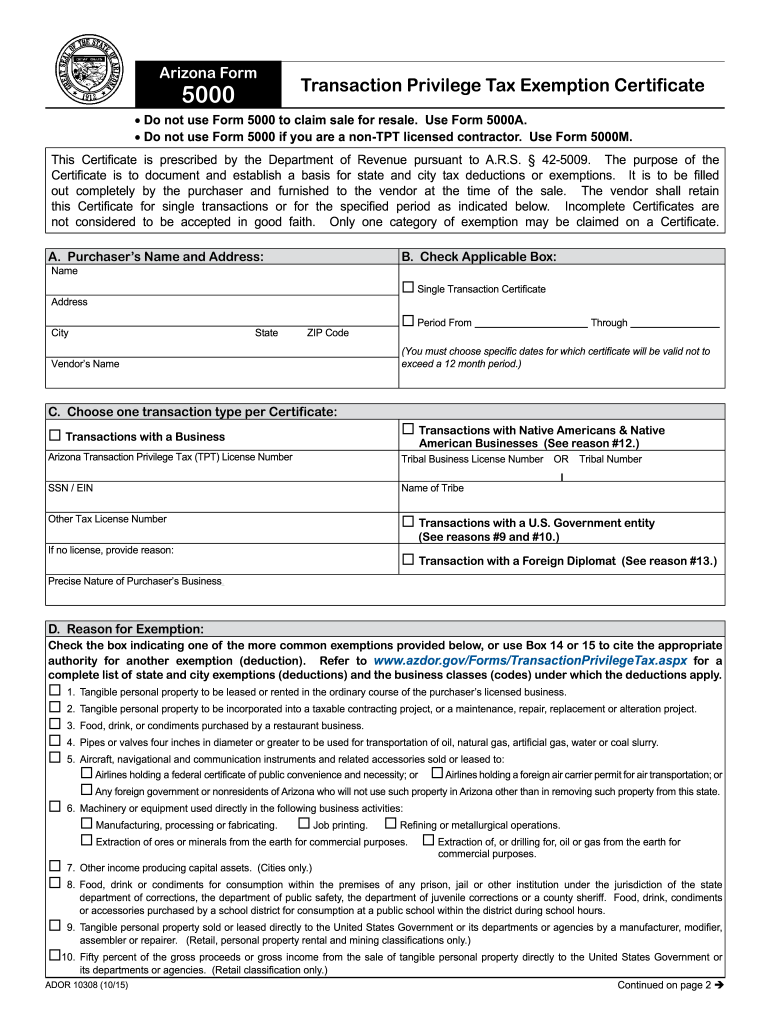

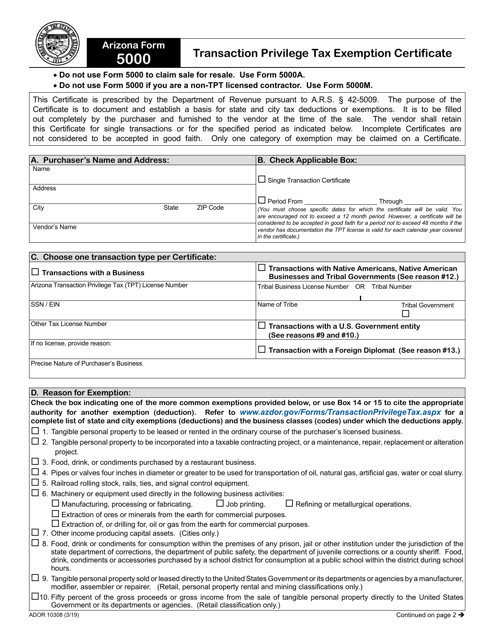

Arizona Form 5000

Arizona Form 5000 - Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. Web learn how to issue and use arizona resale certificates in 3 easy steps. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web arizona form 5000 this form replaces earlier forms: This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected.

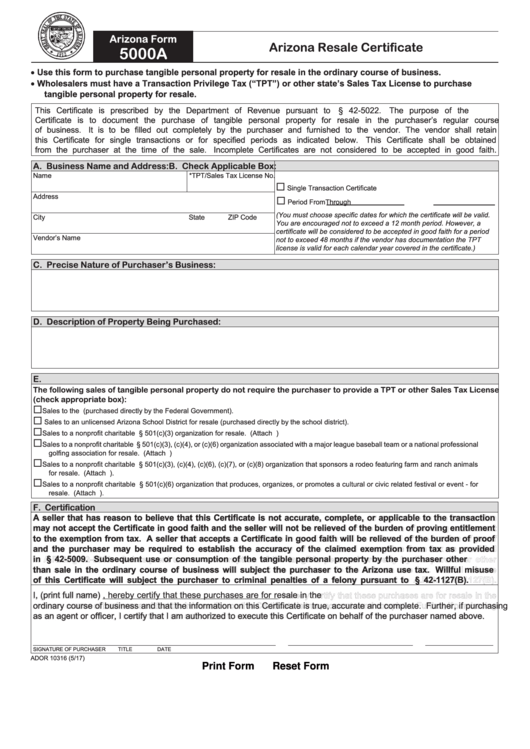

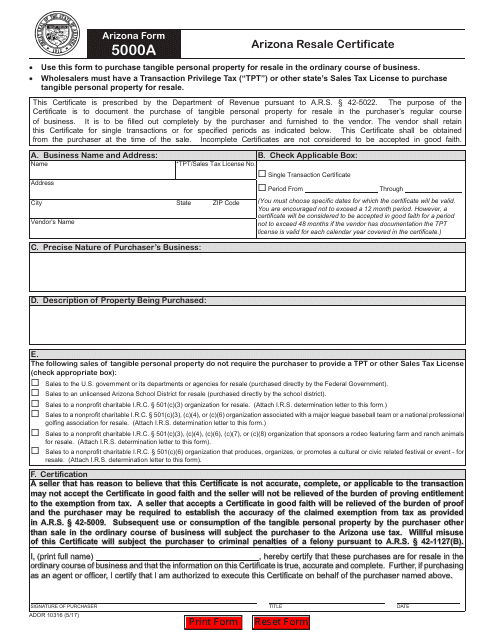

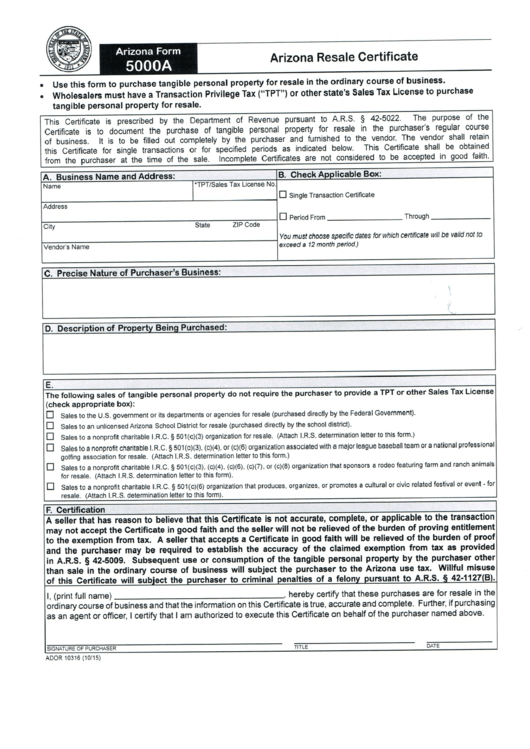

Web arizona form 5000 this form replaces earlier forms: This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web learn how to issue and use arizona resale certificates in 3 easy steps. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. It is to be fi lled out completely by the purchaser and furnished to the vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web arizona form 5000 this form replaces earlier forms: The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. This certificate is prescribed by the department of revenue pursuant to a.r.s.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

This certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web arizona form 5000 this form replaces earlier forms: Web learn how to issue and use arizona.

Fillable Form 5000a Arizona Resale Certificate printable pdf download

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. It is to be fi lled out completely by the purchaser and furnished to the vendor. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Access an online guide in order to download a form az 5000 exemption.

6 Arizona 5000 Forms And Templates free to download in PDF

Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Web learn how to issue and use arizona resale.

Arizona Form 5000A (ADOR10316) Download Fillable PDF or Fill Online

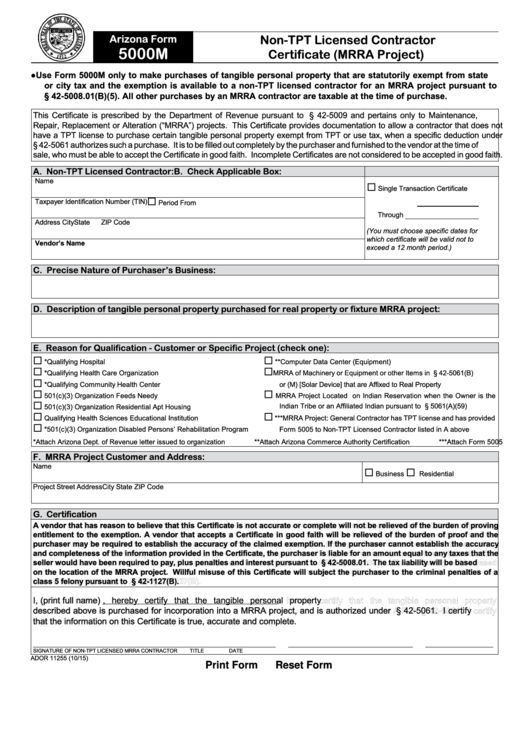

Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. Access an online guide in order to download a form az 5000 exemption license. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale..

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web 5000aarizona resale certificate use.

Arizona Form 5000 (ADOR10308) Fill Out, Sign Online and Download

It is to be fi lled out completely by the purchaser and furnished to the vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate must be provided to the vendor.

Fill Free fillable forms Arizona Department of Real Estate

The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of.

Free Arizona Boat Bill of Sale Form 678 Form PDF Word (.doc)

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. Purchase exempt materials.

6 Arizona 5000 Forms And Templates free to download in PDF

This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. This certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Transaction privilege.

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web learn how to issue and use arizona resale certificates in 3 easy steps. Purchase exempt.

Web Arizona Form 5000 Is Used To Claim Arizona Tpt (Sales Tax) Exemptions From A Vendor.

Web learn how to issue and use arizona resale certificates in 3 easy steps. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. It is to be fi lled out completely by the purchaser and furnished to the vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s.

Web 5000 Transaction Privilege Tax Exemption Certificate Do Not Use Form 5000 To Claim Sale For Resale.

This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Access an online guide in order to download a form az 5000 exemption license. Web arizona form 5000 this form replaces earlier forms:

This Certificate Is Prescribed By The Department Of Revenue Pursuant To A.r.s.

Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to.

Purchase Exempt Materials At Retail For Mrra Projects When The Materials Are Exempt By Statute.

Transaction privilege tax aircraft exemption certificate: Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.