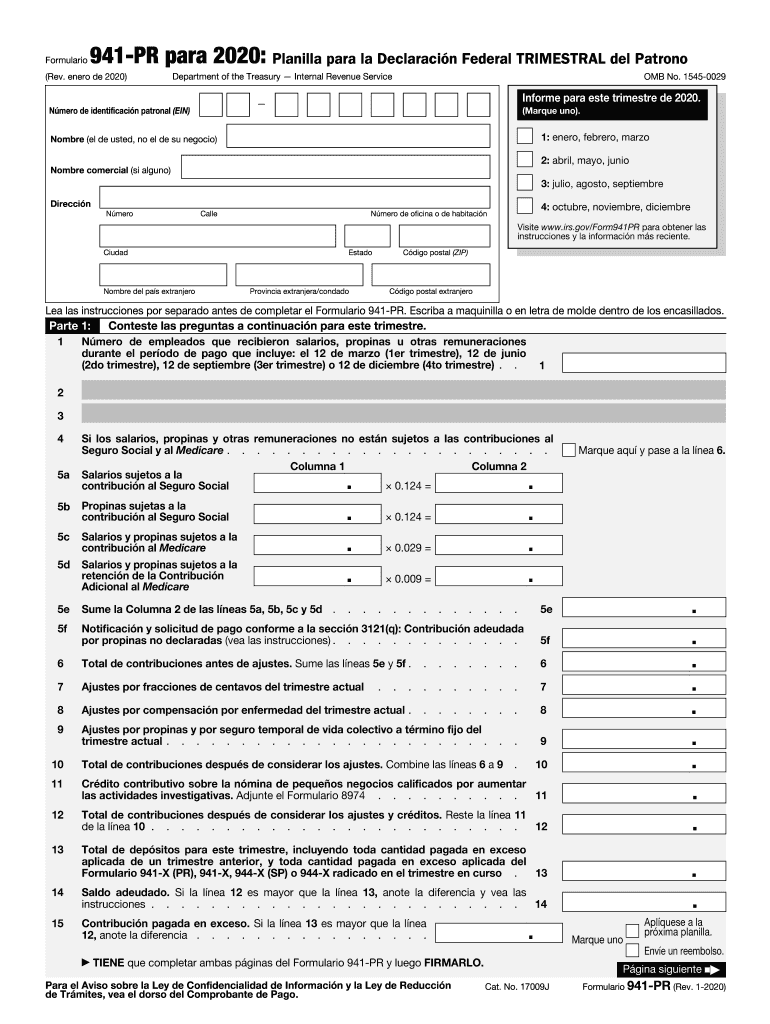

941 Form 2020 Quarter 1

941 Form 2020 Quarter 1 - Complete, edit or print tax forms instantly. Web currently, the irs updated the final version of form 941, which has also affected the form for the first quarter. Web report for this quarter of 2020 (check one.) 1: Web dallas, july 26, 2023 — at&t inc. Yellen issued the following statement on the recent decision by fitch ratings. Upload, modify or create forms. July 2021) adjusted employer’s quarterly federal tax return or claim for. Web use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. Off to the right side,. You can go to click this link to open and furnish the.

Go to the employee menu. 30 by the internal revenue. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Web purpose of form 941. Complete, edit or print tax forms instantly. Yellen issued the following statement on the recent decision by fitch ratings. July 2020) employer’s quarterly federal tax return 950120 omb no. Who must file form 941? Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. Complete, edit or print tax forms instantly.

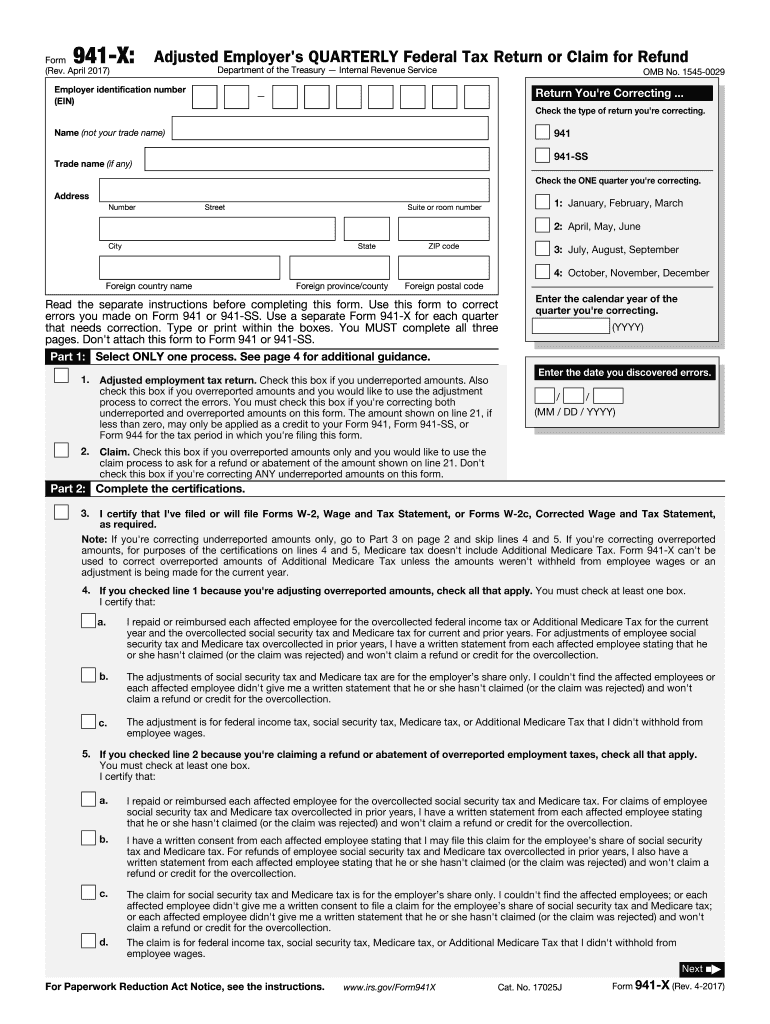

Check the type of return you’re correcting. Yellen issued the following statement on the recent decision by fitch ratings. Try it for free now! 30 by the internal revenue. Go to the employee menu. Web dallas, july 26, 2023 — at&t inc. July 2021) adjusted employer’s quarterly federal tax return or claim for. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. You'll be able to obtain the blank form from the pdfliner. You can go to click this link to open and furnish the.

941 form 2018 Fill out & sign online DocHub

Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. Web currently, the irs updated the final version of form 941, which has also affected the form for the first quarter. Web report for this quarter of 2020 (check one.) 1:.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

See the instructions for line 36. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Web the deadline for filing form 941 for the 3rd quarter of 2020 is october 31, 2020. Web fill out business information. Ad access irs tax forms.

941 Form 2020 941 Forms

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Upload, modify or create forms. Web employer's quarterly federal tax return for 2021. July 2020) employer’s quarterly federal tax return 950120 omb no. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941.

Form 941 3Q 2020

July 2021) adjusted employer’s quarterly federal tax return or claim for. Ad access irs tax forms. Web employer's quarterly federal tax return for 2021. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth.

New 941 form for second quarter payroll reporting

Go to the employee menu. Web use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. You can go to click this link to open and furnish the. Upload, modify or create forms. How should you complete form 941?

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Go to the employee menu. Web dallas, july 26, 2023 — at&t inc. Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report. Complete, edit or print tax forms instantly. Web if you file those in quickbooks desktop, you can follow.

941 Form Fill Out and Sign Printable PDF Template signNow

July 2020) employer’s quarterly federal tax return 950120 omb no. Who must file form 941? Complete, edit or print tax forms instantly. At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. Off to the right side,.

How to fill out IRS Form 941 2019 PDF Expert

Web purpose of form 941. Go to the employee menu. Because this is a saturday this year, the deadline to file this form will actually be. You'll be able to obtain the blank form from the pdfliner. Web 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Web the deadline for filing form 941 for the 3rd quarter of 2020 is october 31, 2020. Yellen issued the following statement on the recent decision by fitch ratings. Upload, modify or create forms. Under these facts, you would qualify for the second and third. You'll be able to obtain the blank form from the pdfliner.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Web employer's quarterly federal tax return for 2021. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept..

Upload, Modify Or Create Forms.

Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Web dallas, july 26, 2023 — at&t inc. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Try it for free now!

Yellen Issued The Following Statement On The Recent Decision By Fitch Ratings.

How should you complete form 941? July 2020) employer’s quarterly federal tax return 950120 omb no. Employer s quarterly federal tax return created date: Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020;

January 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950117 Omb No.

30 by the internal revenue. Web 2021 form 941 author: Complete, edit or print tax forms instantly. Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report.

Web Report For This Quarter Of 2020 (Check One.) 1:

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. At the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. Try it for free now! Web use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report.