Arkansas Tax Exempt Form

Arkansas Tax Exempt Form - Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Ar4mec military employee’s withholding exemption certificate: Grain drying and storage exemption | et1401: [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Web file this form with your employer to exempt your earnings from state income tax withholding. File this form with your employer. If any of these links are broken, or you can't find the form you need, please let us know. Contractor tax rate change rebate supplemental form: Military spouses residency relief act information. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year.

Am married filing jointly with my spouse. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Military spouses residency relief act information. Ar4ecsp employee's special withholding exemption certificate: Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. We have one or no dependent, and [ Web file this form with your employer to exempt your earnings from state income tax withholding. Web ar4ec employee's withholding exemption certificate: Ar4ext application for automatic extension of time: File this form with your employer.

Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Ar4ext application for automatic extension of time: Web ar4ec employee's withholding exemption certificate: To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Ar4ecsp employee's special withholding exemption certificate: Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year. Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. Other decreases in exemptions or dependents, such as the death Ar4mec military employee’s withholding exemption certificate: Ar4p employee's withholding certificate for pensions and.

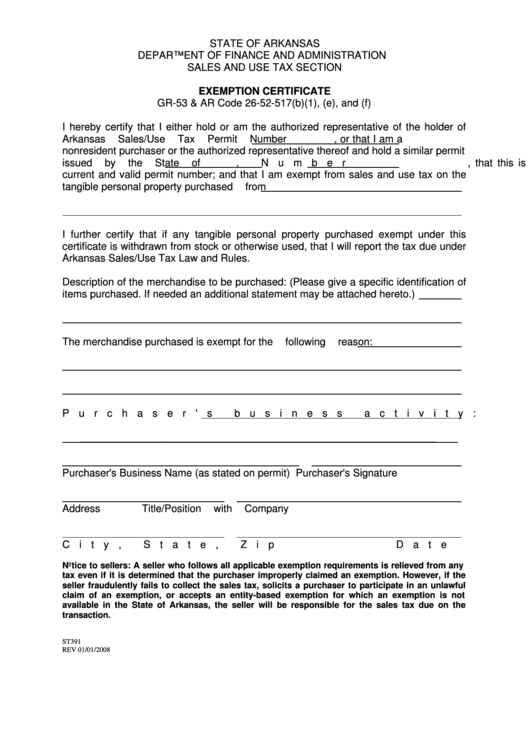

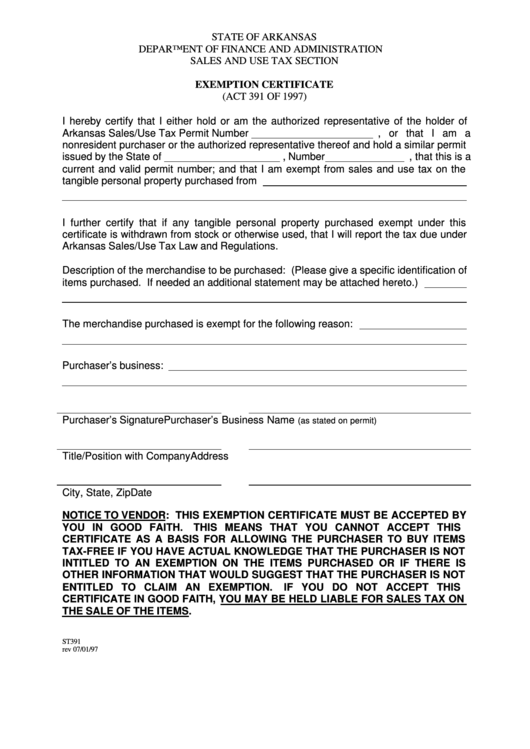

Fillable Form Gr53 & Ar Exemption Certificate Form State Of

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Keep this certificate with your records. Web file this form with your employer to exempt your earnings from state income tax withholding. Contractor tax.

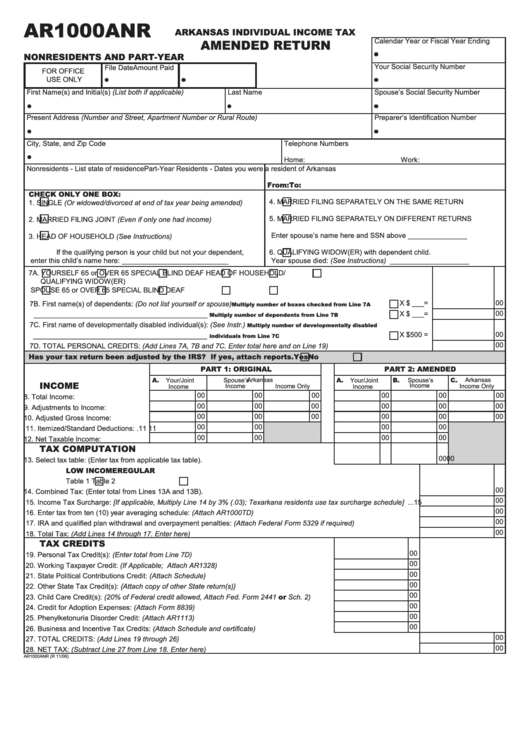

Form Ar1000anr Arkansas Individual Tax Amended Return

Web file this form with your employer to exempt your earnings from state income tax withholding. Other decreases in exemptions or dependents, such as the death Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or.

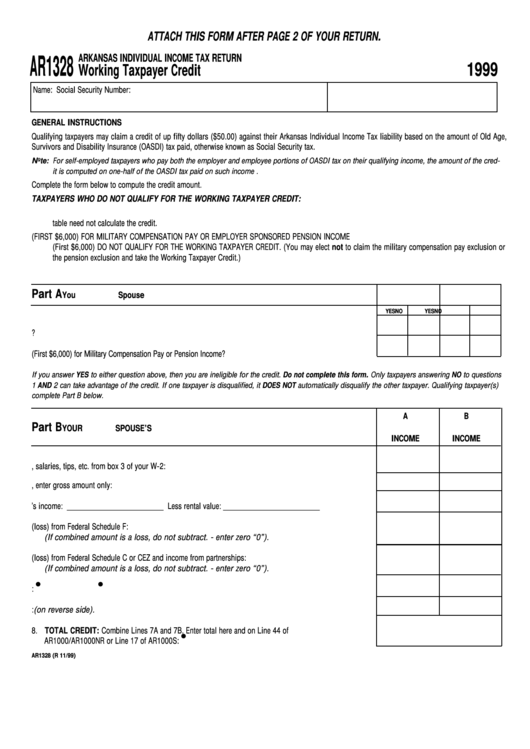

Form Ar1328 Arkansas Individual Tax Return printable pdf download

Web file this form with your employer to exempt your earnings from state income tax withholding. Ar4ecsp employee's special withholding exemption certificate: [ ] [ ] am single and my gross income from all sources will not exceed $10,200. If any of these links are broken, or you can't find the form you need, please let us know. Ar4p employee's.

logodesignlabor Arkansas Tax Exempt Form

We have one or no dependent, and [ Ar4p employee's withholding certificate for pensions and. If any of these links are broken, or you can't find the form you need, please let us know. Grain drying and storage exemption | et1401: [ ] [ ] am single and my gross income from all sources will not exceed $10,200.

Exemption Crtificate Form State Of Arkansas Department Of Finance

You can find resale certificates for other states here. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year. Web file this form with your.

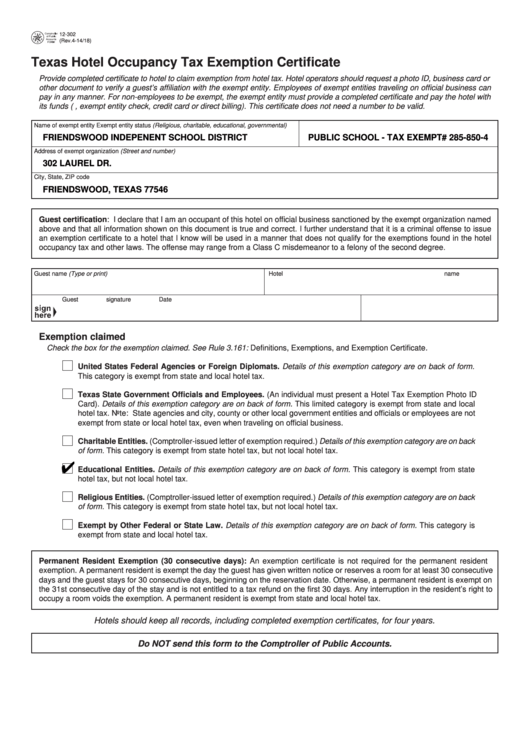

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

Keep this certificate with your records. If any of these links are broken, or you can't find the form you need, please let us know. Contractor tax rate change rebate supplemental form: Ar4ext application for automatic extension of time: Ar4ecsp employee's special withholding exemption certificate:

logodesignlabor Arkansas Tax Exempt Form

Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Ar4ecsp employee's special withholding exemption certificate: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. If any of these links are broken, or you can't find the form you need, please let us.

logodesignlabor Arkansas Tax Exempt Form

We have one or no dependent, and [ Grain drying and storage exemption | et1401: If any of these links are broken, or you can't find the form you need, please let us know. You can find resale certificates for other states here. Keep this certificate with your records.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

You can find resale certificates for other states here. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year. Web state of arkansas employee’s withholding.

Arkansas Resale Certificate PDF Form Fill Out and Sign Printable PDF

If any of these links are broken, or you can't find the form you need, please let us know. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total.

Military Spouses Residency Relief Act Information.

Web ar4ec employee's withholding exemption certificate: Ar4p employee's withholding certificate for pensions and. File this form with your employer. Keep this certificate with your records.

Contractor Tax Rate Change Rebate Supplemental Form:

Web file this form with your employer to exempt your earnings from state income tax withholding. You can find resale certificates for other states here. Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Other decreases in exemptions or dependents, such as the death

Am Married Filing Jointly With My Spouse.

Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Ar4mec military employee’s withholding exemption certificate: If any of these links are broken, or you can't find the form you need, please let us know.

Ar4Ext Application For Automatic Extension Of Time:

To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Grain drying and storage exemption | et1401: We have one or no dependent, and [