Calendar Year Vs Tax Year

Calendar Year Vs Tax Year - Others use a fiscal year, which. Web an annual accounting period does not include a short tax year. Web the key difference is their alignment with the calendar: 31 for those using the gregorian calendar). Your business's tax return deadline typically corresponds with the last day of its tax year. Web here’s a quick and easy breakdown of the core differences between fiscal and calendar years: The tax years you can use are: Web understanding what each involves can help you determine which to use for accounting or tax purposes. Calendar an icon of a desk calendar. Web many business owners use a calendar year as their company’s tax year.

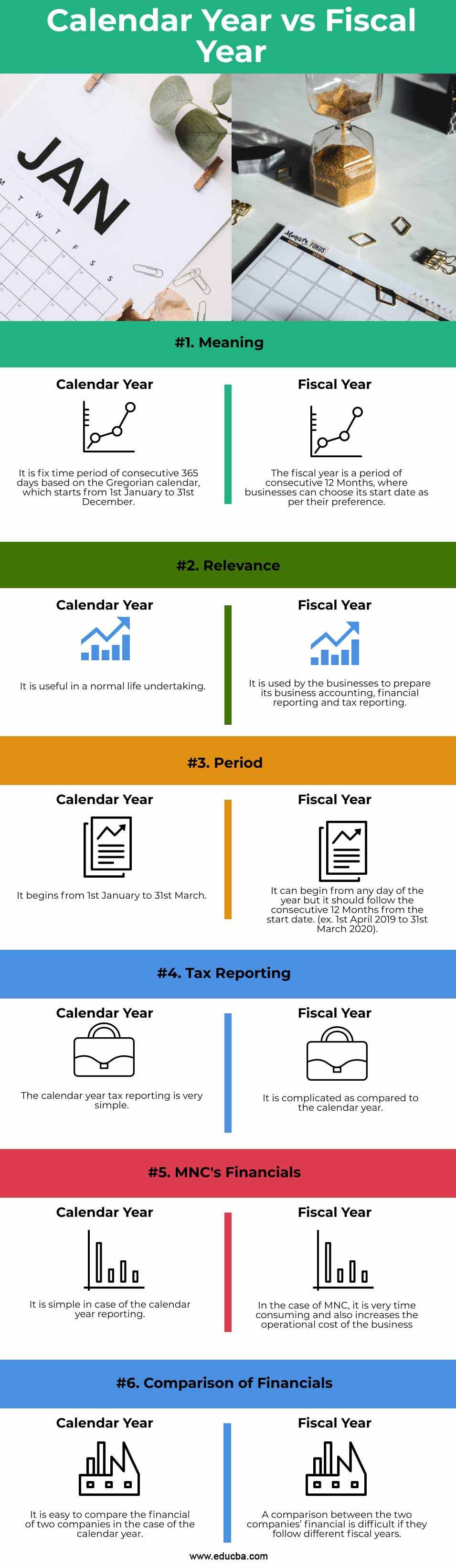

Web understanding what each involves can help you determine which to use for accounting or tax purposes. The tax years you can use are: Web both years have 365 days, but the starting and ending periods differ. In contrast, the latter begins on the first of january and ends every year on the 31st of december. Web here’s a quick and easy breakdown of the core differences between fiscal and calendar years: Web many business owners use a calendar year as their company’s tax year. A calendar year always begins on new year’s day and ends on the last day of the month (jan. Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite ousting him six months into the year. Others use a fiscal year, which. Generally, taxpayers filing a version of form 1040 use the calendar year.

A business's tax year is 12 months used for financial accounting, budgeting, and reporting. While many businesses choose this alignment, some opt for a different fiscal year to better suit their financial. Web an annual accounting period does not include a short tax year. It’s intuitive and aligns with most owners’ personal returns, making it about as simple as anything involving taxes can be. Calendar an icon of a desk calendar. But for some businesses, choosing a fiscal tax year can make more. In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Others use a fiscal year, which. Web understanding what each involves can help you determine which to use for accounting or tax purposes.

Fiscal Year vs Calendar Year Difference and Comparison

Web the tax year can end at different times depending on how a business files taxes. Most other countries begin their year at a different calendar quarter—e.g., april 1 through march 31, july 1 through june 30, or october 1 through september 30. Learn when you should use each. Web an annual accounting period does not include a short tax.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite ousting him six months into the year. Web scotland has been living with minimum unit pricing on alcohol for six years, but will a 15p increase to the policy make a difference? An individual can adopt.

Calendar Vs Fiscal Year Difference Nina Teresa

While many businesses choose this alignment, some opt for a different fiscal year to better suit their financial. A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar. Most other countries begin their year at a different calendar quarter—e.g., april 1 through march 31, july 1 through june 30, or october.

Fillable Online Fiscal Year vs. Tax Year vs. Calendar Year Stash

The start of the financial year is the date that any new tax rates and rules typically come into effect. Calendar an icon of a desk calendar. In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. Web the critical difference between a fiscal.

What is the Difference Between Fiscal Year and Calendar Year

Web calendar year is the period from january 1st to december 31st. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web the fiscal year, a period.

Calendar Year Vs Tax Year 2024 Calendar 2024 Ireland Printable

A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web the key difference is their alignment with the calendar: But for some businesses, choosing a fiscal tax year can make more. Web here’s a quick and easy breakdown of the.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

But for some businesses, choosing a fiscal tax year can make more. Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite ousting him six months into the year. Your business's tax return deadline typically corresponds with the last day of its tax year. Web the.

What is a Fiscal Year? Your GoTo Guide

Web many business owners use a calendar year as their company’s tax year. Generally, taxpayers filing a version of form 1040 use the calendar year. In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. A fiscal year can start and end in any.

Fiscal Year vs Calendar Year Difference and Comparison

Generally, taxpayers filing a version of form 1040 use the calendar year. A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar. A calendar year always begins on new year’s day and ends on the last day of the month (jan. Web the critical difference between a fiscal year and a.

Fiscal Year vs Calendar Year What's The Difference?

A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. Web the fiscal year, a period of 12 months ending on the last day of the month,.

It’s Intuitive And Aligns With Most Owners’ Personal Returns, Making It About As Simple As Anything Involving Taxes Can Be.

The start of the financial year is the date that any new tax rates and rules typically come into effect. Web an annual accounting period does not include a short tax year. Web understanding what each involves can help you determine which to use for accounting or tax purposes. For example, a new corporation tax rate might start on 1st.

Your Business's Tax Return Deadline Typically Corresponds With The Last Day Of Its Tax Year.

But for some businesses, choosing a fiscal tax year can make more. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Generally, taxpayers filing a version of form 1040 use the calendar year. Web for limited companies, the financial year runs from 1st april to 31st march the following year.

A Fiscal Year Can Start.

Others use a fiscal year, which. Calendar an icon of a desk calendar. Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web the key difference is their alignment with the calendar:

Web Calendar Year Is The Period From January 1St To December 31St.

A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar. In contrast, the latter begins on the first of january and ends every year on the 31st of december. Web here’s a quick and easy breakdown of the core differences between fiscal and calendar years: Web many business owners use a calendar year as their company’s tax year.