Can I Print A Blank 1099 Form

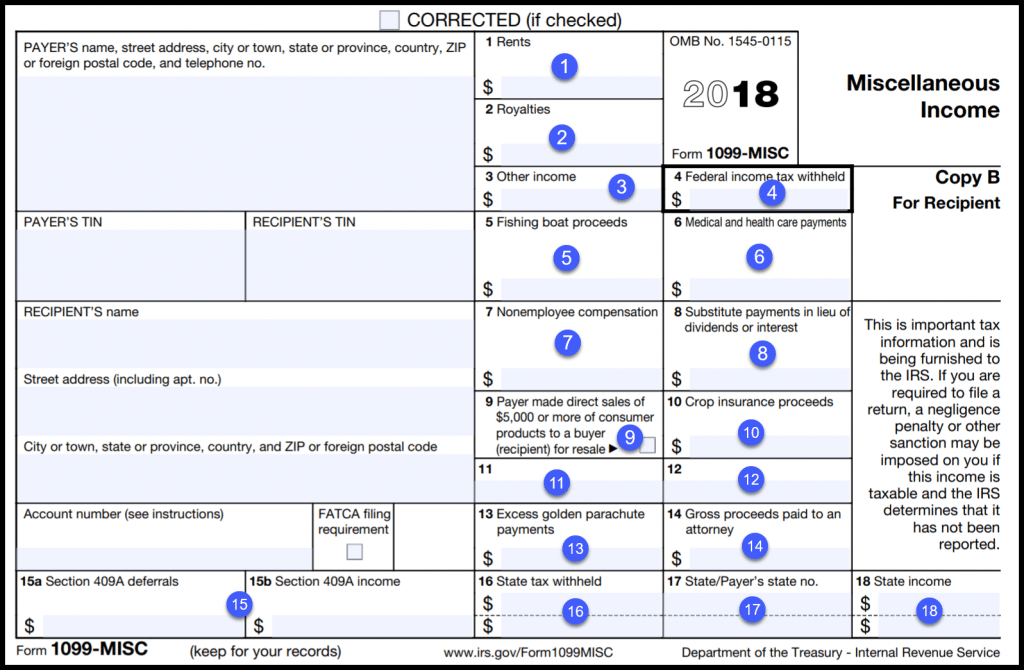

Can I Print A Blank 1099 Form - Get ready for tax season deadlines by completing any required tax forms today. A penalty may be imposed for filing with the irs information return forms that. Employment authorization document issued by the department of homeland security. Web the official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. While they do allow substitute 1099's printed on plain paper to be given to the employee,. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web similar to the official irs form. In the left menu, go to settings > 1099 contractor settings > 1099/1096 print layout. To order these instructions and additional forms, go to. Submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments.

A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Do not miss the deadline A penalty may be imposed for filing with the irs information return forms that. Print and file copy a downloaded from this website; Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you. Web the official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Web the social security administration shares the information with the internal revenue service. A penalty may be imposed for filing with the. Ad get the latest 1099 misc online. Download tax form in your account

While they do allow substitute 1099's printed on plain paper to be given to the employee,. For examples, see 12.3 list c documents that establish employment. For more info about irs and state requirements, consult your accountant, and see: Submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments. Web employee and cannot get the payer to correct this form, report this amount on the line for “wages, salaries, tips, etc.” of form 1040 (or form 1040nr). Employment authorization document issued by the department of homeland security. Ad get the latest 1099 misc online. Complete, edit or print tax forms instantly. Do not miss the deadline 1098, 1099, 3921, or 5498 that you print from the irs website.

Efile 2022 Form 1099R Report the Distributions from Pensions

Do not print and file copy a downloaded from this website; Regardless of whether the interest is reported to you, report it as interest income on your tax return. A penalty may be imposed for filing with the. Web employee and cannot get the payer to correct this form, report this amount on the line for “wages, salaries, tips, etc.”.

Form 1099 Misc Fillable Universal Network

Regardless of whether the interest is reported to you, report it as interest income on your tax return. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you. Web similar to the official irs form. Download tax form in your account Report payments made of at least $600 in.

Where To Get Official 1099 Misc Forms Universal Network

A penalty may be imposed for filing with the irs information return forms that. Web the social security administration shares the information with the internal revenue service. In the left menu, go to settings > 1099 contractor settings > 1099/1096 print layout. Select state you’re filing in we will select the correct. Employers do not need to.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Ad get the latest 1099 misc online. In the left menu, go to settings > 1099 contractor settings > 1099/1096 print layout. Print and file copy a downloaded from this website; Get ready for tax season deadlines by completing any required tax forms today. Web the official printed version of copy a of this irs form is scannable, but the.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

A penalty may be imposed for filing with the irs information return forms that. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Do not miss the deadline A penalty may be imposed for filing with the irs information return forms that. Submit copy a to the irs with form 1096, which.

1099 MISC Form 2022 1099 Forms TaxUni

January 10, 2021 11:49 am. However, the agency will not require transition to the new form until november 1, 2023. Select the type of form you want to change in the dropdown, and click \u201cselect.\u201d (there are two different 1099 forms: Select state you’re filing in we will select the correct. You also must complete form 8919 and attach it.

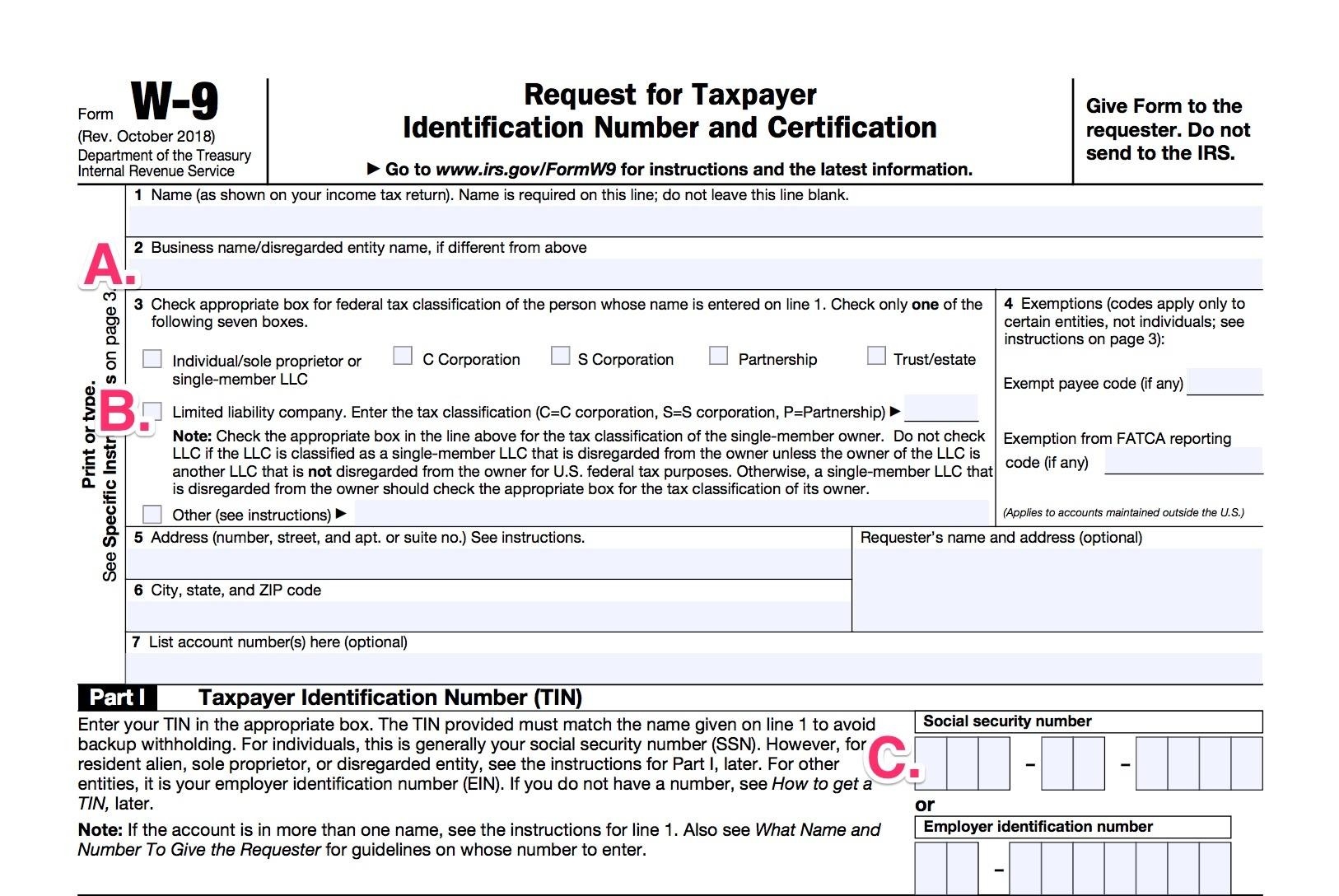

2020 W 9 Blank Form Calendar Template Printable

Submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments. A penalty may be imposed for filing with the irs information return forms that. Web similar to the official irs form. Complete, edit or print tax forms instantly. Report payments made of at least $600 in.

How To File 1099 S Fill Online, Printable, Fillable, Blank pdfFiller

Web setting up to print form 1099: While they do allow substitute 1099's printed on plain paper to be given to the employee,. Web you can print copies to mail to the federal and state governments, plus print and send a copy to each of your contractors. Download tax form in your account Ad access irs tax forms.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Printable from laser and inkjet printers. Employment authorization document issued by the department of homeland security. 1098, 1099, 3921, or 5498 that you print from the irs website. Fill, edit, sign, download & print. Web the official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not.

IRS Form 1099 Reporting for Small Business Owners

If you are not an employee but the amount in this box is. 1098, 1099, 3921, or 5498 that you print from the irs website. In the left menu, go to settings > 1099 contractor settings > 1099/1096 print layout. Employment authorization document issued by the department of homeland security. A penalty may be imposed for filing with the irs.

Web The Official Printed Version Of Copy A Of This Irs Form Is Scannable, But The Online Version Of It, Printed From This Website, Is Not.

See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for. However, the agency will not require transition to the new form until november 1, 2023. Printable from laser and inkjet printers. 1098, 1099, 3921, or 5498 that you print from the irs website.

Employers Do Not Need To.

A penalty may be imposed for filing with the irs information return forms that. Do not print and file copy a downloaded from this website; Web you can print copies to mail to the federal and state governments, plus print and send a copy to each of your contractors. Print and file copy a downloaded from this website;

If You Are Not An Employee But The Amount In This Box Is.

Web print and file copy a downloaded from this website; Web setting up to print form 1099: For more info about irs and state requirements, consult your accountant, and see: A penalty may be imposed for filing with the irs information return forms that.

Web Employee And Cannot Get The Payer To Correct This Form, Report This Amount On The Line For “Wages, Salaries, Tips, Etc.” Of Form 1040 (Or Form 1040Nr).

Select state you’re filing in we will select the correct. Select the type of form you want to change in the dropdown, and click \u201cselect.\u201d (there are two different 1099 forms: Do not print and file copy a downloaded from this website; Submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments.