Az Solar Tax Credit Form

Az Solar Tax Credit Form - Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer. Credit for taxes paid to another state or country:. Ensuring the paperwork is correct and filed timely is. Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets in the current taxable years and. Take control of home energy costs & produce your own solar energy. In this case, an average system will cost around $30,015 before applying the incentives. Custom, efficient solar panels tailored to your needs. Web 26 rows tax credits forms : Web arizona tax credit forms and instructions for all recent years can be obtained at: Web the average cost of az solar panels is $2.61 per watt.

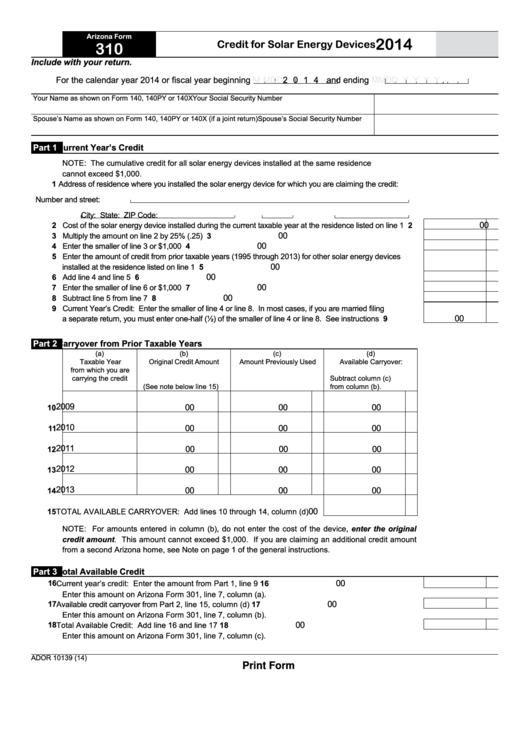

Web solar panels cost an average of $15,000 to $20,000 in arizona, which is a significant investment. Web there are several arizona solar tax credits and exemptions that can help you go solar: Ad go solar with sunnova! The residential arizona solar tax credit. Web application for approval of renewable energy production tax credit. Web arizona tax credit forms and instructions for all recent years can be obtained at: Web if you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual. Web applying for the arizona solar tax credit requires submitting a completed arizona form 310 with your annual tax return. Custom, efficient solar panels tailored to your needs. The renewable energy production tax credit is for a qualified energy generator that has at.

Web application for approval of renewable energy production tax credit. Web we last updated arizona form 343 from the department of revenue in may 2021. Web tax credits forms. Form 343 is an arizona corporate income tax form. Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. States often have dozens of even. Web solar panels cost an average of $15,000 to $20,000 in arizona, which is a significant investment. Drug deaths nationwide hit a record. Web there are several arizona solar tax credits and exemptions that can help you go solar: Ensuring the paperwork is correct and filed timely is.

Fillable Arizona Form 310 Credit For Solar Energy Devices 2014

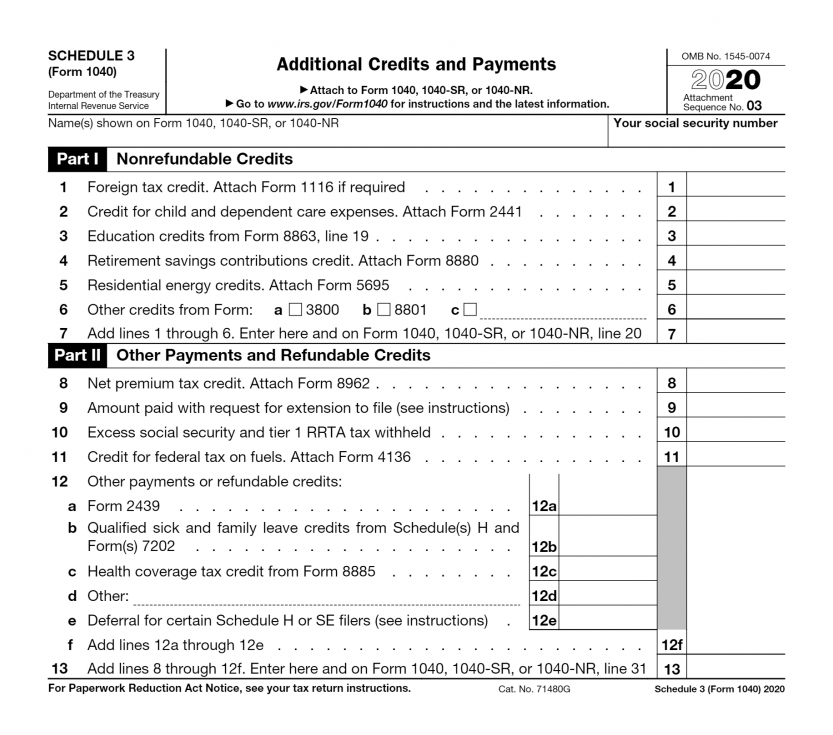

Web the hearing was particularly timely, because the u.s. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Ad go solar with sunnova! Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Form 343 is an arizona corporate income tax.

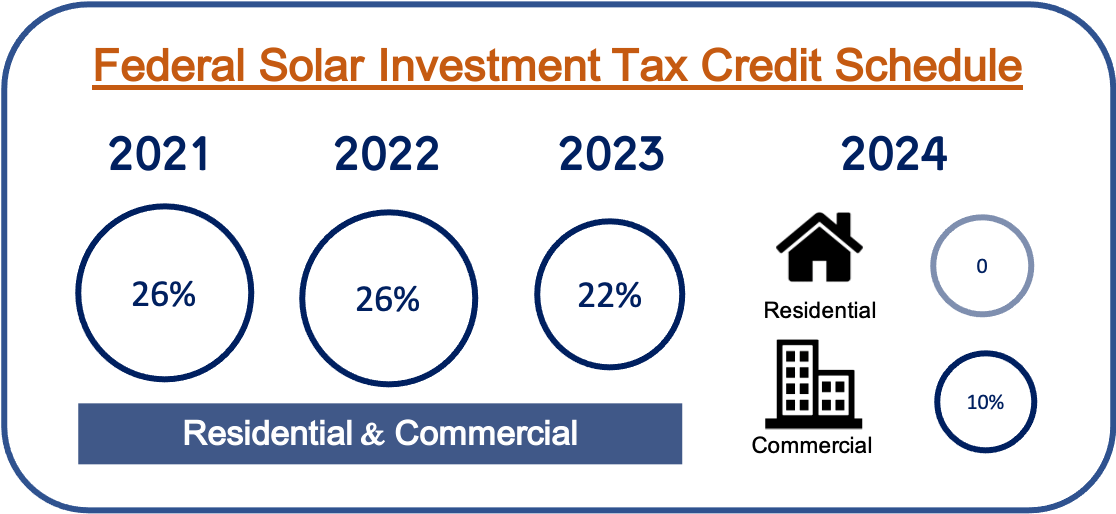

Irs Solar Tax Credit 2022 Form

Fortunately, the grand canyon state offers several tax credits to reduce. Web tax credits forms. Form 343 is an arizona corporate income tax form. Web the average cost of az solar panels is $2.61 per watt. Is facing intensifying urgency to stop the worsening fentanyl epidemic.

Understanding How Solar Tax Credits Work

Form 343 is an arizona corporate income tax form. Ensuring the paperwork is correct and filed timely is. Take control of home energy costs & produce your own solar energy. Web 26 rows tax credits forms : Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of.

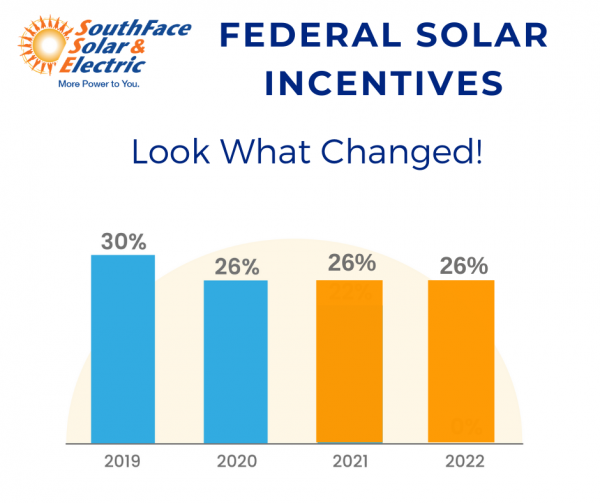

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

Web arizona tax credit forms and instructions for all recent years can be obtained at: Web learn about arizona solar incentives, solar panel pricing, tax credits and local rebates in our solar panels for arizona 2023 guide. To claim this credit, you must also complete arizona. Take control of home energy costs & produce your own solar energy. In this.

Solar Tax Credit Extension

Form 343 is an arizona corporate income tax form. Home solar built just for you. Web march 16, 2022. Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets in the current taxable years and. Residential arizona solar tax credit.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The renewable energy production tax credit is for a qualified energy generator that has at. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web we last updated arizona form 343 from the department of revenue in may 2021. Web s corporations that claimed the credit for solar hot water heater plumbing stub outs and electrical vehicle recharge outlets.

Applying for the Solar Tax Credit is as Easy as 123! ARE Solar

Web tax credits forms. Web the hearing was particularly timely, because the u.s. Web applying for the arizona solar tax credit requires submitting a completed arizona form 310 with your annual tax return. Fortunately, the grand canyon state offers several tax credits to reduce. Credit for taxes paid to another state or country:.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Take control of home energy costs & produce your own solar energy. Credit for taxes paid to another state or country:. Residential arizona solar tax credit. Form 343 is an arizona corporate income tax form. Web applying for the arizona solar tax credit requires submitting a completed arizona form 310 with your annual tax return.

How Does the Federal Solar Tax Credit Work?

Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. Web 26 rows tax credits forms : In this case, an average system will cost around $30,015 before applying the incentives. Custom, efficient solar panels tailored to your needs. The renewable energy production tax credit is for a qualified.

How to Claim Your Solar Tax Credit A.M. Sun Solar

More about the arizona form 310 tax credit we last. Web 1 best answer. Web the federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer. Custom, efficient solar panels tailored to your needs. Web 26 rows.

This Is Claimed On Arizona Form 310, Credit For Solar Energy Devices.

Take control of home energy costs & produce your own solar energy. Web tax credits forms. Web we last updated arizona form 343 from the department of revenue in may 2021. Web march 16, 2022.

Form 343 Is An Arizona Corporate Income Tax Form.

Custom, efficient solar panels tailored to your needs. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. The renewable energy production tax credit is for a qualified energy generator that has at. Home solar built just for you.

Web Learn About Arizona Solar Incentives, Solar Panel Pricing, Tax Credits And Local Rebates In Our Solar Panels For Arizona 2023 Guide.

Web 1 best answer. To claim this credit, you must also complete arizona. Web to claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete irs form 5695 and finally add your renewable energy tax credit. Credit for taxes paid to another state or country:.

Drug Deaths Nationwide Hit A Record.

Web applying for the arizona solar tax credit requires submitting a completed arizona form 310 with your annual tax return. Web there are several arizona solar tax credits and exemptions that can help you go solar: In this case, an average system will cost around $30,015 before applying the incentives. Fortunately, the grand canyon state offers several tax credits to reduce.