California Llc Dissolution Form

California Llc Dissolution Form - Online submission for corporation and partnership dissolution/cancellation forms is. Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business. You must meet specific requirements to. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. Currently, llcs can submit termination forms online. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web dissolution (check the applicable statement. Once logged in, you must: Web certificate of dissolution certificate of cancellation short form cancellation certificate: File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return.

(1) find the applicable entity under your my business. Web certificate of dissolution certificate of cancellation short form cancellation certificate: File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Web forms, samples and fees. Currently, llcs can submit termination forms online. Web must cease doing or transacting business in california after the final taxable year. Web dissolution (check the applicable statement. You must meet specific requirements to. Online submission for corporation and partnership dissolution/cancellation forms is. Web you can request a voluntary administrative dissolution/cancelation if your business is:

If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Currently, llcs can submit termination forms online. Web must cease doing or transacting business in california after the final taxable year. Web forms, samples and fees. Web dissolution (check the applicable statement. Web you can request a voluntary administrative dissolution/cancelation if your business is: Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Online submission for corporation and partnership dissolution/cancellation forms is. You must meet specific requirements to. (1) find the applicable entity under your my business.

How To File A Dissolution Of Corporation In California Nicolette Mill

If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Once logged in, you must: Currently, llcs can submit termination forms online. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited.

Business Dissolution Plan Patricia Wheatley's Templates

Web certificate of dissolution certificate of cancellation short form cancellation certificate: Online submission for corporation and partnership dissolution/cancellation forms is. You must meet specific requirements to. Web forms, samples and fees. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return.

Articles Of Dissolution 2020 Fill and Sign Printable Template Online

File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax.

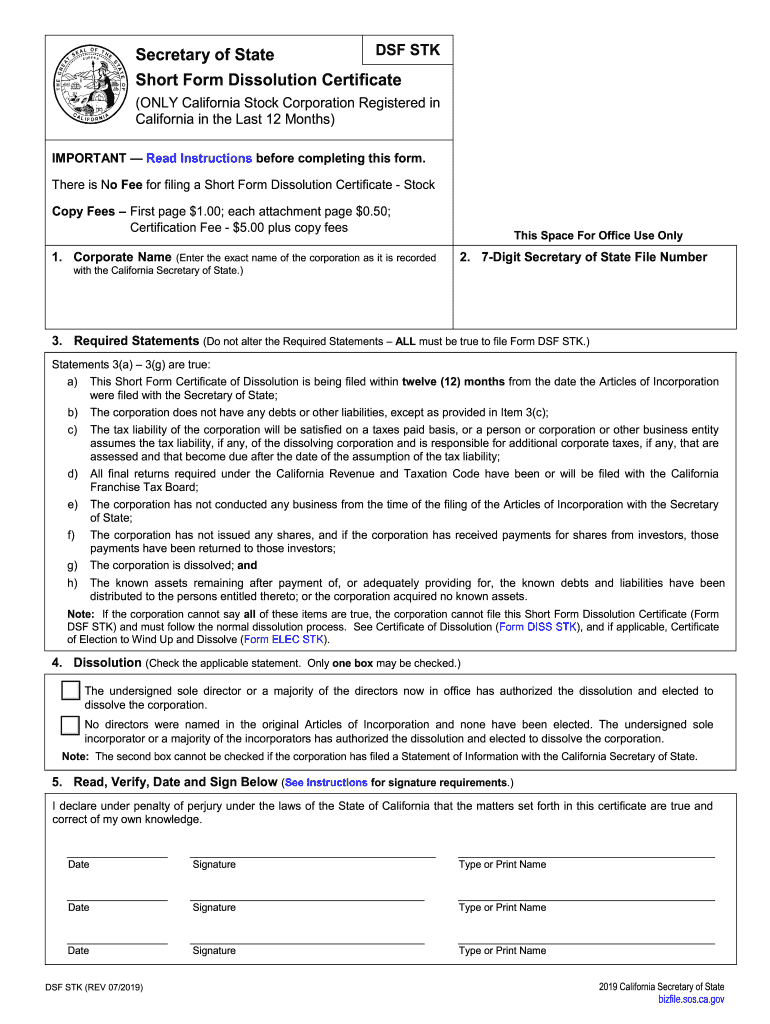

Form Dsf Stk Fill Out and Sign Printable PDF Template signNow

Web you can request a voluntary administrative dissolution/cancelation if your business is: Web forms, samples and fees. (1) find the applicable entity under your my business. Web must cease doing or transacting business in california after the final taxable year. File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return.

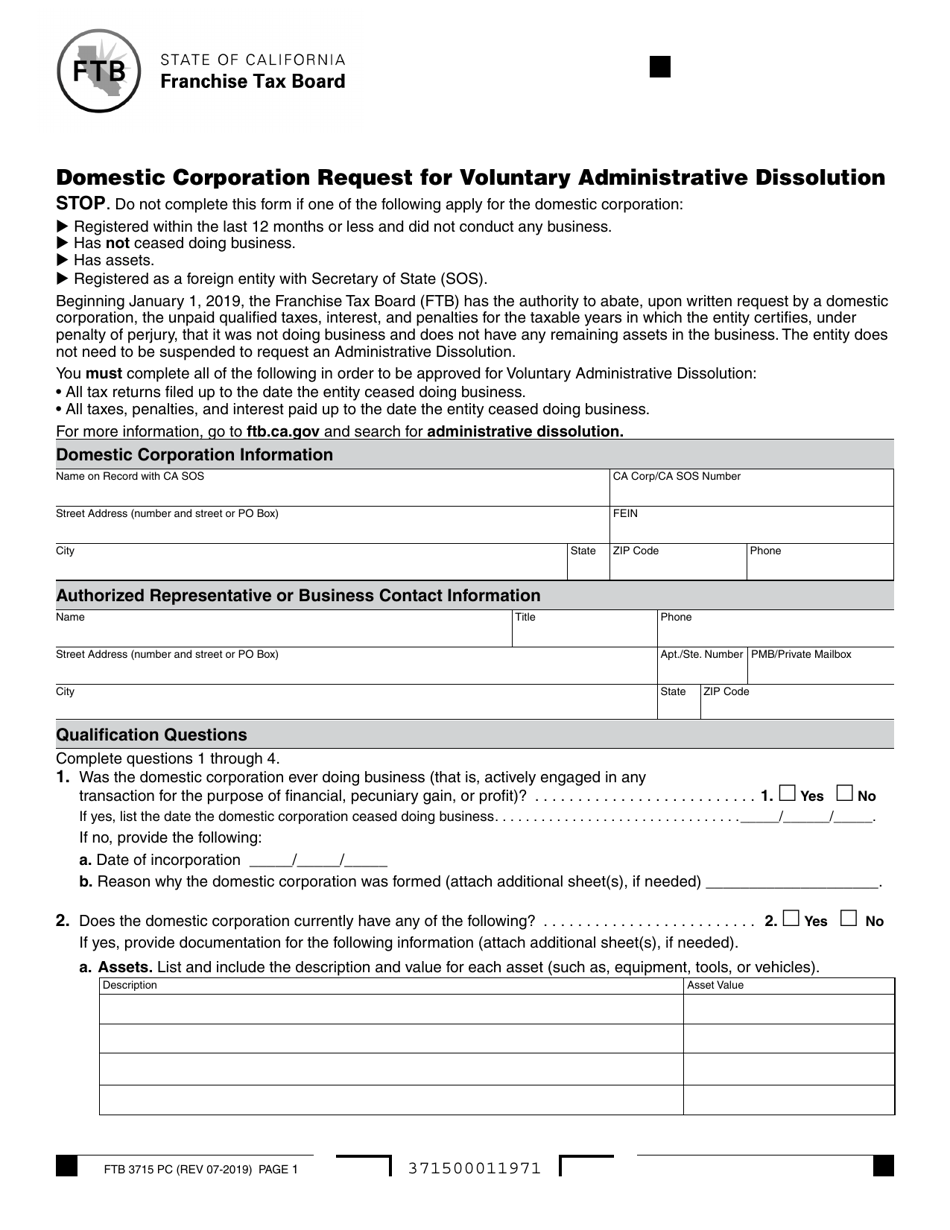

Form FTB3715 PC Download Fillable PDF or Fill Online Domestic

Once logged in, you must: File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Web you can request a voluntary administrative dissolution/cancelation if your business is: Online submission for corporation.

California Dissolution Package to Dissolve Corporation Form Online

Online submission for corporation and partnership dissolution/cancellation forms is. Once logged in, you must: Web certificate of dissolution certificate of cancellation short form cancellation certificate: You must meet specific requirements to. Currently, llcs can submit termination forms online.

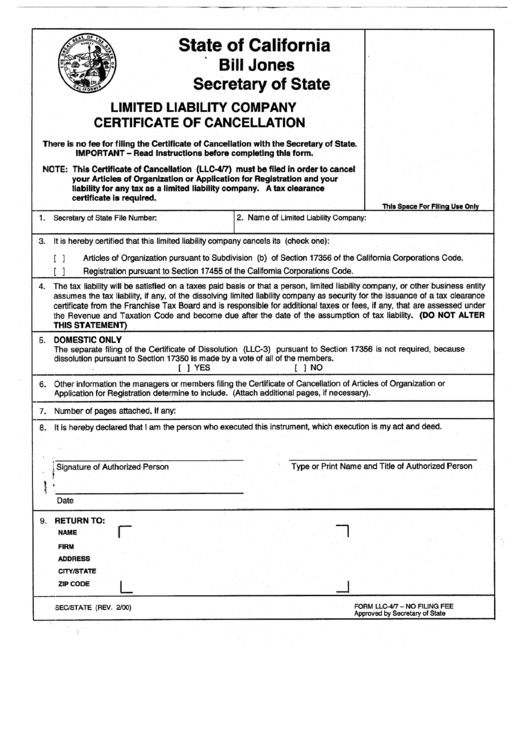

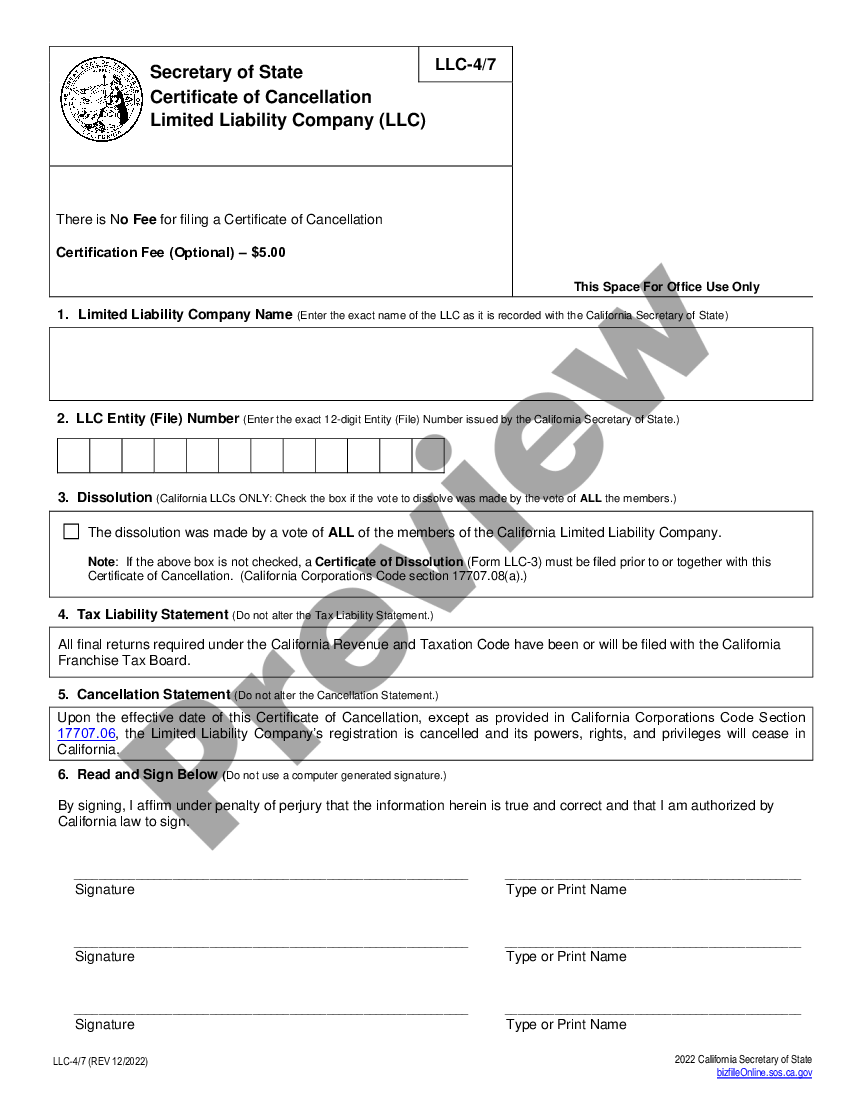

Form Llc4/7 Certificate Of Cancellation For A Limited Liability

Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Active suspended dissolved canceled if your business is active, file a.

How To Dissolve A Foreign Llc In California California Application

Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web dissolution (check the applicable statement. Web you can request a voluntary administrative dissolution/cancelation if your business is: Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final.

California Dissolution Package to Dissolve Limited Liability Company

Online submission for corporation and partnership dissolution/cancellation forms is. Web you can request a voluntary administrative dissolution/cancelation if your business is: If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Web dissolution (check the applicable statement. Web must cease.

Alabama Dissolution Package to Dissolve Corporation Dissolve Llc

Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. You must meet specific requirements to. Web you can request a voluntary administrative dissolution/cancelation if your business is: Once logged in, you must: (1) find the applicable entity under your my business.

Once Logged In, You Must:

Web certificate of dissolution certificate of cancellation short form cancellation certificate: Web forms, samples and fees. If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return.

Web Must Cease Doing Or Transacting Business In California After The Final Taxable Year.

Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Online submission for corporation and partnership dissolution/cancellation forms is. Web you can request a voluntary administrative dissolution/cancelation if your business is: (1) find the applicable entity under your my business.

You Must Meet Specific Requirements To.

Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Web dissolution (check the applicable statement. Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return.