Explanation of IRS Form 5498

Web solved•by turbotax•24127•updated april 05, 2023. You don't need to enter information from your form 5498 (ira contribution information) into turbotax like you. See the instructions for box 14a. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Web the purpose of form 5498 is to inform you that you made contributions to your ira, sep, or simple.

Inst 1099 General InstructionsGeneral Instructions for Forms 1099, 1…

Complete ira contribution guide for 2023 it’s an important document used to report contributions to individual retirement accounts (iras). Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Complete, edit or print tax forms instantly. Web you must report contributions.

Inst 1099 General InstructionsGeneral Instructions for Forms 1099, 1…

Upload, modify or create forms. Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. Web the trustees or administrators.

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web form 5498 new repayment code. Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. We.

Top 21 Form 5498 Templates free to download in PDF format

See the instructions for box 14a. Web get now irs form 5498: You don't need to enter information from your form 5498 (ira contribution information) into turbotax like you. Web you must report contributions to any ira on form 5498. If no reportable contributions were.

Form 5498 Instructions 2016 printable pdf download

Complete, edit or print tax forms instantly. Try it for free now! Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. See the instructions under boxes 1, 2, 3, 4, 8, 9, 10, 13a, and 14a, later. Web the information on form 5498 is.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. See the instructions under boxes 1, 2, 3, 4, 8, 9, 10, 13a, and 14a, later. Web instructions for participant the.

Instructions for How to Fill in IRS Form 5498

Upload, modify or create forms. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web the purpose of form 5498 is to inform you that you made contributions to your ira, sep, or simple plan during the tax year, and whether.

Furnished By Edward Jones To Report Contributions, Rollovers, Conversions And Recharacterizations.

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. If no reportable contributions were. Web the purpose of form 5498 is to inform you that you made contributions to your ira, sep, or simple plan during the tax year, and whether you must begin. Web get now irs form 5498:

Ira Contributions Information Reports To The Irs Your Ira Contributions For The Year Along With Other Information About Your Ira Account.

Web solved•by turbotax•24127•updated april 05, 2023. Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,.

See The Instructions For Box 14A.

You don't need to enter information from your form 5498 (ira contribution information) into turbotax like you. Web you must report contributions to any ira on form 5498. Complete, edit or print tax forms instantly. Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of.

Web Form 5498 New Repayment Code.

Upload, modify or create forms. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Try it for free now! Complete ira contribution guide for 2023 it’s an important document used to report contributions to individual retirement accounts (iras).

/487097635-57a631af5f9b58974a3aceb1.jpg)