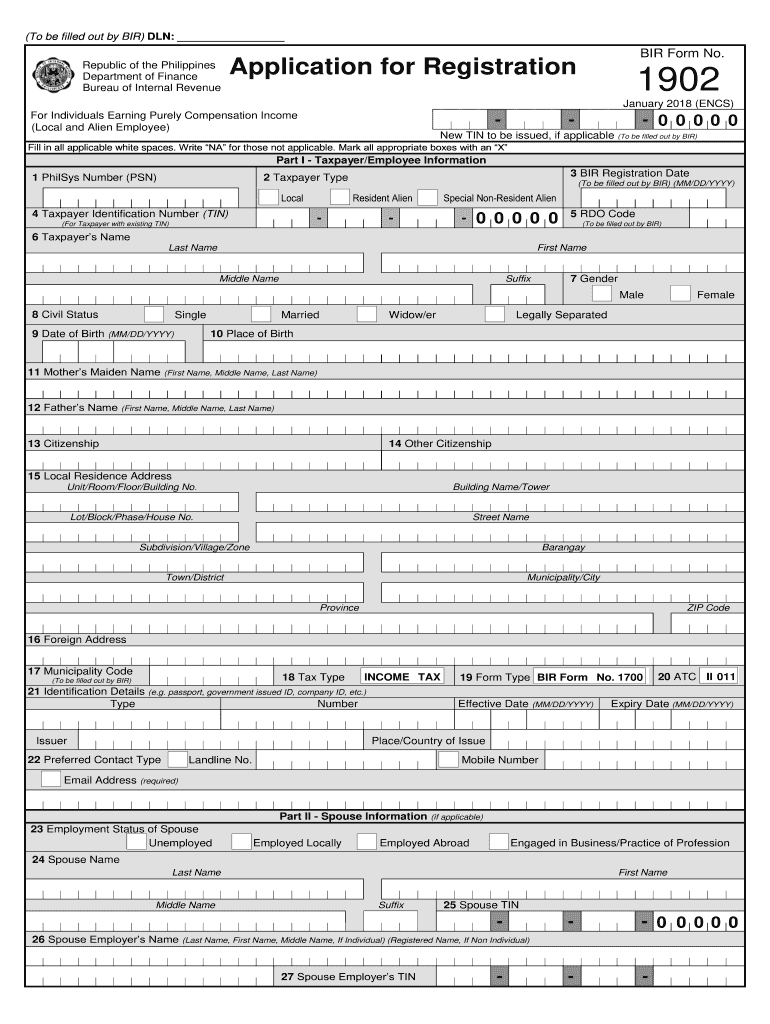

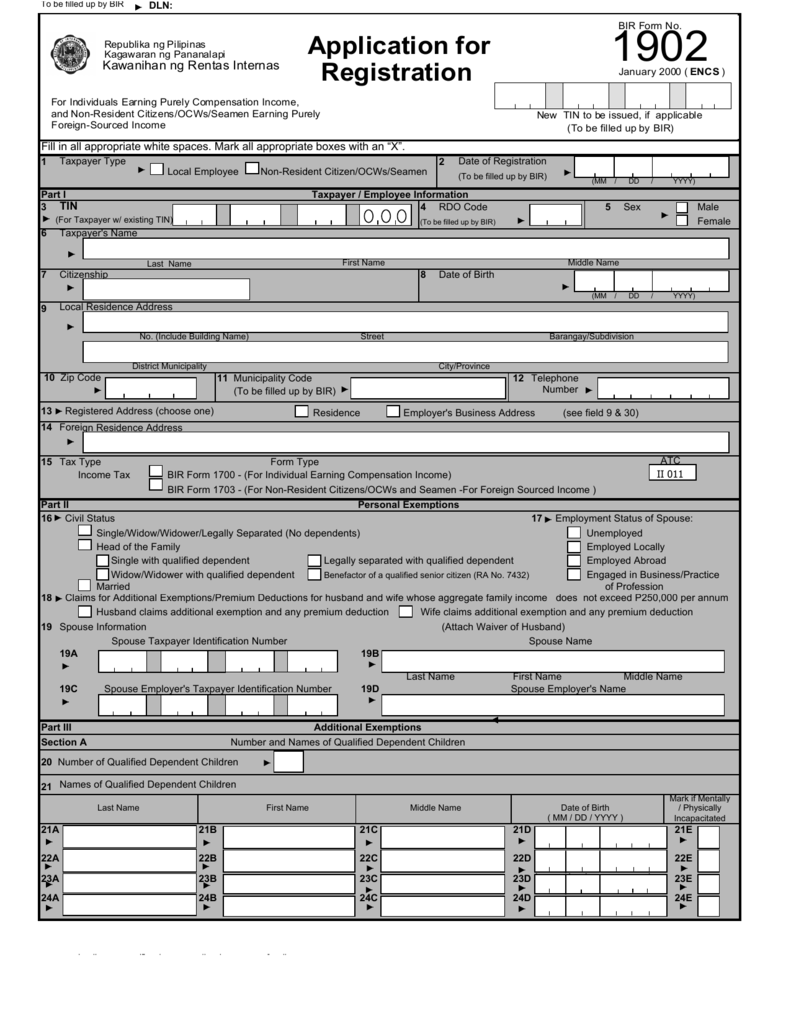

Bir Form 1902

Bir Form 1902 - Now you'll be able to print, download, or share the form. Deadline › new employees shall accomplish and file the. Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration. This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs division (itad) of the bureau of internal revenue. January 2018 (encs) for individuals earning purely compensation income. Write “na” for those not applicable. (photocopy only) for individuals earning purely compensation income New tin to be issued, if applicable (to be filled out by bir) fill in all applicable white spaces. Bureau of internal revenue 1902. Web to be filled up by bir dln:

Write “na” for those not applicable. Now you'll be able to print, download, or share the form. Deadline › new employees shall accomplish and file the. New tin to be issued, if applicable (to be filled out by bir) fill in all applicable white spaces. Web get a bir 1902 here. Web submit bir form 1902 to the revenue district office (rdo) having jurisdiction over the place of office of the employer where such employee is expected to report for work. Web to be filled up by bir dln: This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs division (itad) of the bureau of internal revenue. It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. Quarterly income tax return for individuals, estates and trusts.

January 2018 (encs) for individuals earning purely compensation income. Now you'll be able to print, download, or share the form. Bureau of internal revenue 1902. Web get a bir 1902 here. Quarterly income tax return for individuals, estates and trusts. Web annual income tax return for individuals earning income purely from business/profession (those under the graduated income tax rates with osd as mode of deduction or those who opted to avail of the 8% flat income tax rate) 1701q. Press done after you fill out the form. Web to be filled up by bir dln: Deadline › new employees shall accomplish and file the. Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration.

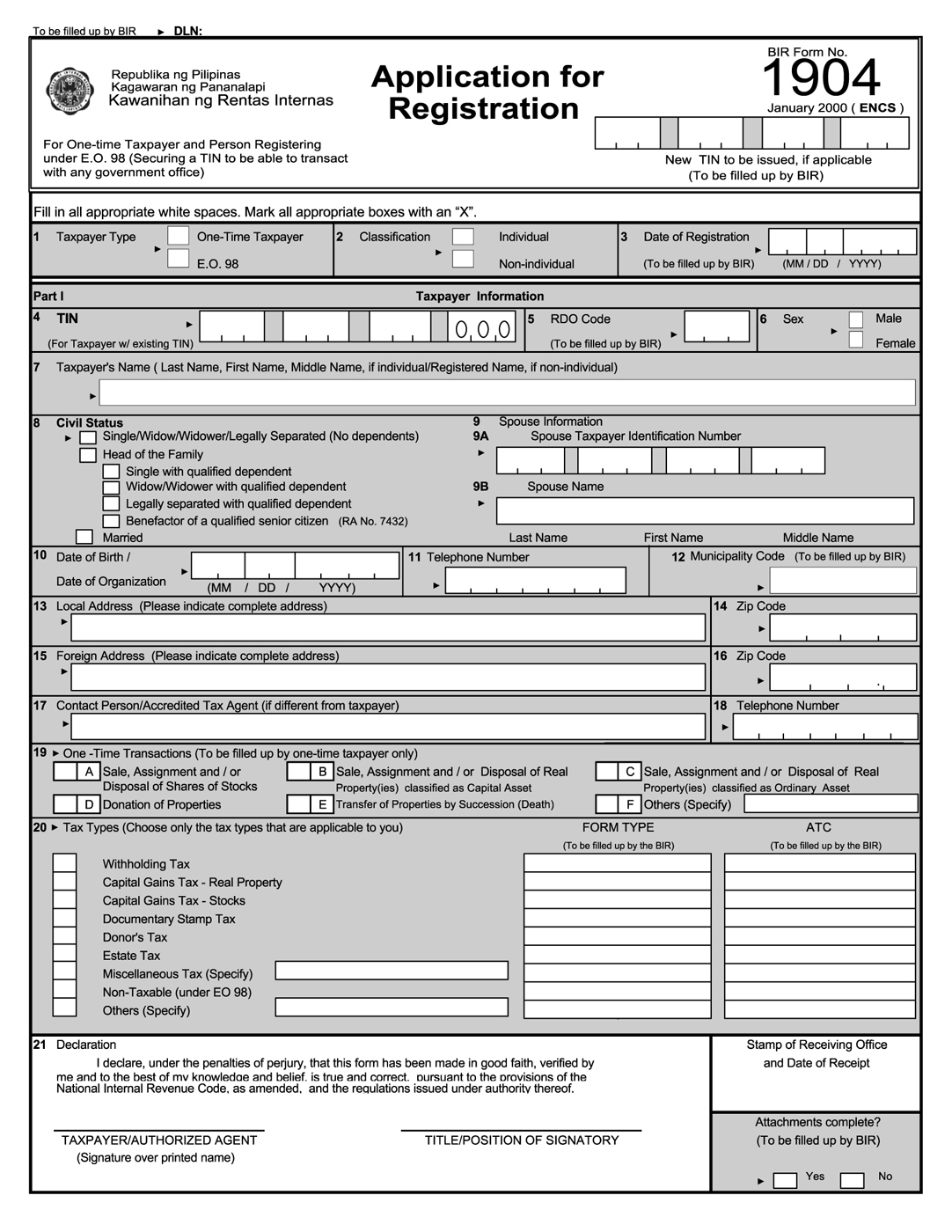

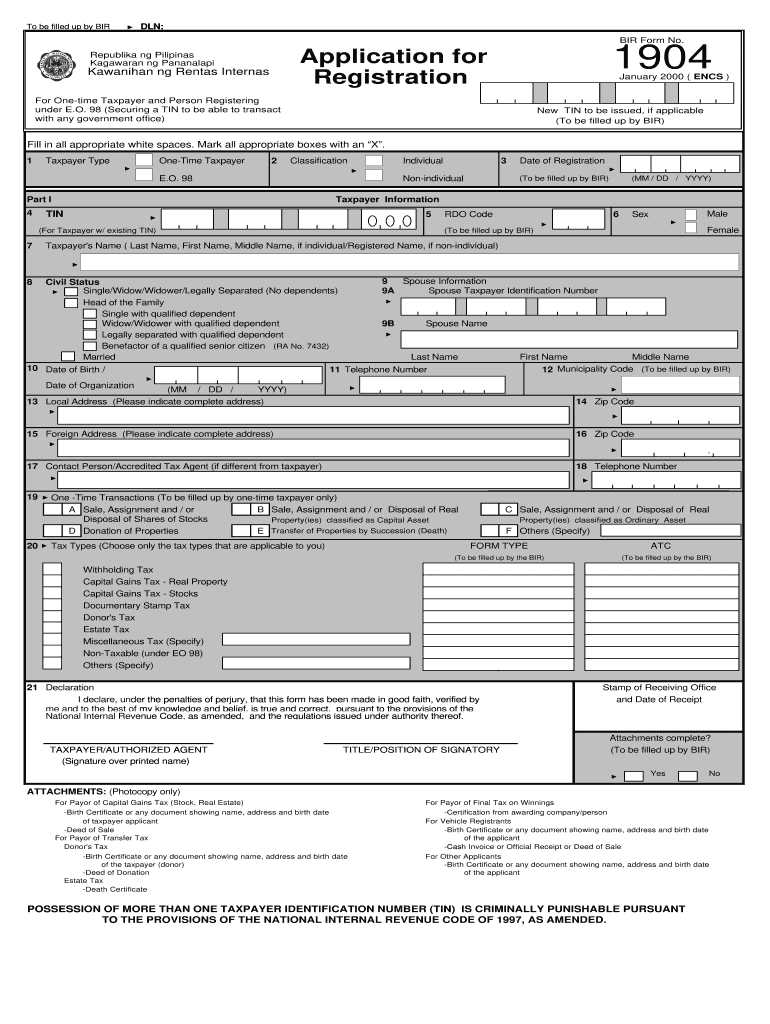

BIR FORM 1904 PDF

It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. Press done after you fill out the form. Web the bir form 1902 is the tax form used to register new employees (either with one employer or multiple employers) in the philippines. January 2018 (encs) for individuals.

BIR Form 1603 Download

Now you'll be able to print, download, or share the form. This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs division (itad) of the bureau of internal revenue. Bureau of internal revenue 1902. January 2018 (encs) for individuals earning purely compensation.

1902 Bir Form Fill Out and Sign Printable PDF Template signNow

New tin to be issued, if applicable (to be filled out by bir) fill in all applicable white spaces. Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration. Write “na” for those not applicable. Bureau of internal revenue 1902. Deadline › new employees shall accomplish and file the.

Online Filipino Freelancers BIR Registration Guide StepbyStep

Write “na” for those not applicable. It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs division (itad) of.

Bir Form 1904 Sample Angga Tani

(photocopy only) for individuals earning purely compensation income January 2018 (encs) for individuals earning purely compensation income. Now you'll be able to print, download, or share the form. Address the support section or contact our support staff in case you have any concerns. Web annual income tax return for individuals earning income purely from business/profession (those under the graduated income.

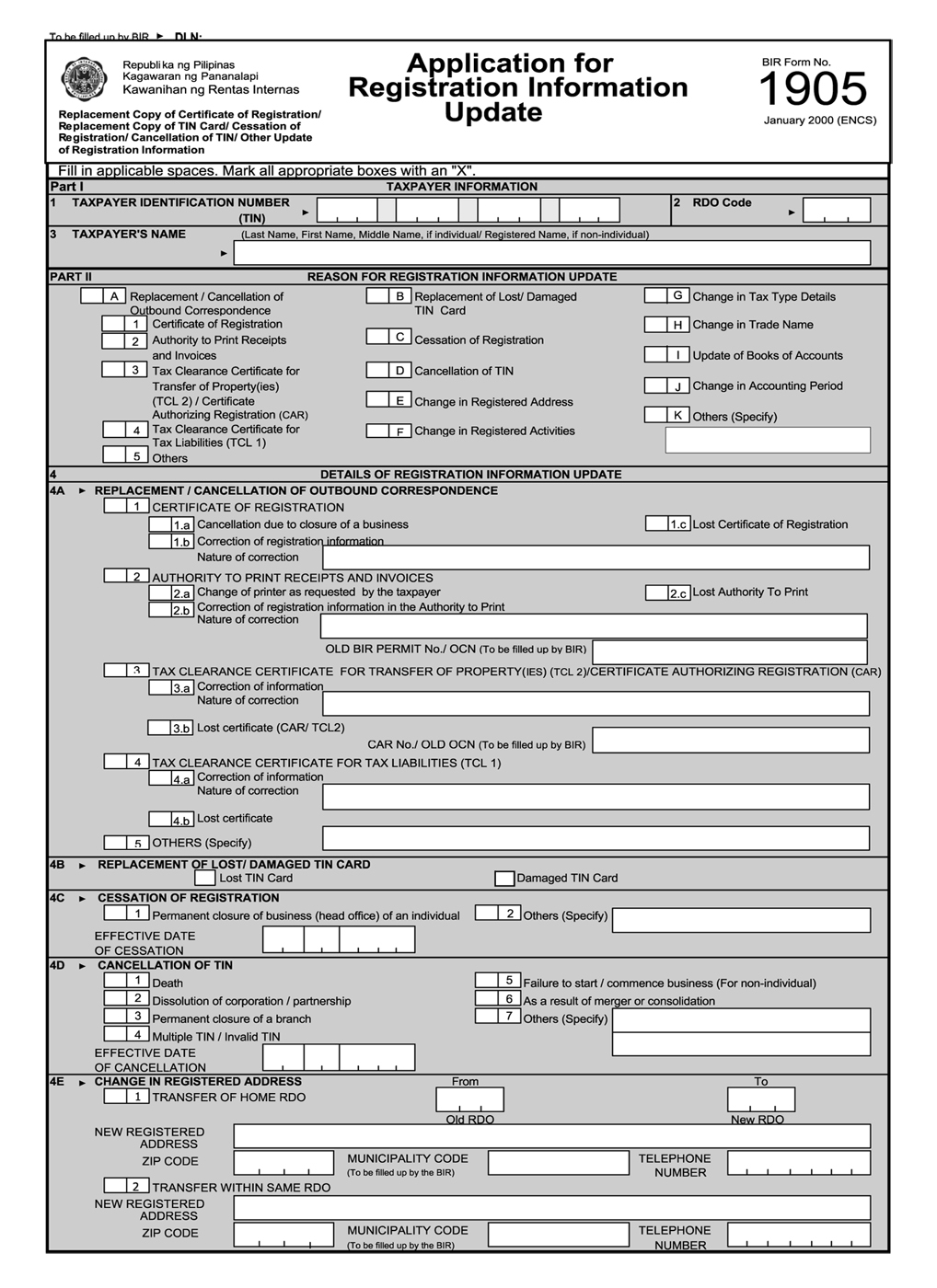

BIR Form 1905 Download

It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. Quarterly income tax return for individuals, estates and trusts. Bureau of internal revenue 1902. Press done after you fill out the form. Web the bir form 1902 is the tax form used to register new employees (either.

BIR Form 1902 Download

New tin to be issued, if applicable (to be filled out by bir) fill in all applicable white spaces. Write “na” for those not applicable. Web to be filled up by bir dln: Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration. Web annual income tax return for individuals.

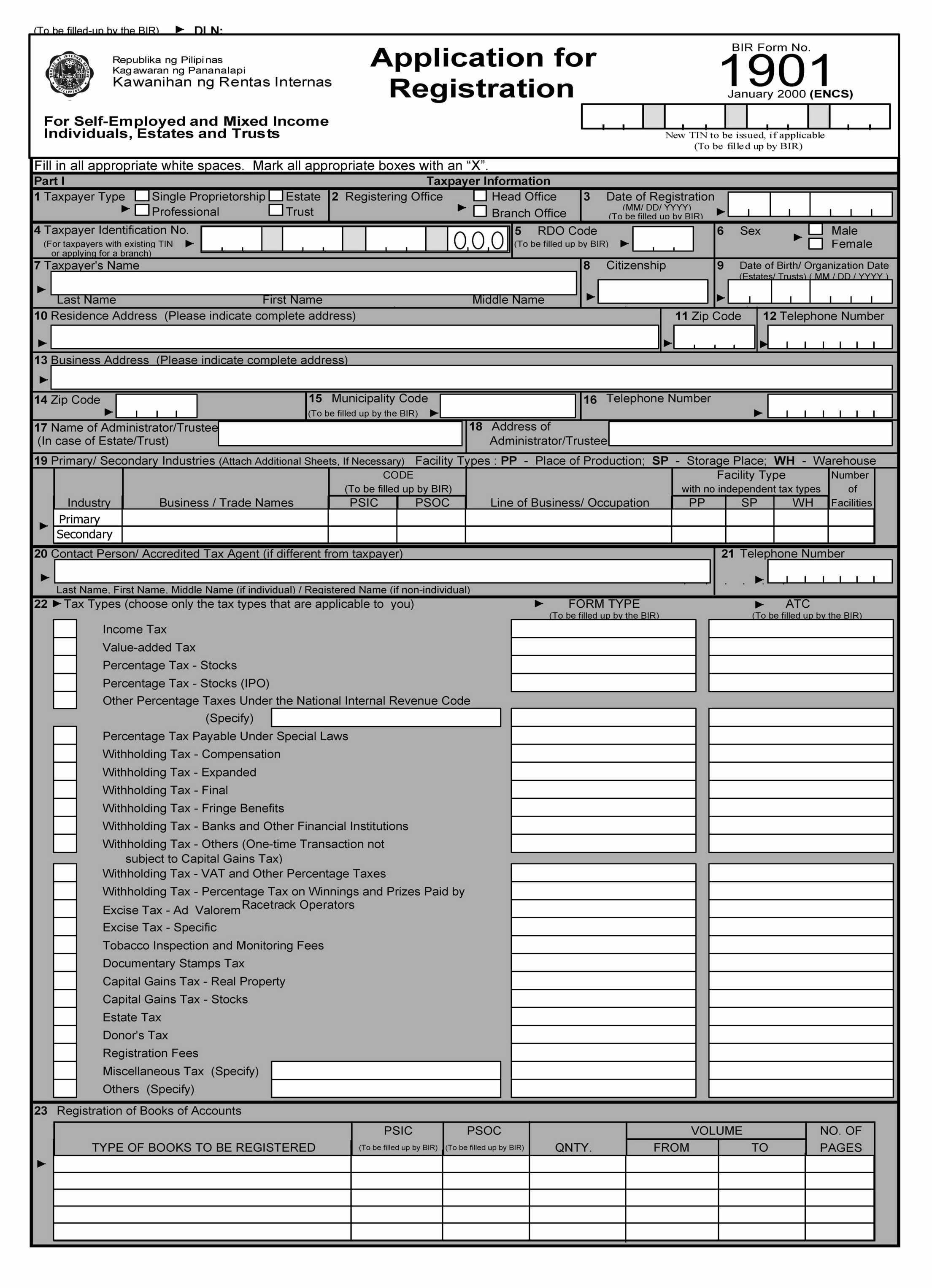

BIR Form 1901 Everything You Need to Know FullSuite

It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. Quarterly income tax return for individuals, estates and trusts. This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs.

Bir Form 1902

Bureau of internal revenue 1902. Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration. Now you'll be able to print, download, or share the form. It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return. This.

Web The Bir Form 1902 Is The Tax Form Used To Register New Employees (Either With One Employer Or Multiple Employers) In The Philippines.

Web submit bir form 1902 to the revenue district office (rdo) having jurisdiction over the place of office of the employer where such employee is expected to report for work. New tin to be issued, if applicable (to be filled out by bir) fill in all applicable white spaces. Bureau of internal revenue 1902. Web use the sign tool to create and add your electronic signature to signnow the bir form 1902 online registration.

Write “Na” For Those Not Applicable.

This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the international tax affairs division (itad) of the bureau of internal revenue. Address the support section or contact our support staff in case you have any concerns. Press done after you fill out the form. Quarterly income tax return for individuals, estates and trusts.

January 2018 (Encs) For Individuals Earning Purely Compensation Income.

Web get a bir 1902 here. (photocopy only) for individuals earning purely compensation income Now you'll be able to print, download, or share the form. Web annual income tax return for individuals earning income purely from business/profession (those under the graduated income tax rates with osd as mode of deduction or those who opted to avail of the 8% flat income tax rate) 1701q.

Web To Be Filled Up By Bir Dln:

Deadline › new employees shall accomplish and file the. It should be filed within 10 days from the hiring date, or before paying any income tax due or filing a tax return.