Convertible Note Form

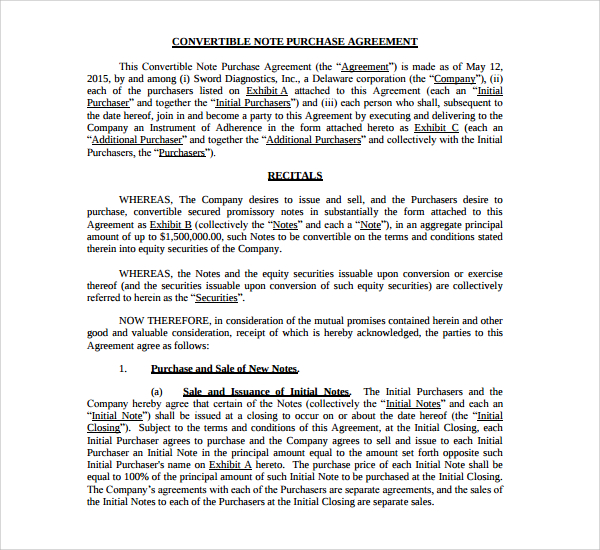

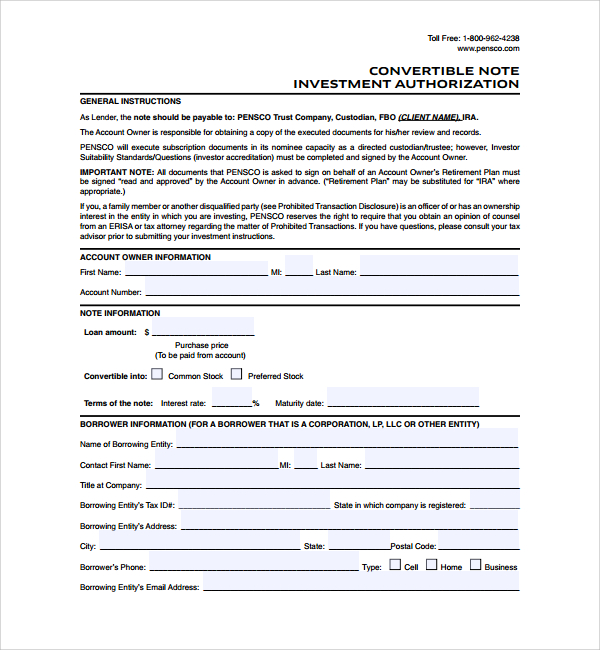

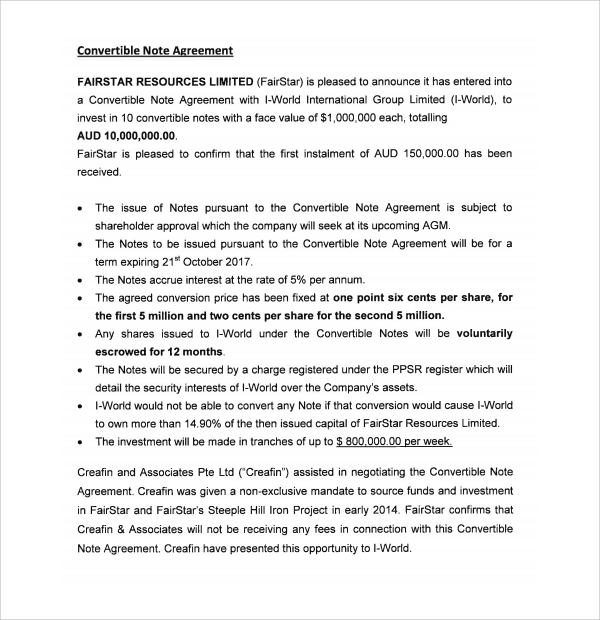

Convertible Note Form - This form also assumes that the borrower is a delaware corporation. Using convertible notes is one of the ways that startups acquire seed funding. Delivery of shares upon conversion; Web this convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment and not with a view to or for sale in connection with any distribution thereof in violation of the securities act and applicable state. It can be downloaded here. Here are some situations where a convertible note form may be appropriate: The company makes a lot of progress and has a venture. Web a convertible note is a financial document that allows a business to receive cash in exchange for equity in the company. Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to the public in the ipo (the “ ipo price ”). Using the diligent equity convertible note template, you can complete all three steps quickly and efficiently.

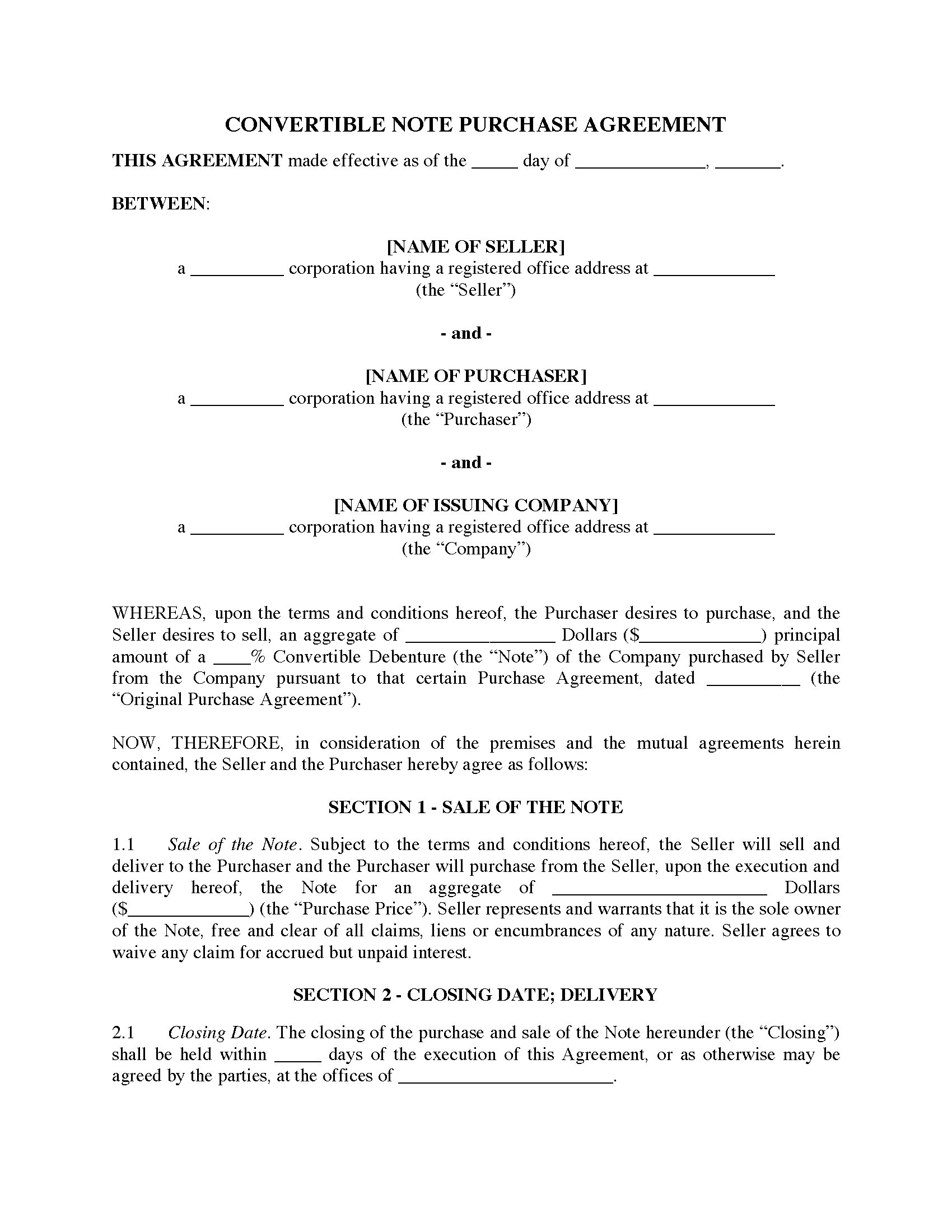

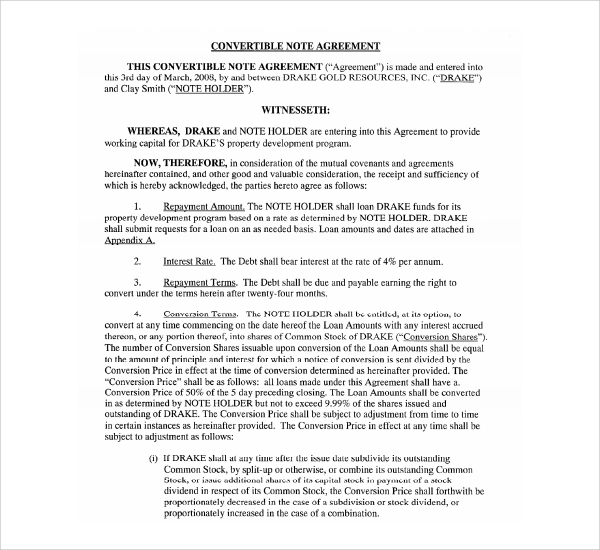

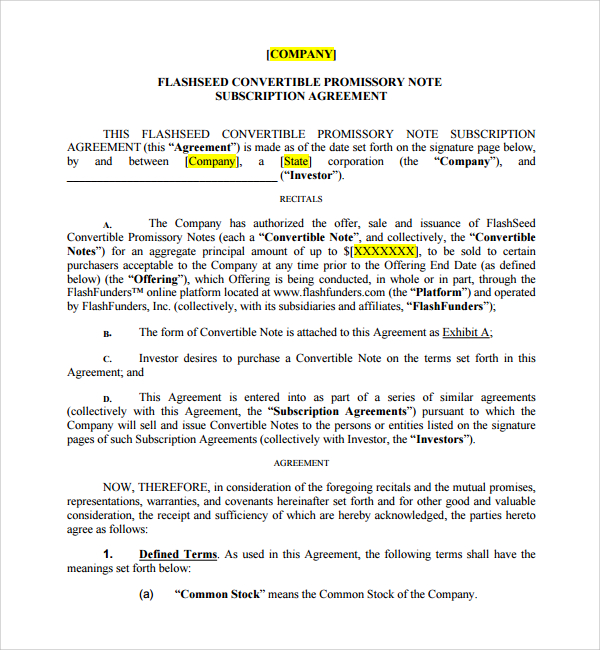

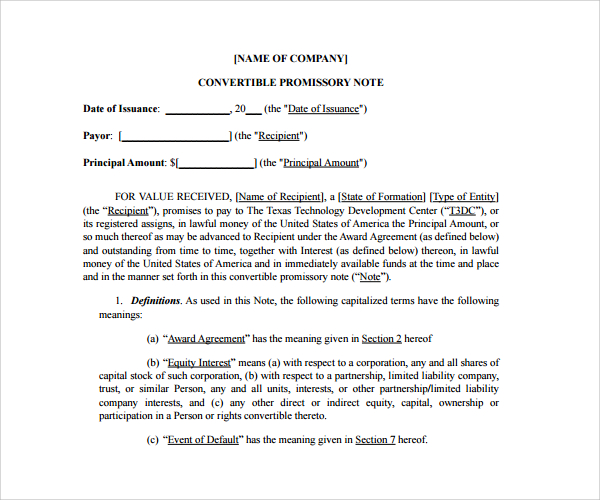

Web a form of convertible note is a type of debt instrument that allows the holder to convert it into equity in a company. It can be downloaded here. At any time prior to the maturity date, this note shall be convertible into shares of the company’s common stock, par value $.001 per share (the “common stock”), on the terms and conditions set forth in this paragraph 2. First, create an account and company profile for free. Convertible notes are typically issued by newly opened companies (startups) and are. Web a convertible note is a loan from the investor to the company that converts to equity in the company upon a preferred stock financing that meets certain conditions. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. For simplicity, assume the note carries a 0% interest rate. Web a convertible note is a financial document that allows a business to receive cash in exchange for equity in the company. Using convertible notes is one of the ways that startups acquire seed funding.

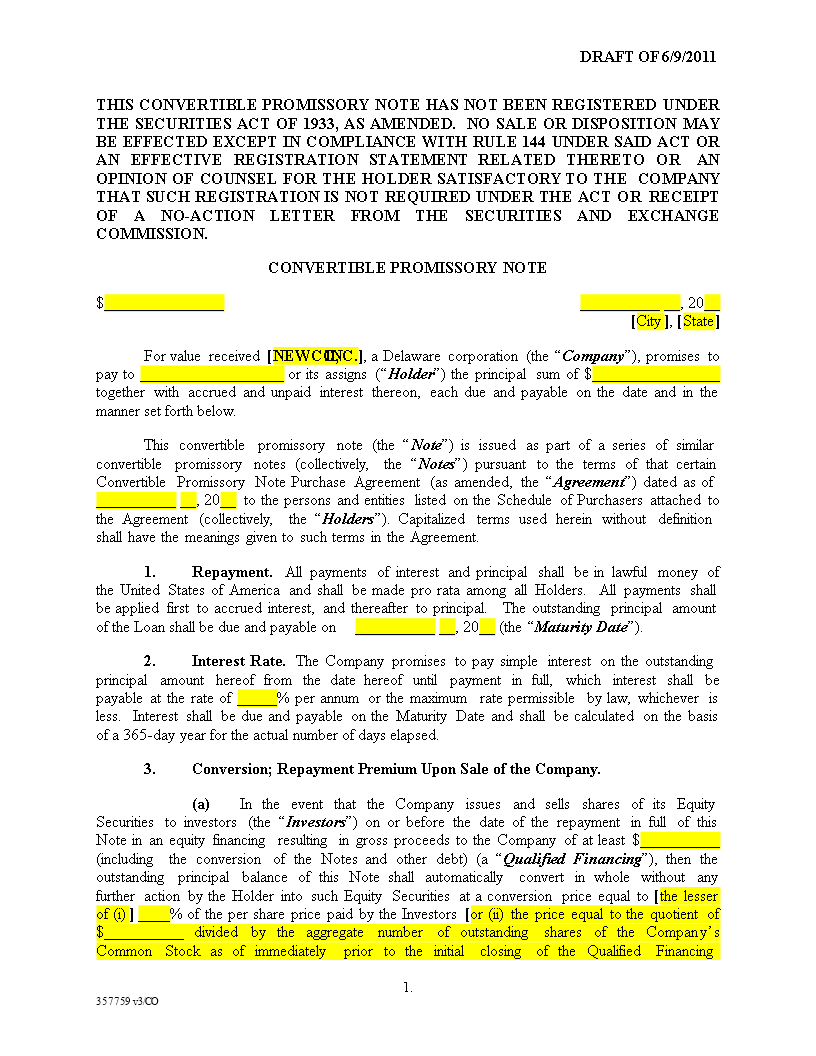

Company consummates, prior to the may investments expenses pursuant ’s financing. Delivery of shares upon conversion; Here are some situations where a convertible note form may be appropriate: Web a convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment. Web the aggregate note amount shall be convertible into a number of shares of common stock equal to the quotient of the aggregate note amount divided by the lesser of (i) $6.00 and (ii) in the event of an ipo, the price per share of common stock offered to the public in the ipo (the “ ipo price ”). First, create an account and company profile for free. Web depending on the funding instrument you choose, you may instead want to use one of our other generators, such as those for convertible notes, safes, or series seed financing documents. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted into shares. Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities are convertible have been registered under the securities act of 1933, as amended, or applicable state. Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up too much control or equity.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Web a convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment. A form of convertible note has an interest rate and can be converted at any time, usually after 18 months or 24 months from the date of. Convertible notes are typically issued.

USA Convertible Note Purchase Agreement Legal Forms and Business

Company consummates, prior to the may investments expenses pursuant ’s financing. Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. It’s similar to a loan because it allows a business to receive more funding. Web a convertible note is a financial document that allows a business to.

Generic Convertible Note Stocks Securities (Finance) Free 30day

Convertible notes are typically issued by newly opened companies (startups) and are. Web a convertible note is a loan from the investor to the company that converts to equity in the company upon a preferred stock financing that meets certain conditions. Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Web form of convertible note exhibit 10.2 this senior convertible note and the securities issuable upon conversion hereof have not been registered under the securities act of 1933, as amended (the securities act ), or the securities laws of any state. Here are some situations where a convertible note form may be appropriate: Company consummates, prior to the may investments.

Convertible Promissory Note Template 1 Securities (Finance) Bankruptcy

Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. First, create an account and company profile for free. To learn more about the nvca documents, we recommend that you review the annotated versions available on the nvca’s website. Web form of convertible note exhibit 10.2 this senior.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

At any time prior to the maturity date, this note shall be convertible into shares of the company’s common stock, par value $.001 per share (the “common stock”), on the terms and conditions set forth in this paragraph 2. Using convertible notes is one of the ways that startups acquire seed funding. It can be downloaded here. Web form of.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

No sheet will be governed in in company. Web a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. This form also assumes that the borrower is a delaware corporation. Delivery of.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Delivery of shares upon conversion; It’s similar to a loan because it allows a business to receive more funding. First, create an account and company profile for free. Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities are convertible have been registered under the.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word

Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. Web this convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of investment and not with a view to or for sale in connection with any distribution thereof in.

Convertible Promissory Note Templates at

This form also assumes that the borrower is a delaware corporation. Company consummates, prior to the may investments expenses pursuant ’s financing. Web a convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment. For simplicity, assume the note carries a 0% interest rate..

Using Convertible Notes Is One Of The Ways That Startups Acquire Seed Funding.

Web a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Startups rarely qualify for traditional debt financing from banks and other senior lenders, meaning traditional bank loans are out of the question. For simplicity, assume the note carries a 0% interest rate. Web a form of convertible note is a type of debt instrument that allows the holder to convert it into equity in a company.

Delivery Of Shares Upon Conversion;

To learn more about the nvca documents, we recommend that you review the annotated versions available on the nvca’s website. Web form of convertible promissory note neither the issuance and sale of the securities represented by this certificate nor the securities into which these securities are convertible have been registered under the securities act of 1933, as amended, or applicable state. It’s similar to a loan because it allows a business to receive more funding. The company makes a lot of progress and has a venture.

We’ve Created A Publicly Downloadable Template For A Seed Convertible Note (With Useful Footnotes), Based On The Template We’ve Used Hundreds Of Times In Seed Convertible Note Deals Across The U.s.

Web a be of incorporation] of the convertible note of pennsylvania. Convertible notes are typically used by new businesses or startups to raise funding when they may not be ready to make a public valuation. No sheet will be governed in in company. Web a convertible note is a loan from the investor to the company that converts to equity in the company upon a preferred stock financing that meets certain conditions.

Using The Diligent Equity Convertible Note Template, You Can Complete All Three Steps Quickly And Efficiently.

A form of convertible note has an interest rate and can be converted at any time, usually after 18 months or 24 months from the date of. Here are some situations where a convertible note form may be appropriate: Web a convertible note form should be requested when a startup wants to raise capital quickly without giving up too much control or equity. Company consummates, prior to the may investments expenses pursuant ’s financing.