Calendar Spread Using Calls

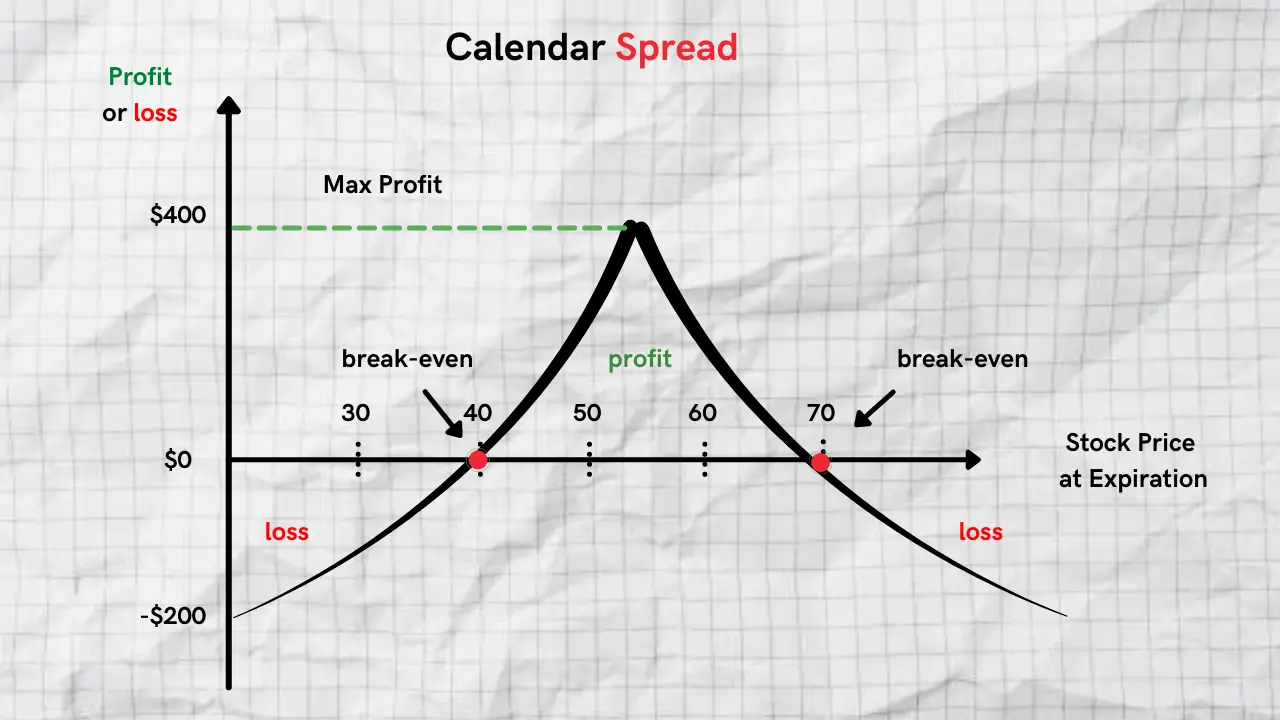

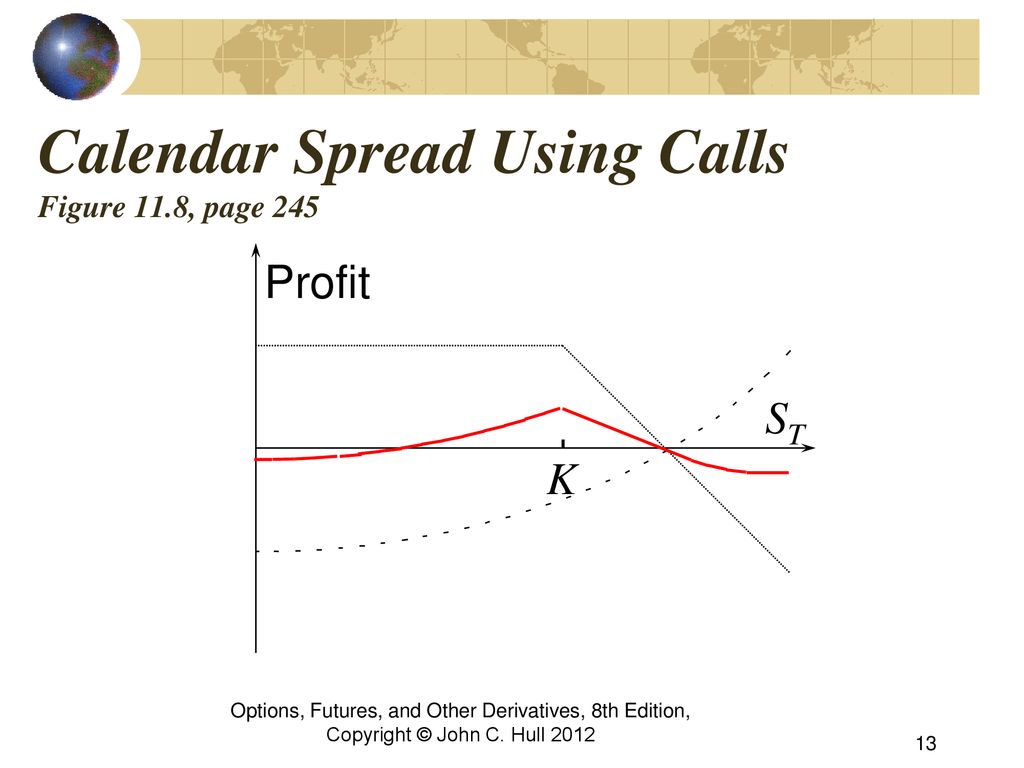

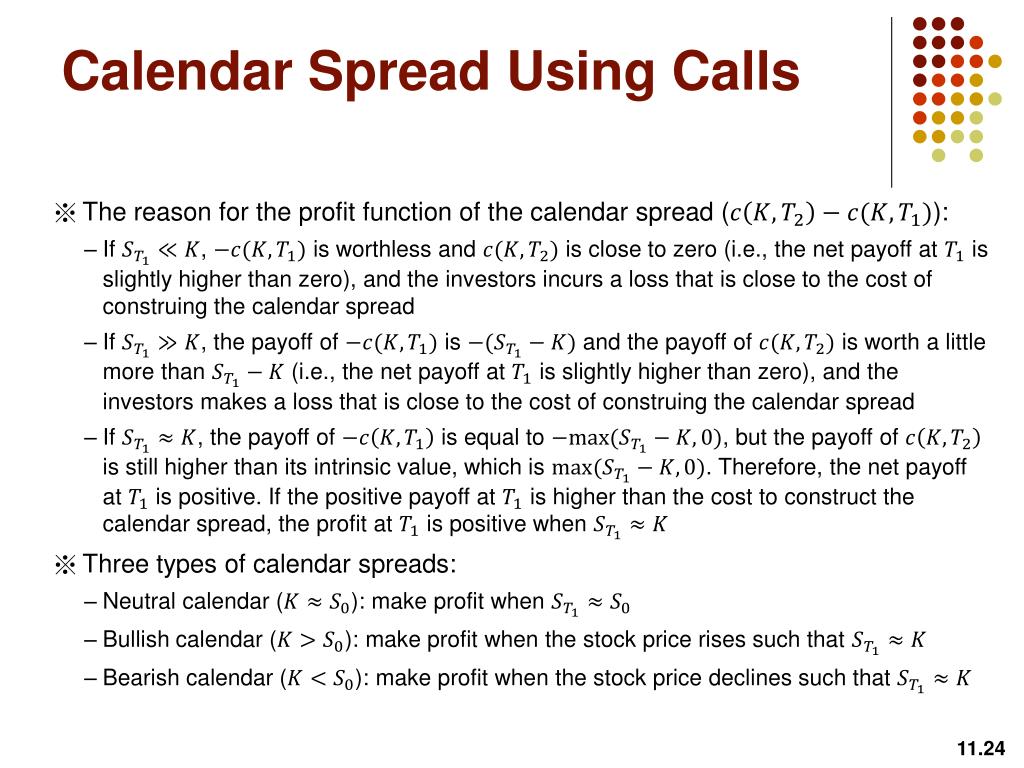

Calendar Spread Using Calls - I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. The strategy most commonly involves calls with. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Web click the “calls and puts” tab at the top to switch to the chain view. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. They can use atm (at the money). Click the bid or ask price of the options you already own to add them as legs of the spread.

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. They can use atm (at the money). Web click the “calls and puts” tab at the top to switch to the chain view. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Click the bid or ask price of the options you already own to add them as legs of the spread. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call.

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. The strategy most commonly involves calls with. They can use atm (at the money). Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Click the bid or ask price of the options you already own to add them as legs of the spread. Web click the “calls and puts” tab at the top to switch to the chain view.

Long Calendar Spread with Calls Strategy With Example

Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. Click the bid or ask price of the options you already own to add them as legs of the spread. Web when you invest in a calendar spread, you buy and sell the same type of option (either a.

Calendar Call Spread Options Edge

Web click the “calls and puts” tab at the top to switch to the chain view. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Web the calendar call spread is a neutral options trading.

Long Call Calendar Spread Explained (Options Trading Strategies For

Web click the “calls and puts” tab at the top to switch to the chain view. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. The strategy most commonly involves calls with. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web click the “calls and puts” tab at the top to switch to the chain view. They can use atm (at the money). Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Click the bid or.

Calendar Call Spread Strategy

Web click the “calls and puts” tab at the top to switch to the chain view. They can use atm (at the money). Web calendar spreads can be done with calls or with puts, which are virtually equivalent if using same strikes and expirations. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long.

Chapter 11 Trading Strategies Involving Options ppt download

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Click the bid or ask price of the options you already own to add them as legs of the spread. I had briefly introduced the concept of.

PPT Trading Strategies Involving Options PowerPoint Presentation

The strategy most commonly involves calls with. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web calendar spreads enable traders to collect weekly to monthly options premium income with defined risk. Click the bid or.

PPT Trading Strategies Involving Options PowerPoint Presentation

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web click the “calls and puts” tab at the top to switch to the chain view. Web the calendar call spread is a neutral options trading strategy,.

Calendar Call Spread Strategy

Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying.

Calendar Spread using Calls YouTube

Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. They can.

Click The Bid Or Ask Price Of The Options You Already Own To Add Them As Legs Of The Spread.

Web click the “calls and puts” tab at the top to switch to the chain view. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. They can use atm (at the money).

Web Calendar Spreads Enable Traders To Collect Weekly To Monthly Options Premium Income With Defined Risk.

I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. The strategy most commonly involves calls with. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little.

Web Calendar Spreads Can Be Done With Calls Or With Puts, Which Are Virtually Equivalent If Using Same Strikes And Expirations.

Web when you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)