California Tax Filing Extension Form

California Tax Filing Extension Form - Please provide your email address and it will be emailed to you. Due to the severe weather, this step is waived for california tax filers this. 16, 2023, to file and pay taxes. Individual income tax return special rules. If a partnership cannot file form 565, partnership return of income, by the return’s due date, the. Web to request a filing extension, use the california department of tax and fee administration’s (cdtfa) online services. This printable booklet contains instructions for filling out and filing form 540es, the self employment tax voucher form. Web file a return; Web simplified income, payroll, sales and use tax information for you and your business Web california does not require the filing of written applications for extensions.

Identify a letter or notice; Web taxformfinder provides printable pdf copies of 175 current california income tax forms. Register for a permit, license, or account; Web more about the california 540 tax table. Web form 540es instruction booklet. The current tax year is 2022, and most states will release updated tax forms between. State extension to file federal extensions of time to file your tax return December 2020, 4th quarter 2020, and annual 2020 returns due: Web california does not require the filing of written applications for extensions. Web if you do owe taxes to the state of california, you must pay by the original tax return filing due date (april 15) to avoid incurring late payment penalties and interest.

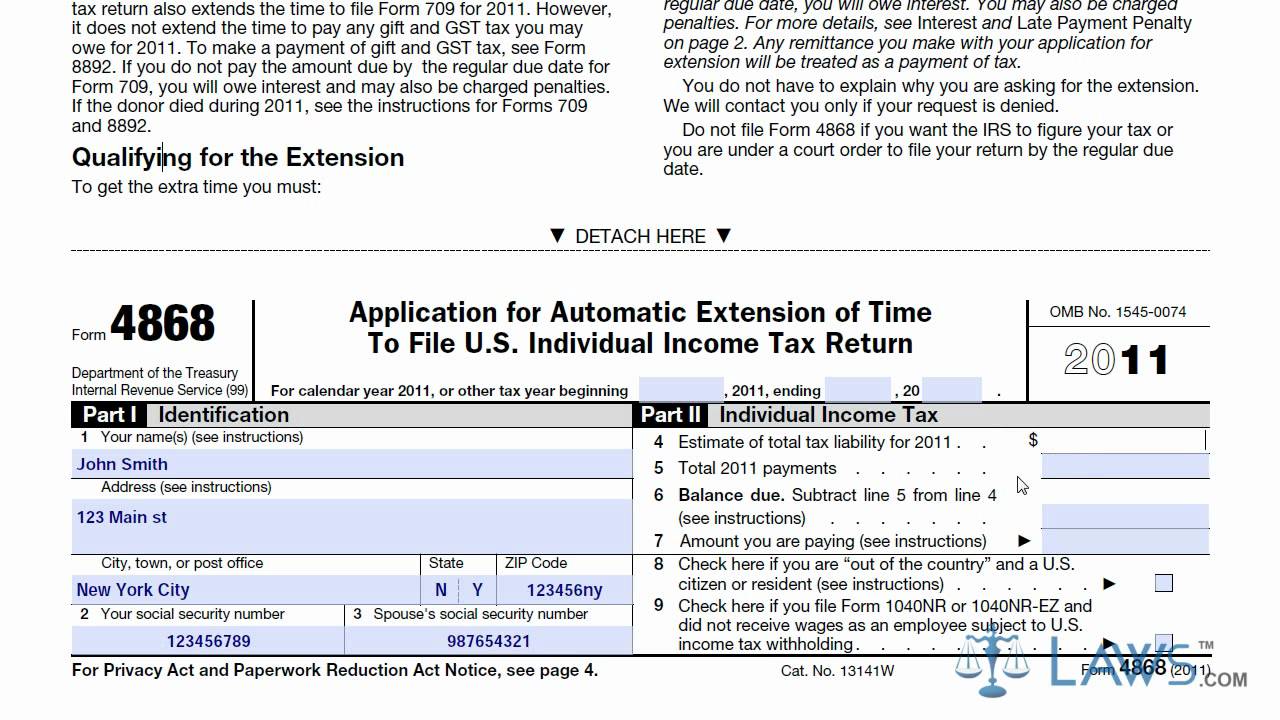

Web if you do owe taxes to the state of california, you must pay by the original tax return filing due date (april 15) to avoid incurring late payment penalties and interest. Web taxformfinder provides printable pdf copies of 175 current california income tax forms. Web if you are claiming the california eitc, you must provide your date of birth (dob), and spouse’s/ registered domestic partner’s (rdp’s) dob if filing jointly, on your california. Web california does not require the filing of written applications for extensions. Web form 540es instruction booklet. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Find out how to get an extension of time to file your income tax return. This printable booklet contains instructions for filling out and filing form 540es, the self employment tax voucher form. 16, 2023, to file and pay taxes. Web according to the irs, you can request an extension until oct.

Taxes 2016 extension form gasgram

Web to request a filing extension, use the california department of tax and fee administration’s (cdtfa) online services. Register for a permit, license, or account; This form is for income earned in. To request more time, estimate your total amount of tax debt on the form and pay. Web california does not require the filing of written applications for extensions.

COVID19 & Tax Season The IRS Has Extended The 2021 Tax Filing

Web filing period original due date extension due date; Web if you do owe taxes to the state of california, you must pay by the original tax return filing due date (april 15) to avoid incurring late payment penalties and interest. Register for a permit, license, or account; Web use this form to make a payment by april 15th if.

Tax Form California Free Download

Web use this form to make a payment by april 15th if you have requested an extension to file your ca tax return, and owe a balance on the filing date. Individual income tax return special rules. Web according to the irs, you can request an extension until oct. We last updated the payment. We last updated california 540 tax.

Tax Filing Extension Deadline 2022 Federal Tax TaxUni

We last updated california 540 tax table in january 2023 from the california franchise tax board. Web to request a filing extension, use the california department of tax and fee administration’s (cdtfa) online services. Please provide your email address and it will be emailed to you. Individual income tax return special rules. Web california does not require the filing of.

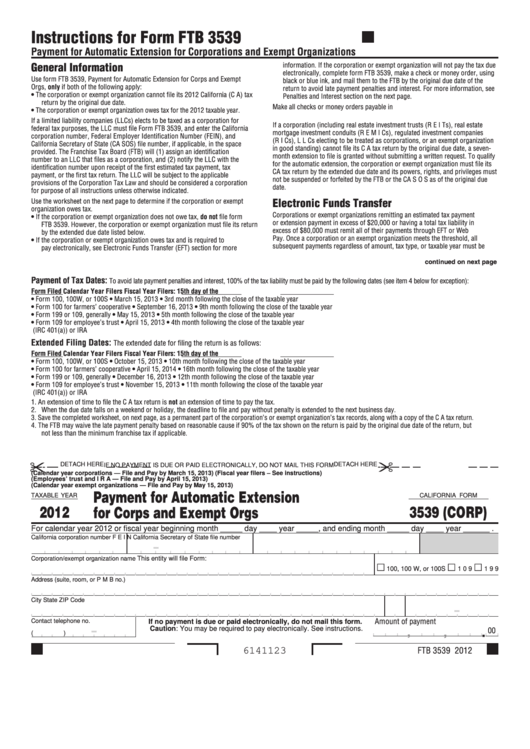

California Form 3539 (Corp) Payment For Automatic Extension For Corps

Web more about the california 540 tax table. Due to the severe weather, this step is waived for california tax filers this. We last updated california 540 tax table in january 2023 from the california franchise tax board. Web file a return; Web use this form to make a payment by april 15th if you have requested an extension to.

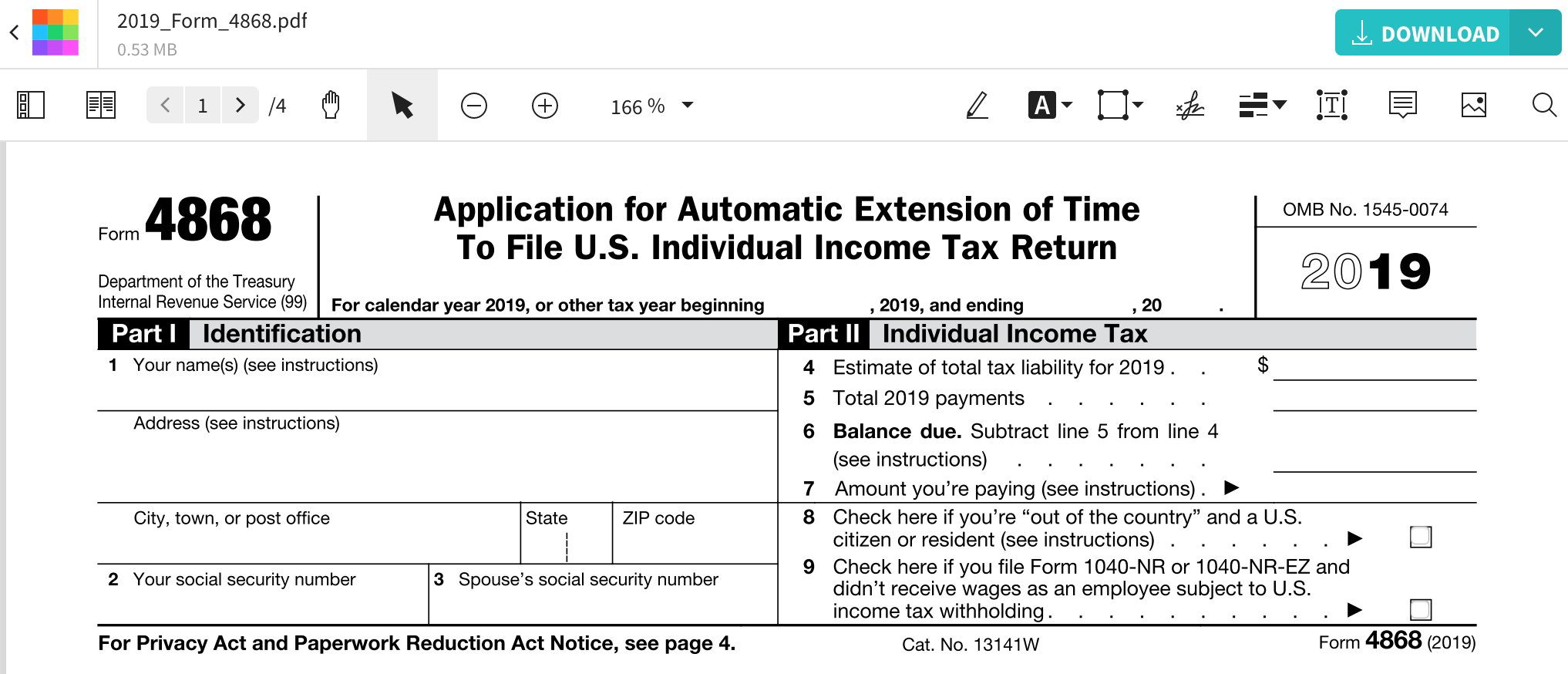

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

If you are self employed or. Web use this form to make a payment by april 15th if you have requested an extension to file your ca tax return, and owe a balance on the filing date. Please provide your email address and it will be emailed to you. The current tax year is 2022, and most states will release.

Extension for Certain Maryland Tax Returns and Payments in 2021

If a partnership cannot file form 565, partnership return of income, by the return’s due date, the. Web form 540es instruction booklet. Web if you do owe taxes to the state of california, you must pay by the original tax return filing due date (april 15) to avoid incurring late payment penalties and interest. Individual income tax return special rules..

Tax Filing extension form How and why can you get a tax extension? Marca

If a partnership cannot file form 565, partnership return of income, by the return’s due date, the. Individual income tax return special rules. Web taxformfinder provides printable pdf copies of 175 current california income tax forms. You must make a proper estimate of your tax for the year. Web yes, california postponed the income tax filing due date for individuals.

California Nonprofit Tax Filing Deadline Looming Semanchik Law Group

Web form 540es instruction booklet. Web 2021, 540, california explanation of amended return changes this is only available by request. Web california does not require the filing of written applications for extensions. December 2020, 4th quarter 2020, and annual 2020 returns due: Web filing period original due date extension due date;

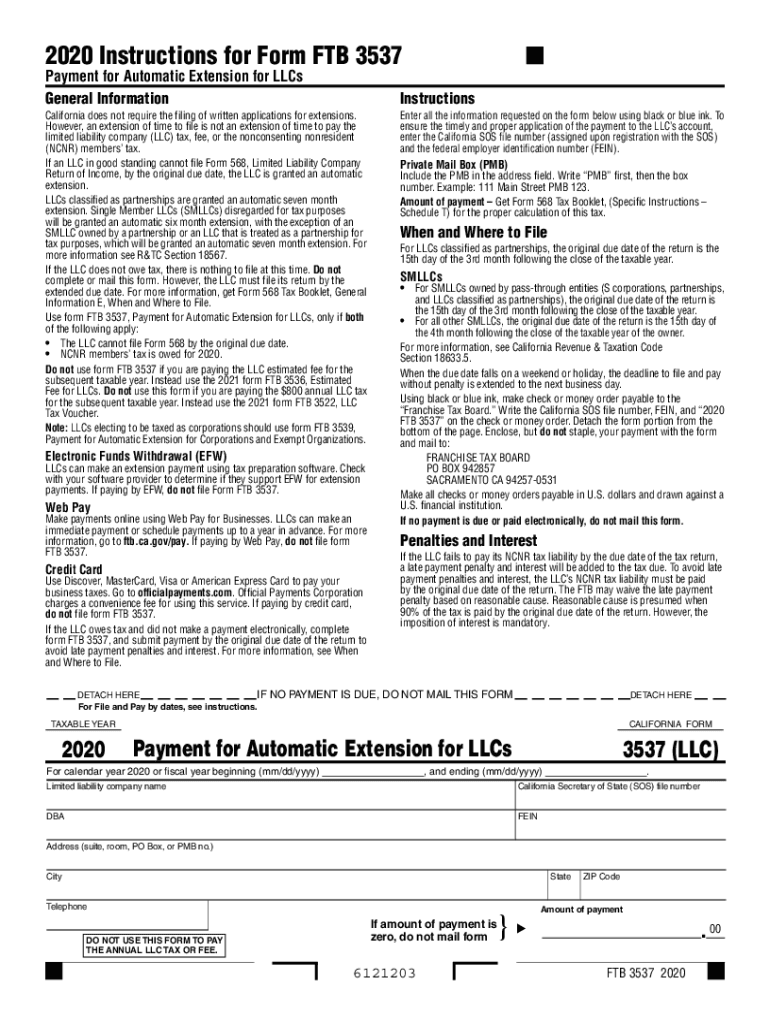

Form 3537 California Fill Out and Sign Printable PDF Template signNow

Web if you do owe taxes to the state of california, you must pay by the original tax return filing due date (april 15) to avoid incurring late payment penalties and interest. You must make a proper estimate of your tax for the year. Web if you are claiming the california eitc, you must provide your date of birth (dob),.

Web Form 540Es Instruction Booklet.

Due to the severe weather, this step is waived for california tax filers this. Register for a permit, license, or account; Web tax extension to help alleviate some of the hardship many have endured during this trying period, the ftb has extended the filing and payment deadlines for. This printable booklet contains instructions for filling out and filing form 540es, the self employment tax voucher form.

Web If You Do Owe Taxes To The State Of California, You Must Pay By The Original Tax Return Filing Due Date (April 15) To Avoid Incurring Late Payment Penalties And Interest.

Web yes, california postponed the income tax filing due date for individuals (those who file forms 540, 540 2ez, and 540nr, including pit composite returns) for the 2020 tax year from. If a partnership cannot file form 565, partnership return of income, by the return’s due date, the. You must make a proper estimate of your tax for the year. Individual income tax return special rules.

We Last Updated California 540 Tax Table In January 2023 From The California Franchise Tax Board.

Web california does not require the filing of written applications for extensions. Web use this form to make a payment by april 15th if you have requested an extension to file your ca tax return, and owe a balance on the filing date. Web if you are claiming the california eitc, you must provide your date of birth (dob), and spouse’s/ registered domestic partner’s (rdp’s) dob if filing jointly, on your california. If you are self employed or.

December 2020, 4Th Quarter 2020, And Annual 2020 Returns Due:

Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Web more about the california 540 tax table. Find out how to get an extension of time to file your income tax return. We last updated the payment.