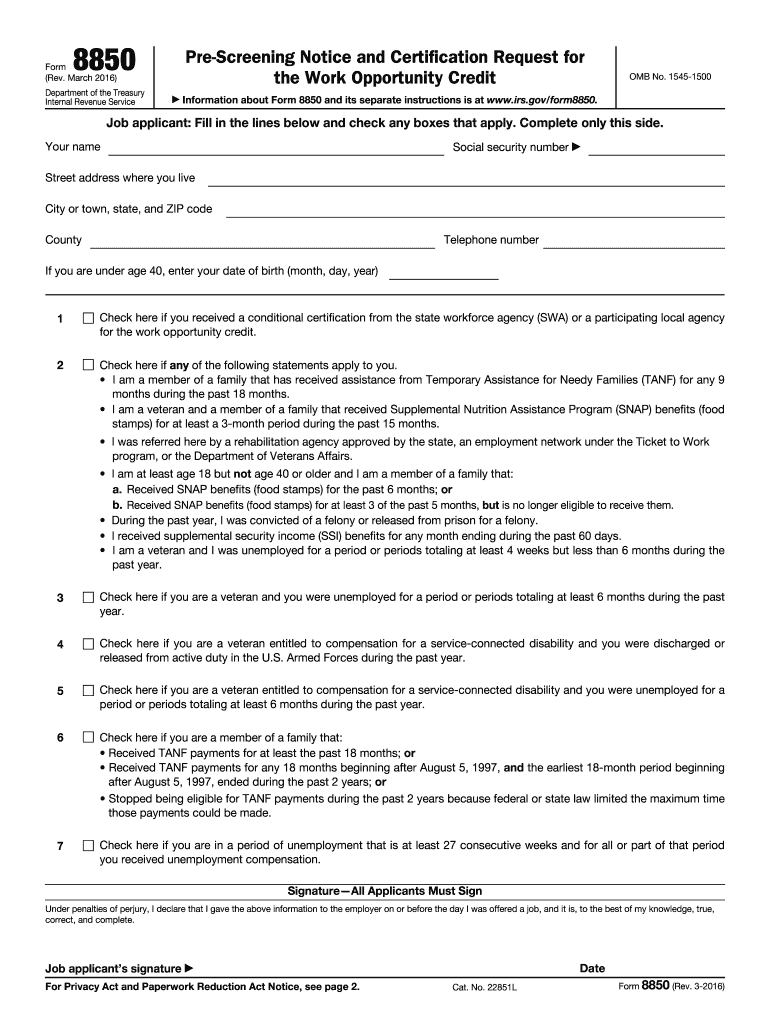

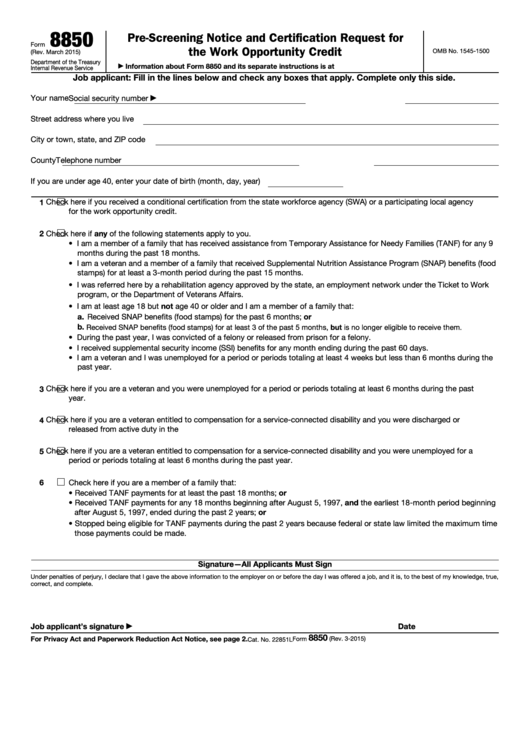

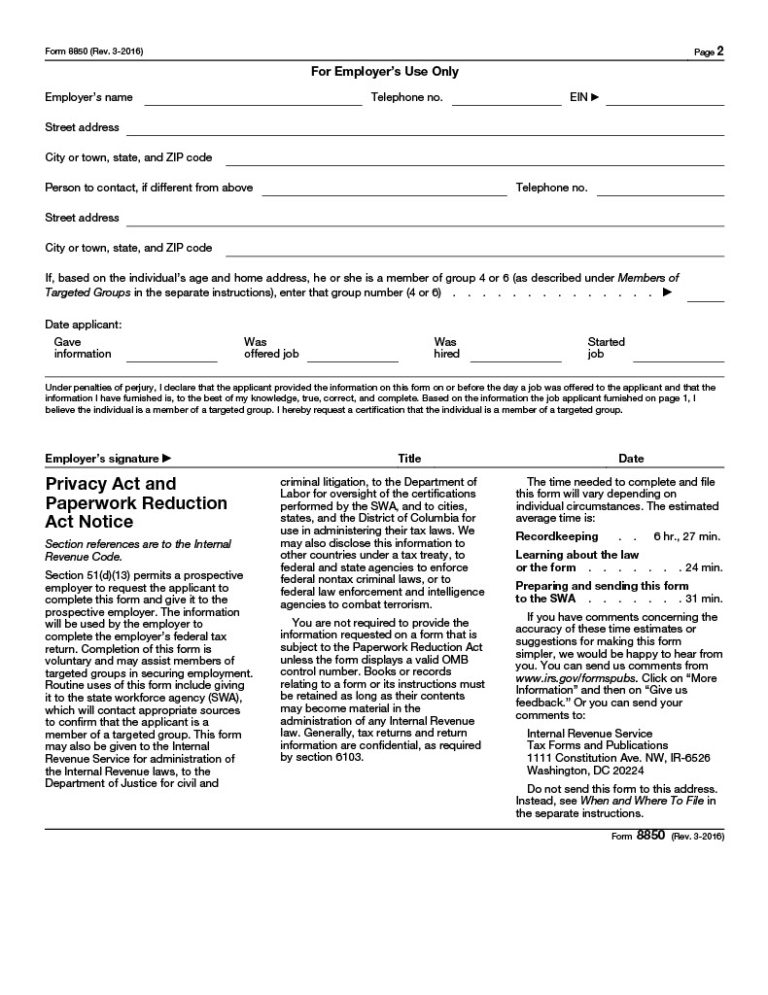

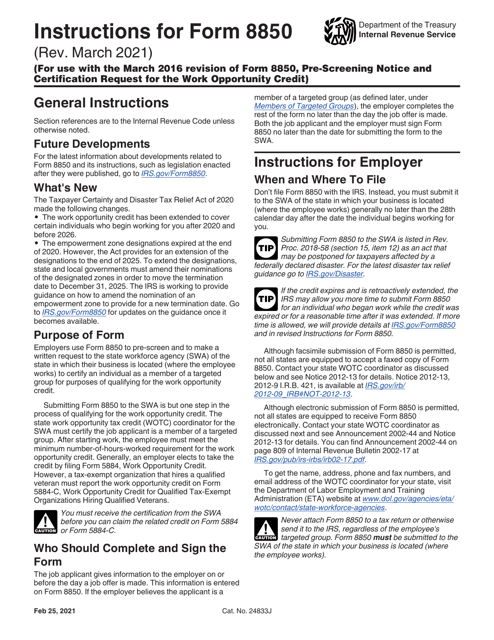

8850 Form 2022

8850 Form 2022 - Web the form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. October 11, 2022 by matt kelm. No need to install software, just go to dochub, and sign up instantly and for free. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers. Web edit, sign, and share 8850 form 2022 online. Web submitting form 8850 to the swa is listed in rev. Although facsimile submission of form 8850 is permitted, not all states are equipped to accept a faxed copy of form 8850.

Get ready for tax season deadlines by completing any required tax forms today. If the job seeker has indicated that they. October 11, 2022 by matt kelm. Web edit, sign, and share 8850 form 2022 online. Ad complete irs tax forms online or print government tax documents. No need to install software, just go to dochub, and sign up instantly and for free. Get a fillable 8850 form 2022 template online. Web we last updated federal form 8850 in january 2023 from the federal internal revenue service. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Ad access irs tax forms.

Get ready for tax season deadlines by completing any required tax forms today. Web what is form 8850. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. If the job seeker has indicated that they. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Reduce document preparation complexity by getting the most out of this helpful video guide. Ad access irs tax forms. Web video instructions and help with filling out and completing 8850 form 2023. Although facsimile submission of form 8850 is permitted, not all states are equipped to accept a faxed copy of form 8850.

Form 8850 Fill out & sign online DocHub

Web the form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers. Complete, edit or print tax forms instantly. Web and in revised instructions for form 8850. Web submitting form.

Fill Free fillable Form 8850 PreScreening Notice and Certification

Web edit, sign, and share 8850 form 2022 online. Web submitting form 8850 to the swa is listed in rev. No need to install software, just go to dochub, and sign up instantly and for free. Web we last updated federal form 8850 in january 2023 from the federal internal revenue service. Reduce document preparation complexity by getting the most.

Top 17 Form 8850 Templates free to download in PDF format

Web submitting form 8850 to the swa is listed in rev. Reduce document preparation complexity by getting the most out of this helpful video guide. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers. Web and in revised instructions for form 8850. Get ready for tax season deadlines by completing any required tax.

Payroll Forms MyTPG TPG Payroll & HR Services

Web edit, sign, and share 8850 form 2022 online. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. Web the form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the.

8850 Form 2023, PreScreening Notice and Certification Request for the

Although facsimile submission of form 8850 is permitted, not all states are equipped to accept a faxed copy of form 8850. Ad complete irs tax forms online or print government tax documents. Ad access irs tax forms. Web we last updated federal form 8850 in january 2023 from the federal internal revenue service. Web the form 8850 and the eta.

Payroll Forms MyTPG TPG Payroll & HR Services

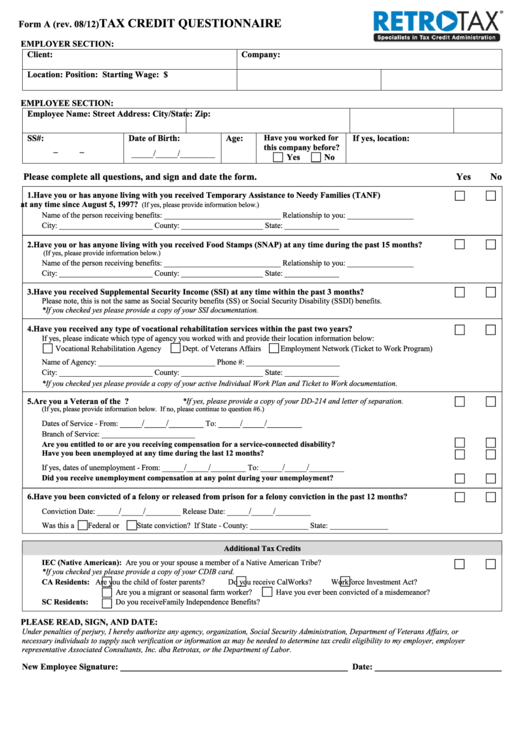

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web this form is used together with irs form 8850 to help state workforce agencies (swas) determine eligibility for the work opportunity tax credit (wotc) program. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. The.

Download Instructions for IRS Form 8850 Prescreening Notice and

No need to install software, just go to dochub, and sign up instantly and for free. October 11, 2022 by matt kelm. Web we last updated federal form 8850 in january 2023 from the federal internal revenue service. Web the form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the.

11 INFO FORM 8850 QUESTIONNAIRE CDR DOWNLOAD ZIP PRINTABLE DOCX

Web this form is used together with irs form 8850 to help state workforce agencies (swas) determine eligibility for the work opportunity tax credit (wotc) program. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. This form is for income earned in tax year 2022,.

W4 Form 2020 W4 Forms

Web submitting form 8850 to the swa is listed in rev. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Reduce document preparation complexity by getting the most out of this helpful video guide. Web edit, sign, and share 8850 form 2022 online. Web we last updated federal form 8850 in january 2023 from.

Fillable Form 8850 (Rev. August 2009) printable pdf download

Web and in revised instructions for form 8850. No need to install software, just go to dochub, and sign up instantly and for free. Reduce document preparation complexity by getting the most out of this helpful video guide. Get a fillable 8850 form 2022 template online. Web we last updated federal form 8850 in january 2023 from the federal internal.

Web Edit, Sign, And Share 8850 Form 2022 Online.

No need to install software, just go to dochub, and sign up instantly and for free. Reduce document preparation complexity by getting the most out of this helpful video guide. Web this form is used together with irs form 8850 to help state workforce agencies (swas) determine eligibility for the work opportunity tax credit (wotc) program. Ad complete irs tax forms online or print government tax documents.

Web Video Instructions And Help With Filling Out And Completing 8850 Form 2023.

Web what is form 8850. Web the form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work. Get a fillable 8850 form 2022 template online. Although facsimile submission of form 8850 is permitted, not all states are equipped to accept a faxed copy of form 8850.

Web Submitting Form 8850 To The Swa Is Listed In Rev.

If the job seeker has indicated that they. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers. Get ready for tax season deadlines by completing any required tax forms today. Web and in revised instructions for form 8850.

October 11, 2022 By Matt Kelm.

Web we last updated federal form 8850 in january 2023 from the federal internal revenue service. Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.