Az Form 140Ptc 2022

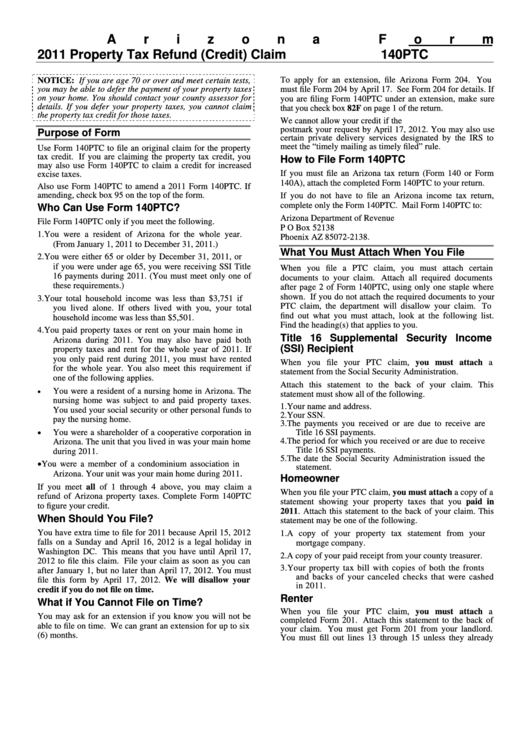

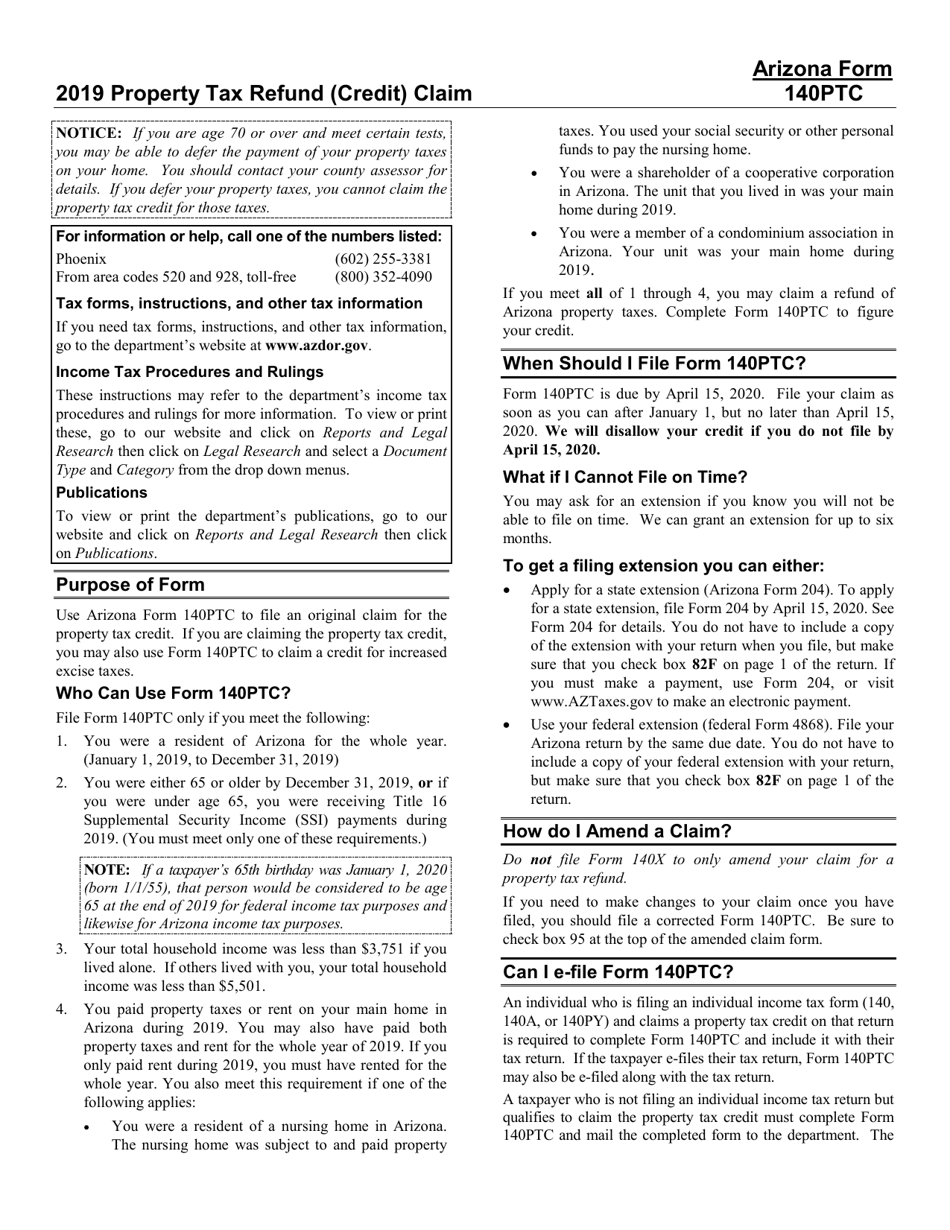

Az Form 140Ptc 2022 - Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online. Web handy tips for filling out az form 140ptc 2022 online. Complete form 140ptc to figure your credit. The taxpayer was a resident of arizona for the entire year. Web use arizona form 140ptc to file an original claim for the property tax credit. Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. Web 140ptc property tax refund (credit) claim 2021 88 revenue use only. Printing and scanning is no longer the best way to manage documents. Web purpose of form use arizona form 140ptc to file an original claim for the property tax credit. You paid property taxes or r

Ad upload, modify or create forms. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Web purpose of form use arizona form 140ptc to file an original claim for the property tax credit. The taxpayer was a resident of arizona for the entire year. File your claim as soon as you. The most common arizona income tax form is the arizona form 140. Try it for free now! Register and subscribe now to work on your az ador 140ptc & more fillable forms. Tax credits forms, individual : This form is for income earned in tax year 2022, with tax returns due in april.

Save or instantly send your ready documents. Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. Try it for free now! Complete, edit or print tax forms instantly. Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online. Your total household income was less than $3,751 if you lived alone. Get ready for this year's tax season quickly and safely with pdffiller! This form is used by residents who file an individual. Register and subscribe now to work on your az ador 140ptc & more fillable forms. Tax credits forms, individual :

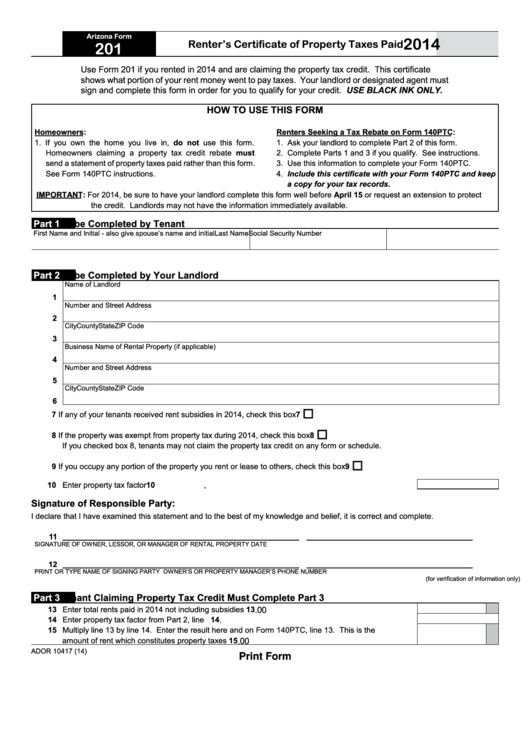

Fillable Arizona Form 201 Renter'S Certificate Of Property Taxes Paid

Go digital and save time with signnow, the best solution. Web common arizona income tax forms & instructions. Web purpose of form use arizona form 140ptc to file an original claim for the property tax credit. Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. Try it for free now!

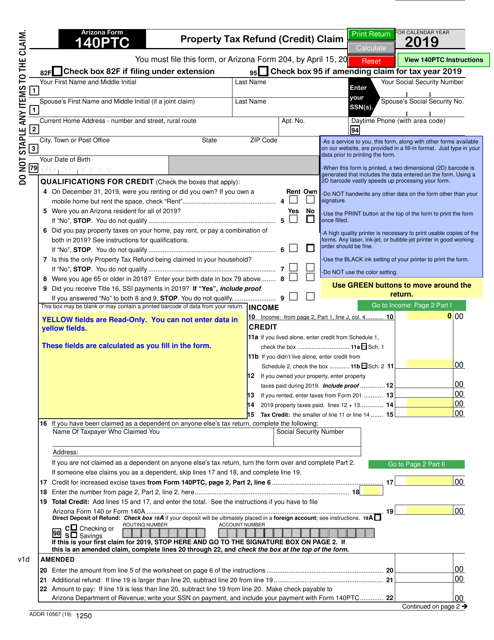

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web common arizona income tax forms & instructions. You paid property taxes or r Tax credits forms, individual : If others lived with you, your total household income was less than $5,501. Form 140ptc is due april by 15, 2022.

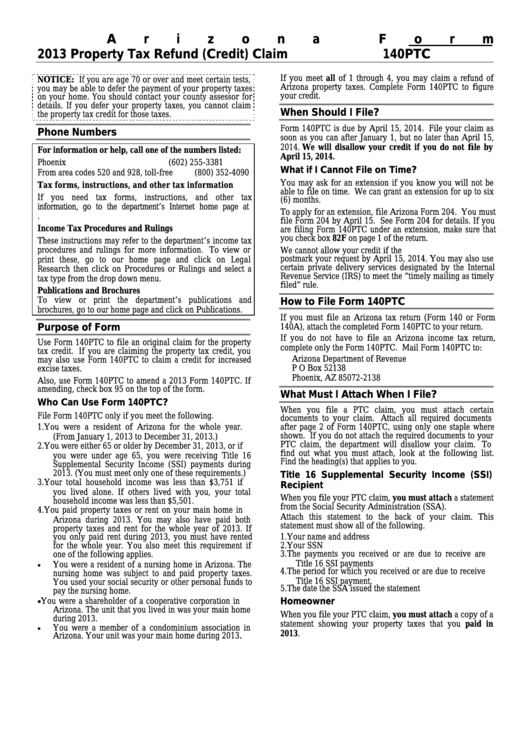

Instructions For Form 140ptc Property Tax Refund (Credit) Claim

Web common arizona income tax forms & instructions. When should i file form 140ptc? Do not mark in this area. Get ready for this year's tax season quickly and safely with pdffiller! Complete, edit or print tax forms instantly.

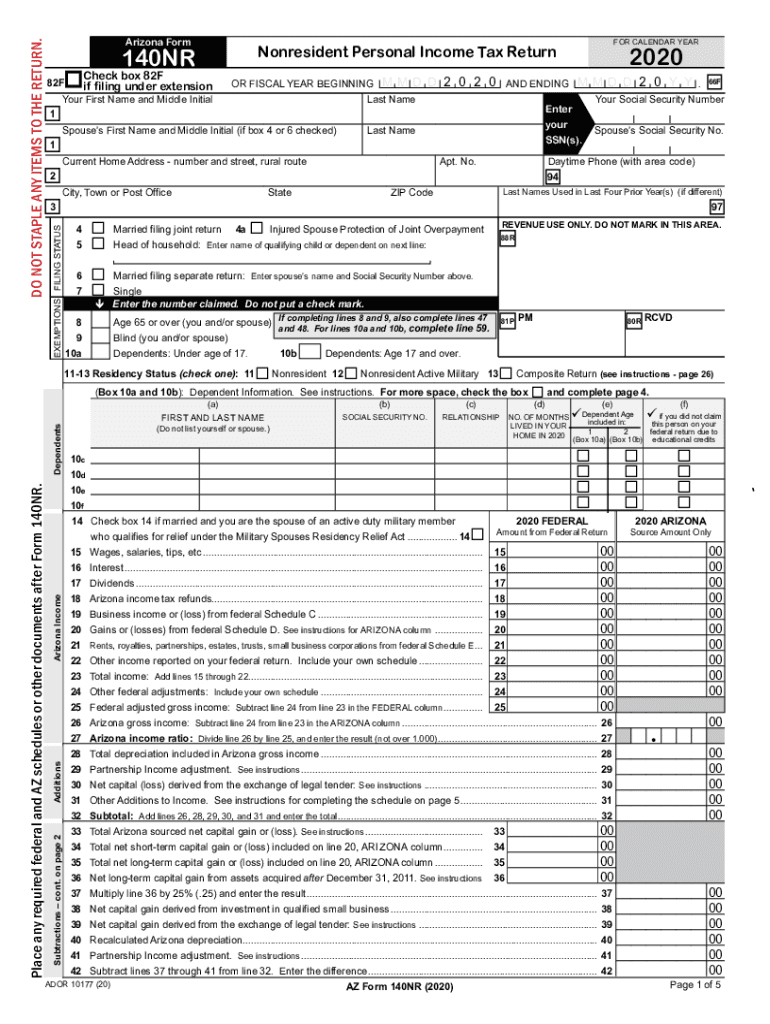

2020 Form AZ DoR 140NR Fill Online, Printable, Fillable, Blank pdfFiller

Web taxpayer's claiming the property income tax credit, may also use this form to claim a credit for increased excise taxes. Web donors have until april 18, 2023 to make a tax credit gift (of up to $400/individual or $800/couple) that is eligible for their 2022 arizona state tax filings. Web form is used by qualified individuals to claim a.

State Taxes Az State Taxes Refund

Web we last updated arizona form 140ptc in february 2023 from the arizona department of revenue. Try it for free now! Register and subscribe now to work on your az ador 140ptc & more fillable forms. Easily fill out pdf blank, edit, and sign them. Web donors have until april 18, 2023 to make a tax credit gift (of up.

Arizona Form 140ptc Instruction Property Tax Refund (Credit) Claim

Go digital and save time with signnow, the best solution. Form 140ptc is due april by 15, 2022. Complete, edit or print tax forms instantly. Web 26 rows form number title; If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for.

azdor.gov Forms 140PTC

Do not mark in this area. Sign it in a few clicks draw your. Complete form 140ptc to figure your credit. Printing and scanning is no longer the best way to manage documents. Web taxpayer's claiming the property income tax credit, may also use this form to claim a credit for increased excise taxes.

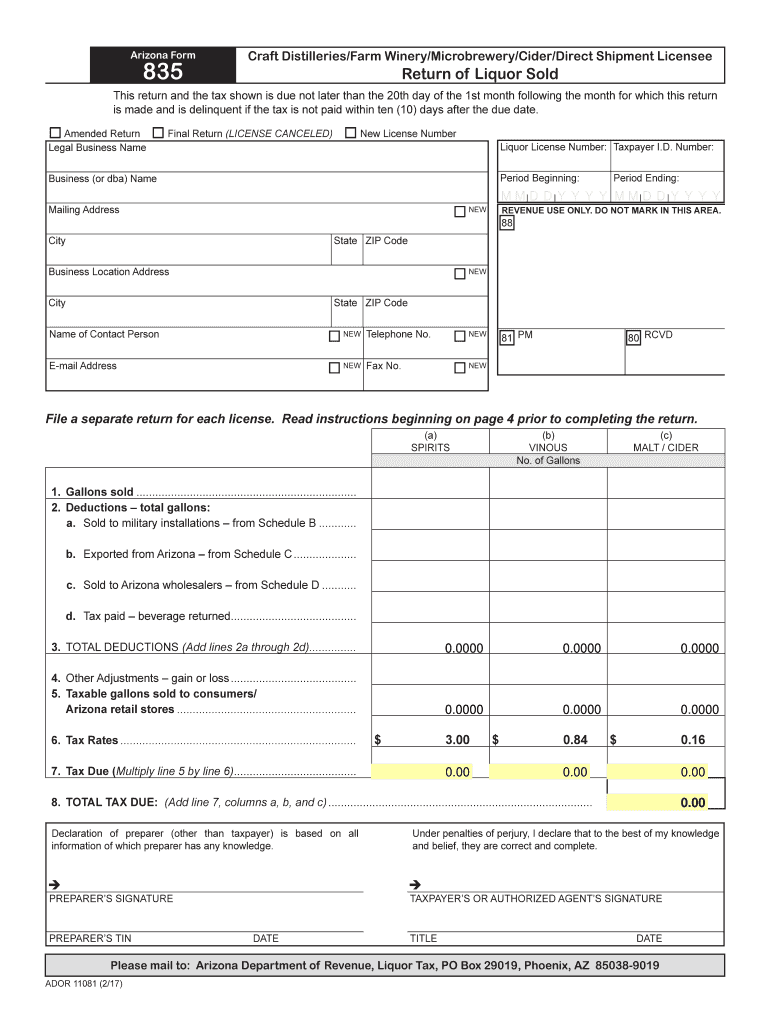

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

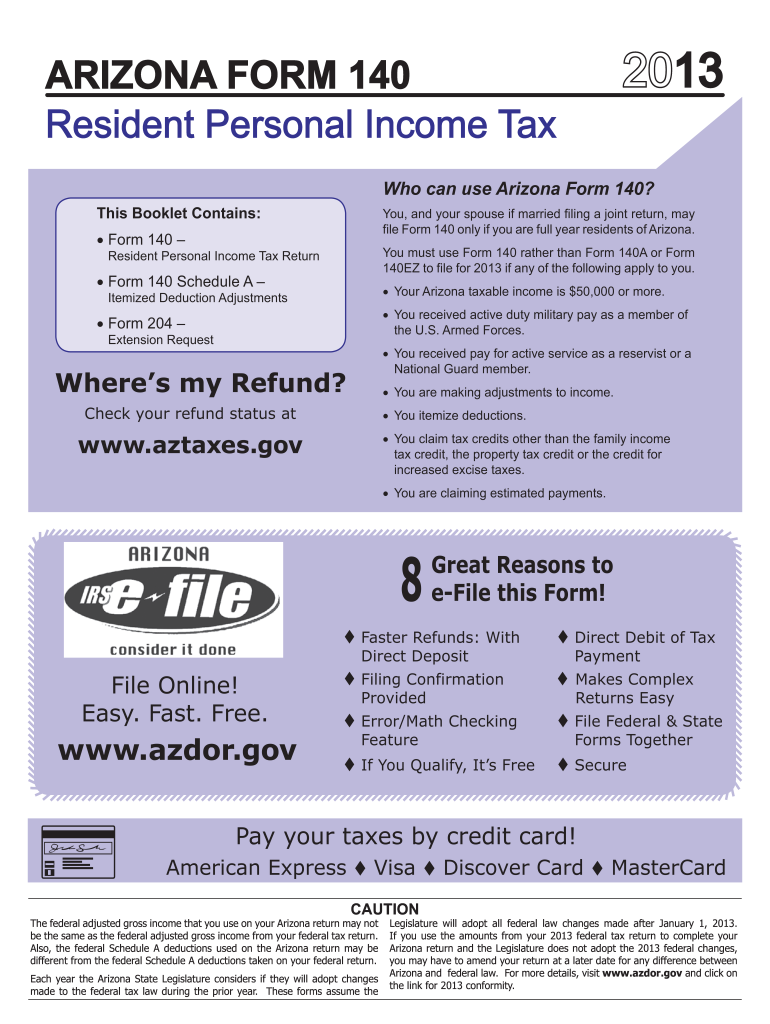

Do not mark in this area. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. 81 pm 80 rcvd do not staple any items to the claim. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue.

Download Instructions for Arizona Form 140PTC, ADOR10567 Property Tax

Do not mark in this area. This form is for income earned in tax year 2022, with tax returns due in april. Web 26 rows form number title; Register and subscribe now to work on your az ador 140ptc & more fillable forms. Web up to $40 cash back easily complete a printable irs arizona form 140ptc 2020 2023 online.

az 140 fillable form Fill out & sign online DocHub

Web 26 rows form number title; 81 pm 80 rcvd do not staple any items to the claim. Web taxpayer's claiming the property income tax credit, may also use this form to claim a credit for increased excise taxes. Get ready for tax season deadlines by completing any required tax forms today. Register and subscribe now to work on your.

Complete, Edit Or Print Tax Forms Instantly.

Edit your arizona form 140ptc fillable online type text, add images, blackout confidential details, add comments, highlights and more. Complete form 140ptc to figure your credit. Web this form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the taxpayer. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue.

Web We Last Updated Arizona Form 140Ptc In February 2023 From The Arizona Department Of Revenue.

Web taxpayer's claiming the property income tax credit, may also use this form to claim a credit for increased excise taxes. Web common arizona income tax forms & instructions. Register and subscribe now to work on your az ador 140ptc & more fillable forms. This form is for income earned in tax year 2022, with tax returns due in april.

Your Total Household Income Was Less Than $3,751 If You Lived Alone.

File your claim as soon as you can after january 1, but no later than april 15, 2022. Web handy tips for filling out az form 140ptc 2022 online. Sign it in a few clicks draw your. The most common arizona income tax form is the arizona form 140.

Web 26 Rows Form Number Title;

If you have questions on this form, contact customer. If others lived with you, your total household income was less than $5,501. Web form 140ptc is due april by 15, 2022. Web donors have until april 18, 2023 to make a tax credit gift (of up to $400/individual or $800/couple) that is eligible for their 2022 arizona state tax filings.