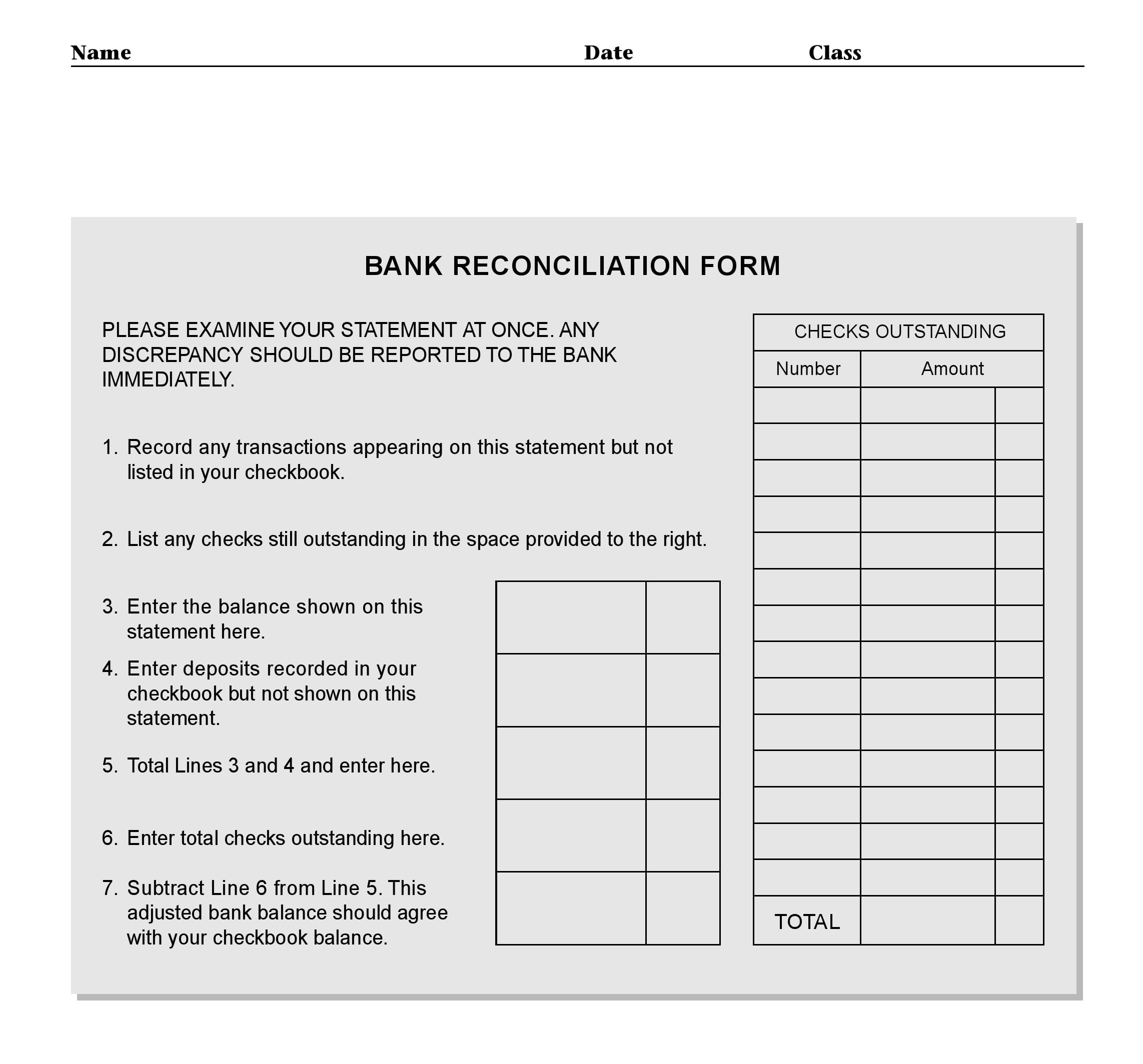

Blank Bank Reconciliation Form

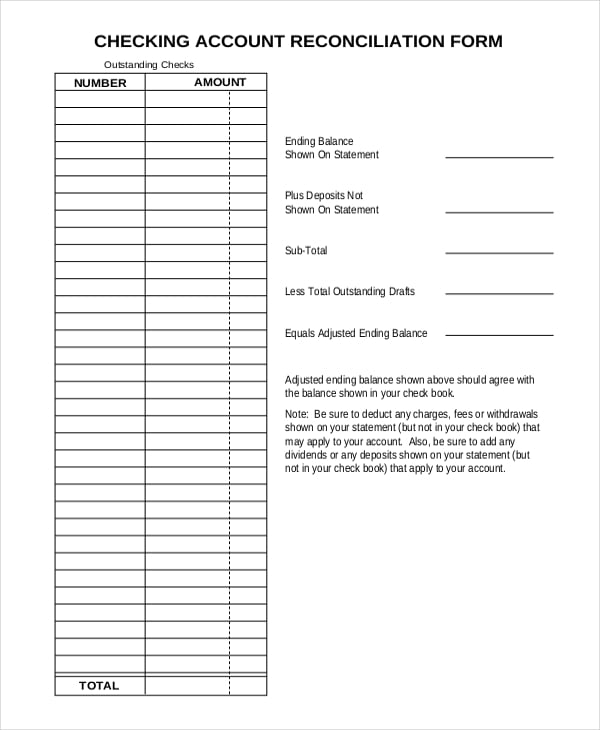

Blank Bank Reconciliation Form - Spot fraudulent transactions and theft; Keeping track of accounts payable and receivables of the business; Tracking and adding bank fees and penalties in the books; Web download the free template. Detecting errors such as double payments, missed payments, calculation errors etc. Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register; Reconciling the two accounts helps identify whether accounting changes are needed. Verify additions and subtractions above and in your check register; You can customize all of the templates offered below for business use or for reconciling personal accounts. It has three columns for add, less, and equal for recording the different amounts.

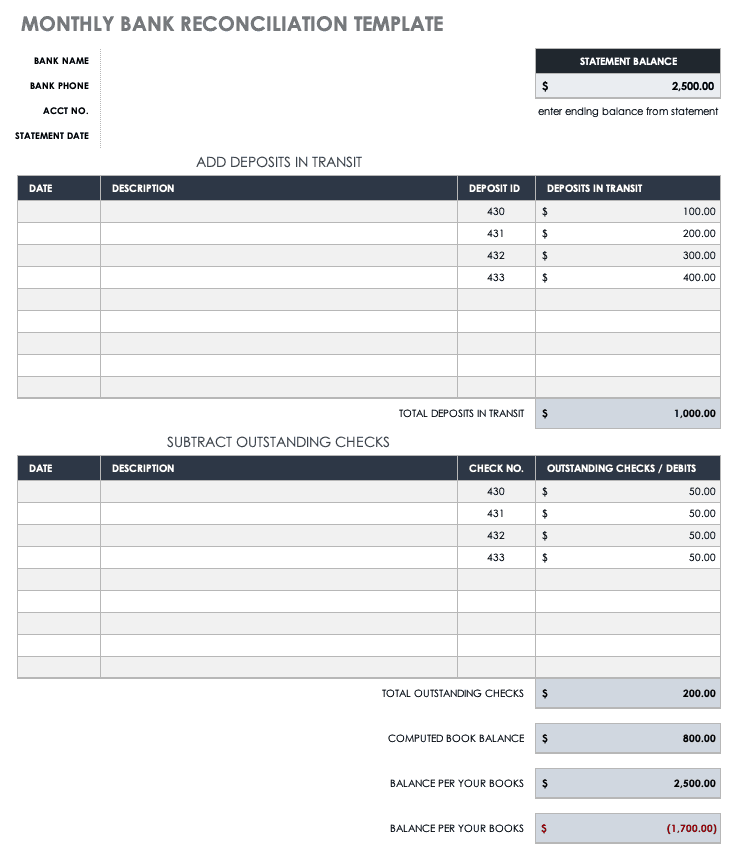

Be sure to deduct any. Verify additions and subtractions above and in your check register; It has three columns for add, less, and equal for recording the different amounts. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Detecting errors such as double payments, missed payments, calculation errors etc. Spot fraudulent transactions and theft; Web updated april 17, 2023 what is a bank reconciliation? Your bank reconciliation form can be as simple or as detailed as you like. In the case of personal bank accounts, like. Tracking and adding bank fees and penalties in the books;

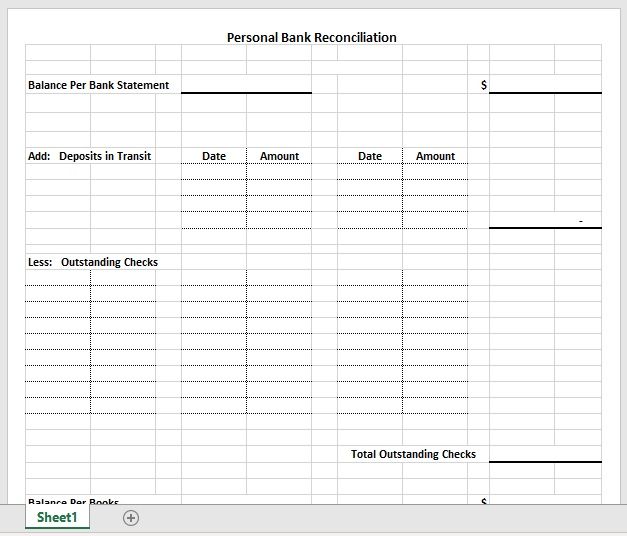

Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. In the case of personal bank accounts, like. Spot fraudulent transactions and theft; It has three columns for add, less, and equal for recording the different amounts. Be sure to deduct any. Below is a good example of a simple reconciliation form. Verify additions and subtractions above and in your check register; Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register; Detecting errors such as double payments, missed payments, calculation errors etc.

50+ Bank Reconciliation Examples & Templates [100 Free]

The total adjusted bank balance is written in the end. Keeping track of accounts payable and receivables of the business; Web if you do not balance 1. Below is a good example of a simple reconciliation form. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections.

Free Account Reconciliation Templates Smartsheet

Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register; Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. The total adjusted bank balance.

50+ Bank Reconciliation Examples & Templates [100 Free]

It has three columns for add, less, and equal for recording the different amounts. Web if you do not balance 1. Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding.

20+ Free Bank Reconciliation Sheet Templates Printable Samples

Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Compare the dollar amounts of checks listed on this statement with the check amounts listed in our check register; You can customize all of the templates offered below for business use or for reconciling personal accounts. Verify additions.

Bank Statement Reconciliation Form Business Mentor

Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Web the bank reconciliation process offers several advantages including: Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Keeping track of accounts payable and receivables of the business; What are the uses of.

Bank Statement Reconciliation Template

Web blank bank reconciliation form records the cash book and bank statement summary for the account. Web if you do not balance 1. Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to.

Bank Statement Template 28+ Free Word, PDF Document Downloads

Web download the free template. For more financial management tools, download cash flow and other accounting templates. Spot fraudulent transactions and theft; Web blank bank reconciliation form records the cash book and bank statement summary for the account. Verify additions and subtractions above and in your check register;

Bank Reconciliation Template Excel Free Download Of 5 Payroll

Web if you do not balance 1. Detecting errors such as double payments, missed payments, calculation errors etc. It has three columns for add, less, and equal for recording the different amounts. Web the bank reconciliation process offers several advantages including: Verify additions and subtractions above and in your check register;

50+ Bank Reconciliation Examples & Templates [100 Free]

Spot fraudulent transactions and theft; A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Be sure to deduct any. You can customize all of the templates offered below for business use or for reconciling personal accounts. Web bank reconciliation is the process of comparing.

Free Bank Reconciliation Form PDF Template Form Download

Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. You can customize all of the templates offered below for business use or for reconciling personal accounts. The total adjusted bank balance is written in the end. Detecting errors such as double payments, missed payments, calculation errors etc..

Your Bank Reconciliation Form Can Be As Simple Or As Detailed As You Like.

The total adjusted bank balance is written in the end. Detecting errors such as double payments, missed payments, calculation errors etc. For more financial management tools, download cash flow and other accounting templates. Web download the free template.

A Bank Reconciliation Statement Is A Document That Matches The Cash Balance On A Company’s Balance Sheet To The Corresponding Amount On Its Bank Statement.

Reconciling the two accounts helps identify whether accounting changes are needed. Enter your name and email in the form below and download the free template now! In the case of personal bank accounts, like. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement.

Tracking And Adding Bank Fees And Penalties In The Books;

Web the bank reconciliation process offers several advantages including: Be sure to deduct any. Web if you do not balance 1. It has three columns for add, less, and equal for recording the different amounts.

Keeping Track Of Accounts Payable And Receivables Of The Business;

Compare the dollar amounts of deposits listed on this statement with the deposit amounts recorded in your check register. Spot fraudulent transactions and theft; What are the uses of this form? Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-34.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-20.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-37.jpg)