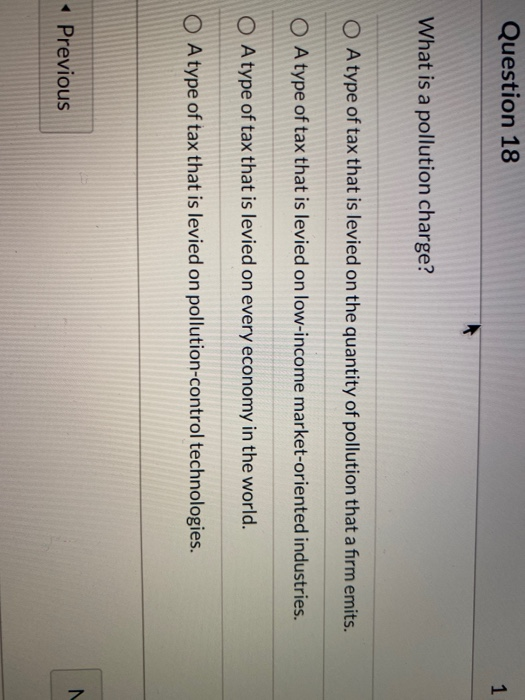

A Pollution Charge Is A Form Of Tax Imposed On

A Pollution Charge Is A Form Of Tax Imposed On - A pollution charge is a form of tax imposed on o a pollution control technologies. Ensure firms have pollution charge credits for all reduced emissions. Web terms in this set (27) _ includes both the private costs incurred by firms and also costs incurred by third parties outside the production process. The objective of imposing a higher pollution tax is to. Product charges, which are based upon the potential pollution of a product; Web an effluent (or pollution) charge is a tax imposed on the quantity of pollution that a firm emits. A tax imposed on the quantity of pollution that a firm emits. Every economy in the world d. Web the main drawback is that fees, charges and taxes cannot guarantee a specific amount of pollution reduction, only that those who pollute will be penalized. The quantity of pollution that a firm emits.

A) a tax imposed on the quant. A pollution charge is a tax imposed on the quantity of pollution that a firm emits. After reading the passage above, tell me one. Web a pollution charge is a form of tax imposed on the quantity of pollution that a firm emits. Ensure firms have pollution charge credits for all reduced emissions. Collected as separate payment or as part of a broader levy, such as a locally defined water use tariff or national energy tax. The quantity of pollution that a firm emits. Web a pollution charge is a form of tax imposed on _____. Web economics questions and answers. Every economy in the world.

Web an effluent (or pollution) charge is a tax imposed on the quantity of pollution that a firm emits. Collected as separate payment or as part of a broader levy, such as a locally defined water use tariff or national energy tax. A pollution charge is a tax imposed on the quantity of pollution that a firm emits. After reading the passage above, tell me one. A pollution charge is a form of tax imposed on every economy in the world. The quantity of pollution that a firm emits. The quantity of pollution that a firm emits. The quantity of pollution that a firm emits. User charges, which are payments for public treatment facilities; Web a pollution charge is a tax imposed on the quantity of pollution that a firm emits.

Solved Question 18 1 What is a pollution charge? O A type of

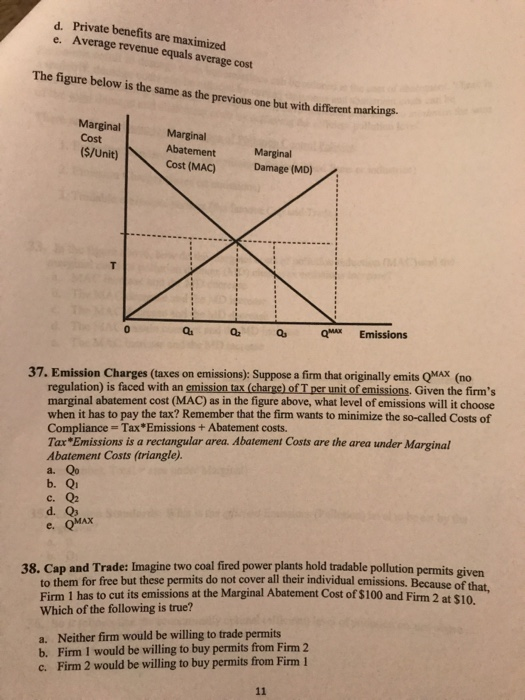

Under an effluent charge system, firms are allowed to pollute, as long as they pay the charge for every unit of pollution. A pollution charge is a tax imposed on the quantity of pollution that a firm emits. A user charge is a fee paid in exchange for the use of natural resources or for the collection or disposal of.

Form L400 Download Fillable PDF or Fill Online Fuel Charge Registration

Effluent charges, based upon the quantity of discharges; Web a pollution charge is a form of tax imposed on _____. Provide incentive for firms to maintain regulation emission levels. The legal rights of ownership on which others are not allowed to infringe without paying compensation. A pollution charge is a tax imposed on the quality of pollution that.

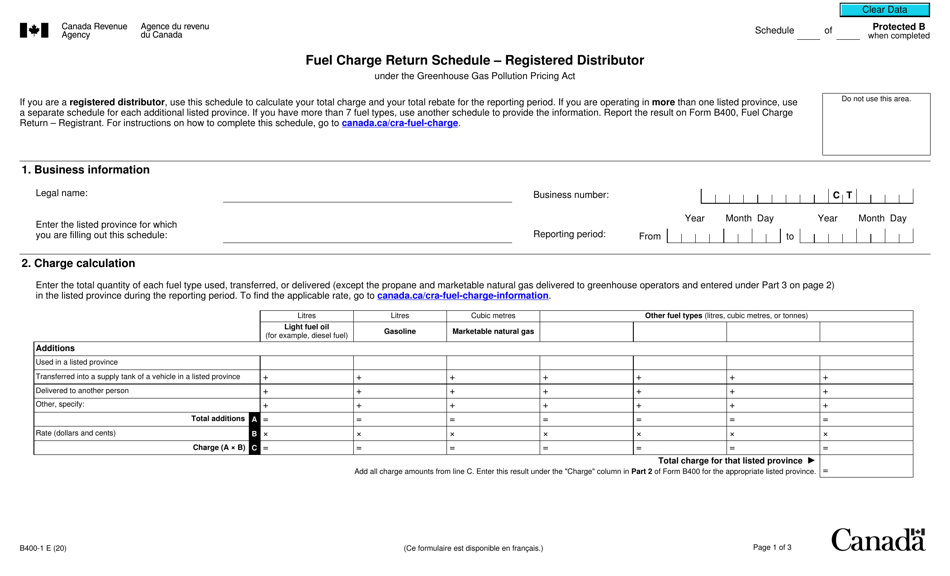

Form B4001 Download Fillable PDF or Fill Online Fuel Charge Return

A pollution charge is a form of tax imposed on every economy in the world. Every economy in the world. Web pollution charges are an instrument for controlling pollution, designed to reflect the financial and economic costs imposed on society and the environment from discharging wastes and pollutants into water bodies. The quantity of pollution that a firm emits. Product.

Solved IV. POLLUTION CONTROL (3339) We did not have time to

Provide incentive for firms to maintain regulation emission levels. Pollution charges can be levied on actual source emissions (direct. Ensure firms have pollution charge credits for all reduced emissions. Every economy in the world. A pollution charge is a tax imposed on the quality of pollution that.

PPT POLLUTION TAX PowerPoint Presentation ID88345

Web a pollution charge is a tax imposed on the quantity of pollution that a firm emits. Every economy in the world d. Collected as separate payment or as part of a broader levy, such as a locally defined water use tariff or national energy tax. Web a pollution charge is a tax imposed on the quantity of pollution that.

ULEZ London gets world's first 24hour air pollution charge zone CNN

A pollution charge is directly related to a firm's pollution levels. Web the main drawback is that fees, charges and taxes cannot guarantee a specific amount of pollution reduction, only that those who pollute will be penalized. Question 20 (1 point) listen what is a pollution charge? A pollution charge is a tax imposed on the quality of pollution that..

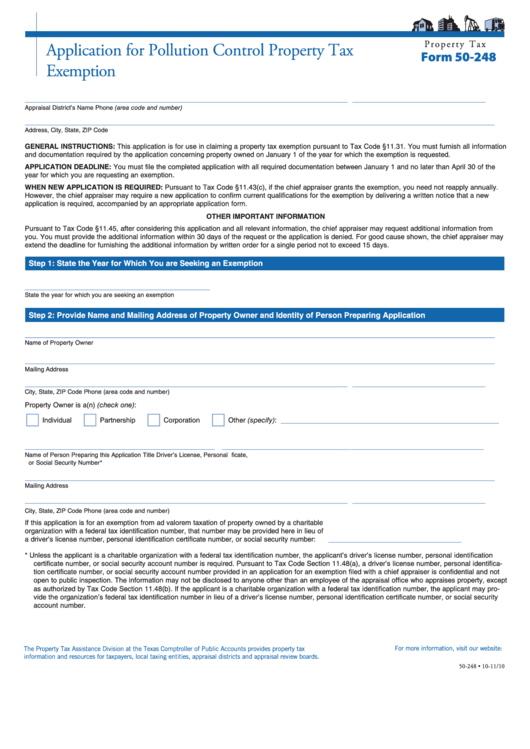

Fillable Form 50248 Application For Pollution Control Property Tax

A pollution charge is a form of tax imposed on every economy in the world. The quantity of pollution that a firm emits. A user charge is a fee paid in exchange for the use of natural resources or for the collection or disposal of pollutants. Web this article examines pollution charges, a set of environmental policy instruments that are.

Pollution charge hits dead end Scotland The Times & The Sunday Times

Web pollution charges are an instrument for controlling pollution, designed to reflect the financial and economic costs imposed on society and the environment from discharging wastes and pollutants into water bodies. A pollution charge is a form of tax imposed on every economy in the world. Every economy in the world. Web economics questions and answers. Effluent charges, based upon.

PPT POLLUTION TAX PowerPoint Presentation, free download ID88345

The quantity of pollution that a firm emits. Web 1 answer 0 watching 234 views periwinkleraccoon781 lv1 11 dec 2019 a pollution charge is a form of tax imposed on a. A pollution charge encourages a firm to reduce its pollution, as long as the cost of reducing pollution is less than the tax. A pollution charge is directly related.

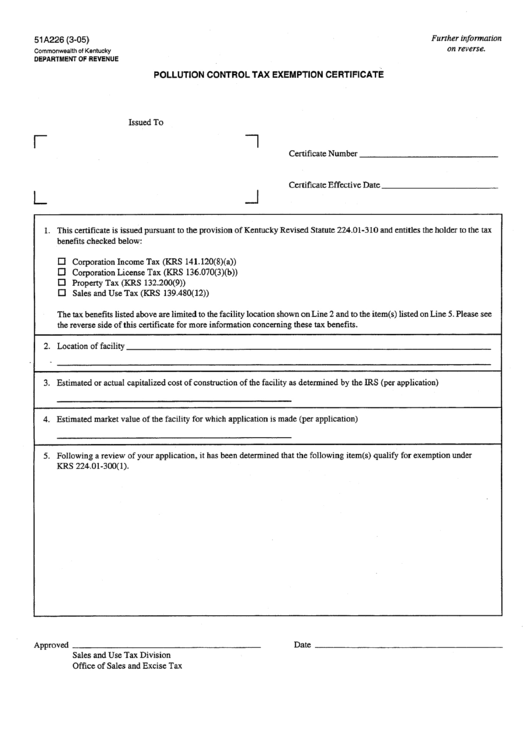

Form 51a226 Pollution Control Tax Exemption Certificate 2005

A pollution charge is directly related to a firm's pollution levels. Effluent charges, based upon the quantity of discharges; Examples include pollution taxes, water user fees, wastewater discharge fees, and solid waste disposal fees. A pollution charge is a tax imposed on the quality of pollution that. Every economy in the world.

Web A Pollution Charge Is A Tax Imposed On The Quantity Of Pollution That A Firm Emits.

Question 20 (1 point) listen what is a pollution charge? The legal rights of ownership on which others are not allowed to infringe without paying compensation. A study by the environmental protection agency looked at the costs and benefits of the clean air act from 1970 to 1990. Web the main drawback is that fees, charges and taxes cannot guarantee a specific amount of pollution reduction, only that those who pollute will be penalized.

Under An Effluent Charge System, Firms Are Allowed To Pollute, As Long As They Pay The Charge For Every Unit Of Pollution.

Web this article examines pollution charges, a set of environmental policy instruments that are receiving increased consideration in discussions of many environmental issues. Examples include pollution taxes, water user fees, wastewater discharge fees, and solid waste disposal fees. The objective of imposing a higher pollution tax is to. Provide adequate incentive for firms to reduce their emissions by more.

The Quantity Of Pollution That A Firm Emits.

A user charge is a fee paid in exchange for the use of natural resources or for the collection or disposal of pollutants. Every economy in the world. A) a tax imposed on the quant. The quantity of pollution that a firm emits.

Product Charges, Which Are Based Upon The Potential Pollution Of A Product;

Every economy in the world. A pollution charge is a form of tax imposed on o a pollution control technologies. They can be levied as a fee for. Web pollution charges are an instrument for controlling pollution, designed to reflect the financial and economic costs imposed on society and the environment from discharging wastes and pollutants into water bodies.