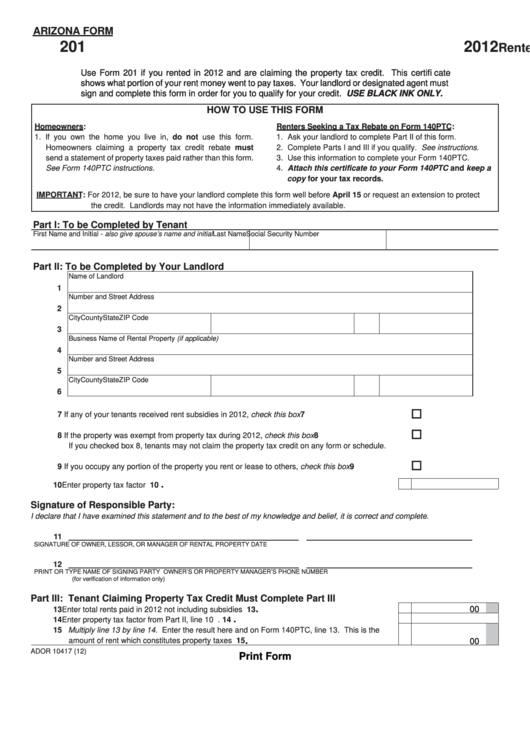

Arizona Form 201

Arizona Form 201 - It is recommended that the user obtain. The use of these forms requires the user to have installed adobe reader, version 8.0 or later. Web 26 rows arizona corporate or partnership income tax payment voucher: Web use form 201 if you rented in 2019 and are claiming the property tax credit. If you are filing a joint claim, enter your ssns in the same. If you own a mobile home but rent the space,. Web 26 rows individual income tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Web online services forms forms please note: When the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the.

The arizona form 201 provides your proof of property taxes paid from your rent. It is recommended that the user obtain. Web use form 201 if you rented in 2019 and are claiming the property tax credit. Web follow the simple instructions below: You must get form 201 from your nursing home administrator. Web online services forms forms please note: Web your landlord must complete and sign the form 201. Web 26 rows arizona corporate or partnership income tax payment voucher: The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Form 201provides your proof of property taxes paid from your rent.

Web use form 201 if you rented in 2019 and are claiming the property tax credit. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Web follow the simple instructions below: It is recommended that the user obtain. Web we last updated arizona form 201 in february 2023 from the arizona department of revenue. Your nursing home administrator must complete. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Web use form 201 if you rented in 2019 and are claiming the property tax credit. If you are filing a joint claim, enter your ssns in the same. This form is for income earned in tax year 2022, with tax returns due in april.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

This certificate shows what portion of your rent money went to pay taxes. If you own a mobile home but. Web use form 201 if you rented in 2015 and are claiming the property tax credit. Web 26 rows individual income tax forms. It is recommended that the user obtain.

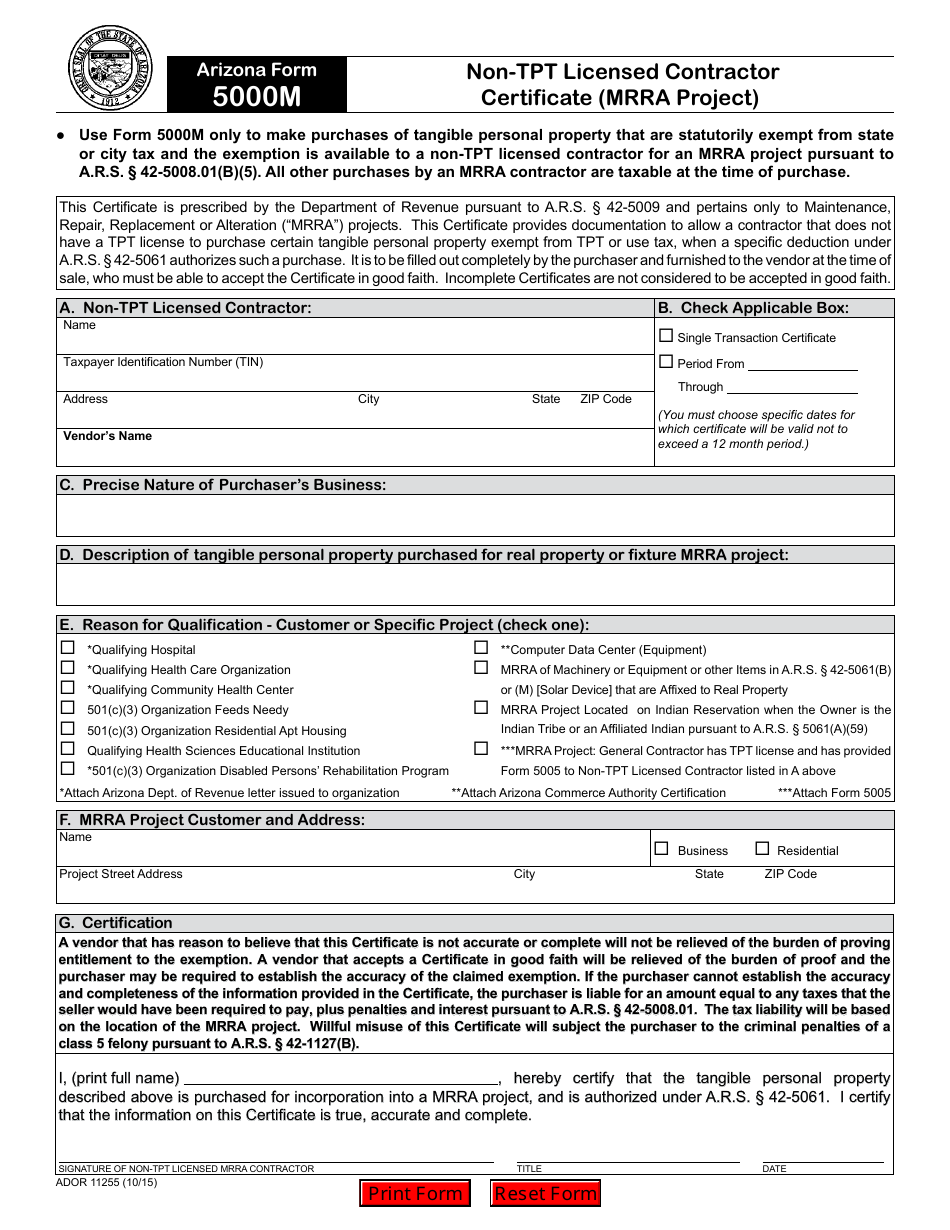

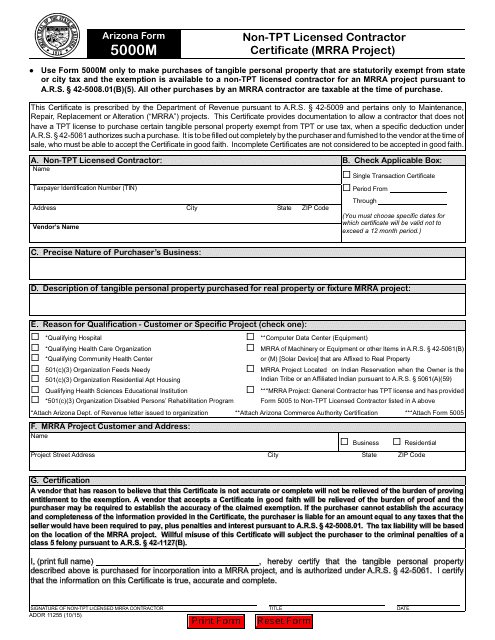

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

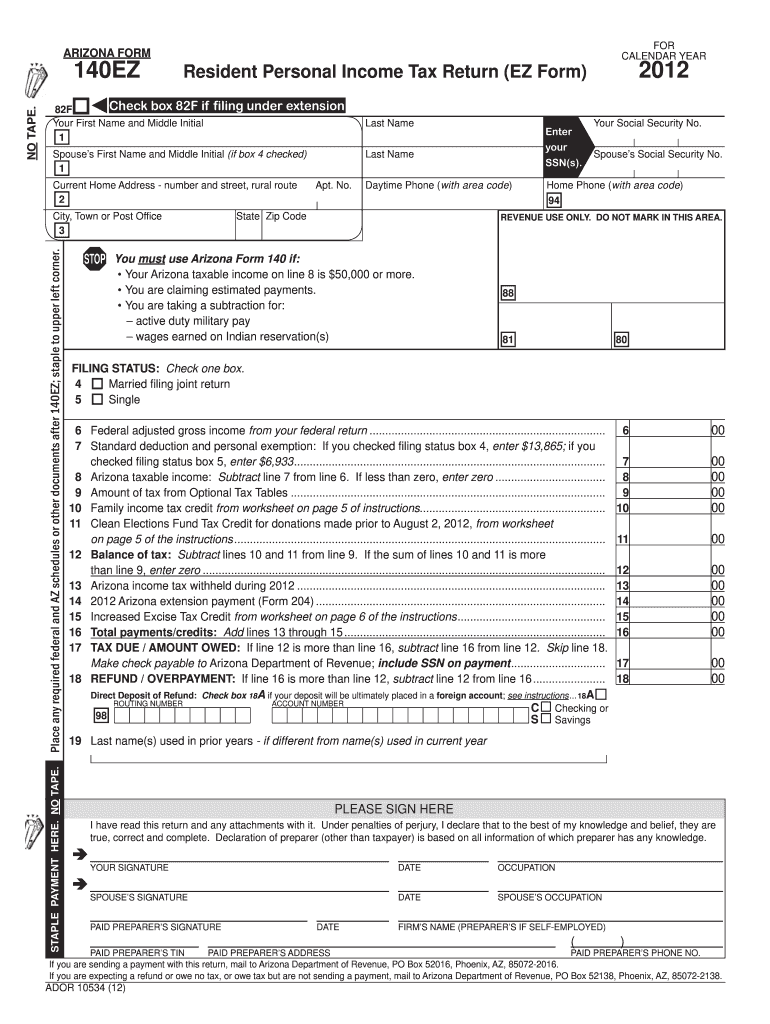

This form is for income earned in tax year 2022, with tax returns due in april. If you are filing a joint claim, enter your ssns in the same. Ad download or email form #201 & more fillable forms, register and subscribe now! Web use form 201 if you rented in 2019 and are claiming the property tax credit. If.

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Web use form 201 if you rented in 2021 and are claiming the property tax credit. The use of these forms requires the user to have installed adobe reader, version 8.0 or later. Web use form 201 if you rented in 2019 and are claiming the property tax credit. If you own a mobile home but. Your nursing home administrator.

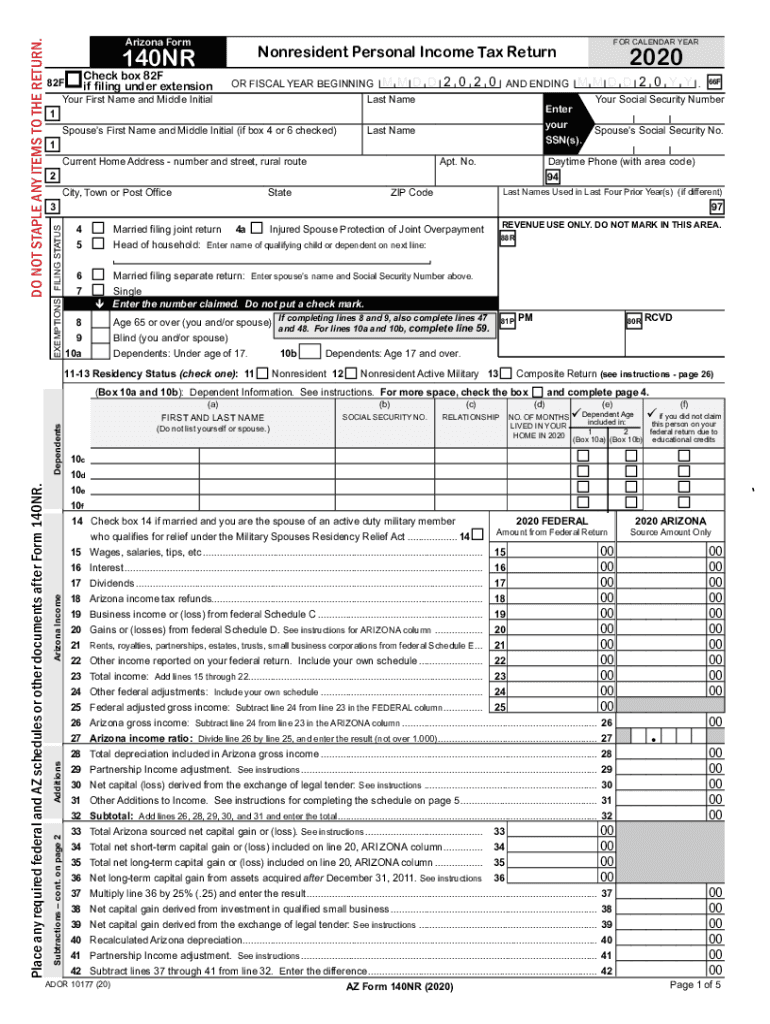

PDF Arizona Form 140NR Arizona Department of Revenue Fill Out and

Form 201provides your proof of property taxes paid from your rent. Choose the document template you will need from our collection of legal form samples. Web 24 rows renter's certificate of property taxes paid form. Include form 201 with your claim. Web 26 rows individual income tax forms.

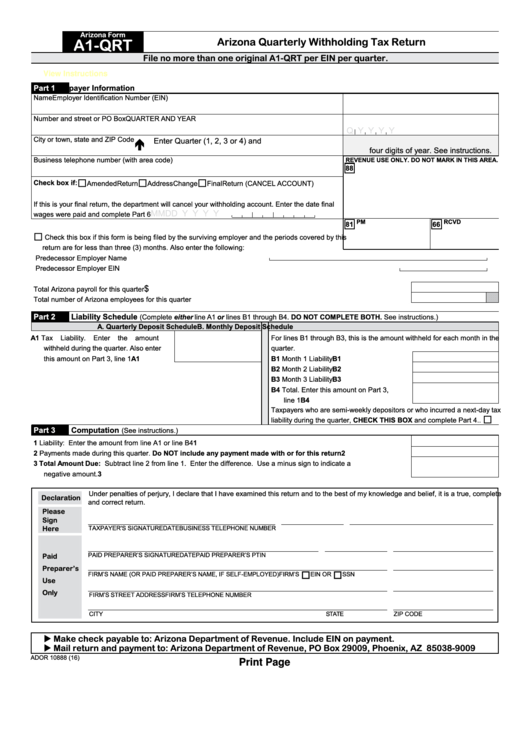

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

Web use form 201 if you rented in 2019 and are claiming the property tax credit. Web online services forms forms please note: This certificate shows what portion of your rent money went to pay taxes. Web 26 rows arizona corporate or partnership income tax payment voucher: You must get form 201 from your nursing home administrator.

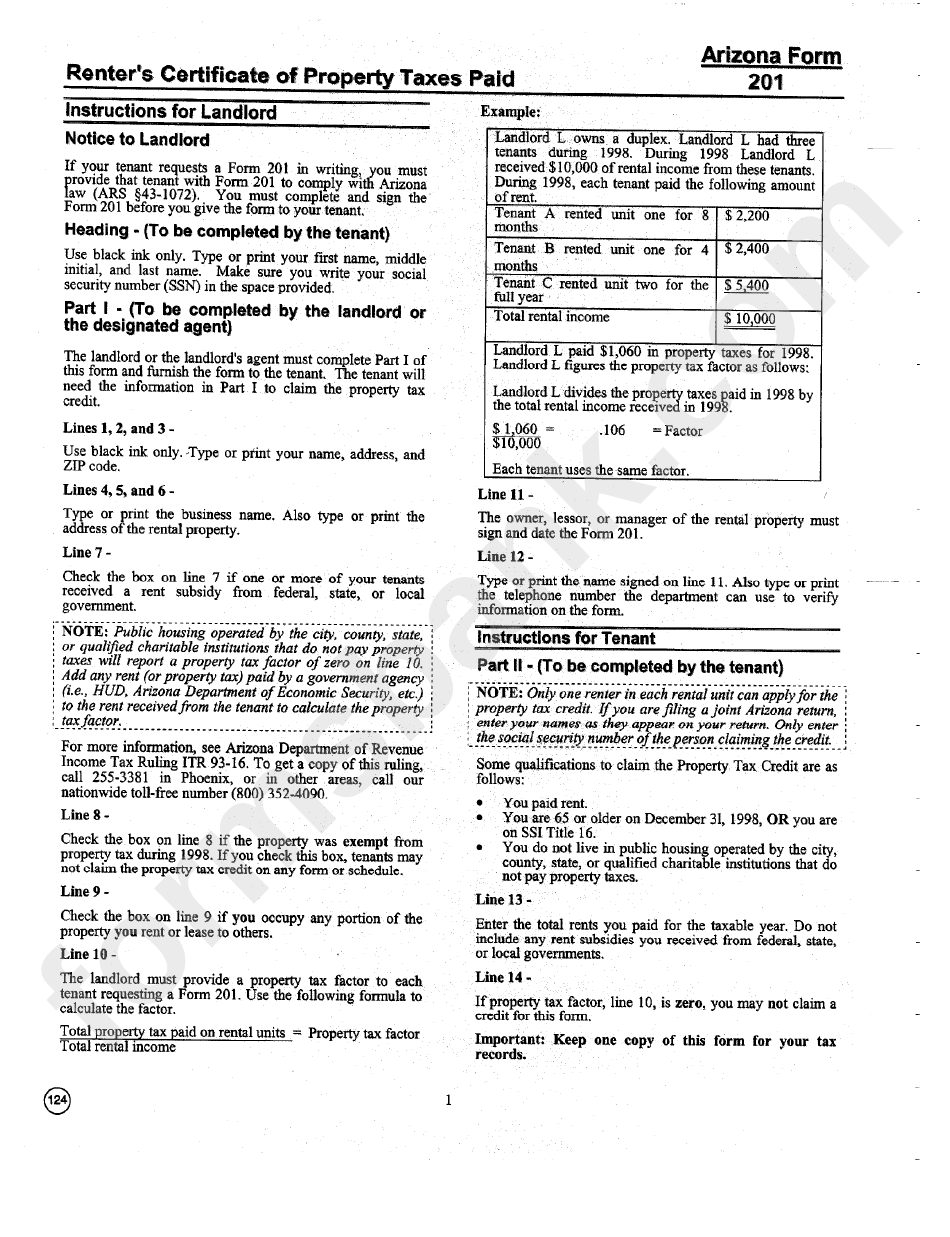

Form 201 Renter'S Certificate Of Property Taxes Paid Instructions

If you own a mobile home but rent the space,. Web 26 rows individual income tax forms. This certificate shows what portion of your rent money went to pay taxes. Choose the document template you will need from our collection of legal form samples. Web use form 201 if you rented in 2021 and are claiming the property tax credit.

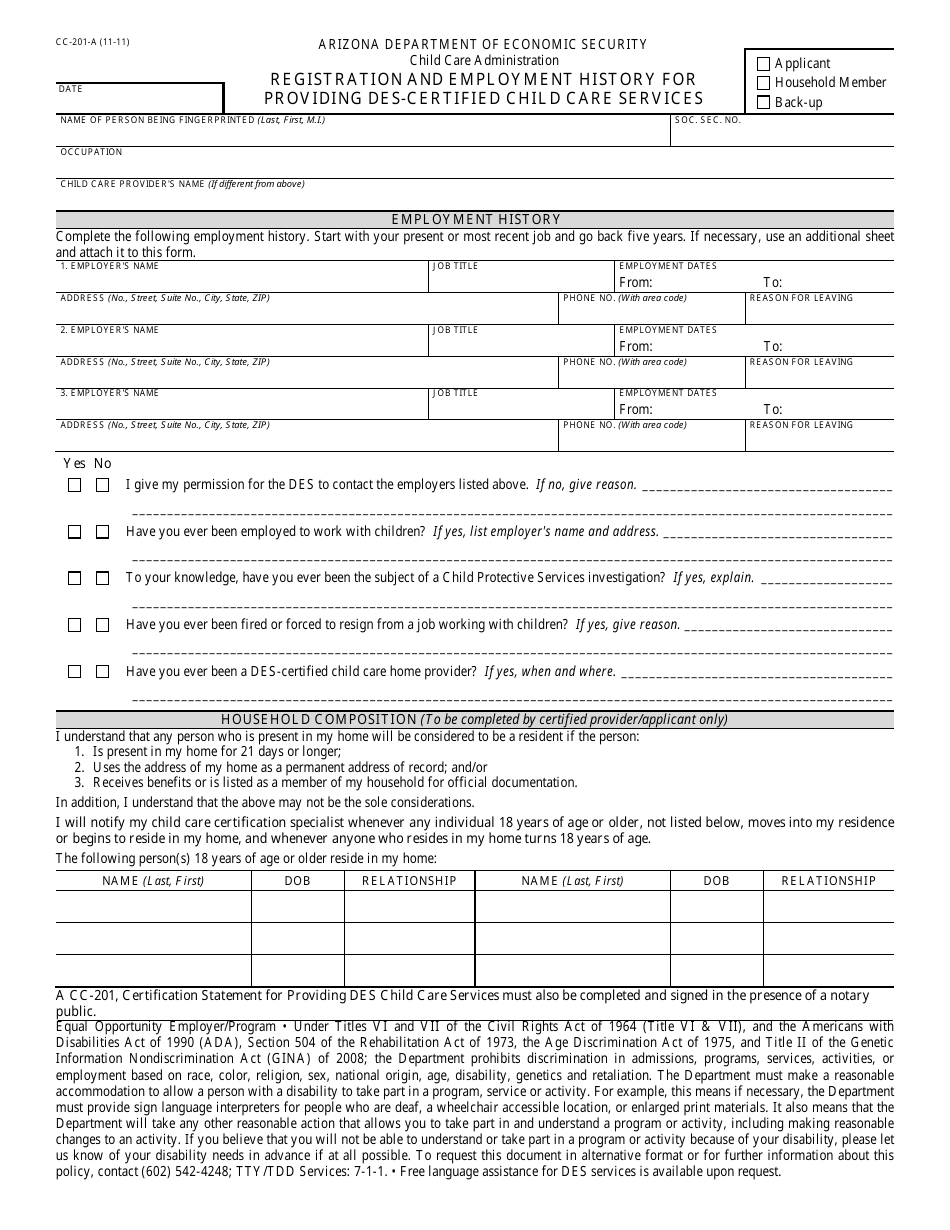

Form CC201A Download Printable PDF or Fill Online Registration

The use of these forms requires the user to have installed adobe reader, version 8.0 or later. When the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the. Choose the document template you will need from our collection of legal form samples. If you own a mobile home but rent.

Arizona Form Fill Out and Sign Printable PDF Template signNow

Ad download or email form #201 & more fillable forms, register and subscribe now! When the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the. Web 26 rows arizona corporate or partnership income tax payment voucher: This certificate shows what portion of your rent money went to pay taxes. Web.

Fillable Arizona Form 201 Renter'S Certificate Of Property Taxes Paid

Form 201provides your proof of property taxes paid from your rent. Choose the document template you will need from our collection of legal form samples. You must get form 201 from your nursing home administrator. Web follow the simple instructions below: If you own a mobile home but rent the space, complete the form 140ptc as a renter.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Web 26 rows arizona corporate or partnership income tax payment voucher: If you own a mobile home but rent the space,. This certificate shows what portion of your rent money went to pay taxes. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Web 26 rows individual income tax.

The Arizona Department Of Revenue Will Follow The Internal Revenue Service (Irs) Announcement Regarding The Start Of The 2022 Electronic.

Web 26 rows arizona corporate or partnership income tax payment voucher: Web use form 201 if you rented in 2019 and are claiming the property tax credit. Form 201provides your proof of property taxes paid from your rent. This certificate shows what portion of your rent money went to pay taxes.

If You Own A Mobile Home But Rent The Space, Complete The Form 140Ptc As A Renter.

Web use form 201 if you rented in 2015 and are claiming the property tax credit. Your nursing home administrator must complete. Include form 201 with your claim. The use of these forms requires the user to have installed adobe reader, version 8.0 or later.

This Certificate Shows What Portion Of Your Rent Money Went To Pay Taxes.

Web your landlord must complete and sign the form 201. When the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the. Web 24 rows renter's certificate of property taxes paid form. Form 201provides your proof of property taxes paid from your rent.

If You Are Filing A Joint Claim, Enter Your Ssns In The Same.

Choose the document template you will need from our collection of legal form samples. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Web use form 201 if you rented in 2019 and are claiming the property tax credit. If you own a mobile home but.