Connecticut Withholding Form

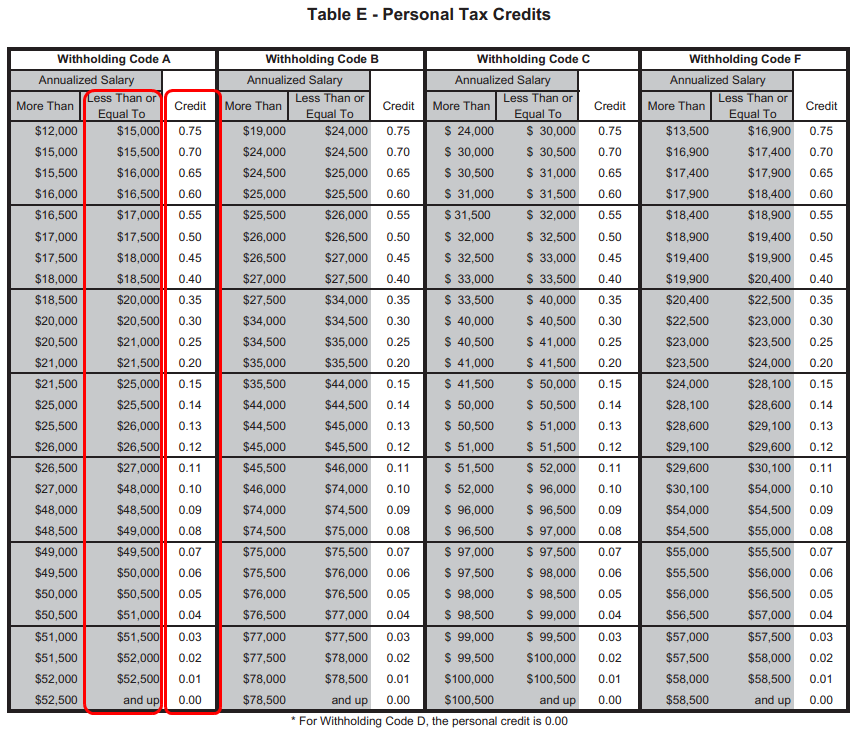

Connecticut Withholding Form - A, b, c, d, or f. Determine the total number of allowances field as follows: Who must complete a registration application and file a withholding tax return. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. You are required to pay connecticut income tax as income is earned or received during the year. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code: Withholding information for connecticut residents who work in another state. Withholding information for nonresidents who work in connecticut. 2022 connecticut annual reconciliation of.

You are required to pay connecticut income tax as income is earned or received during the year. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Withholding information for connecticut residents who work in another state. Withholding information for nonresidents who work in connecticut. Determine the total number of allowances field as follows: Who must complete a registration application and file a withholding tax return. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code: A, b, c, d, or f. 2022 connecticut annual reconciliation of.

2022 connecticut annual reconciliation of withholding for nonpayroll amounts. A, b, c, d, or f. You are required to pay connecticut income tax as income is earned or received during the year. Determine the total number of allowances field as follows: Web state tax withholding state code: Withholding information for nonresidents who work in connecticut. Withholding information for connecticut residents who work in another state. 2023 connecticut withholding tax payment form for nonpayroll amounts. 2022 connecticut annual reconciliation of. Who must complete a registration application and file a withholding tax return.

Connecticut State Tax Withholding Form 2022

Withholding information for connecticut residents who work in another state. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. 2023 connecticut withholding tax payment form for nonpayroll amounts. Determine the total number of allowances field as follows:

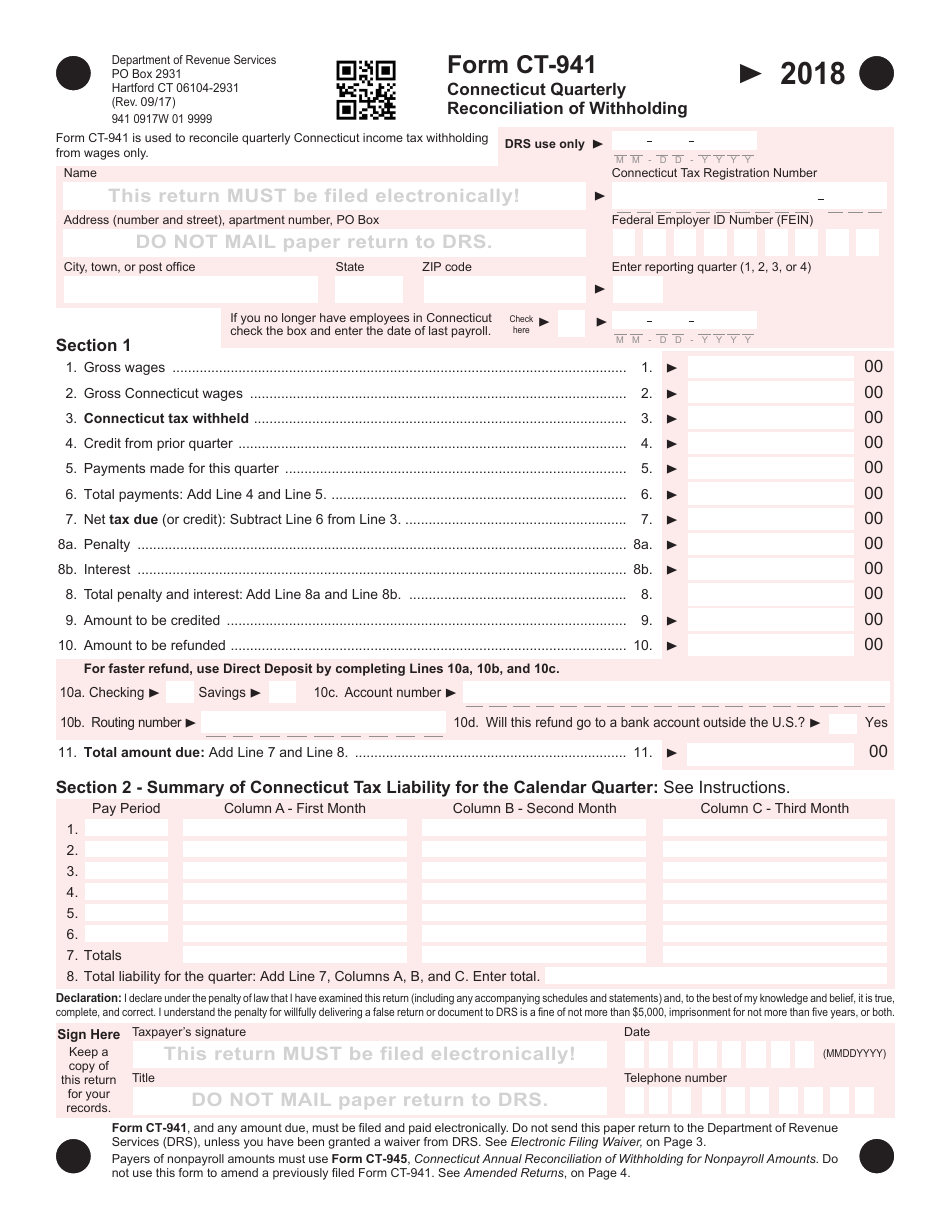

Form CT941 Download Printable PDF or Fill Online Connecticut Quarterly

Who must complete a registration application and file a withholding tax return. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts. A, b, c, d, or f. You are required to pay connecticut income tax as income is earned or received during the year. Determine the total number of allowances field as follows:

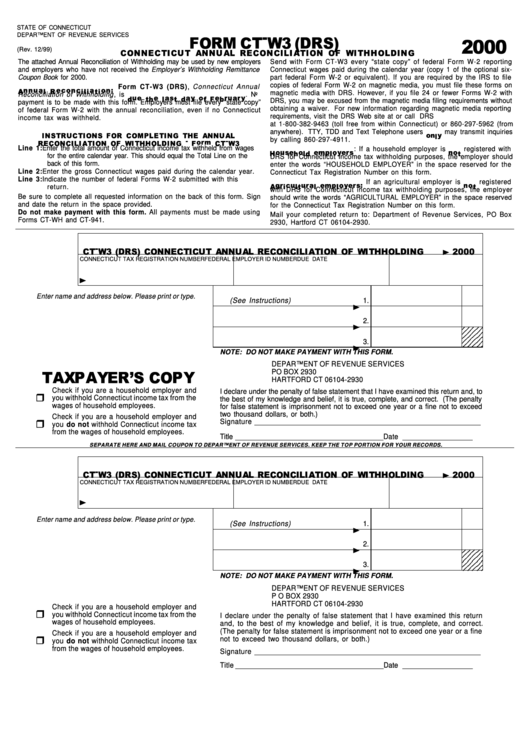

Form CtW3 (Drs) Connecticut Annual Reconciliation Of Withholding

Withholding information for nonresidents who work in connecticut. Withholding information for connecticut residents who work in another state. Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of. 2023 connecticut withholding tax payment form for nonpayroll amounts.

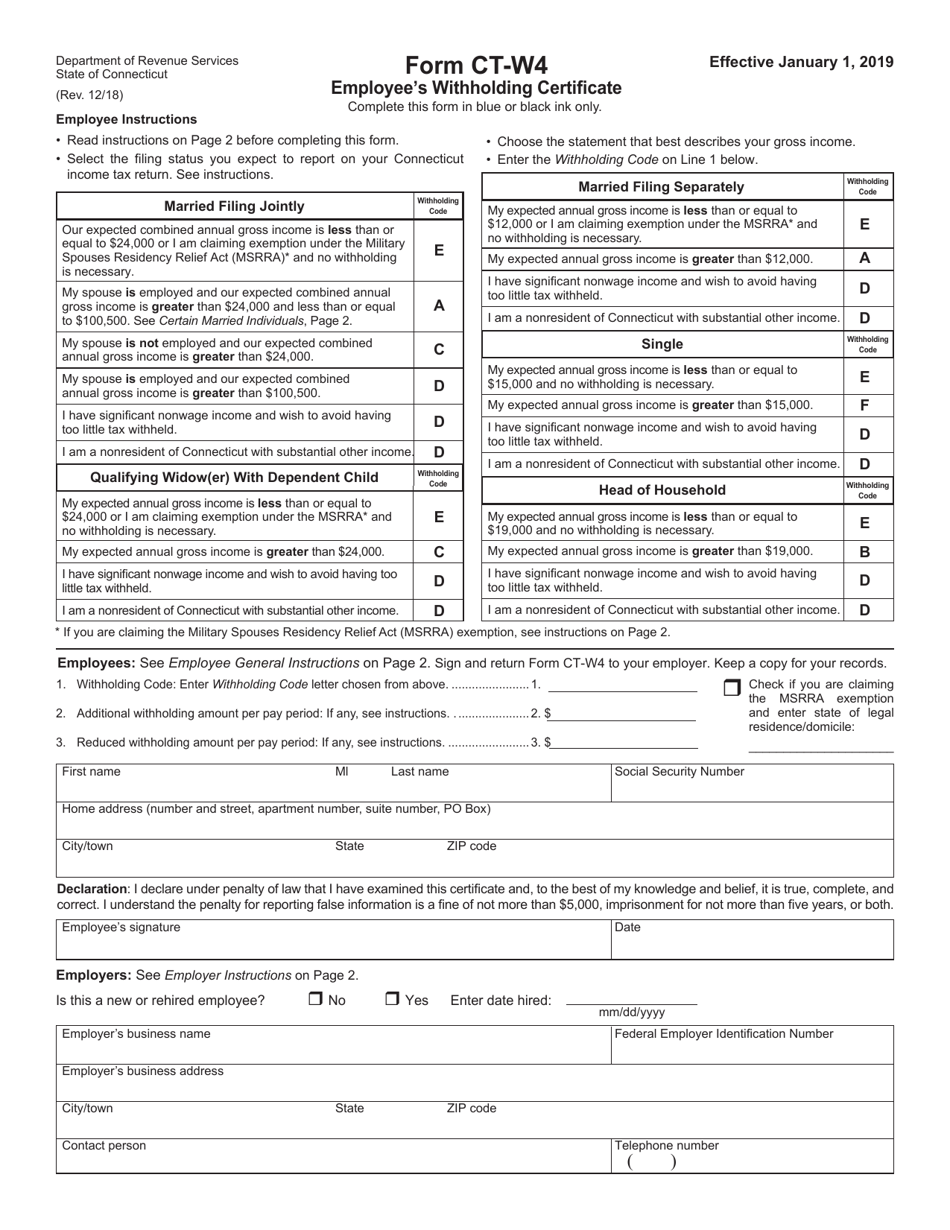

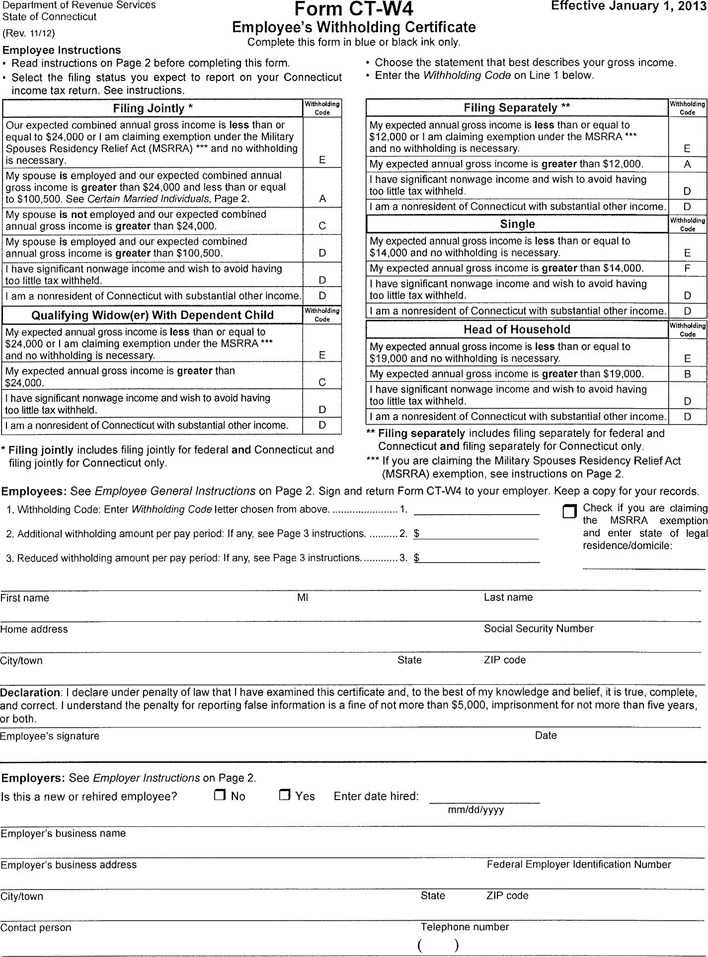

Form CTW4 Download Printable PDF or Fill Online Employee's Withholding

2023 connecticut withholding tax payment form for nonpayroll amounts. Who must complete a registration application and file a withholding tax return. You are required to pay connecticut income tax as income is earned or received during the year. Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of withholding for nonpayroll amounts.

Employee's Withholding Certificate Connecticut Free Download

2023 connecticut withholding tax payment form for nonpayroll amounts. Determine the total number of allowances field as follows: Withholding information for connecticut residents who work in another state. Web state tax withholding state code: Who must complete a registration application and file a withholding tax return.

Download Connecticut Form CTW4 (2013) for Free Page 3 FormTemplate

Determine the total number of allowances field as follows: 2022 connecticut annual reconciliation of. Web state tax withholding state code: Who must complete a registration application and file a withholding tax return. Withholding information for nonresidents who work in connecticut.

W4 Form 2023 Printable Employee's Withholding Certificate 2022 Edd Form

Withholding information for connecticut residents who work in another state. 2022 connecticut annual reconciliation of. Web state tax withholding state code: Who must complete a registration application and file a withholding tax return. 2022 connecticut annual reconciliation of withholding for nonpayroll amounts.

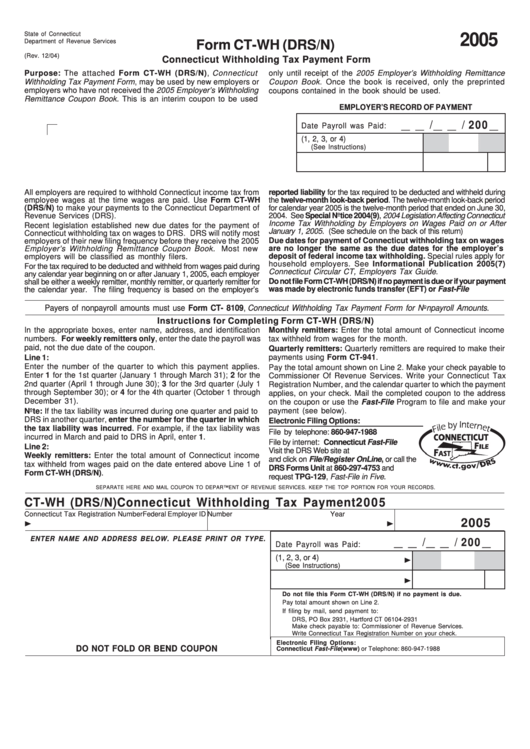

Form CtWh (Drs/n) Connecticut Withholding Tax Payment Form 2005

Withholding information for connecticut residents who work in another state. Determine the total number of allowances field as follows: Withholding information for nonresidents who work in connecticut. 2022 connecticut annual reconciliation of. 2023 connecticut withholding tax payment form for nonpayroll amounts.

Connecticut State Withholding Form 2021 2022 W4 Form

2022 connecticut annual reconciliation of. 2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code: A, b, c, d, or f. Who must complete a registration application and file a withholding tax return.

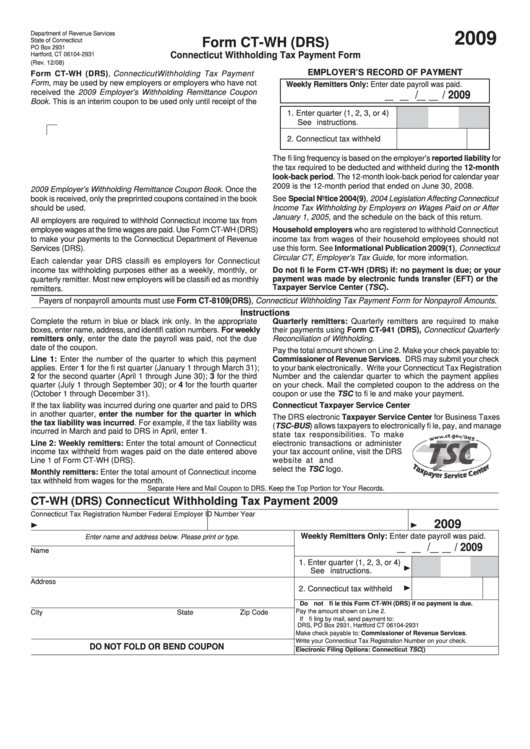

Form CtWh (Drs) Connecticut Withholding Tax Payment Form 2009

2023 connecticut withholding tax payment form for nonpayroll amounts. Web state tax withholding state code: 2022 connecticut annual reconciliation of. You are required to pay connecticut income tax as income is earned or received during the year. Withholding information for connecticut residents who work in another state.

2022 Connecticut Annual Reconciliation Of.

Web state tax withholding state code: You are required to pay connecticut income tax as income is earned or received during the year. Withholding information for connecticut residents who work in another state. Who must complete a registration application and file a withholding tax return.

2022 Connecticut Annual Reconciliation Of Withholding For Nonpayroll Amounts.

2023 connecticut withholding tax payment form for nonpayroll amounts. Withholding information for nonresidents who work in connecticut. Determine the total number of allowances field as follows: A, b, c, d, or f.