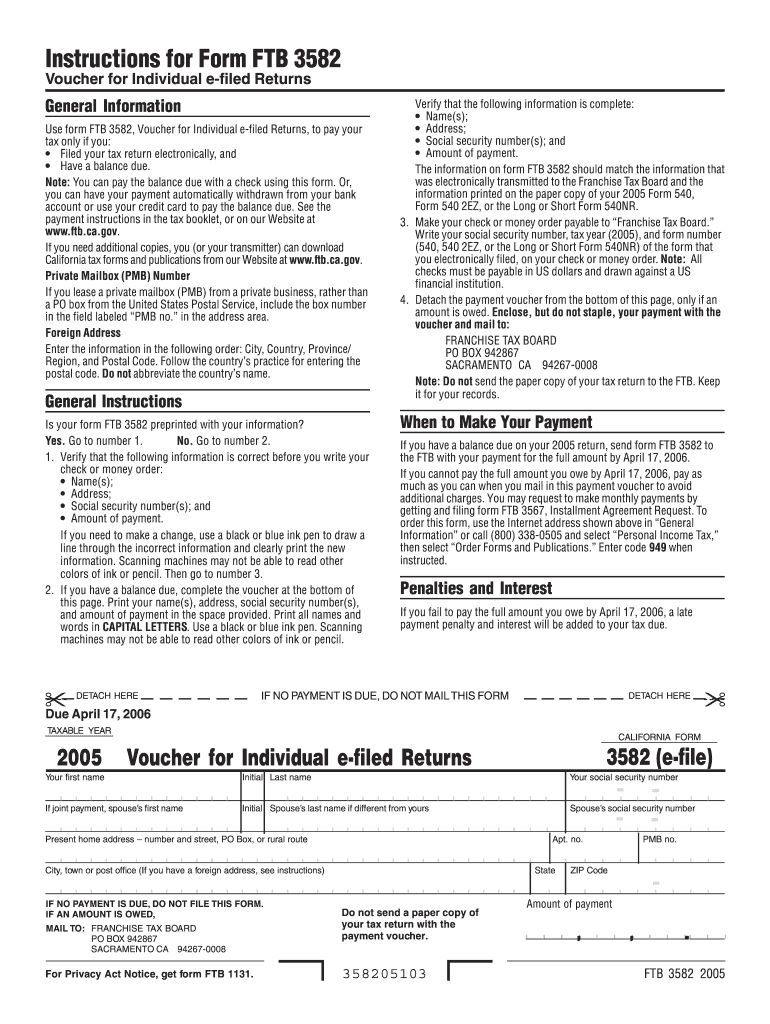

Ca Form 3582

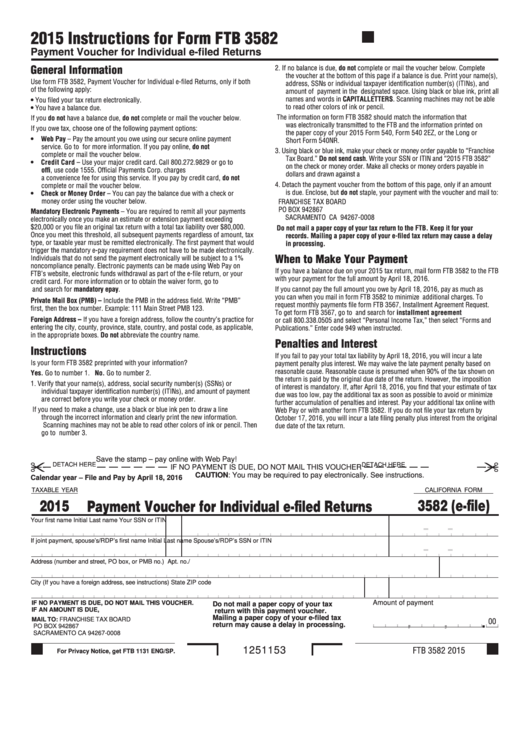

Ca Form 3582 - You filed your amended tax return electronically. Web if you have california taxes due, the form ftb 3582 payment voucher should have been included in your tax return. Web form 3582 is a california individual income tax form. This is listed in the instructions for ca. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web follow our simple steps to have your ca ftb 3582 ready quickly: You can print the form here. Form 5805f, underpayment of estimated tax by farmers and fishermen. You filed your amended tax return electronically. Choose the template you require from our collection of legal forms.

You can print the form here. Web waiver form, go to ftb.ca.gov and search for mandatory epay. Web if you have california taxes due, the form ftb 3582 payment voucher should have been included in your tax return. Ad edit, sign and print tax forms on any device with signnow. Web execute 1382 form california pdf in a few minutes by simply following the guidelines listed below: Web if you have a balance due on your 2020 tax return, mail form ftb 3582 to the ftb with your payment for the full amount by april 15, 2021. You filed your tax return electronically. You filed your amended tax return electronically. Ad download or email ca ftb 3582 & more fillable forms, register and subscribe now! Web california requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status schedule, to report how the hoh filing.

Complete, edit or print tax forms instantly. Web execute 1382 form california pdf in a few minutes by simply following the guidelines listed below: Web california requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status schedule, to report how the hoh filing. Web the california form 3582 is an important tax form for taxpayers in the state. Start completing the fillable fields. We last updated california form 3582 in january 2023 from the california. You filed your amended tax return electronically. Web if you have california taxes due, the form ftb 3582 payment voucher should have been included in your tax return. Web why is the california form 3582, payment voucher not producing? Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

California 3582

You filed your amended tax return electronically. This form is used to report estimated tax payments, and it must be filed each year by april 18th. Complete, edit or print tax forms instantly. You filed your tax return electronically. You filed your tax return electronically.

DSC_3582 AWIN

We last updated california form 3582 in january 2023 from the california. Web why is the california form 3582, payment voucher not producing? Web waiver form, go to ftb.ca.gov and search for mandatory epay. You filed your amended tax return electronically. Web the california form 3582 is an important tax form for taxpayers in the state.

Lincoln, CA 4 Bedroom Homes for Sale

You can print the form here. Ad edit, sign and print tax forms on any device with signnow. You filed your tax return electronically. You have a balance due and pay. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

Ca Form 3522 amulette

Web the california form 3582 is an important tax form for taxpayers in the state. This form is used to report estimated tax payments, and it must be filed each year by april 18th. Ad edit, sign and print tax forms on any device with signnow. Web follow our simple steps to have your ca ftb 3582 ready quickly: Web.

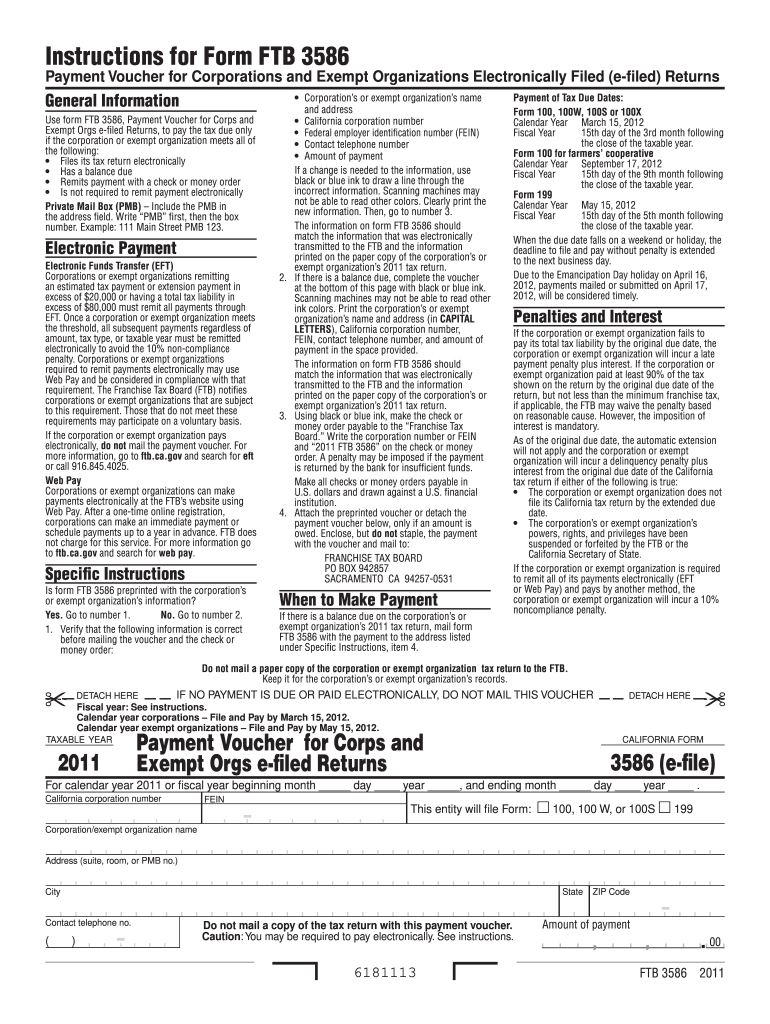

Form 3586 2019 Fill Online, Printable, Fillable, Blank pdfFiller

Start completing the fillable fields. Web waiver form, go to ftb.ca.gov and search for mandatory epay. Ad edit, sign and print tax forms on any device with signnow. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Get ready for tax season deadlines by completing any required tax forms today.

Fillable Form 3582 California Payment Voucher For Individual EFiled

Form 5805f, underpayment of estimated tax by farmers and fishermen. Web follow our simple steps to have your ca ftb 3582 ready quickly: Web if you have a balance due on your 2020 tax return, mail form ftb 3582 to the ftb with your payment for the full amount by april 15, 2021. Ad edit, sign and print tax forms.

3582 W Holland Ave, Fresno, CA 93722

Pick the web sample from the library. You filed your tax return electronically. If you cannot pay the full amount you owe. Web form 3582 is a california individual income tax form. Get ready for tax season deadlines by completing any required tax forms today.

3582 Camino Arena, Carlsbad, CA 92009 MLS 180014296 Redfin

Web california requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status schedule, to report how the hoh filing. Get ready for tax season deadlines by completing any required tax forms today. Web form 3582 is a california individual income tax form. We last updated california form 3582 in january.

N° 3582 The Nanz Company

Web waiver form, go to ftb.ca.gov and search for mandatory epay. Use get form or simply click on the template preview to open it in the editor. You filed your amended tax return electronically. Choose the template you require from our collection of legal forms. Web if you have california taxes due, the form ftb 3582 payment voucher should have.

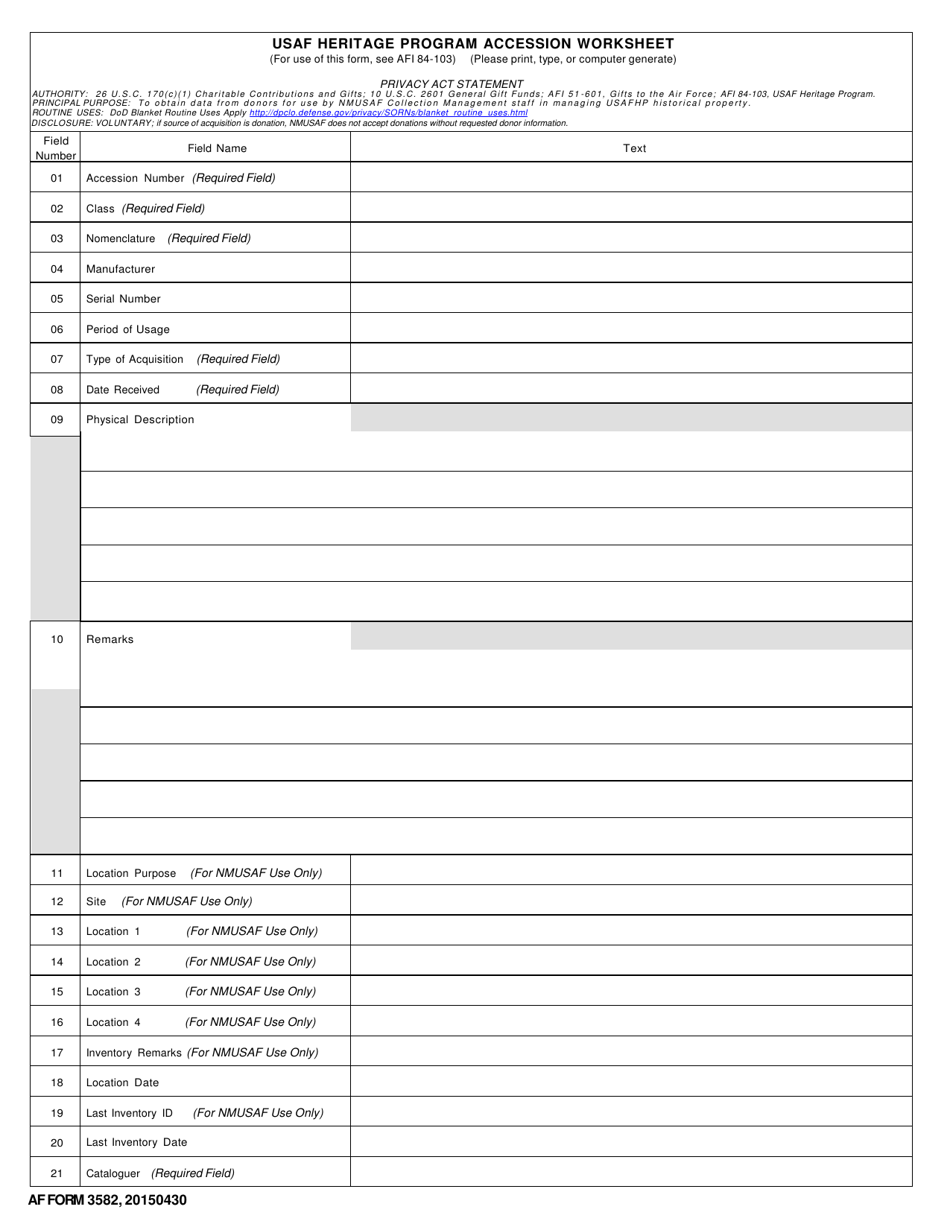

AF Form 3582 Download Fillable PDF or Fill Online USAF Heritage Program

Pick the web sample from the library. Web if you have california taxes due, the form ftb 3582 payment voucher should have been included in your tax return. If you cannot pay the full amount you owe. Web form 3582 is a california individual income tax form. You filed your tax return electronically.

This Form Is Used To Report Estimated Tax Payments, And It Must Be Filed Each Year By April 18Th.

Get ready for tax season deadlines by completing any required tax forms today. You filed your tax return electronically. You have a balance due and pay. You filed your amended tax return electronically.

Pick The Web Sample From The Library.

Web if you have a balance due on your 2020 tax return, mail form ftb 3582 to the ftb with your payment for the full amount by april 15, 2021. You can print the form here. Ad download or email ca ftb 3582 & more fillable forms, register and subscribe now! Web the california form 3582 is an important tax form for taxpayers in the state.

Form 5805F, Underpayment Of Estimated Tax By Farmers And Fishermen.

If you cannot pay the full amount you owe. Complete, edit or print tax forms instantly. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields.

Type All Required Information In The Necessary Fillable Areas.

You have a balance due and pay. Web form 3582 is a california individual income tax form. Web waiver form, go to ftb.ca.gov and search for mandatory epay. Ad edit, sign and print tax forms on any device with signnow.