941 Form 2021 3Rd Quarter

941 Form 2021 3Rd Quarter - This may seem far off, but why wait? Go to the employee menu. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Web starting a new form 941. Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web taxes for 2021. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Web third quarter of 2020 was $20,000 and you deposited $5,000 of the $20,000 during the third quarter of 2020 and you deferred $15,000 on form 941, line 13b, then you must pay. Web the deadline for the third quarter is november 1, 2021. Web employers must file their form 941 for the third quarter by november 1, 2021.

Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. This may seem far off, but why wait? Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Form 941 for the third quarter is now available from taxbandits, giving their clients. Here are some of our top tips to help you master your form 941 this. Web employer’s quarterly federal tax return form 941 for 2023: March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web employers must file their form 941 for the third quarter by november 1, 2021. Web report for this quarter of 2021 (check one.) 1: Web the deadline for the third quarter is november 1, 2021.

Rock hill, sc / accesswire / september 27, 2021 / the third quarter is coming to a close, which means that the deadline to file form. Form 941 reports federal income and fica taxes each. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web third quarter of 2020 was $20,000 and you deposited $5,000 of the $20,000 during the third quarter of 2020 and you deferred $15,000 on form 941, line 13b, then you must pay. Once you’ve signed in to taxbandits, select ‘start new’ in the upper right corner: Complete, edit or print tax forms instantly. The irs expects the june 2021 revision of form 941. This may seem far off, but why wait? Form 941 for the third quarter is now available from taxbandits, giving their clients. Web report for this quarter of 2021 (check one.) 1:

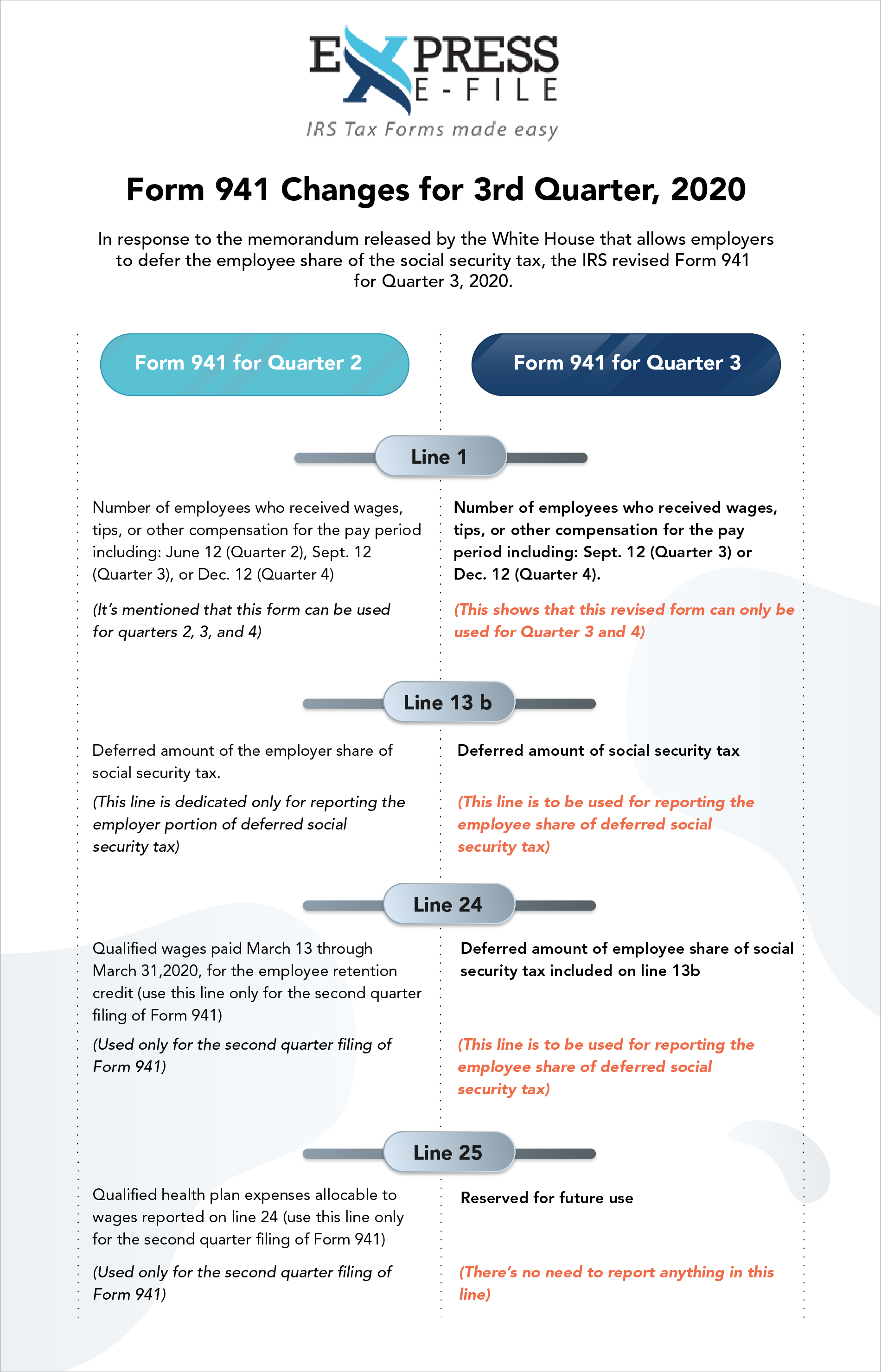

How to fill out IRS Form 941 2019 PDF Expert

Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Web report for this quarter of 2021 (check one.) 1: Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Web a finalized.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Get ready for tax season deadlines by completing any required tax forms today. Rock hill, sc / accesswire / september 27, 2021 / the third quarter is coming to a close, which means that the deadline to file form. Web starting a new form 941. Complete, edit or print tax forms instantly. This may seem far off, but why wait?

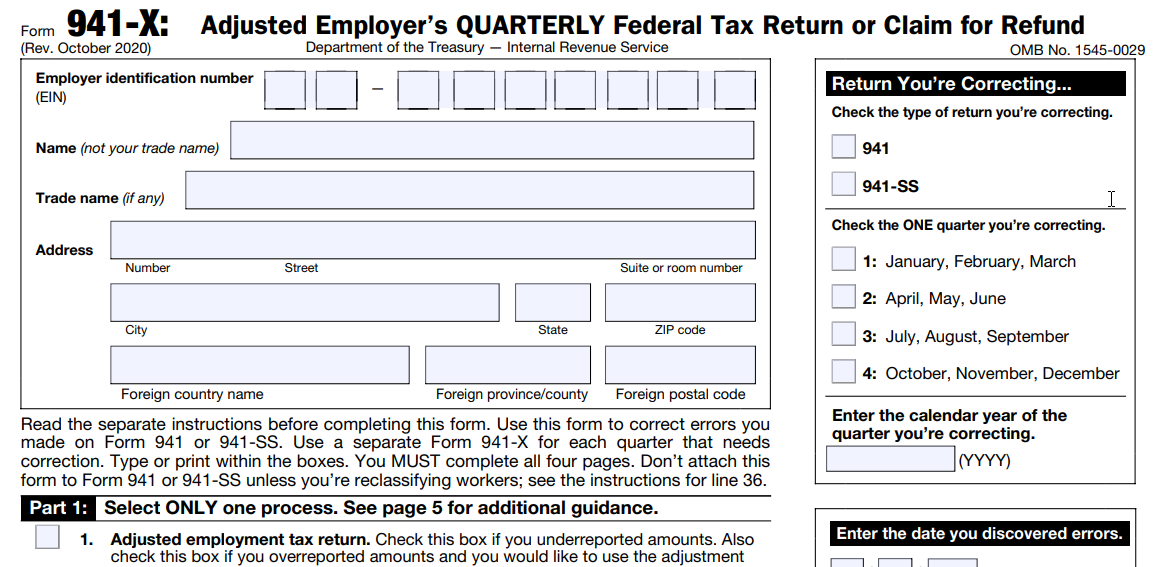

Update Form 941 Changes Regulatory Compliance

Web third quarter of 2020 was $20,000 and you deposited $5,000 of the $20,000 during the third quarter of 2020 and you deferred $15,000 on form 941, line 13b, then you must pay. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Complete, edit or print tax.

Form 941 Efiling Tips for the 2nd Quarter of 2021 Blog

Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web on demand | ceu approved. March 2023) employer’s quarterly federal tax return department of the treasury — internal. This may seem far off, but why wait? Go to the employee menu.

IRS Form 941 Instructions for 2021 How to fill out Form 941

Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Go to the employee menu. Web employers must file their form 941 for the third quarter by november 1, 2021. Web report for this quarter of 2021 (check one.) 1: Here are some of our top tips to.

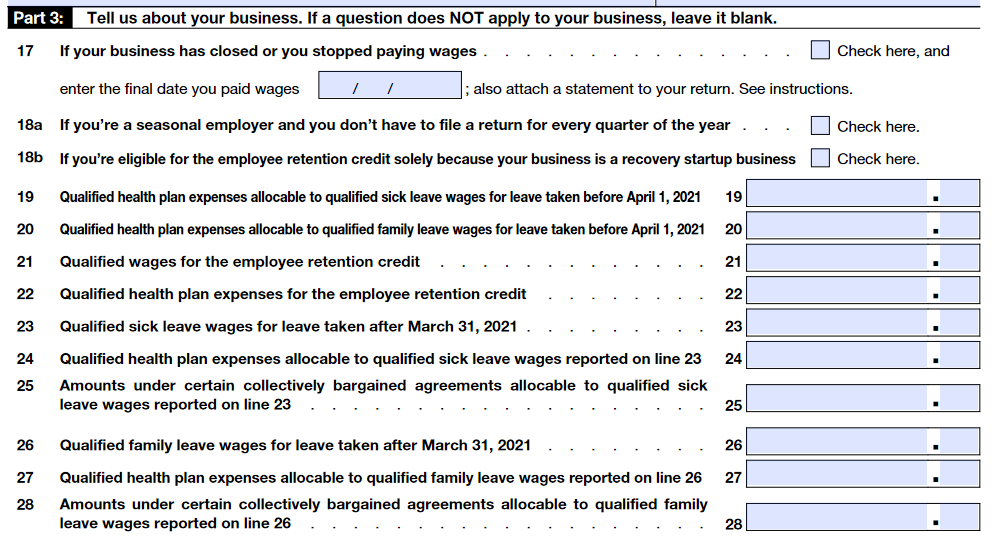

Form 941 Changes for 3rd Quarter 2020

Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Here are some of our top tips to help you master your form 941 this. Web starting a new form 941. This may seem far off, but why wait? Web report for this quarter of 2021 (check one.) 1:

The IRS Released A Draft of Form 941 for Tax Year 2021 Blog TaxBandits

Web a finalized version of the revised form 941 for use in the second through fourth quarters of 2021 was issued june 24 by the internal revenue service. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Get ready.

Expected Changes to Form 941 for the Second Quarter of 2021

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Use the march 2021 revision of form.

Printable 941 Form 2021 Printable Form 2022

The irs expects the june 2021 revision of form 941. Form 941 for the third quarter is now available from taxbandits, giving their clients. Web on demand | ceu approved. Go to the employee menu. Web the deadline for the third quarter is november 1, 2021.

941 Form Fill Out and Sign Printable PDF Template signNow

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. This may seem far off, but why wait? Form 941 reports federal income and fica taxes each. Use the march 2021 revision of form 941 only to report taxes.

Web If You File Those In Quickbooks Desktop, You Can Follow The Steps Below To See Those Federal 941 From The 4Th Quarter Of 2021.

This may seem far off, but why wait? Web the deadline for the third quarter is november 1, 2021. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Web employer’s quarterly federal tax return form 941 for 2023:

Go To The Employee Menu.

Complete, edit or print tax forms instantly. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Form 941 reports federal income and fica taxes each. Web a finalized version of the revised form 941 for use in the second through fourth quarters of 2021 was issued june 24 by the internal revenue service.

Here Are Some Of Our Top Tips To Help You Master Your Form 941 This.

The irs expects the june 2021 revision of form 941. Web on demand | ceu approved. Get ready for tax season deadlines by completing any required tax forms today. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service.

Web “2Nd Quarter 2023,” “3Rd Quarter 2023,” Or “4Th Quarter 2023”) On Your Check Or Money Order.

Web report for this quarter of 2021 (check one.) 1: Once you’ve signed in to taxbandits, select ‘start new’ in the upper right corner: Web the form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third. Form 941 for the third quarter is now available from taxbandits, giving their clients.