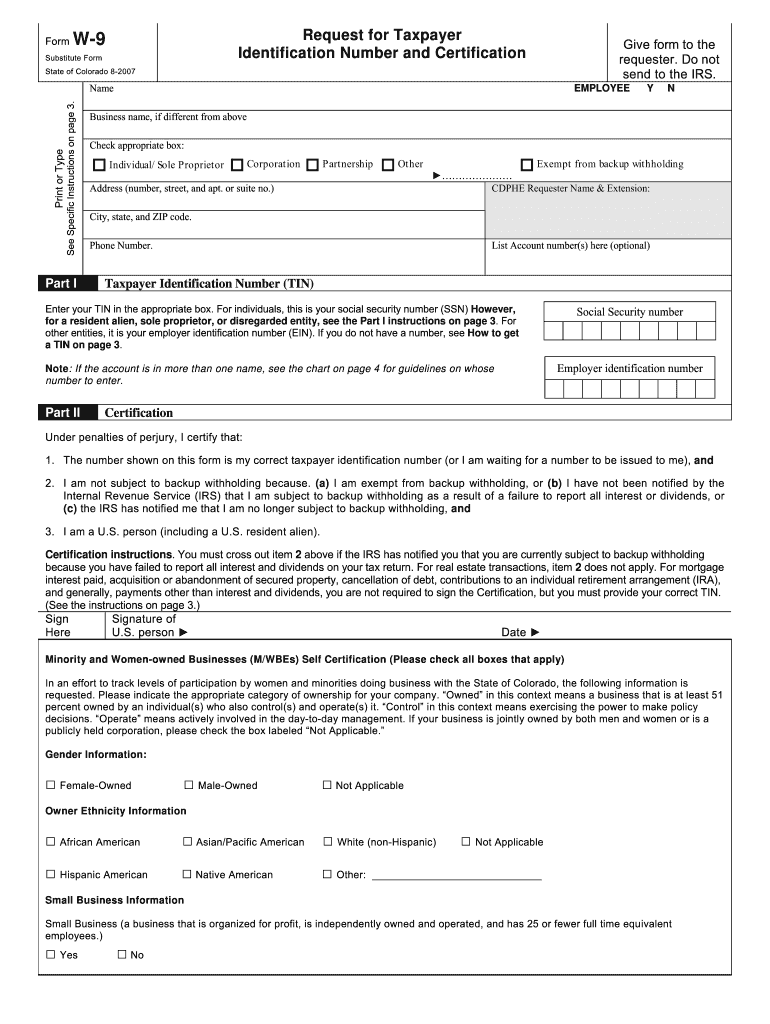

Colorado W9 Form

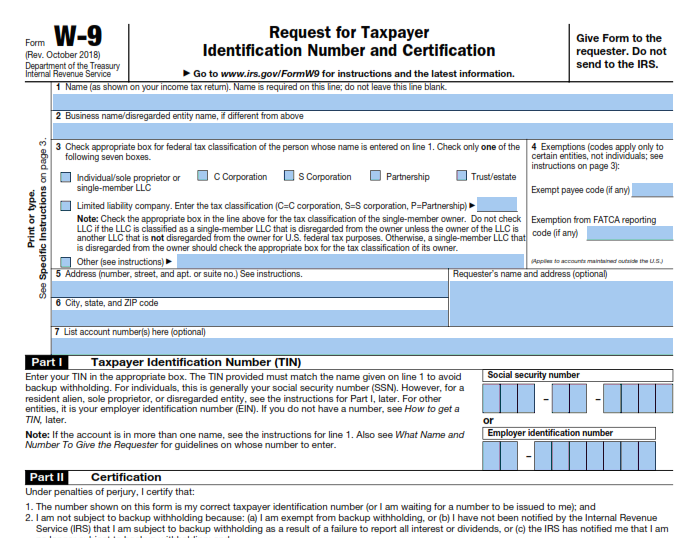

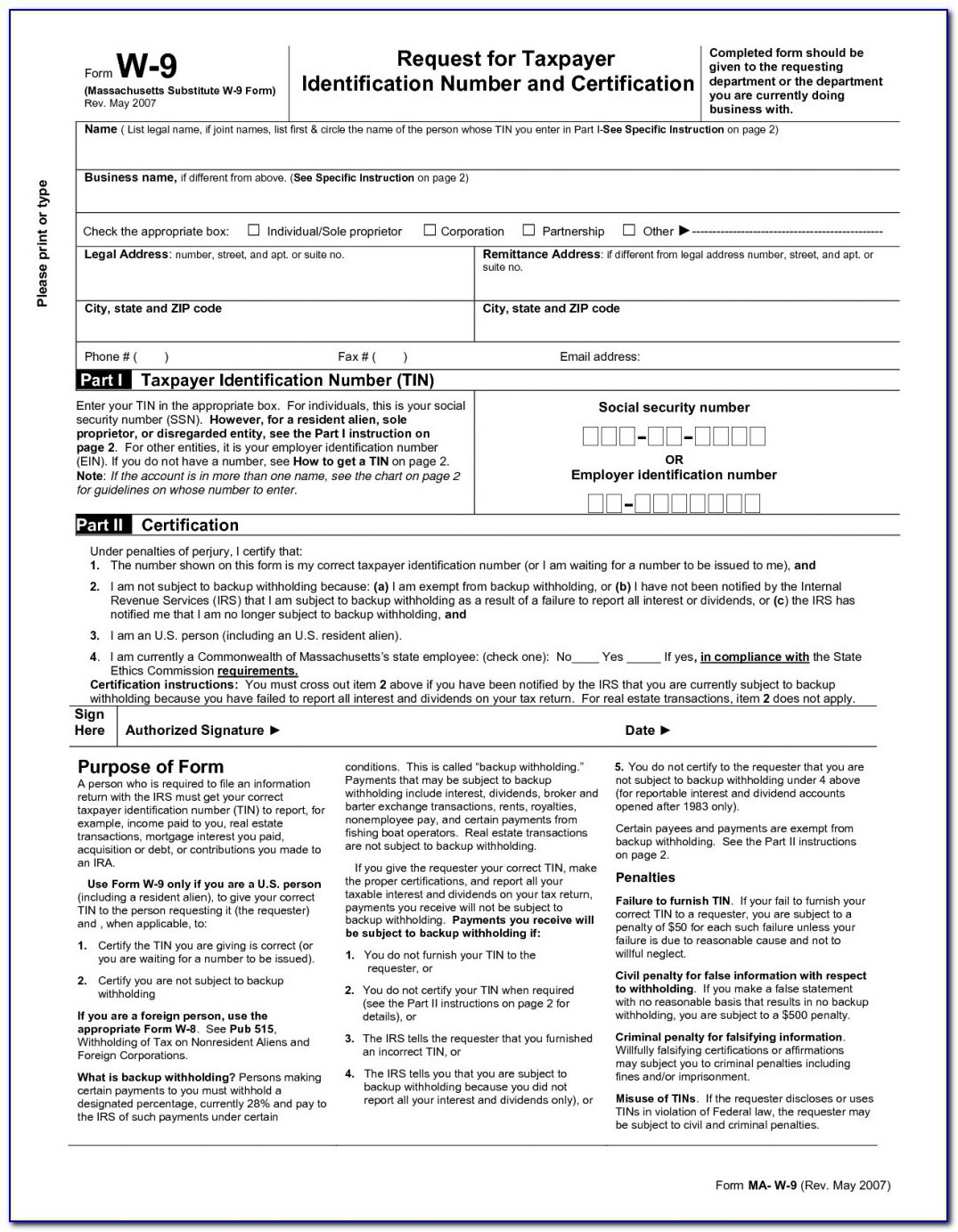

Colorado W9 Form - Do not send to the irs. That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and it will generally result in a refund when you file your colorado income tax return. Name is required on this line; Exempt payee code (if any) Web partnership trust/estate limited liability company. Business name, if different from above. Acquisition or abandonment of secured property. Contributions you made to an ira. Give form to the requester. See instructions on page 3):

The form is titled “request for taxpayer identification number and certification.”. Business name, if different from above. Acquisition or abandonment of secured property. Do not send to the irs. Check appropriate box:.……………… address (number, street, and apt. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exemptions (codes apply only to certain entities, not individuals; Web partnership trust/estate limited liability company. That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and it will generally result in a refund when you file your colorado income tax return. See specific instructions on page 3. Do not leave this line blank.

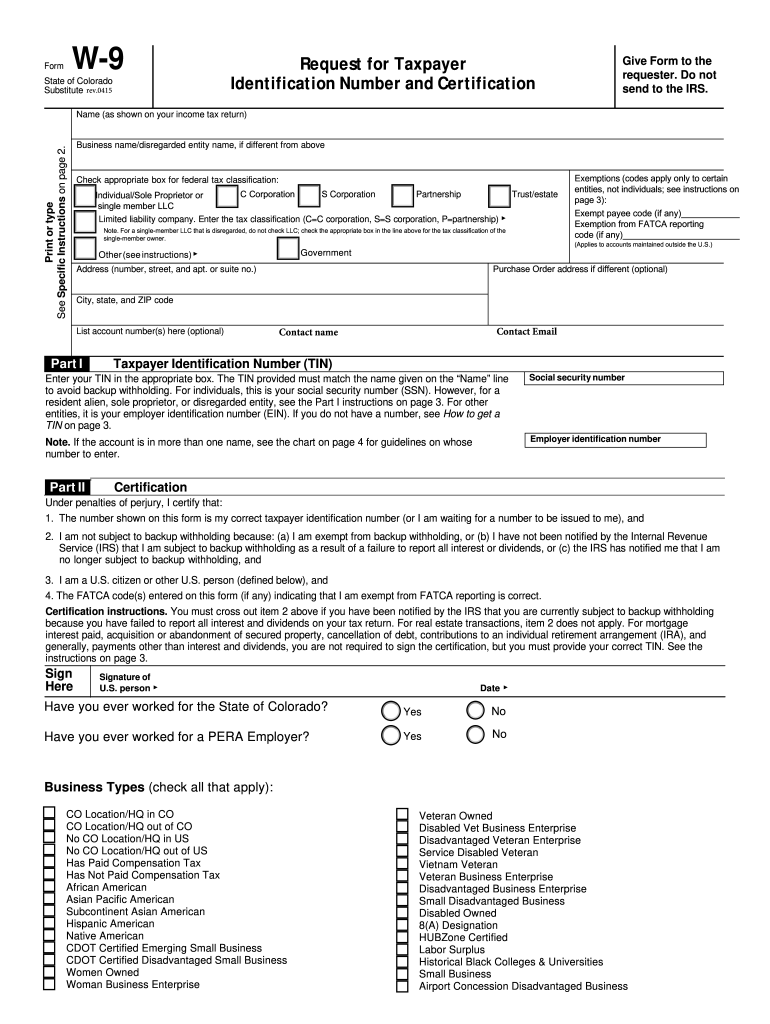

See specific instructions on page 3. Web real estate withholding forms. Web corporation partnership trust/estate limited liability company. That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and it will generally result in a refund when you file your colorado income tax return. Acquisition or abandonment of secured property. The form is titled “request for taxpayer identification number and certification.”. Or suite no.) requester’s name and address (optional) city, state, and zip code list account number(s) here (optional) Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions) address (number, street, and apt. Do not send to the irs. Name is required on this line;

W9 2007 Fill Out and Sign Printable PDF Template signNow

Name (as shown on your income tax return). Reasons to complete this certificate Do not send to the irs. Web partnership trust/estate limited liability company. See specific instructions on page 3.

Colorado W9 Fill Out and Sign Printable PDF Template signNow

Name (as shown on your income tax return). Acquisition or abandonment of secured property. Name is required on this line; Exempt payee code (if any) Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions) address (number, street, and apt.

Blank W 9 Form 2021 Fillable Printable Calendar Template Printable

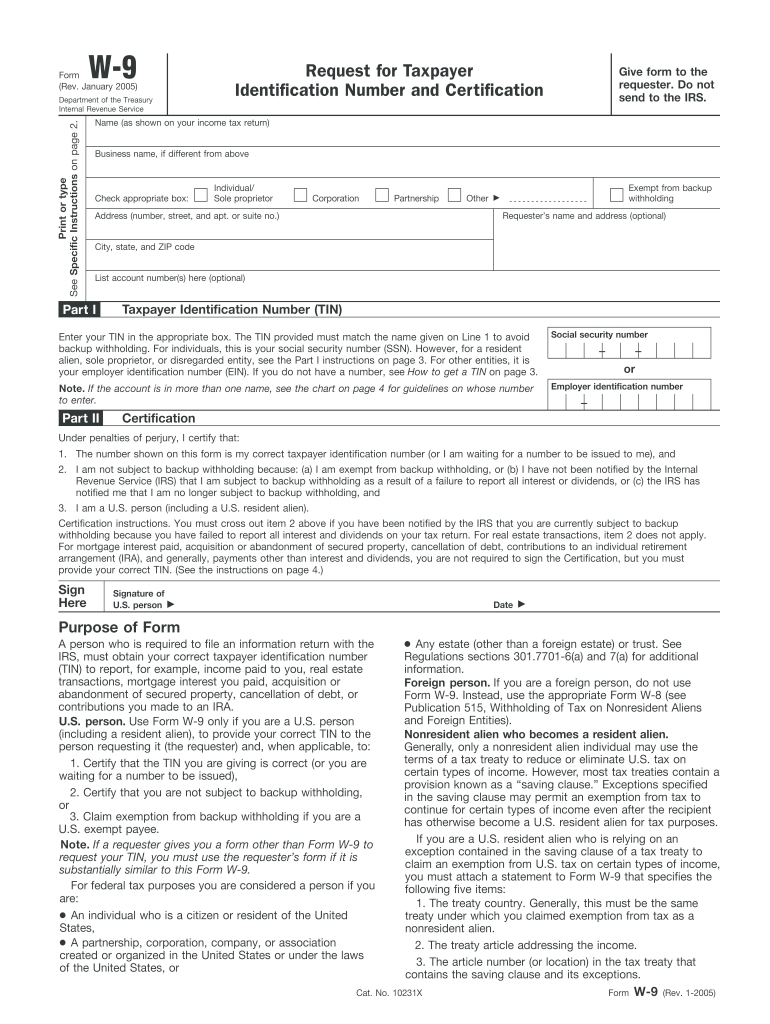

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions) address (number, street, and apt. Web partnership trust/estate limited liability company. Contributions you made to an ira. See specific instructions on page 3. Check appropriate box:.……………… address (number, street, and apt.

2015 Irs W9 form top 22 W 9 form Templates Free to In Pdf format

Name is required on this line; That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and it will generally result in a refund when you file your colorado income tax return. Or suite no.) requester’s name and address (optional) city, state, and zip code list account number(s) here (optional) Web partnership.

Federal I9 Form 2021 Writable Calendar Printables Free Blank

Give form to the requester. Acquisition or abandonment of secured property. The form is titled “request for taxpayer identification number and certification.”. Name is required on this line; Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exemptions (codes apply only to certain entities, not individuals;

Top20 US Tax Forms in 2022 Explained PDF.co

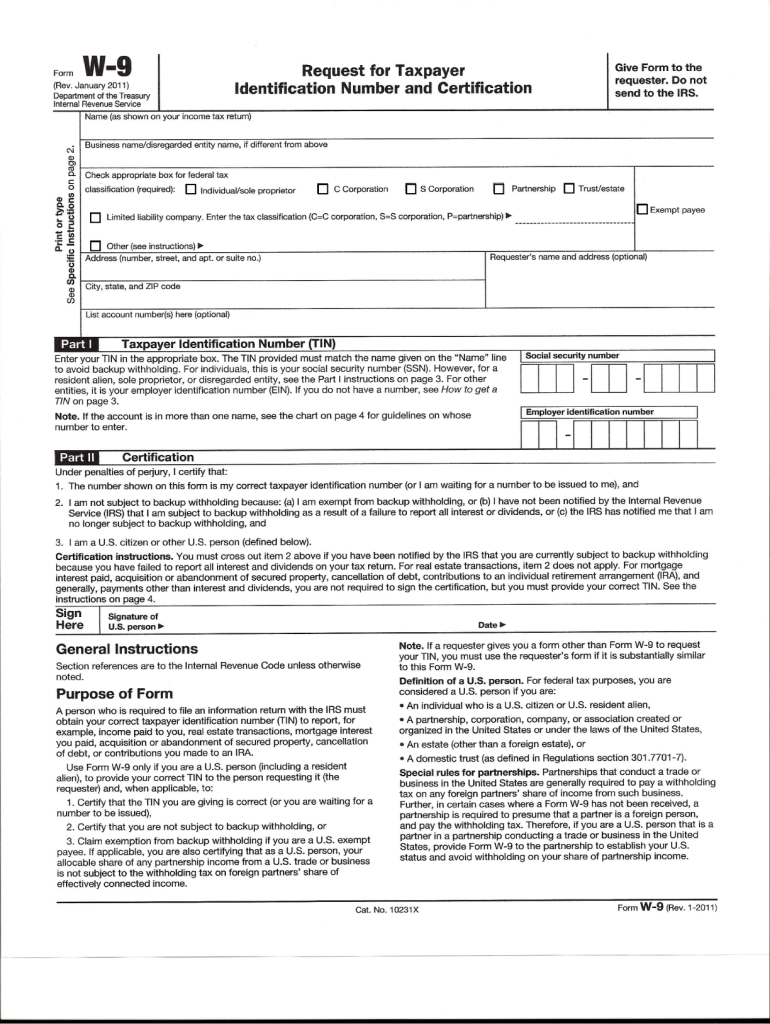

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exemptions (codes apply only to certain entities, not individuals; Web real estate withholding forms. Or suite no.) requester’s name and address (optional) city, state, and zip code list account number(s) here (optional) That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Do not leave this line blank. Web partnership trust/estate limited liability company. Check appropriate box:.……………… address (number, street, and apt. Exempt payee code (if any) Reasons to complete this certificate

Printable Blank W9 Form Calendar Template Printable

Web partnership trust/estate limited liability company. Give form to the requester. Name (as shown on your income tax return). Acquisition or abandonment of secured property. Do not leave this line blank.

Fill And Sign W9 Form Online for Free DigiSigner

Or suite no.) requester’s name and address (optional) city, state, and zip code list account number(s) here (optional) Contributions you made to an ira. The form is titled “request for taxpayer identification number and certification.”. Web real estate withholding forms. Business name, if different from above.

Web Real Estate Withholding Forms.

See instructions on page 3): Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exempt payee other (see instructions) address (number, street, and apt. The form is titled “request for taxpayer identification number and certification.”. Do not leave this line blank.

That Calculation Is Designed To Withhold The Required Colorado Income Tax Due On Your Wages Throughout The Year, And It Will Generally Result In A Refund When You File Your Colorado Income Tax Return.

Name (as shown on your income tax return). Exempt payee code (if any) Reasons to complete this certificate Give form to the requester.

Acquisition Or Abandonment Of Secured Property.

Check appropriate box:.……………… address (number, street, and apt. Business name, if different from above. Contributions you made to an ira. Web corporation partnership trust/estate limited liability company.

See Specific Instructions On Page 3.

Do not send to the irs. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) exemptions (codes apply only to certain entities, not individuals; Or suite no.) requester’s name and address (optional) city, state, and zip code list account number(s) here (optional) Name is required on this line;