Backdoor Ira Tax Form

Backdoor Ira Tax Form - Distributions from traditional, sep, or simple iras, if you have ever made. Here’s the recipe i recommend using to report the backdoor roth ira. Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes. Use this application to open an investor, a, c or advisor class traditional, roth or rollover ira using a financial professional. For people with a modified adjusted. Use this address if you are not enclosing a payment use this. If your conversion contains contributions made in 2022 for 2021 if your conversion. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Make a nondeductible contribution to a traditional ira. Web you can use a back door roth ira by completing these steps:

Make a nondeductible contribution to a traditional ira. Web how can we help you? This ira has no income limits preventing you from. Nondeductible contributions you made to traditional iras. Web to check the results of your backdoor roth ira conversion, see your form 1040: Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Use this application to open an investor, a, c or advisor class traditional, roth or rollover ira using a financial professional. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older.

Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes. Nondeductible contributions you made to traditional iras. Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax. Note that there's no tax benefit for the year you establish a. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. If your conversion contains contributions made in 2022 for 2021 if your conversion. Sign in to your account. This ira has no income limits preventing you from. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Web backdoor roth ira contribution limit.

Backdoor Roth IRA steps Roth ira, Ira, Roth ira contributions

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Here’s the recipe i recommend using to report the backdoor roth ira. Nondeductible contributions you made to traditional iras. Web a backdoor roth ira permits account holders to work.

Backdoor IRA Gillingham CPA

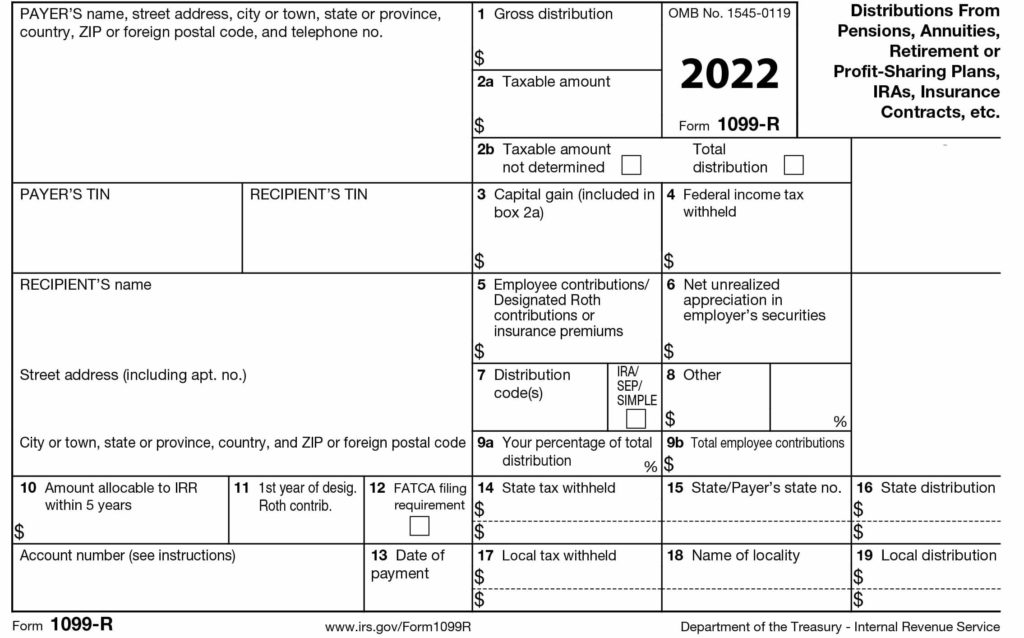

Distributions from traditional, sep, or simple iras, if you have ever made. Web use form 8606 to report: Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes. Nondeductible contributions you made to traditional iras. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax. Nondeductible contributions you made to traditional iras. This ira has no income limits preventing you from. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to.

How to report a backdoor Roth IRA contribution on your taxes Merriman

Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax. Make a nondeductible contribution to a traditional ira. Web you can use a back door roth ira by completing these steps: Web reporting a backdoor roth ira on tax returns remains confusing.

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web use form 8606 to report: Make a nondeductible contribution to a traditional ira. Web a backdoor roth ira permits account holders to work around income tax limits by.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Distributions from traditional, sep, or simple iras, if you have ever.

5 Essential Backdoor Roth IRA Facts That You Need to Know Tony Florida

If your conversion contains contributions made in 2022 for 2021 if your conversion. Web to check the results of your backdoor roth ira conversion, see your form 1040: Distributions from traditional, sep, or simple iras, if you have ever made. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a.

Information About Congress Ending the Backdoor IRA Conversion

Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Web for backdoor roths, the tax preparer will need irs tax form 8606 to.

Backdoor Roth A Complete HowTo

Web use form 8606 to report: Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Nondeductible contributions you made to traditional iras. Web you can use a back door roth.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

Here’s the recipe i recommend using to report the backdoor roth ira. If your conversion contains contributions made in 2022 for 2021 if your conversion. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Sign in to your account. Nondeductible contributions you made to traditional iras.

For People With A Modified Adjusted.

If your conversion contains contributions made in 2022 for 2021 if your conversion. Nondeductible contributions you made to traditional iras. Web use form 8606 to report: Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes.

Web It's A Backdoor Way Of Moving Money Into A Roth Ira, Which Is Accomplished By Making Nondeductible Contributions—Or Contributions On Which You Do Not Take A Tax.

Note that there's no tax benefit for the year you establish a. Web backdoor roth ira contribution limit. This ira has no income limits preventing you from. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira.

Web The Contribution Is Considered Nondeductible Once You Fill Out Irs Form 8606 And Complete Your Tax Return.

Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Use this address if you are not enclosing a payment use this. Web to check the results of your backdoor roth ira conversion, see your form 1040: Use this application to open an investor, a, c or advisor class traditional, roth or rollover ira using a financial professional.

Web As You'll See On Form 8606 Itself (Link Opens A Pdf), Whenever You Contribute To A Nondeductible Ira, You Have To Report Your Contribution To The Irs.

Web you can use a back door roth ira by completing these steps: Sign in to your account. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information.