Ca Form 568 Due Date

Ca Form 568 Due Date - References in these instructions are to the internal revenue code (irc) as of. 565 form (pdf) | 565 booklet; Web do not mail the $800 annual tax with form 568. Web our due dates apply to both calendar and fiscal tax years. All california llcs must file form 568. You and your clients should be aware that a disregarded smllc is required to: Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) Web smllcs, owned by an individual, are required to file form 568 on or before april 15.

565 form (pdf) | 565 booklet; 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) There is a difference between how california treats businesses vs federal. Open an llc to register or organize an llc in california, contact the secretary of state (sos): 2022 personal income tax returns due and tax due. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. The 15th day of 3rd month after end of their tax year. If the due date falls on a weekend or. Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information.

Open an llc to register or organize an llc in california, contact the secretary of state (sos): Web do not mail the $800 annual tax with form 568. You and your clients should be aware that a disregarded smllc is required to: 2022 personal income tax returns due and tax due. The 15th day of 3rd month after end of their tax year. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. There is a difference between how california treats businesses vs federal. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35.

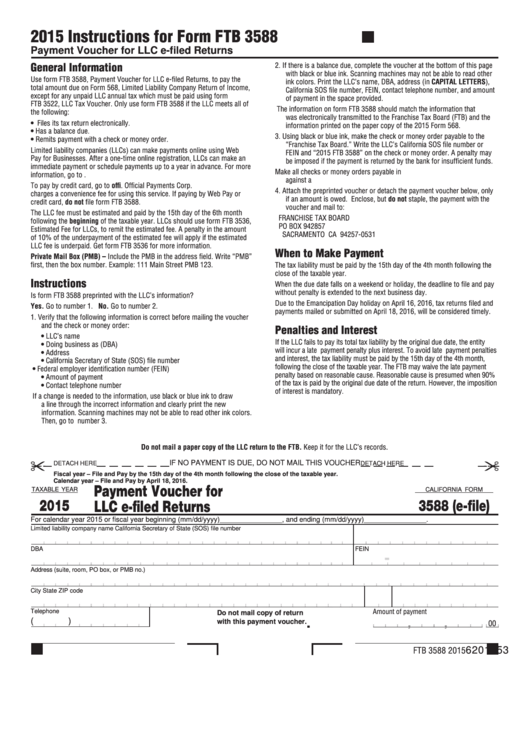

Fillable Form 3588 (EFile) Payment Voucher For Llc EFiled Returns

References in these instructions are to the internal revenue code (irc) as of. Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. 565 form (pdf) | 565 booklet; Aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. You can find out how much you.

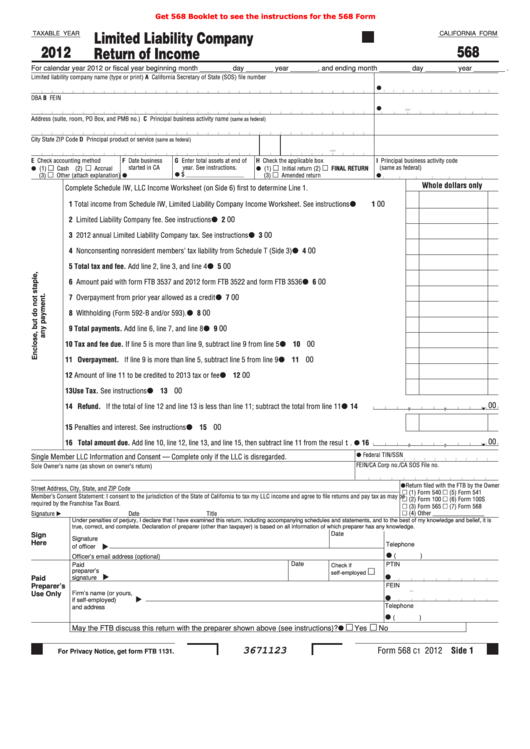

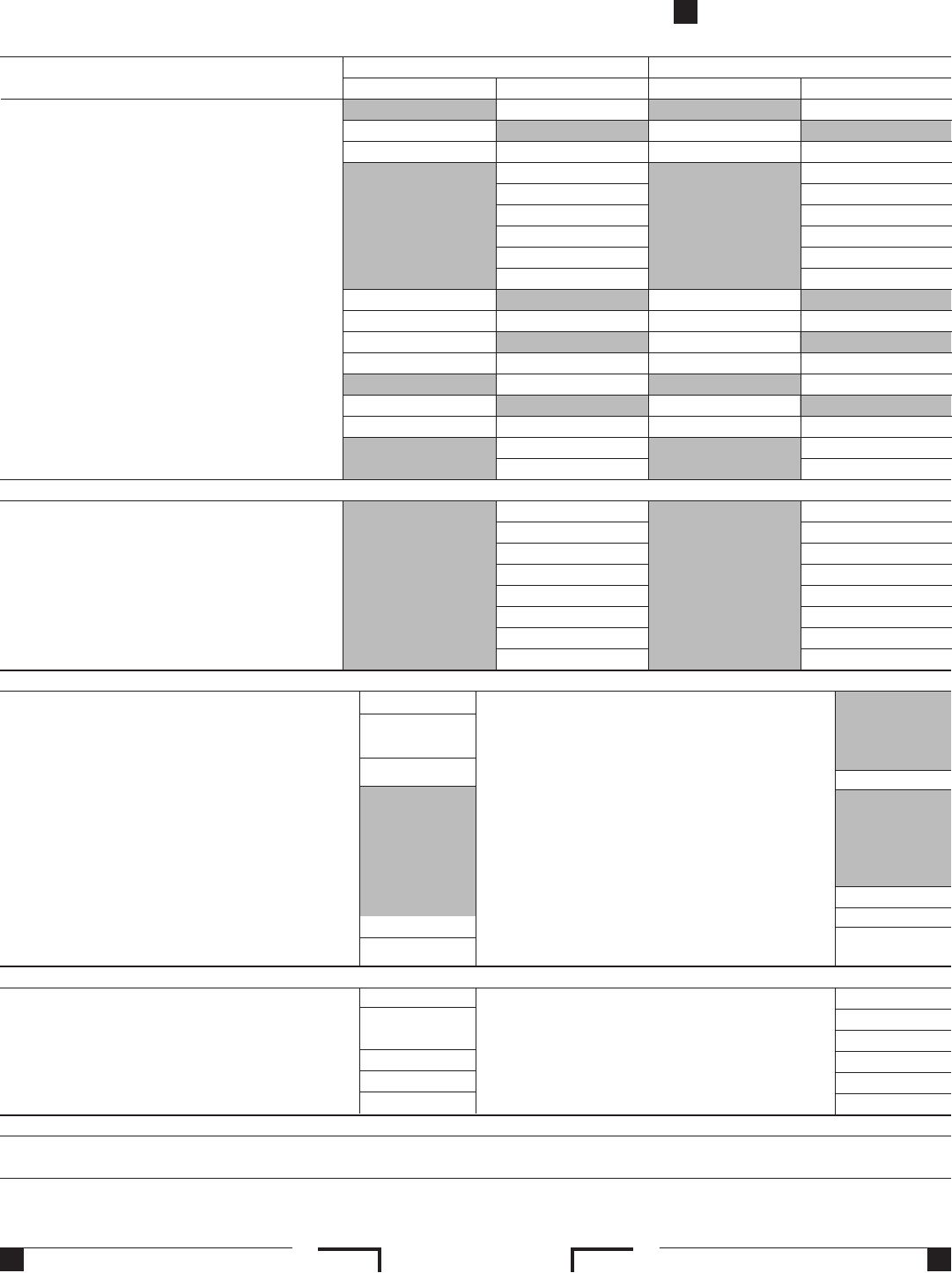

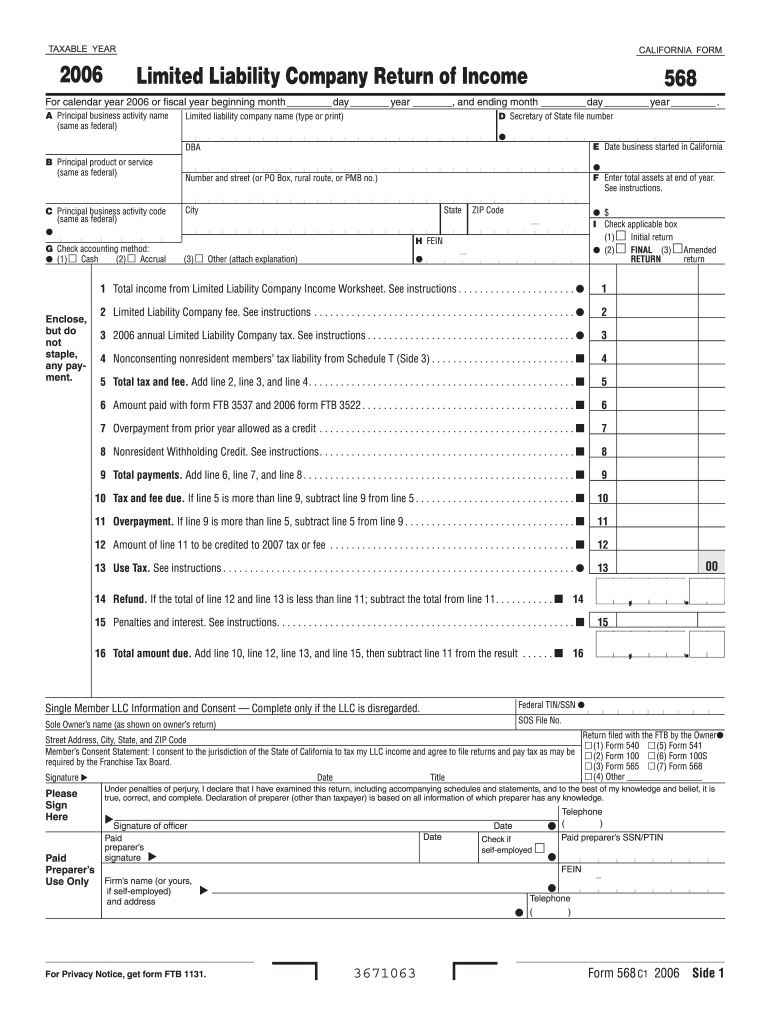

Fillable California Form 568 Limited Liability Company Return Of

Web 2022 instructions for form 568, limited liability company return of income. Web our due dates apply to both calendar and fiscal tax years. 568 form (pdf) | 568 booklet; 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) Web form 568 payment due date.

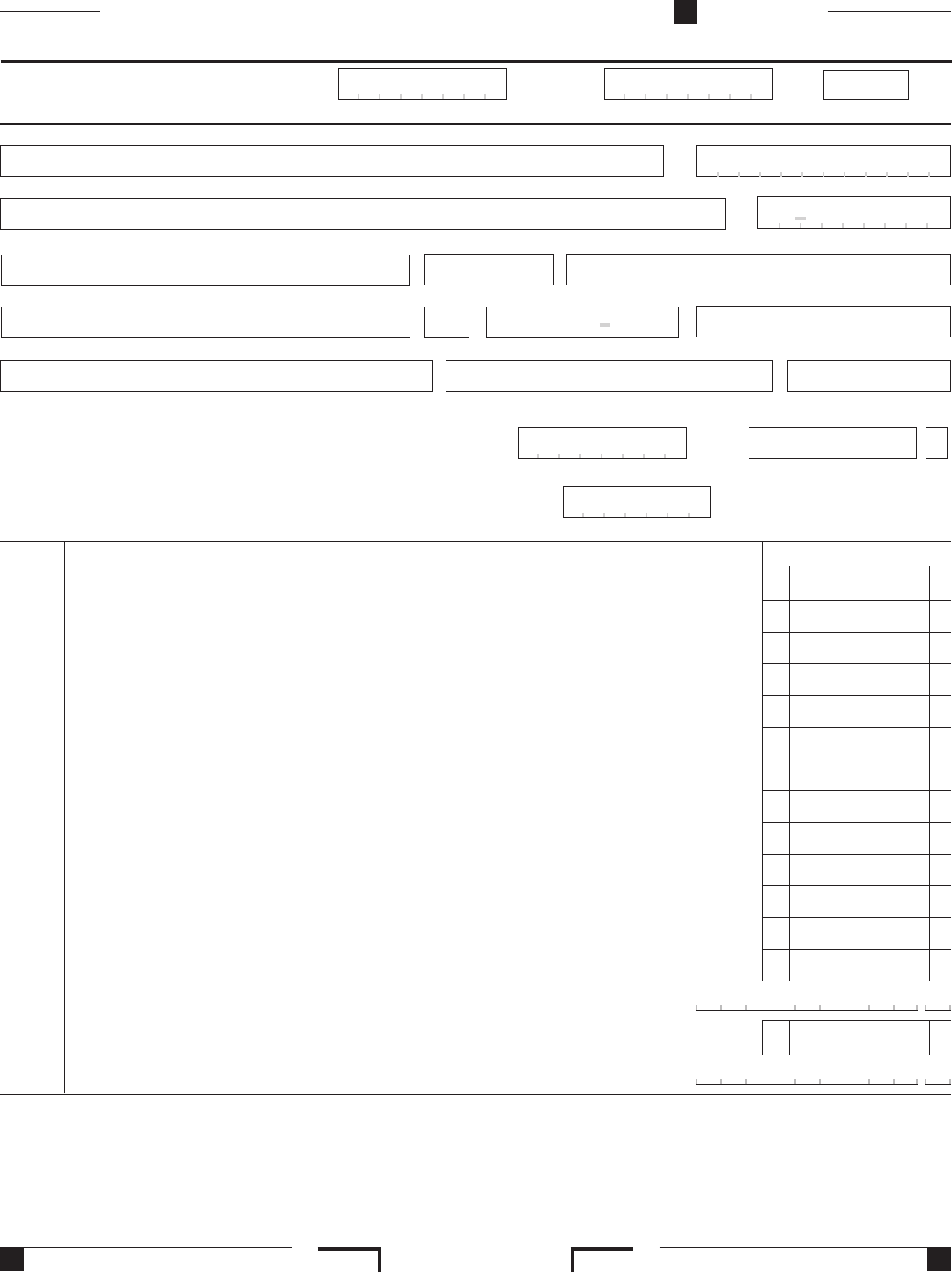

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web our due dates apply to both calendar and fiscal tax years. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. References in these instructions are to the internal revenue code (irc) as of. Due to the federal emancipation day holiday observed on april 17, 2023, tax returns filed and payments mailed.

CA FTB 568 2019 Fill out Tax Template Online US Legal Forms

If the due date falls on a weekend or. References in these instructions are to the internal revenue code (irc) as of. Web 2022 instructions for form 568, limited liability company return of income. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. When the due date falls on a.

CA Form 568 Due Dates 2022 State And Local Taxes Zrivo

January 1, 2015, and to the california revenue and taxation code (r&tc). Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. Web our due dates apply to both calendar and fiscal tax years. Web series limited liability company an llc being taxed as a corporation an.

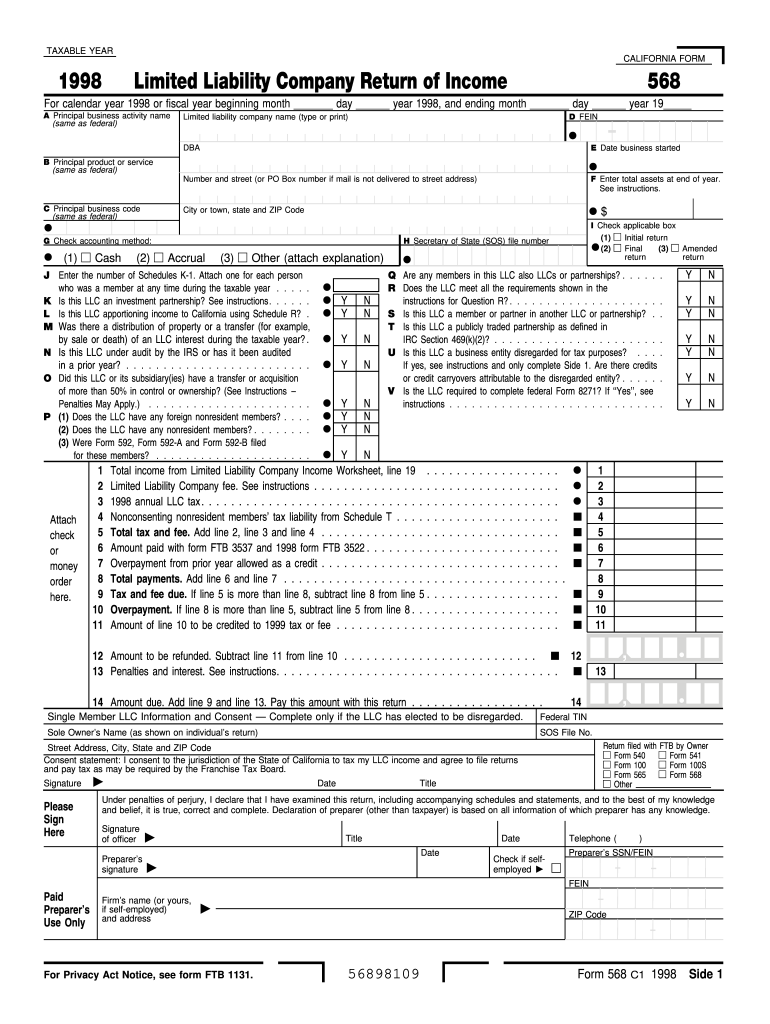

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web 2022 instructions for form 568, limited liability company return of income. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. There is a difference between how california treats businesses vs federal. For example,.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

2022 personal income tax returns due and tax due. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) References in these instructions are to the internal revenue code (irc) as of. Filing a limited liability company return of income (form 568) to the california franchise tax board registers your california llc.

CA FTB 568 2006 Fill out Tax Template Online US Legal Forms

Aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. Web 2022 instructions for form 568, limited liability company return of income. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. If an llc fails.

NEW! Ca Form 568 Instructions 2020 Coub

2022 personal income tax returns due and tax due. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web 2022 instructions for form 568, limited liability company return of income. 568 form (pdf) | 568 booklet; References in these instructions are to the internal revenue code (irc) as of.

Form 568 Instructions 2022 2023 State Tax TaxUni

There is a difference between how california treats businesses vs federal. Web form 568 payment due date. Filing a limited liability company return of income (form 568) to the california franchise tax board registers your california llc with california. Web 2022 instructions for form 568, limited liability company return of income. All california llcs must file form 568.

If The Due Date Falls On A Weekend Or.

Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. If an llc fails to file the form on time, they will need to pay a late fee. Web 2022 instructions for form 568, limited liability company return of income. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers).

Filing A Limited Liability Company Return Of Income (Form 568) To The California Franchise Tax Board Registers Your California Llc With California.

The 15th day of 3rd month after end of their tax year. 565 form (pdf) | 565 booklet; Web this tax amounts to $800 for every type of entity and is due on april 15 every year. References in these instructions are to the internal revenue code (irc) as of.

You And Your Clients Should Be Aware That A Disregarded Smllc Is Required To:

Web do not mail the $800 annual tax with form 568. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. 2022 personal income tax returns due and tax due.

Form 3522, Or The Llc Tax Voucher, Needs To Be Filed To Pay The Franchise Tax.

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web form 568 payment due date. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information.