Arizona State Tax Form 140

Arizona State Tax Form 140 - Your arizona taxable income is $50,000 or more, regardless of filing status; Web arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0 2 1and ending m m d d 2 0 y y. Estimated payments fields marked with * are required. Web 2013 arizona form 140ptc. Payment for unpaid income tax small business payment type options include: Web we last updated the individual amended return in february 2023, so this is the latest version of form 140x, fully updated for tax year 2022. Web individual payment type options include: This form is used by residents who file an individual income tax return. Here are links to common arizona tax forms for individual filers, along with instructions: Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year (2020) or prior tax year (2019).

Web individual income tax forms. Form 140a arizona resident personal income tax booklet. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Your arizona taxable income is $50,000 or more, regardless of filing status. Here are links to common arizona tax forms for individual filers, along with instructions: Web personal income tax return filed by resident taxpayers. Payment for unpaid income tax small business payment type options include: Easily fill out pdf blank, edit, and sign them. You may use form 140ez if all of the following apply: Web show sources > about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

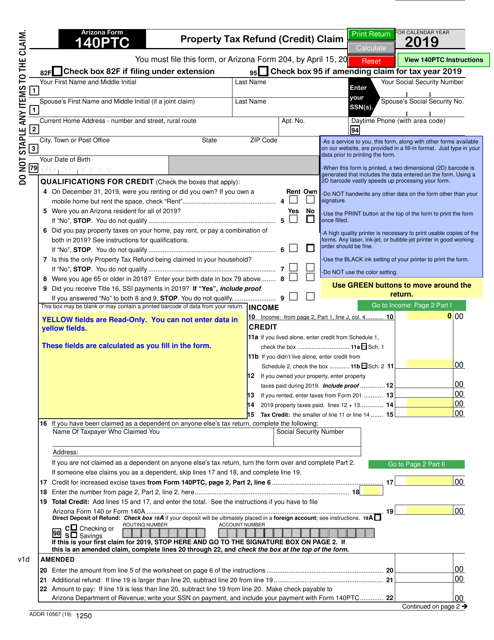

Web show sources > about the individual income tax the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Easily fill out pdf blank, edit, and sign them. You can print other arizona tax forms here. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll) taxes state tax forms other tax forms. Payment for unpaid income tax small business payment type options include: You are single, or if married, you and your spouse are filing a joint return. Your taxable income is less than $50,000 regardless of your filing status. Web individual income tax forms. You are making adjustments to income On the form 140, locate the section for the arizona property tax refund, which is labeled as form 140ptc.

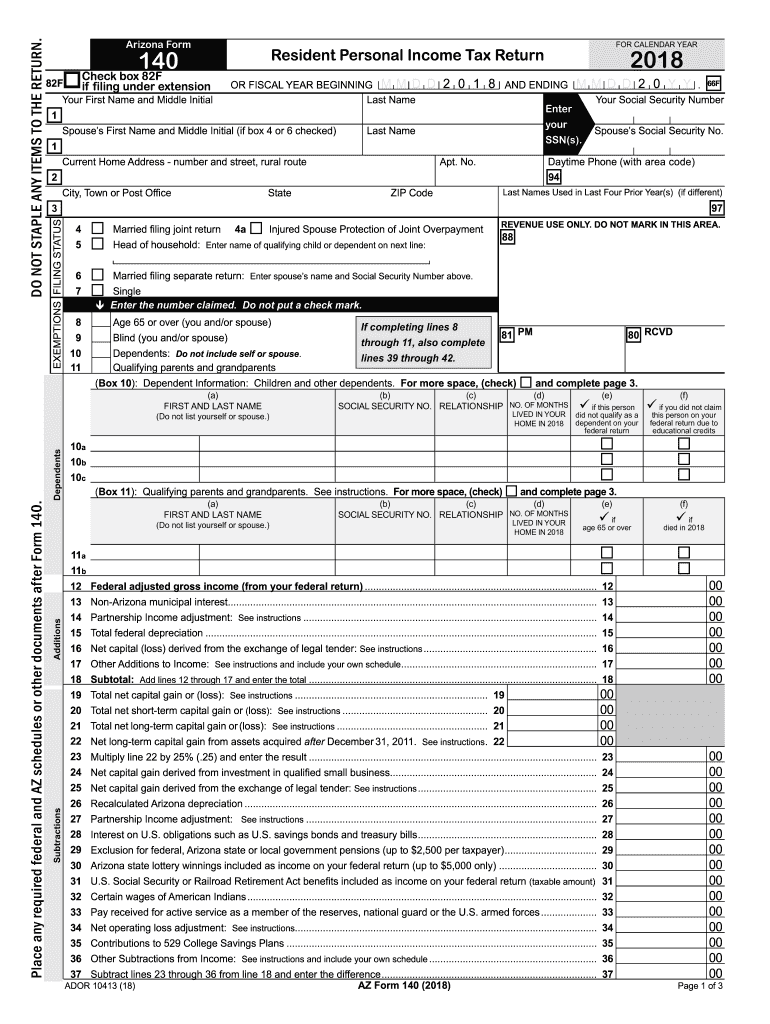

2018 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web individual payment type options include: All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll) taxes state tax forms other tax forms. Web 2013 arizona form 140ptc.

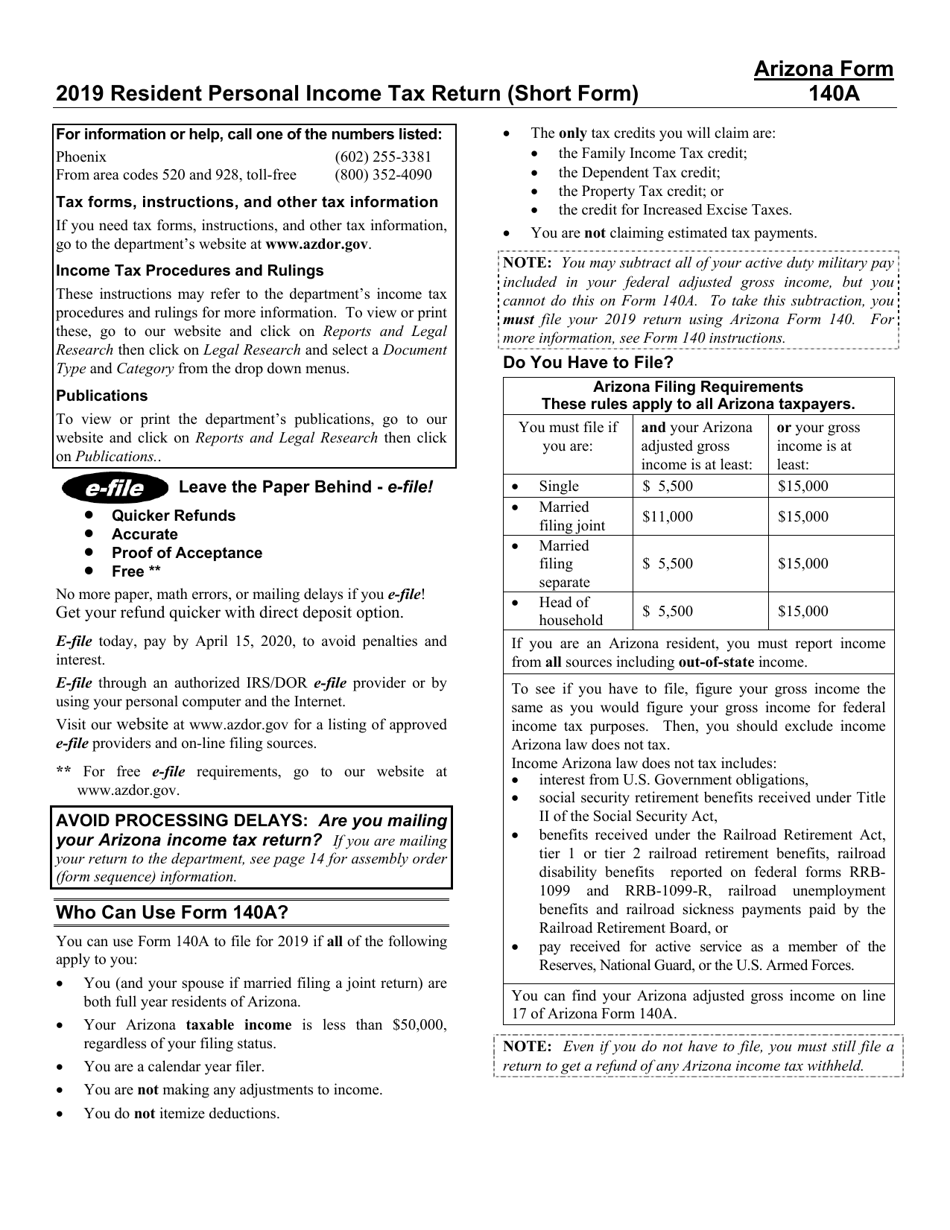

Download Instructions for Arizona Form 140A, ADOR10414 Resident

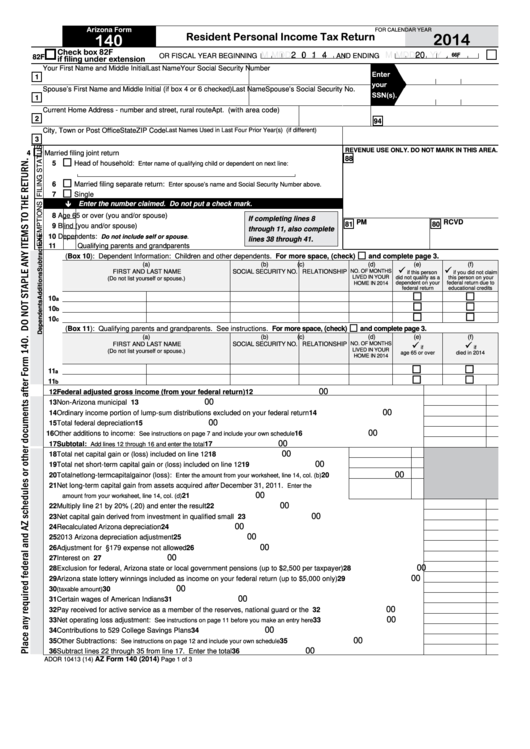

Web arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0 2 1and ending m m d d 2 0 y y. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the individual amended return in february.

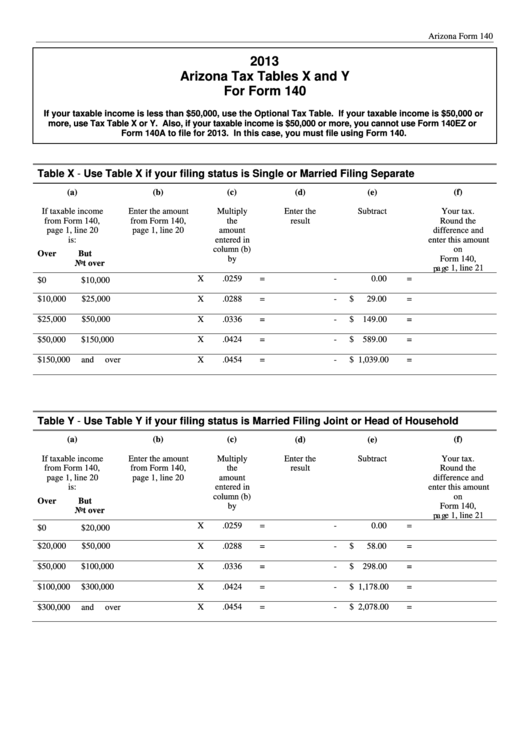

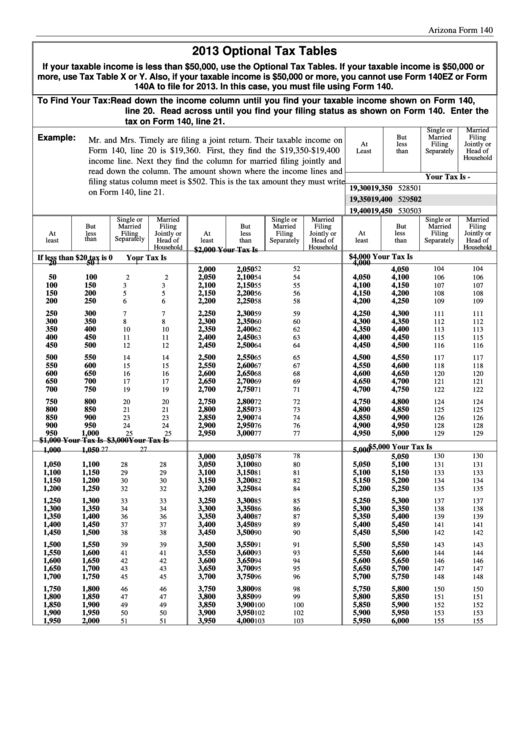

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

You must use form 140 rather than form 140a or form 140ez to file for 2020 if any of the following apply to you. Your arizona taxable income is $50,000 or more, regardless of filing status; •our arizona taxable income is y $50,000 or more You may file form 140 only if you (and your spouse, if married filing a.

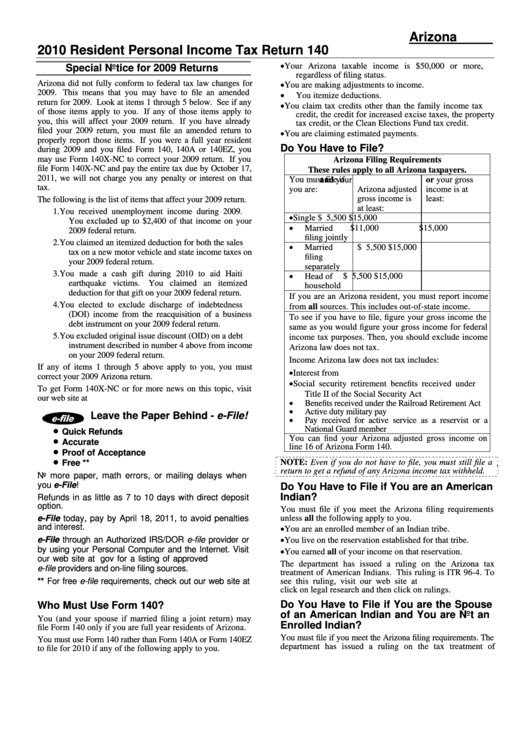

Arizona Form 140 Resident Personal Tax Return 2010 printable

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. This form is used by residents who file an individual income tax return. Web individual payment type options include: Rates, who pays you don’t necessarily have to live in arizona to pay. You are making adjustments to.

Arizona Form 140 Optional Tax Tables 2013 printable pdf download

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0 2 1and ending m m d d 2 0 y y. This form should be completed after filing your federal taxes,.

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

•our arizona taxable income is y $50,000 or more Web individual payment type options include: You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Arizona also provides two additional forms taxpayers can use to file state tax returns: Web individual income tax forms.

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Individual estimated tax payment booklet: •our arizona taxable income is y $50,000 or more You can print other arizona tax forms here. You are single, or if married, you and your spouse are filing a joint return. We last updated arizona form 140 in february 2023 from the arizona department of revenue.

Fillable Arizona Form 140 Resident Personal Tax Return 2014

Web individual payment type options include: Web personal income tax return filed by resident taxpayers. This form should be completed after filing your federal taxes, using form 1040. Your taxable income is less than $50,000 regardless of your filing status. This form is for income earned in tax year 2022, with tax returns due in april 2023.

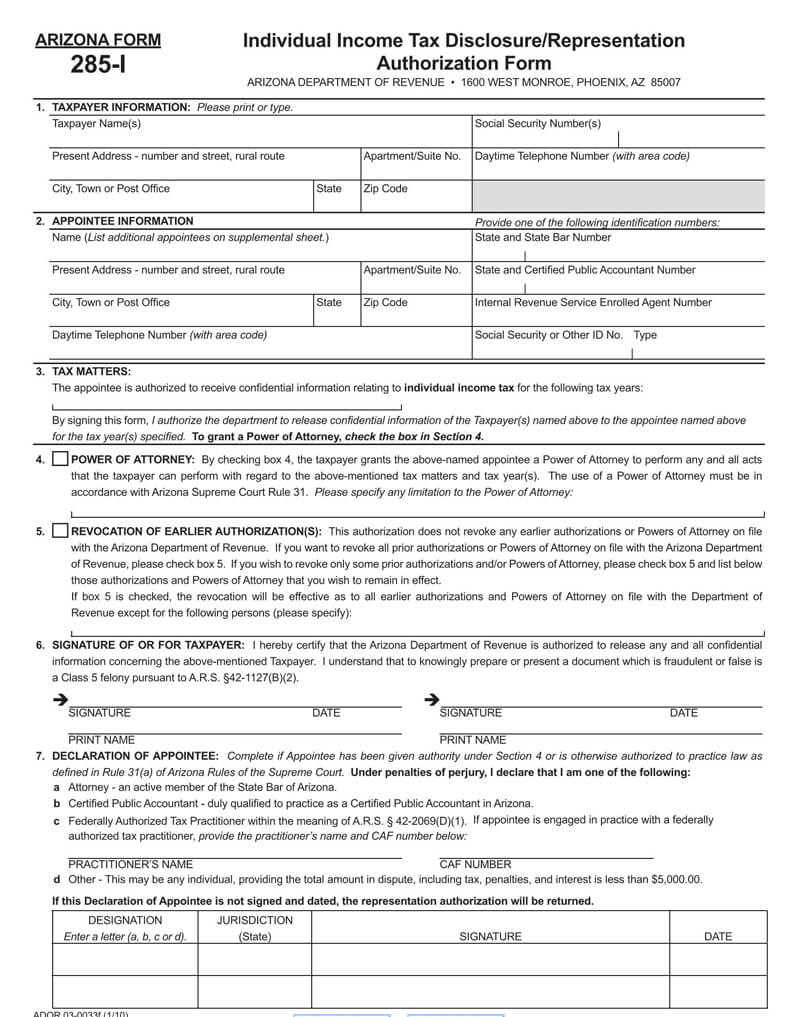

Free State Tax Power of Attorney Forms (by State) WordPDF

Your arizona taxable income is $50,000 or more, regardless of filing status; •our arizona taxable income is y $50,000 or more Web individual income tax forms. Begin by gathering all necessary documentation, such as your arizona resident tax return form, form 140, and any applicable supporting documents. We last updated arizona form 140 in february 2023 from the arizona department.

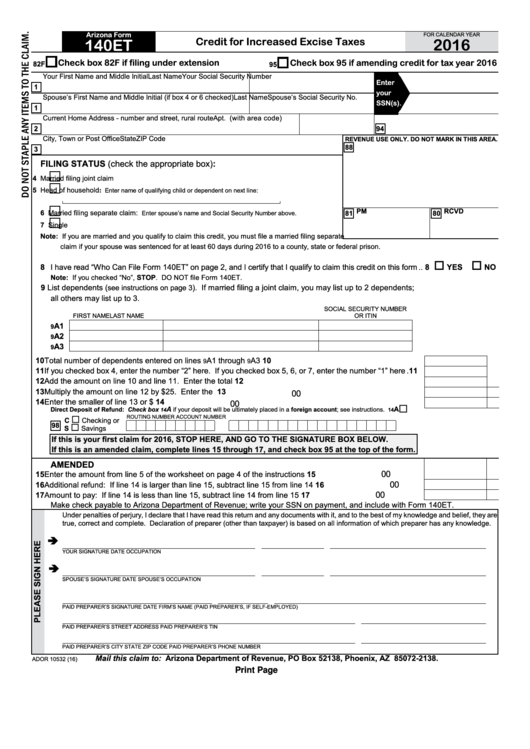

Fillable Arizona Form 140et Credit For Increased Excise Taxes 2016

Web who can use arizona form 140? Estimated payments fields marked with * are required. Arizona also provides two additional forms taxpayers can use to file state tax returns: •our arizona taxable income is y $50,000 or more Rates, who pays you don’t necessarily have to live in arizona to pay.

Web Individual Payment Type Options Include:

You can print other arizona tax forms here. All arizona taxpayers must file a form 140 with the arizona department of revenue. This form is used by residents who file an individual income tax return. Payment for unpaid income tax small business payment type options include:

We Last Updated Arizona Form 140 In February 2023 From The Arizona Department Of Revenue.

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Easily fill out pdf blank, edit, and sign them. Web we last updated the individual amended return in february 2023, so this is the latest version of form 140x, fully updated for tax year 2022. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona.

Web Who Can Use Arizona Form 140?

Form 140ez (easy form), and form 140a (short form). You are single, or if married, you and your spouse are filing a joint return. Web individual income tax forms. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022.

All Forms Individual Forms Information Returns Fiduciary Reporting Entity Returns Transfer Taxes Employment (Payroll) Taxes State Tax Forms Other Tax Forms.

Individual estimated tax payment booklet: •our arizona taxable income is y $50,000 or more You are making adjustments to income You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.