Arizona A-4 Form 2023

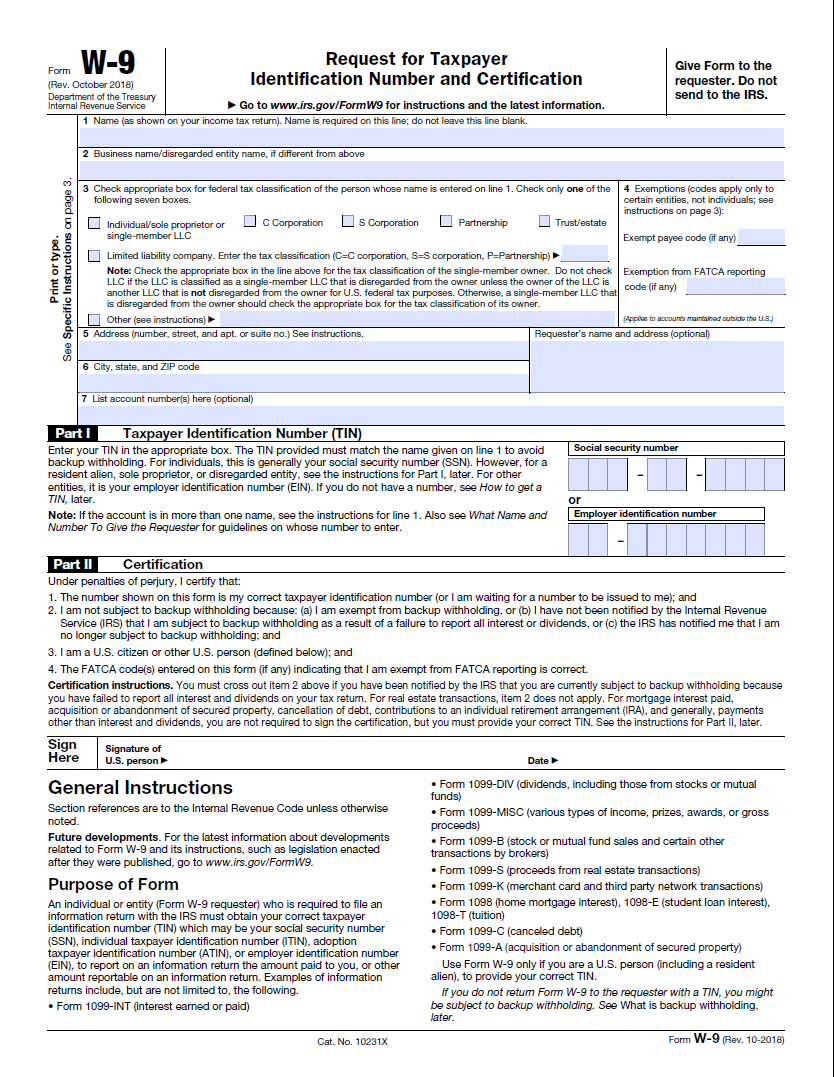

Arizona A-4 Form 2023 - Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Annuitant's request for voluntary arizona income tax. Request for reduced withholding to designate for tax credits. For additional questions not addressed in this document, contact [email protected]. Choose either box 1 or box 2: Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. 1 withhold from gross taxable wages at the percentage checked (check only one.

Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Request for reduced withholding to designate for tax credits. For additional questions not addressed in this document, contact [email protected]. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. 1 withhold from gross taxable wages at the percentage checked (check only one. Annuitant's request for voluntary arizona income tax. Choose either box 1 or box 2: Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding.

1 withhold from gross taxable wages at the percentage checked (check only one. Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Request for reduced withholding to designate for tax credits. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Choose either box 1 or box 2: Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: For additional questions not addressed in this document, contact [email protected].

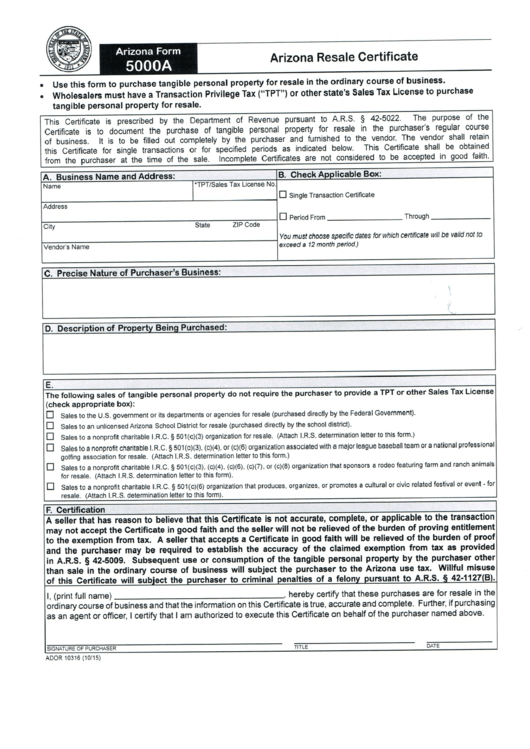

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

Choose either box 1 or box 2: Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Web arizona’s income tax for the year 2023 (filed by april 2024) will.

Arizona Form A4 Effective January 31, 2023 Wallace, Plese + Dreher

Choose either box 1 or box 2: For additional questions not addressed in this document, contact [email protected]. Annuitant's request for voluntary arizona income tax. 1 withhold from gross taxable wages at the percentage checked (check only one. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

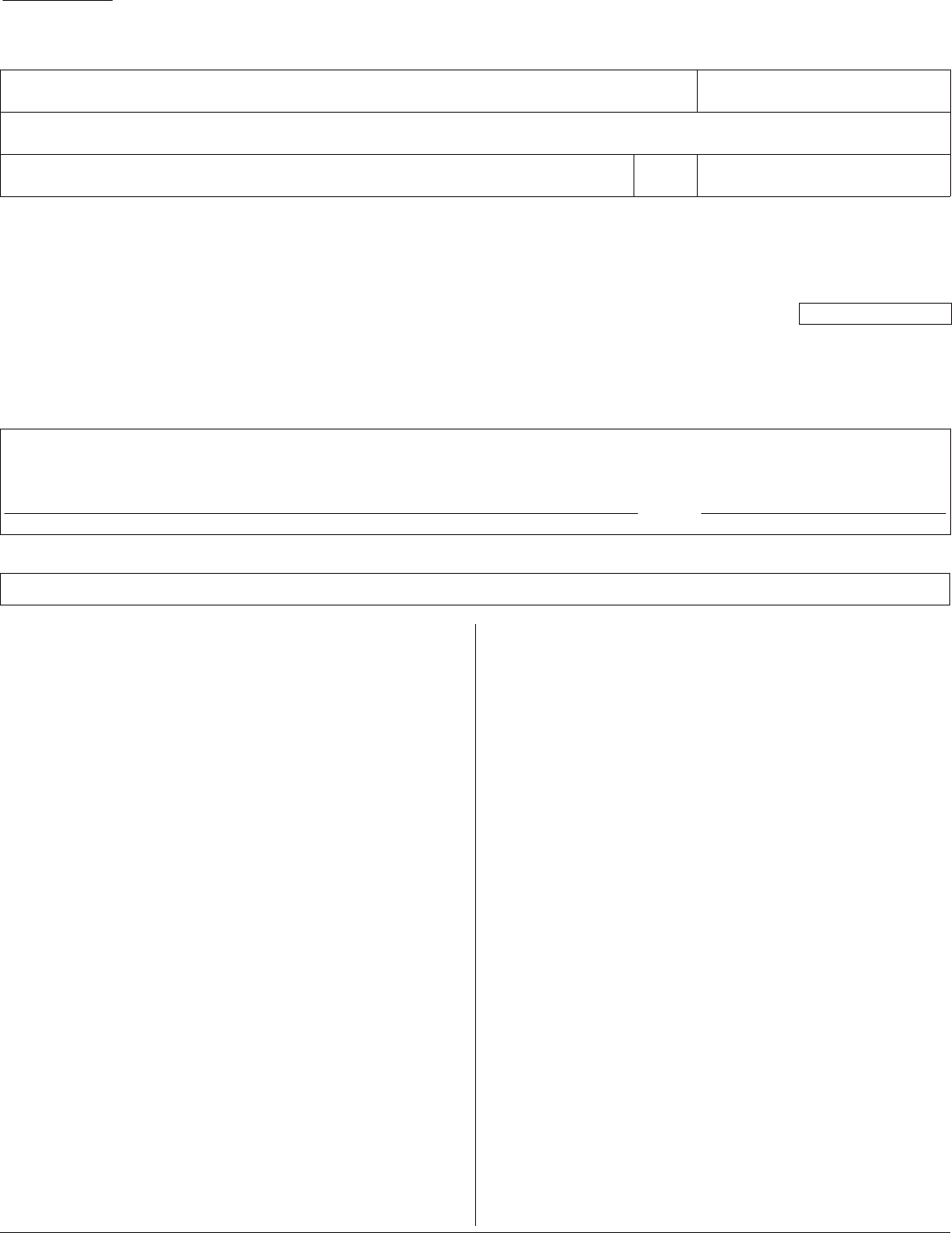

6 Arizona 5000 Forms And Templates free to download in PDF

For additional questions not addressed in this document, contact [email protected]. Choose either box 1 or box 2: Request for reduced withholding to designate for tax credits. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

Download Arizona Form A4 (2013) for Free FormTemplate

Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. For additional questions not addressed in this document, contact [email protected]. Web arizona’s income tax for the year 2023 (filed.

Free Printable 2023 W 4 Form IMAGESEE

Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Annuitant's request for voluntary arizona income tax. 1 withhold from gross taxable wages at the percentage checked (check only one. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web questions.

A4 Form Fill Out and Sign Printable PDF Template signNow

Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: For additional questions not addressed in this document, contact [email protected]. Single filers with a taxable income of up to.

StepbyStep Guide to Forming an LLC in Arizona

Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Request for reduced withholding to designate for tax credits. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. For additional questions not addressed in this document, contact [email protected]..

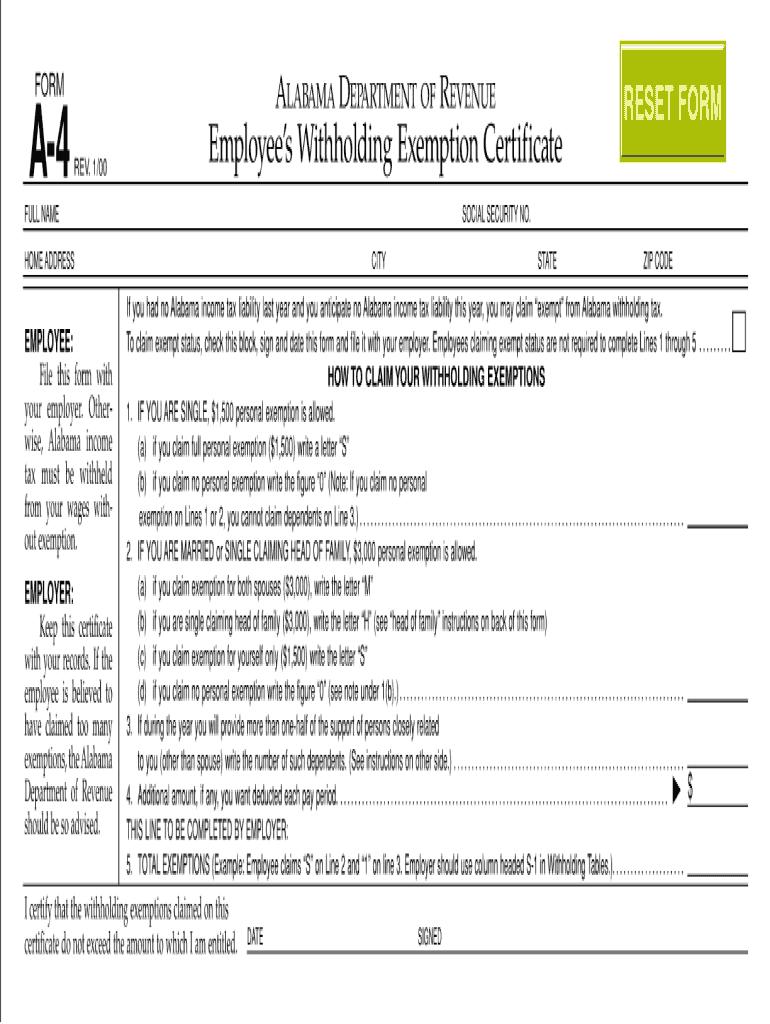

W9 Form 2023 Printable 2023 Payroll Calendar

1 withhold from gross taxable wages at the percentage checked (check only one. For additional questions not addressed in this document, contact [email protected]. Annuitant's request for voluntary arizona income tax. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Request for reduced withholding to designate for tax credits.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

1 withhold from gross taxable wages at the percentage checked (check only one. For additional questions not addressed in this document, contact [email protected]. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Request for reduced withholding to designate for tax credits. Single filers with a taxable income of up to $28,652.

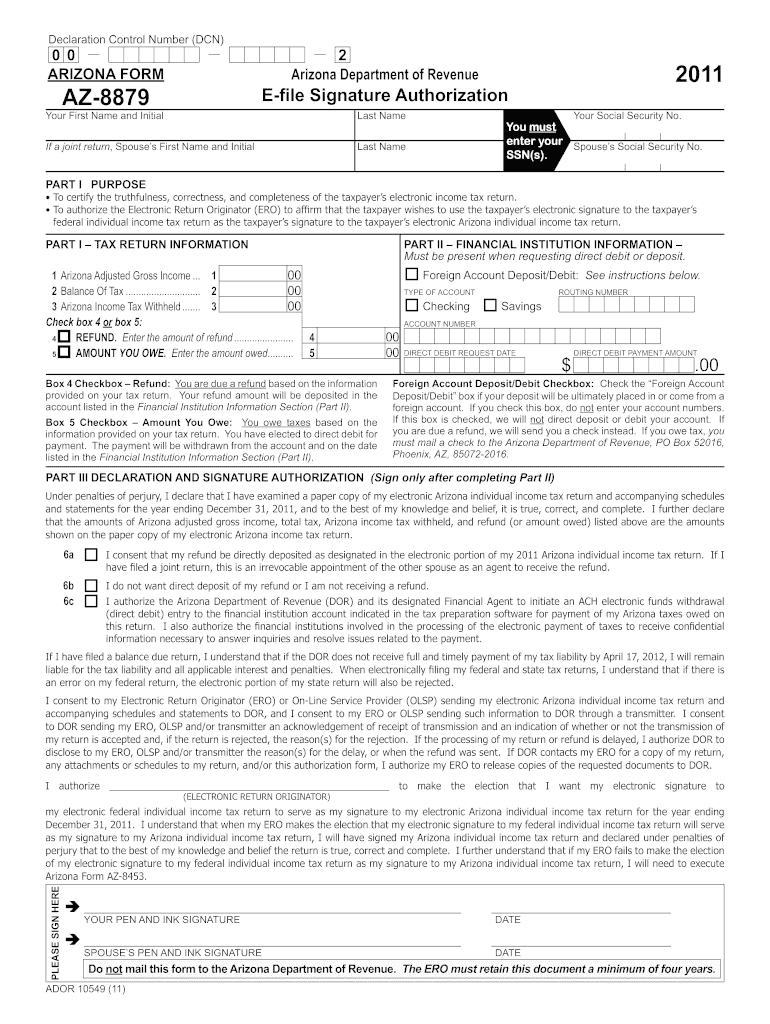

Az8879 Fill Out and Sign Printable PDF Template signNow

Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Choose either box 1 or box 2: Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. 1 withhold from gross taxable wages at the.

Web Arizona’s Income Tax For The Year 2023 (Filed By April 2024) Will Be A Flat Rate Of 2.5% For All Residents.

Annuitant's request for voluntary arizona income tax. Request for reduced withholding to designate for tax credits. Choose either box 1 or box 2: Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

Web Questions And Answers For New Arizona Form A 4 (2023) Changes To Arizona Income Tax Withholding.

For additional questions not addressed in this document, contact [email protected]. 1 withhold from gross taxable wages at the percentage checked (check only one. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%.