8233 Form Irs

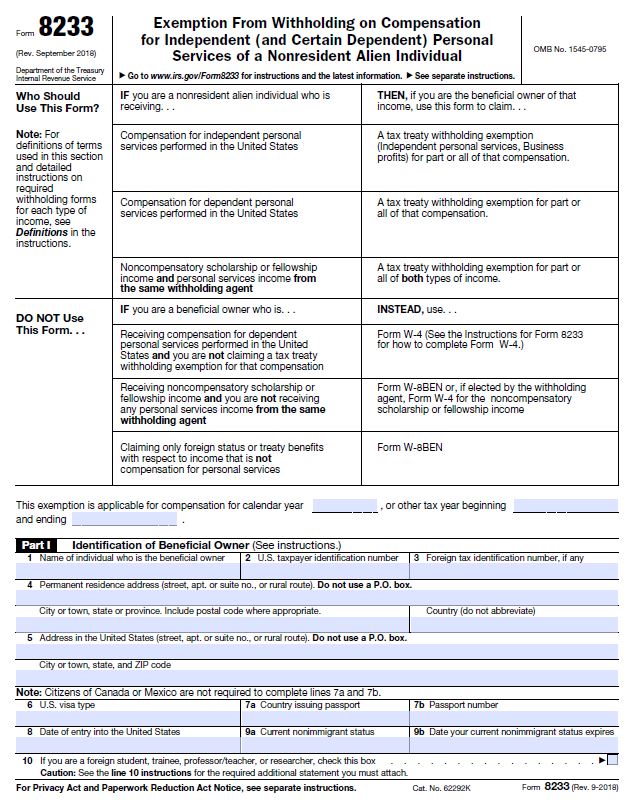

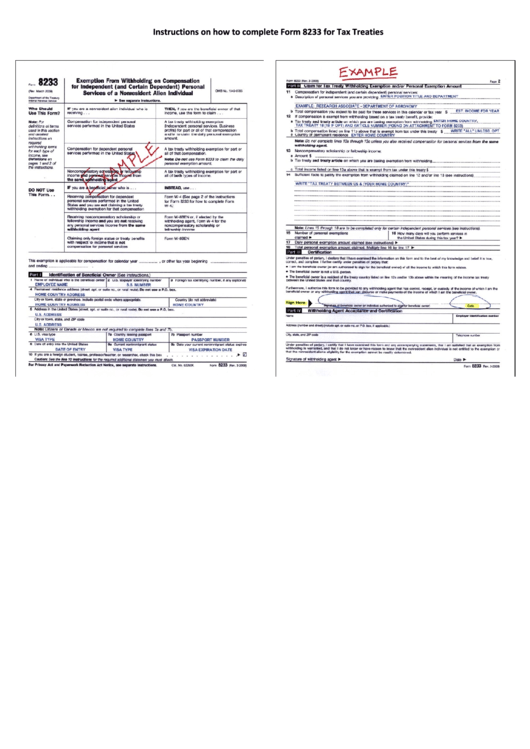

8233 Form Irs - • for each tax year (be sure to specify the tax year in the space. The payee has a u.s. December 2001) department of the treasury internal revenue service exemption from withholding on compensation for independent (and certain. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Tax refunds for previous tax years must be claimed with the irs on your tax return. Web complete and give form 8233 to your withholding agent if some or all of your compensation is exempt from withholding. Web what is form 8233 and what is its purpose? Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. Form 8233 ( exemption from. By filing form 8233, they are looking to claim an exemption from federal income tax.

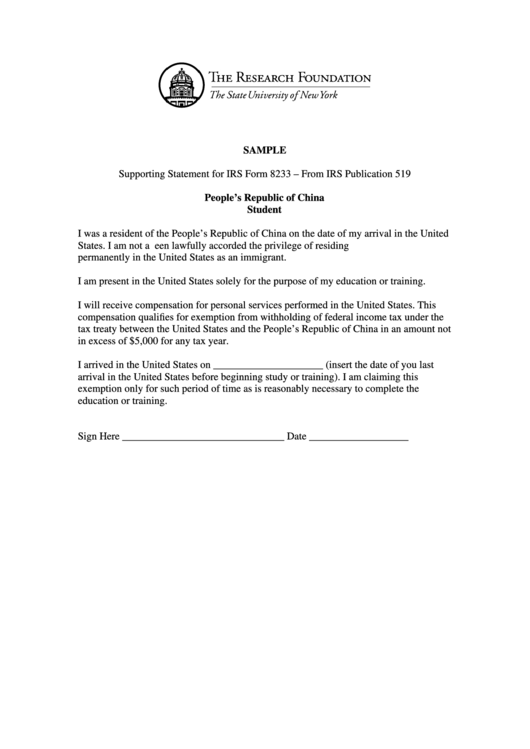

Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Web 314 rows form 8233 is valid for only one (1) year. Web what is form 8233 and what is its purpose? Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. Form 8233 ( exemption from. Identification of beneficial owner line 1. This form is used if an employee is a resident of another. Every year, countless nonresidents ask us what form 8233 is used for.

Web complete and give form 8233 to your withholding agent if some or all of your compensation is exempt from withholding. Web employer's quarterly federal tax return. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Ad access irs tax forms. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Web tax refunds are included on the next regular paycheck. Every year, countless nonresidents ask us what form 8233 is used for. Form 8233 ( exemption from. Get ready for tax season deadlines by completing any required tax forms today. This form is used if an employee is a resident of another.

fw8ben Withholding Tax Irs Tax Forms

Get ready for tax season deadlines by completing any required tax forms today. Web employer's quarterly federal tax return. Web 314 rows form 8233 is valid for only one (1) year. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. By filing form 8233, they are looking to claim an exemption.

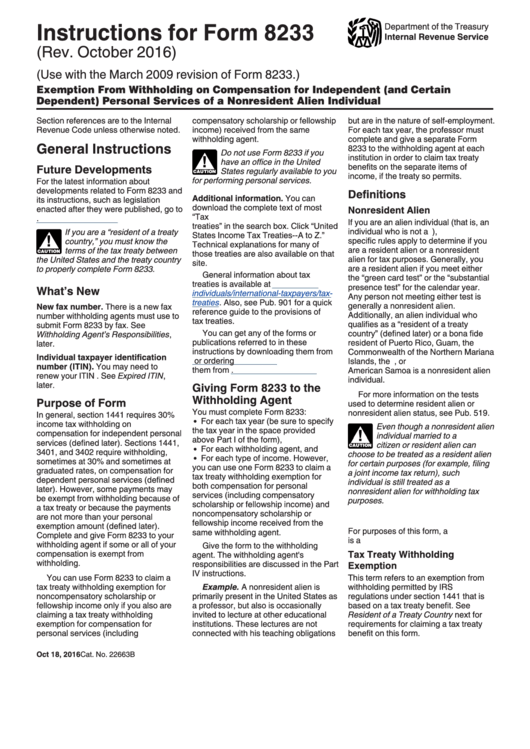

Instructions For Form 8233 2016 printable pdf download

Tax refunds for previous tax years must be claimed with the irs on your tax return. Every year, countless nonresidents ask us what form 8233 is used for. Web employer's quarterly federal tax return. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web we last updated the exemption from withholding.

16 Form 8233 Templates free to download in PDF

Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Web 314 rows form 8233 is valid for only one (1) year. Web what is form 8233 and what is its purpose? Employers who withhold income taxes, social security tax, or medicare tax from employee's.

irs 8233 form Fill out & sign online DocHub

The payee has a u.s. Web what is form 8233 and what is its purpose? Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien..

Form 8233 Exemption from Withholding on Compensation for Independent

Complete, edit or print tax forms instantly. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web 314 rows form 8233 is valid for only one (1) year. Identification of beneficial owner line 1. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra).

Tax Return Uk International Student QATAX

Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Giving form 8233 to the withholding agent you must complete a.

Instructions On How To Complete Form 8233 For Tax Treaties printable

Web 314 rows form 8233 is valid for only one (1) year. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. Every year, countless nonresidents ask us what form 8233 is used for. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service.

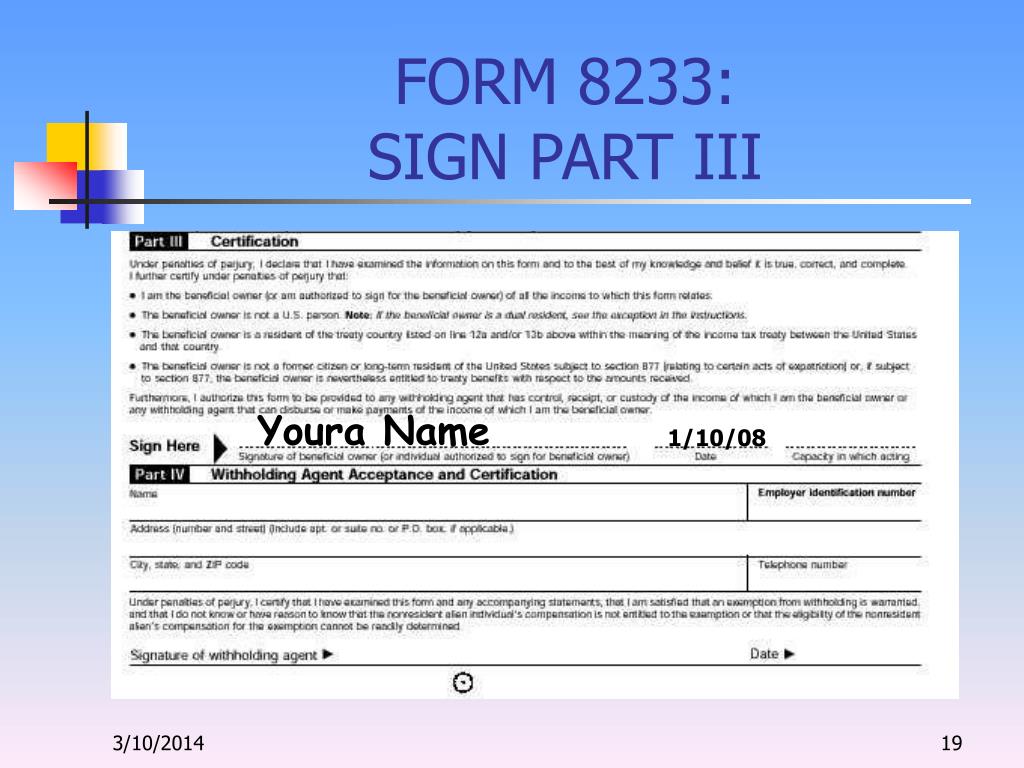

PPT Taxes & Treaties for International Student Employees PowerPoint

Web sections 1441, 3401, and 3402 require withholding, sometimes at 30% and sometimes at graduated rates, on compensation for dependent personal services (defined later). Every year, countless nonresidents ask us what form 8233 is used for. Ad access irs tax forms. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal.

IRS FORM 8233 Non Resident Alien EXEMPTIONS YouTube

Web 314 rows form 8233 is valid for only one (1) year. This form is used if an employee is a resident of another. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Web what is form 8233 and what is its purpose? Form 8233 ( exemption from.

irs form 8233 printable pdf file enter the appropriate calendar year

Complete, edit or print tax forms instantly. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Tax refunds for previous tax years must be claimed with the irs on your tax return. The payee has a u.s. Every year, countless nonresidents ask us what form.

Ad Access Irs Tax Forms.

Web sections 1441, 3401, and 3402 require withholding, sometimes at 30% and sometimes at graduated rates, on compensation for dependent personal services (defined later). Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Giving form 8233 to the withholding agent you must complete a separate form 8233: Web 314 rows form 8233 is valid for only one (1) year.

Web Tax Refunds Are Included On The Next Regular Paycheck.

Tax refunds for previous tax years must be claimed with the irs on your tax return. This form is used if an employee is a resident of another. Web employer's quarterly federal tax return. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien.

Web We Last Updated The Exemption From Withholding On Compensation For Independent (And Certain Dependent) Personal Services Of A Nonresident Alien Individual In February.

Web what is form 8233 and what is its purpose? Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. The payee has a u.s. • for each tax year (be sure to specify the tax year in the space.

Web Complete And Give Form 8233 To Your Withholding Agent If Some Or All Of Your Compensation Is Exempt From Withholding.

Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Complete, edit or print tax forms instantly. Identification of beneficial owner line 1.