Calendar Spread Futures

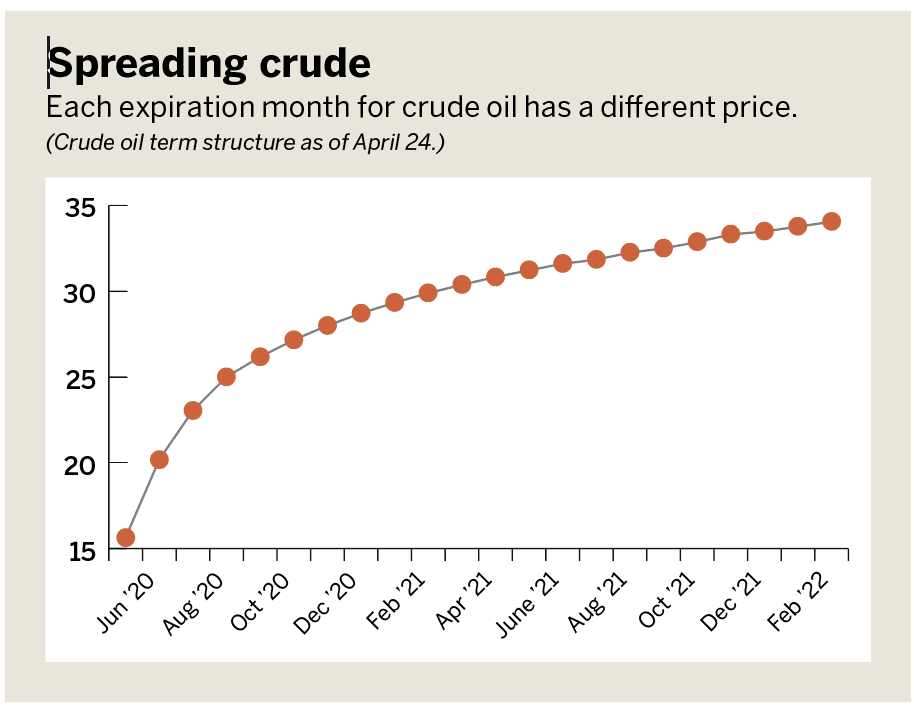

Calendar Spread Futures - Web learn about different types of futures spreads, such as intramarket, intermarket and commodity product spreads, and how they can be used for hedging or. Web a futures spread is an arbitrage technique that involves taking two offsetting positions on a commodity to profit from price differences. Learn how it can be used to profit from implied volatility, how. Investors take into account the time differences between two options to realise a profit. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying. Die strategie wird am besten. Web calendar spreads mit optionen. Web a calendar spread, also known as a horizontal spread or time spread, is a popular trading strategy in futures trading.

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. For its nature, calendar spread deals are also known as. Compare long and short call and put calendar spreads with. Web learn how to trade option calendar spreads, which are combinations of calls or puts with different expiration dates and the same strike price. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Die strategie wird am besten. Web learn how to use calendar spreads with options and futures to profit from time decay and volatility. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Investors take into account the time differences between two options to realise a profit. It involves the simultaneous purchase and.

Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. It involves the simultaneous purchase and. Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying. Die strategie wird am besten. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Learn how it can be used to profit from implied volatility, how. Beim calendar spread werden optionen auf den selben basiswert aber mit unterschiedlichen laufzeiten verwendet. Learn about the types of. Web a futures spread is an arbitrage technique that involves taking two offsetting positions on a commodity to profit from price differences. Web calendar spreads mit optionen.

Calendar Spreads in Futures and Options Trading Explained

Investors take into account the time differences between two options to realise a profit. Web a futures spread is an arbitrage technique that involves taking two offsetting positions on a commodity to profit from price differences. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same.

Leg Up on Futures Calendar Spreading luckbox magazine

Compare long and short call and put calendar spreads with. Web learn how to trade option calendar spreads, which are combinations of calls or puts with different expiration dates and the same strike price. Web learn what futures spread is and how it can be used to benefit from price discrepancies in different futures contracts. Die strategie wird am besten..

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying. Die strategie wird am besten. Web learn how to use calendar spreads with options and futures to profit from time decay and volatility. Web learn about different types of futures spreads,.

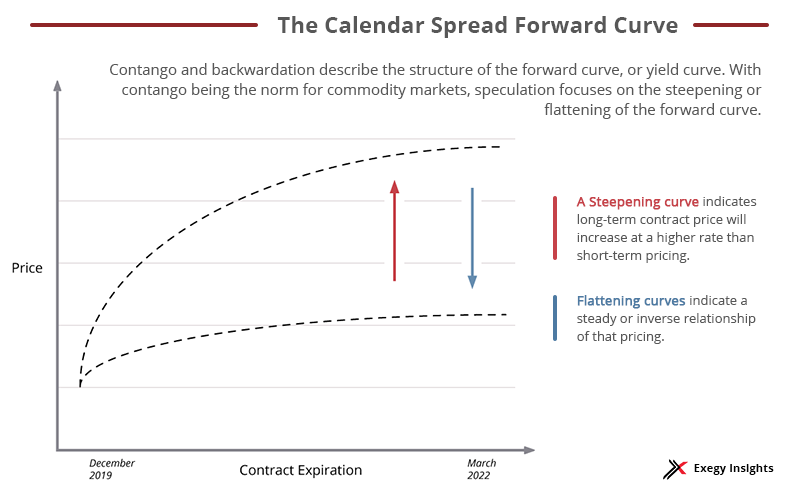

Getting Started with Calendar Spreads in Futures Exegy

Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying. Learn about the types of. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and.

Futures Calendar Spreads on Interactive Brokers 30 Day Trading

Web a futures spread is an arbitrage technique that involves taking two offsetting positions on a commodity to profit from price differences. Web calendar spreads mit optionen. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. Beim.

Futures Trading the definitive guide to trading calendar spreads on

Web a calendar spread, also known as a horizontal spread or time spread, is a popular trading strategy in futures trading. Learn about the types of. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Compare calendar spread and commodity. Web.

Calendar Spread Arbitrage Futures Dari Coralyn

Web a futures spread is an arbitrage technique that involves taking two offsetting positions on a commodity to profit from price differences. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Web learn how to construct and profit from long calendar.

Calendar Spread Futures

For its nature, calendar spread deals are also known as. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web die optionsstrategie „neutral calendar spread“ bietet dem investor begrenzte gewinnmöglichkeiten bei ebenso limitiertem risiko. Web a calendar spread is a trade involving the purchase.

Futures Calendar Spread

Compare long and short call and put calendar spreads with. Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Investors.

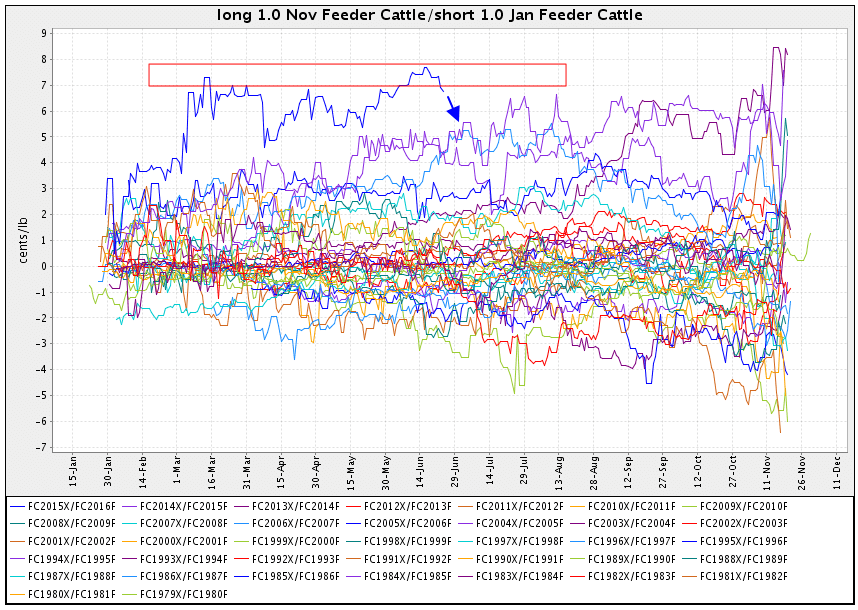

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Web die optionsstrategie „neutral calendar spread“ bietet dem investor begrenzte gewinnmöglichkeiten bei ebenso limitiertem risiko. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. It involves the simultaneous purchase and. Web learn how to construct and profit from long calendar spreads,.

Web Learn What Futures Spread Is And How It Can Be Used To Benefit From Price Discrepancies In Different Futures Contracts.

Web a calendar spread, also known as a horizontal spread or time spread, is a popular trading strategy in futures trading. Beim calendar spread werden optionen auf den selben basiswert aber mit unterschiedlichen laufzeiten verwendet. Compare calendar spread and commodity. Compare long and short call and put calendar spreads with.

Learn About The Types Of.

Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike. Web a calendar spread is a trade involving the purchase and sale of futures or options with different expiration dates. Web learn how to use calendar spreads with options and futures to profit from time decay and volatility. Web a calendar spread is a trading strategy in which an investor simultaneously buys and sells two futures or options contracts with different expiration dates for the same underlying.

Web Die Optionsstrategie „Neutral Calendar Spread“ Bietet Dem Investor Begrenzte Gewinnmöglichkeiten Bei Ebenso Limitiertem Risiko.

Investors take into account the time differences between two options to realise a profit. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Die strategie wird am besten. Web learn about different types of futures spreads, such as intramarket, intermarket and commodity product spreads, and how they can be used for hedging or.

For Its Nature, Calendar Spread Deals Are Also Known As.

Web learn how to trade option calendar spreads, which are combinations of calls or puts with different expiration dates and the same strike price. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web calendar spreads mit optionen.

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)