941 Form 2020 Quarter 2

941 Form 2020 Quarter 2 - View sales history, tax history, home value. Web 3 beds, 2 baths, 1965 sq. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. April, may, june enter the calendar year of the quarter you’re correcting. Try it for free now! Web form 941 employer's quarterly federal tax return. Web johnson & johnson reports q2 2023 results. Web there are only two worksheets for q2, these should be used by employers that need to calculate and claim credits for applicable wages paid in previous quarters. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020;

Download or email irs 941 & more fillable forms, register and subscribe now! If the due date falls on a saturday, sunday, or a legal holiday, the next. Web 3 beds, 2 baths, 1965 sq. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web form 941 employer's quarterly federal tax return. Try it for free now! Download or email irs 941 & more fillable forms, register and subscribe now! Employers engaged in a trade or business who pay compensation form 9465; As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web dallas, july 26, 2023 — at&t inc.

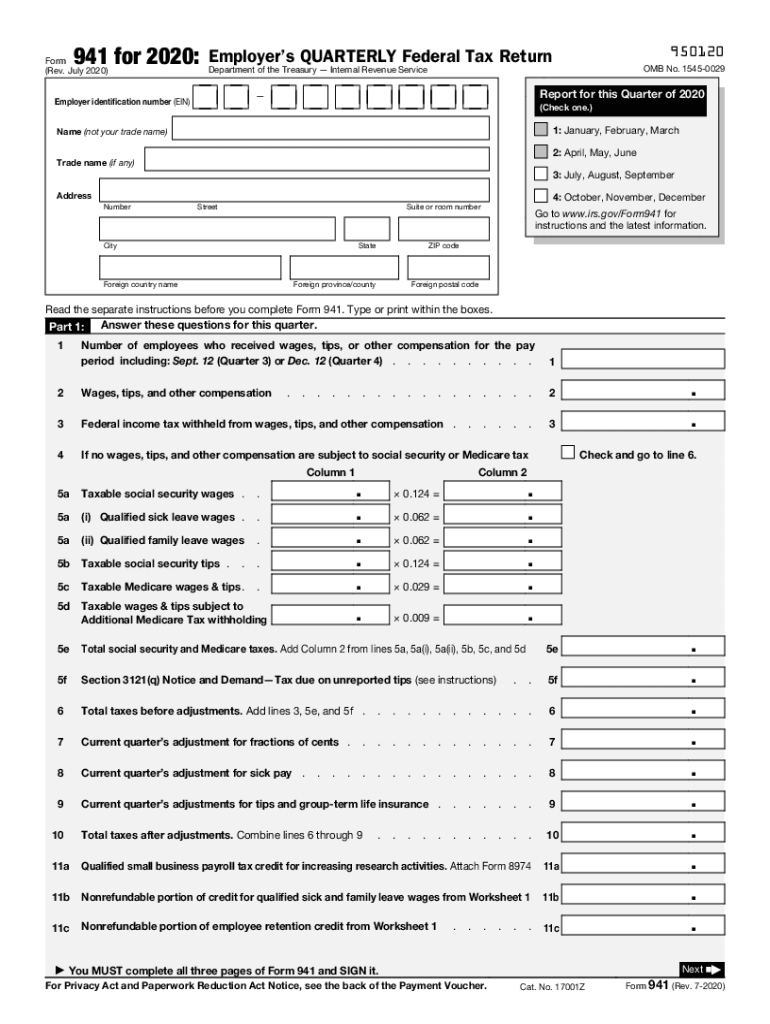

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Under these facts, you would qualify for the second and third. Answer these questions for this quarter. Web revised form 941 for quarter 2, 2020. Web employer's quarterly federal tax return for 2021. Type or print within the boxes. Web dallas, july 26, 2023 — at&t inc. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. April 2022) adjusted employer’s quarterly federal tax return or claim for.

941 Form 2020 941 Forms

Yellen issued the following statement on the recent decision by fitch ratings. Web johnson & johnson reports q2 2023 results. (yyyy) read the separate instructions before completing this form. View sales history, tax history, home value. Web dallas, july 26, 2023 — at&t inc.

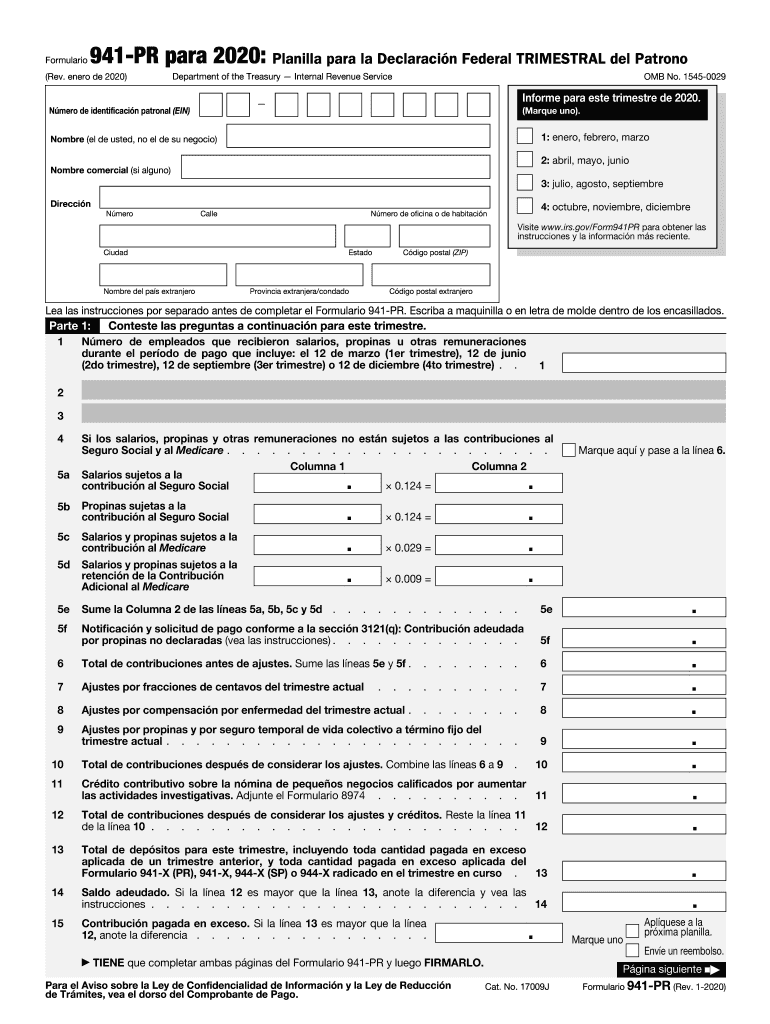

IRS 941PR 20202022 Fill and Sign Printable Template Online US

Ad upload, modify or create forms. 1 number of employees who. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; If the due date falls on a saturday, sunday, or a legal holiday, the next. Try it for free now!

How to fill out IRS Form 941 2019 PDF Expert

Web revised form 941 for quarter 2, 2020. Ad upload, modify or create forms. Ad upload, modify or create forms. Web “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or money order. Try it for free now!

Print Irs Form 941 Fill Online, Printable, Fillable, Blank pdfFiller

Yellen issued the following statement on the recent decision by fitch ratings. Web johnson & johnson reports q2 2023 results. Download or email irs 941 & more fillable forms, register and subscribe now! Ad upload, modify or create forms. Web employer's quarterly federal tax return for 2021.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

April 2022) adjusted employer’s quarterly federal tax return or claim for. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money. Ad upload, modify or create forms. Web dallas, july 26, 2023 — at&t inc. Under these facts, you would qualify for.

Update Form 941 Changes Regulatory Compliance

30 by the internal revenue. Web johnson & johnson reports q2 2023 results. Answer these questions for this quarter. Ad upload, modify or create forms. Web payroll tax returns.

941 Form 2020 941 Forms

Web employer's quarterly federal tax return for 2021. 30 by the internal revenue. 1 number of employees who. Ad upload, modify or create forms. (yyyy) read the separate instructions before completing this form.

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

Web read the separate instructions before you complete form 941. House located at 1141 ne 202nd st, miami, fl 33179 sold for $270,000 on sep 19, 2005. April 2022) adjusted employer’s quarterly federal tax return or claim for. July 2020) employer’s quarterly federal tax return 950120 omb no. View sales history, tax history, home value.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web employer's quarterly federal tax return for 2021. If the due date falls on a saturday, sunday, or a legal holiday, the next. Yellen issued the following statement on the recent decision by fitch ratings. Web read the separate instructions before you complete form 941. Web “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or.

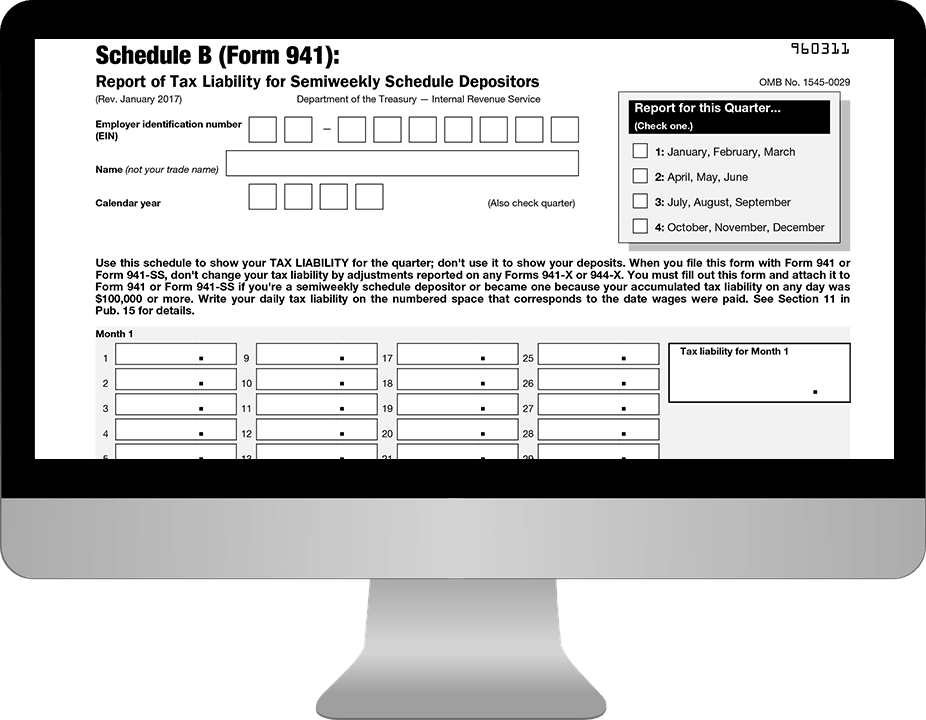

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web “2nd quarter 2020,” “3rd quarter 2020,” or “4th quarter 2020”) on your check or money order. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money. If the due date falls on a saturday, sunday, or a legal holiday, the next..

Web Payroll Tax Returns.

Web form 941 employer's quarterly federal tax return. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. House located at 1141 ne 202nd st, miami, fl 33179 sold for $270,000 on sep 19, 2005. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money.

Therefore, Any Corrections To The.

Answer these questions for this quarter. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web 3 beds, 2 baths, 1965 sq. Web revised form 941 for quarter 2, 2020.

Download Or Email Irs 941 & More Fillable Forms, Register And Subscribe Now!

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. July 2020) employer’s quarterly federal tax return 950120 omb no. Web dallas, july 26, 2023 — at&t inc. Web johnson & johnson reports q2 2023 results.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

30 by the internal revenue. April 2022) adjusted employer’s quarterly federal tax return or claim for. (yyyy) read the separate instructions before completing this form. Web usually, the deadline to file form 941 for the 3rd quarter (july, august, september) is october 31.