Bank Statement Reconciliation Form

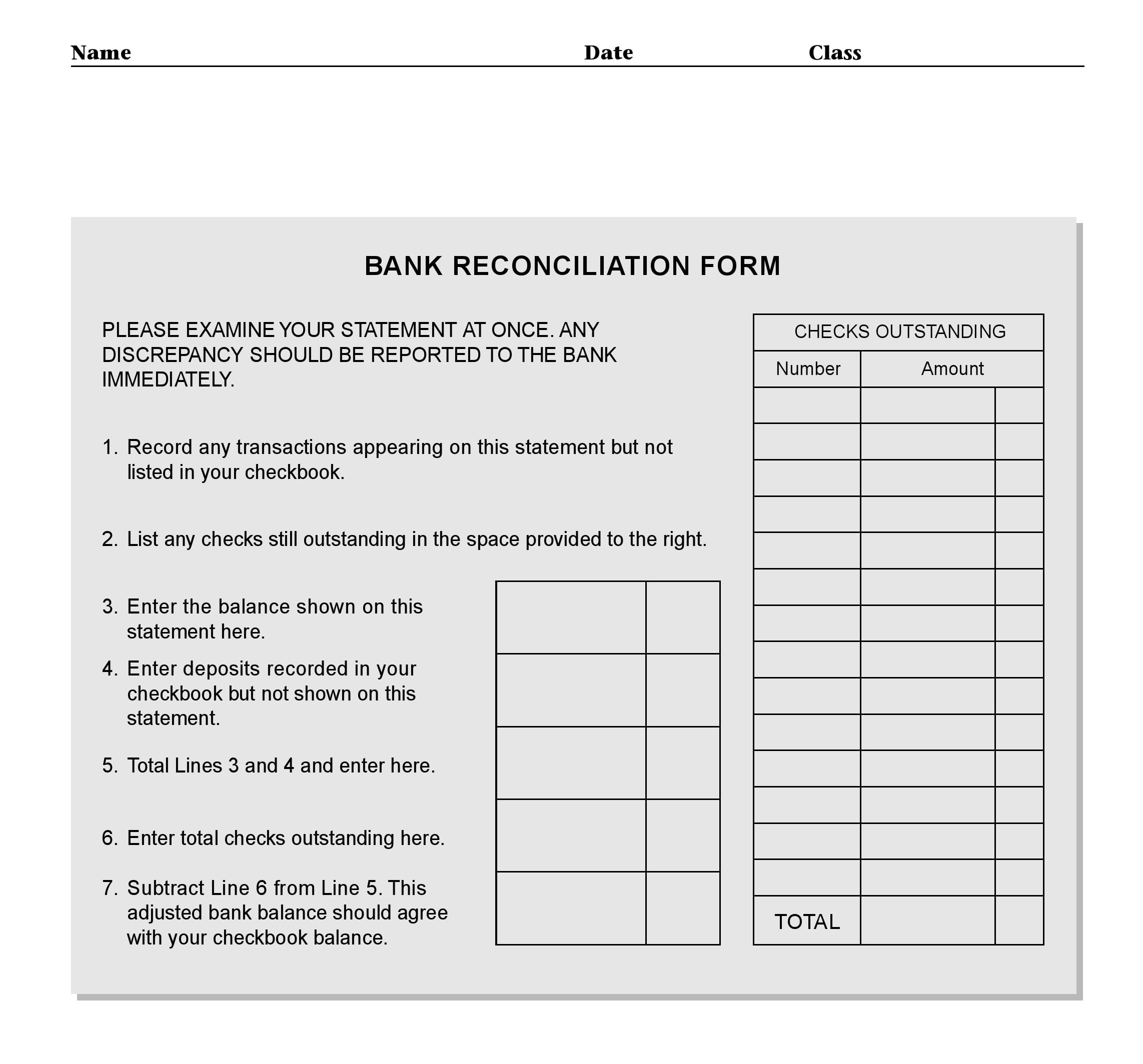

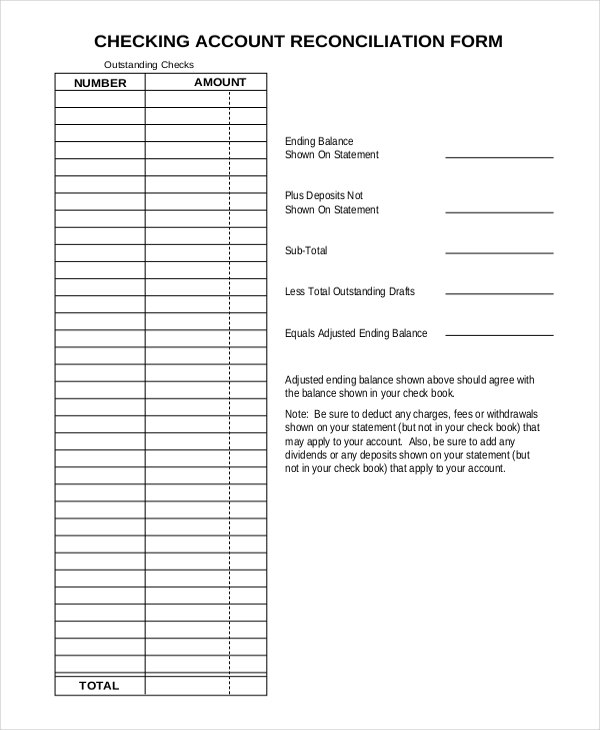

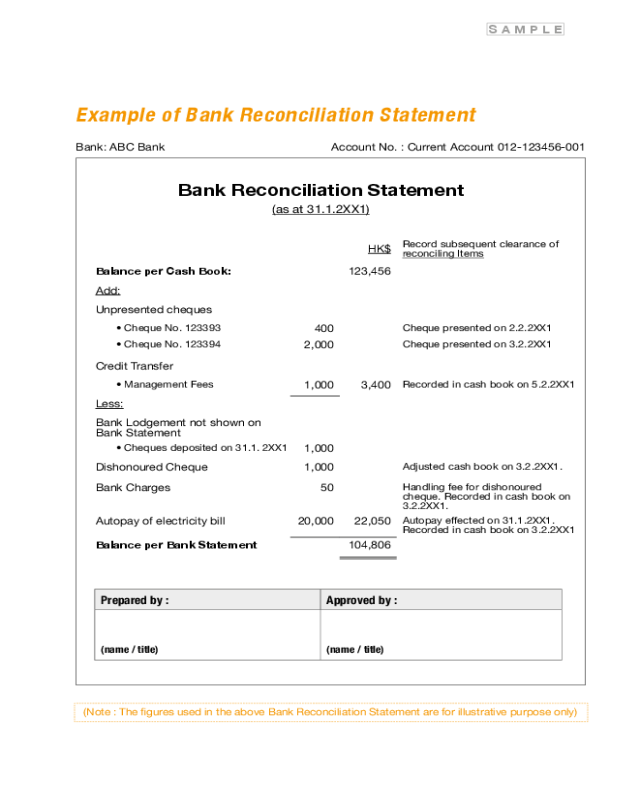

Bank Statement Reconciliation Form - This statement includes all transactions, such. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. Match each of the deposits in your records to those noted on the bank statement. Web to do a bank reconciliation you need to match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions. Below is a good example of a simple reconciliation form. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Match book deposits to statement. Web a bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web what is a bank reconciliation?

Reconciling the two accounts helps identify whether accounting changes are needed. In the case of personal bank accounts,. Web what is a bank reconciliation? Web to do a bank reconciliation you need to match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions. If it is easier, use your own reconciliation form. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. The very purpose of reconciling the bank statement with your business’ books of accounts is to identify any differences between the balance of the two accounts. Below is a good example of a simple reconciliation form. Match each of the deposits in your records to those noted on the bank statement.

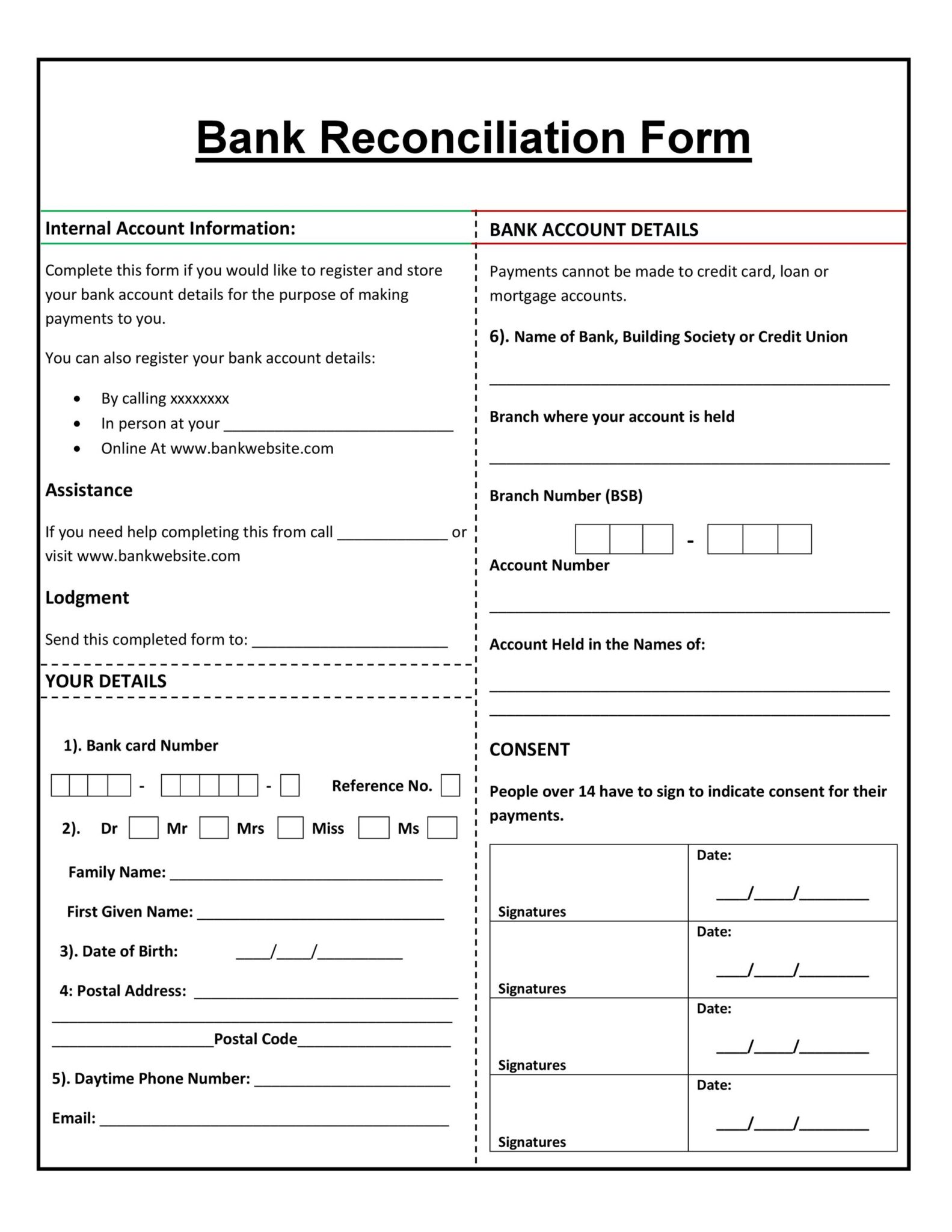

In the case of personal bank accounts,. Match book deposits to statement. Web a bank reconciliation statement is a summary of banking and business activity prepared by a company or individual. The very purpose of reconciling the bank statement with your business’ books of accounts is to identify any differences between the balance of the two accounts. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Prepare your reconciliation form your bank reconciliation form can be as simple or as detailed as you like. Be sure to deduct any. Reconciling the two accounts helps identify whether accounting changes are needed. If it is easier, use your own reconciliation form. Web there should be a reconciliation form on the back of this statement, which you can use to complete a reconciliation.

50+ Bank Reconciliation Examples & Templates [100 Free]

A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Enter your name and email in the form below and download the free template now! Match each of the deposits in your records to those noted on the bank statement. If it is easier, use.

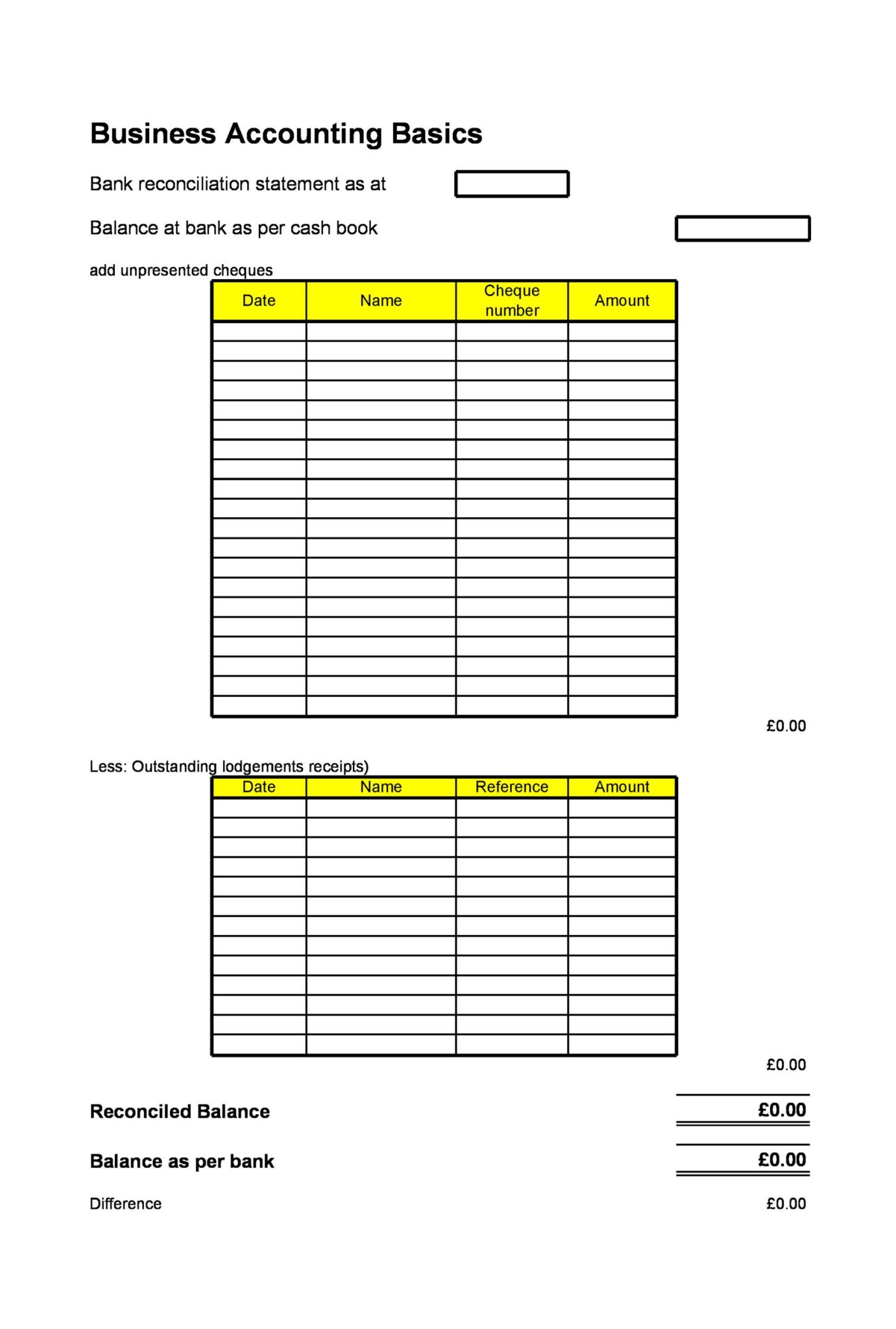

Bank Statement Reconciliation Form Business Mentor

Web a bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. Be sure to deduct any. Below is a good example.

Bank Reconciliation Definition & Example of Bank Reconciliation

If it is easier, use your own reconciliation form. In the case of personal bank accounts,. Web a bank reconciliation statement is a summary of banking and business activity prepared by a company or individual. Reconciling the two accounts helps identify whether accounting changes are needed. Web this simple bank reconciliation template is designed for personal or business use, and.

55 Useful Bank Reconciliation Template RedlineSP

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Reconciling the two accounts helps identify whether accounting changes.

55 Useful Bank Reconciliation Template RedlineSP

Prepare your reconciliation form your bank reconciliation form can be as simple or as detailed as you like. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. The very purpose of reconciling the bank statement with your business’ books of accounts is to.

Bank Reconciliation Statement Form Edit, Fill, Sign Online Handypdf

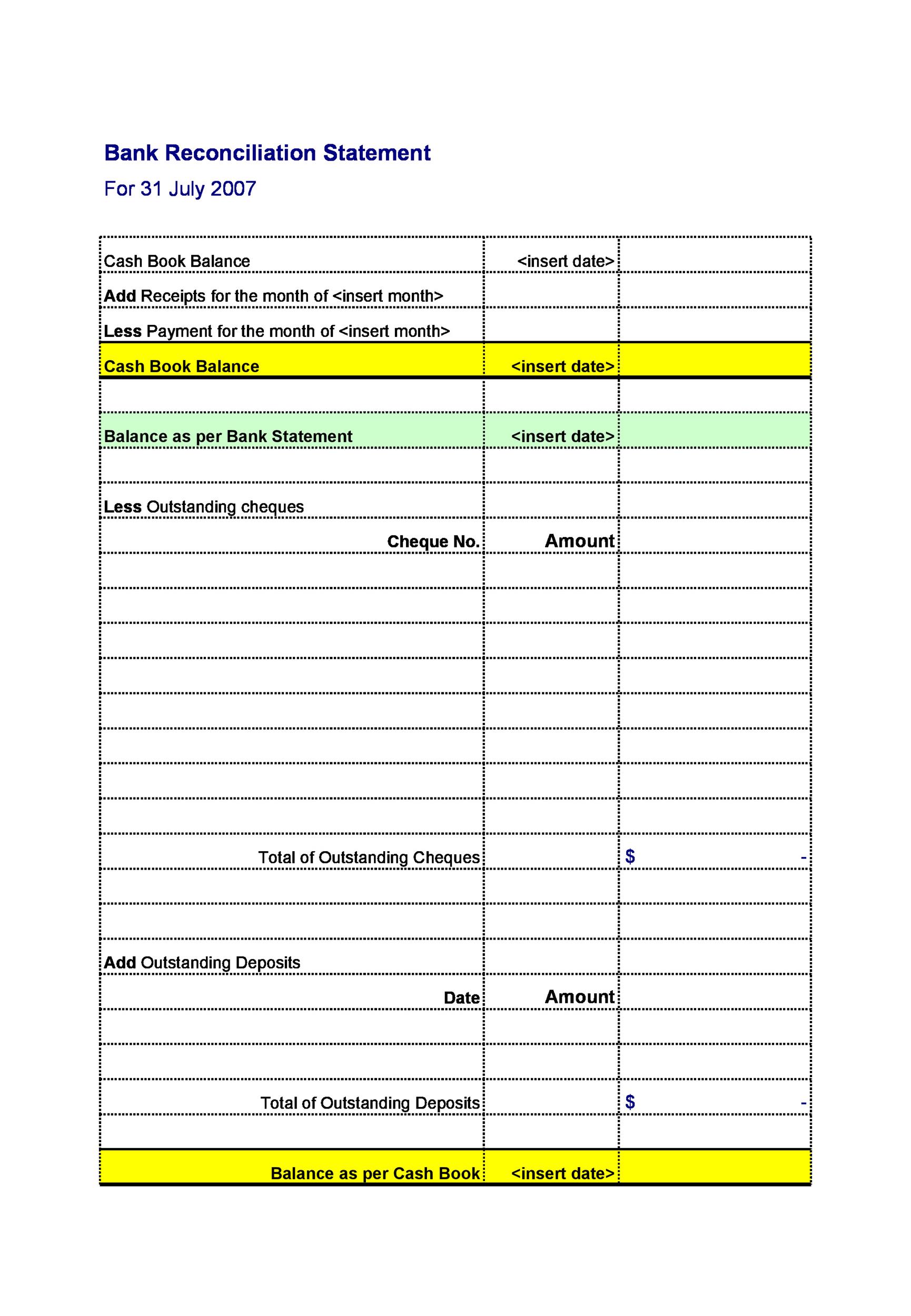

Web a bank reconciliation statement is a summary of banking and business activity prepared by a company or individual. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify.

55 Useful Bank Reconciliation Template RedlineSP

Be sure to deduct any. Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. Web a bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. Enter your financial details, and.

50+ Bank Reconciliation Examples & Templates [100 Free]

Web a bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Enter your financial details, and the template will automatically calculate.

Bank Reconciliation Statements

Prepare your reconciliation form your bank reconciliation form can be as simple or as detailed as you like. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an.

Free Bank Reconciliation Form PDF Template Form Download

The very purpose of reconciling the bank statement with your business’ books of accounts is to identify any differences between the balance of the two accounts. Web to do a bank reconciliation you need to match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to.

Web A Bank Reconciliation Statement Is A Document Prepared By A Company That Shows Its Recorded Bank Account Balance Matches The Balance The Bank Lists.

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. In the case of personal bank accounts,. Reconciling the two accounts helps identify whether accounting changes are needed. Web what is a bank reconciliation?

Web A Bank Reconciliation Statement Is A Summary Of Banking And Business Activity Prepared By A Company Or Individual.

Web download the free template. The very purpose of reconciling the bank statement with your business’ books of accounts is to identify any differences between the balance of the two accounts. Below is a good example of a simple reconciliation form. If it is easier, use your own reconciliation form.

Match Book Deposits To Statement.

Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. Web there should be a reconciliation form on the back of this statement, which you can use to complete a reconciliation. Web bank reconciliation is the process of comparing the balance as per the cash book with the balance as per the passbook (bank statement). Web to do a bank reconciliation you need to match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions.

Match Each Of The Deposits In Your Records To Those Noted On The Bank Statement.

This statement includes all transactions, such. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web a bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. Prepare your reconciliation form your bank reconciliation form can be as simple or as detailed as you like.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-11.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-47.jpg?w=320)