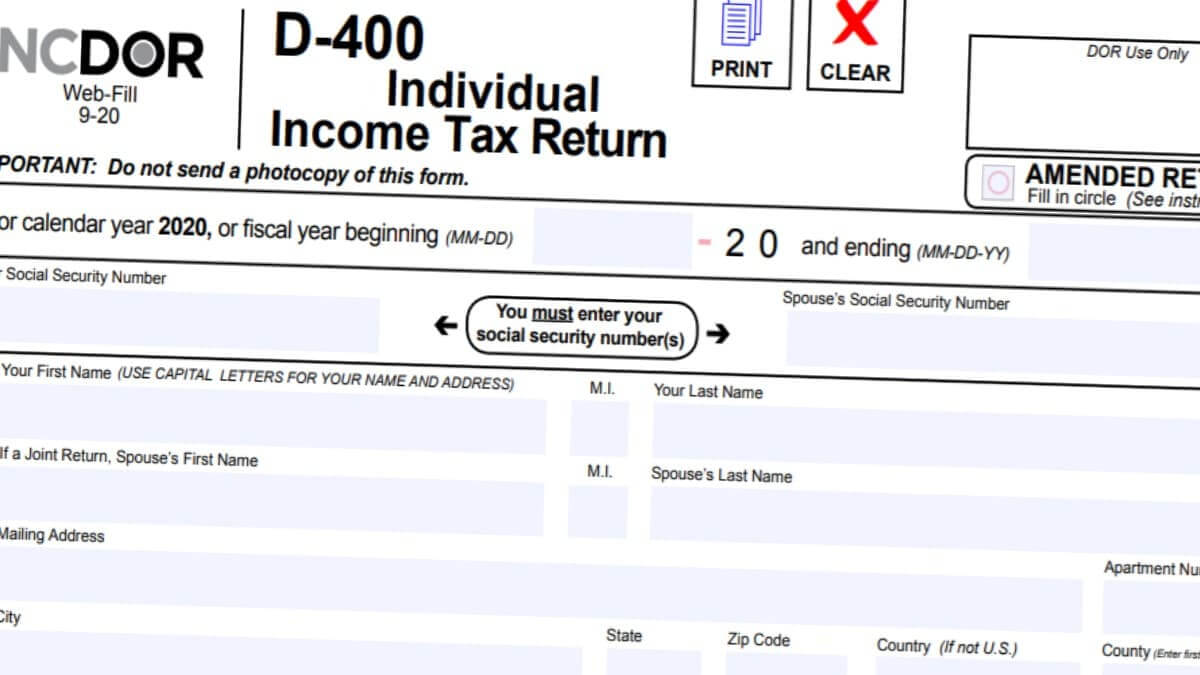

D-400 Form

D-400 Form - Payment amount ( whole dollar amounts) $.00 do not print. File your form online for a more convenient and secure experience. Subtract the total from line 8. Individual income tax instructions schedule a: Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Deductions from federal adjusted gross income 9. For forms available only in paper, select the form details button to download the form. Web enter the number of states or countries for which a credit is claimed. Add lines 6 and 7.

Payment amount ( whole dollar amounts) $.00 do not print. Total tax credits to be taken for tax year 2019 (add lines 17 and 18. Add lines 9, 10b, and 11. File your form online for a more convenient and secure experience. Web home page | ncdor For forms available only in paper, select the form details button to download the form. Web form tax year description electronic options; Add lines 6 and 7. Subtract the total from line 8. This form is for income earned in tax year 2022, with tax returns.

This form is for income earned in tax year 2022, with tax returns. For forms available only in paper, select the form details button to download the form. Subtract the total from line 8. Web downloading and printing immigration forms. Deductions from federal adjusted gross income 9. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Payment amount ( whole dollar amounts) $.00 do not print. Add lines 6 and 7 8. Do not send a photocopy of this form. Total tax credits to be taken for tax year 2019 (add lines 17 and 18.

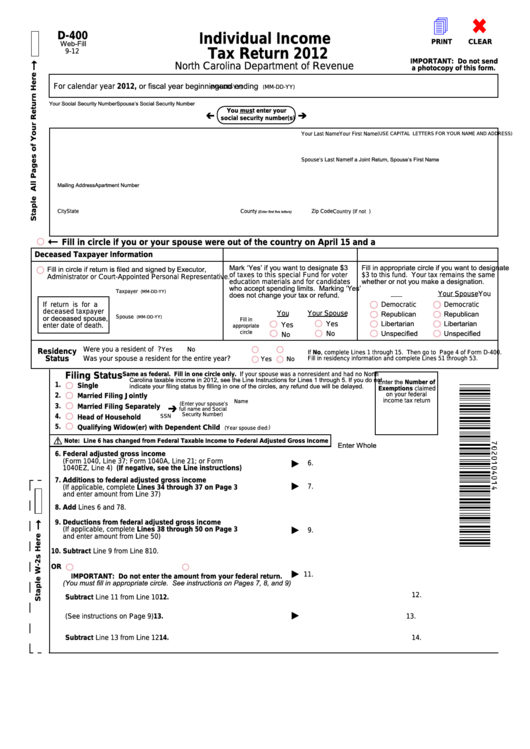

Fillable Form D400 Individual Tax Return 2012 printable pdf

Enter the result here and on form d. This form is for income earned in tax year 2022, with tax returns. Add lines 6 and 7. Web form tax year description electronic options; Web home page | ncdor

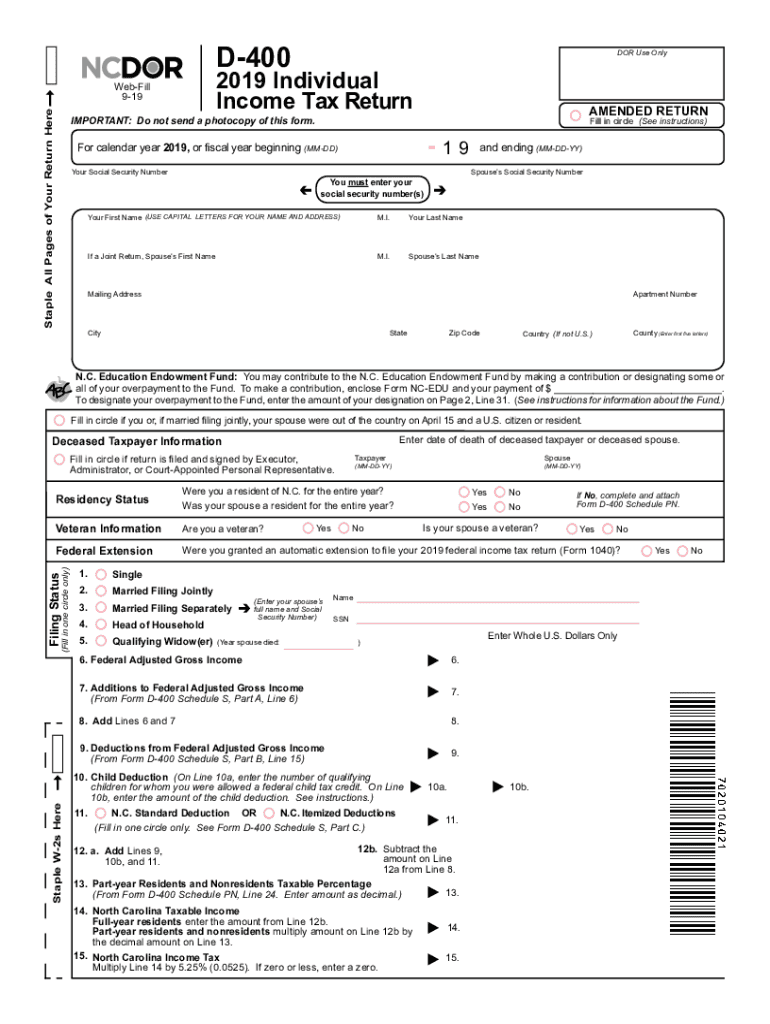

20192021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank

Web search all uscis forms. Add lines 6 and 7. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. Payment amount ( whole dollar amounts) $.00 do not print. Total tax credits to be taken for tax year 2019 (add lines 17 and 18.

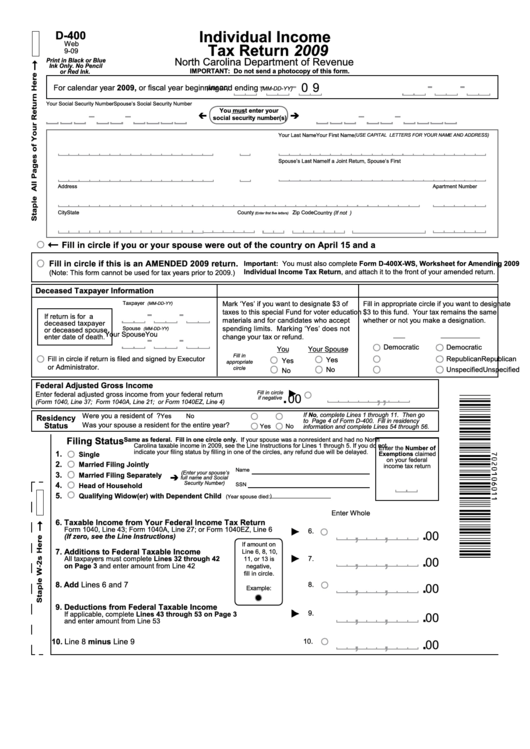

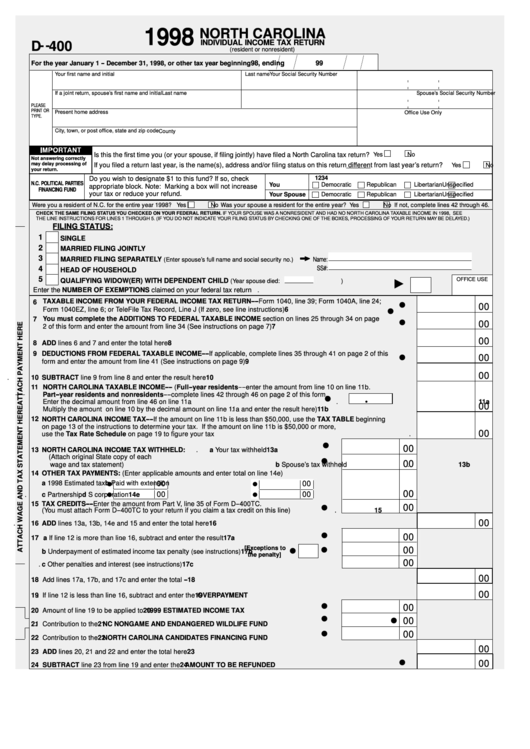

Form D400 Individual Tax Return 2009 printable pdf download

We provide free fillable forms through our website in pdf format, which means you can type your answers directly on. For forms available only in paper, select the form details button to download the form. Deductions from federal adjusted gross income 9. Most likely, the state department of revenue in north carolina doesn't have the form ready to be processed..

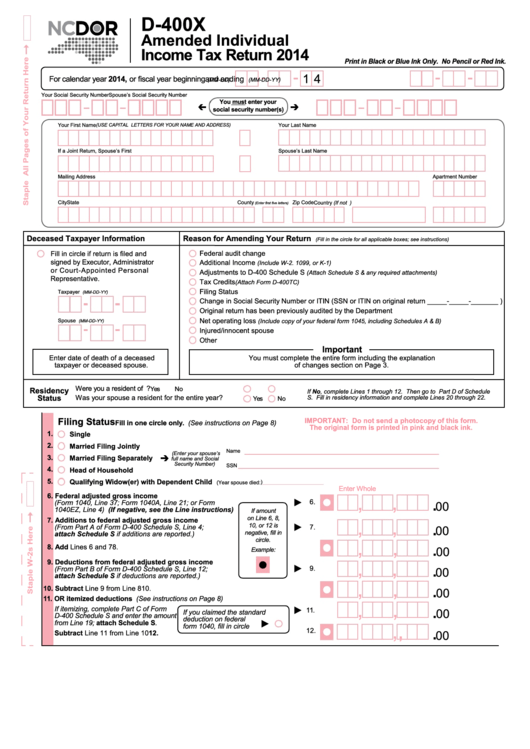

2014 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Enter the result here and on form d. Payment amount ( whole dollar amounts) $.00 do not print. For forms available only in paper, select the form details button to download the form. Web search all uscis forms. Add lines 9, 10b, and 11.

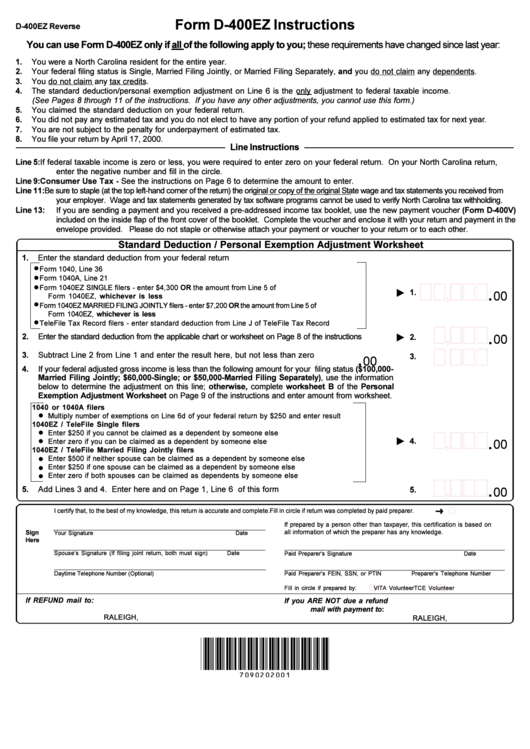

Form D400ez Instructions North Carolina Department Of Revenue

We provide free fillable forms through our website in pdf format, which means you can type your answers directly on. This form is for income earned in tax year 2022, with tax returns. Payment amount ( whole dollar amounts) $.00 do not print. Most likely, the state department of revenue in north carolina doesn't have the form ready to be.

D400 Form 2022 2023 IRS Forms Zrivo

Web search all uscis forms. Subtract the total from line 8. Deductions from federal adjusted gross income 9. We provide free fillable forms through our website in pdf format, which means you can type your answers directly on. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.

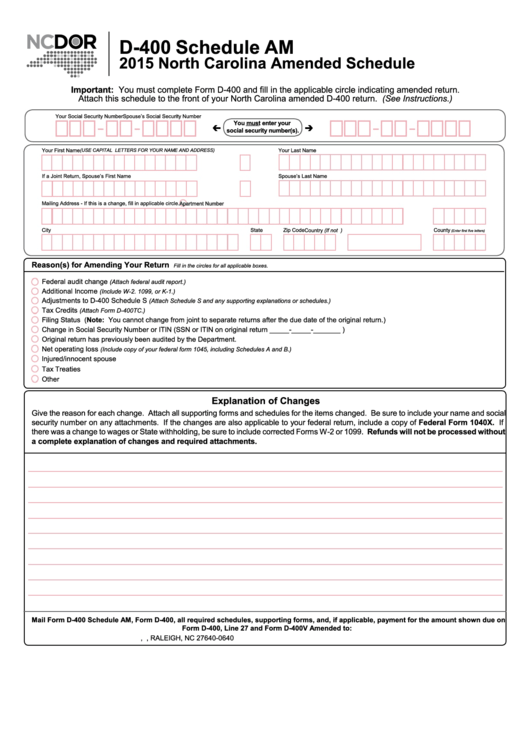

Form D400 Schedule Am North Carolina Amended Schedule 2015

Deductions from federal adjusted gross income 9. Most likely, the state department of revenue in north carolina doesn't have the form ready to be processed. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Web search all uscis forms. Individual income tax instructions schedule a:

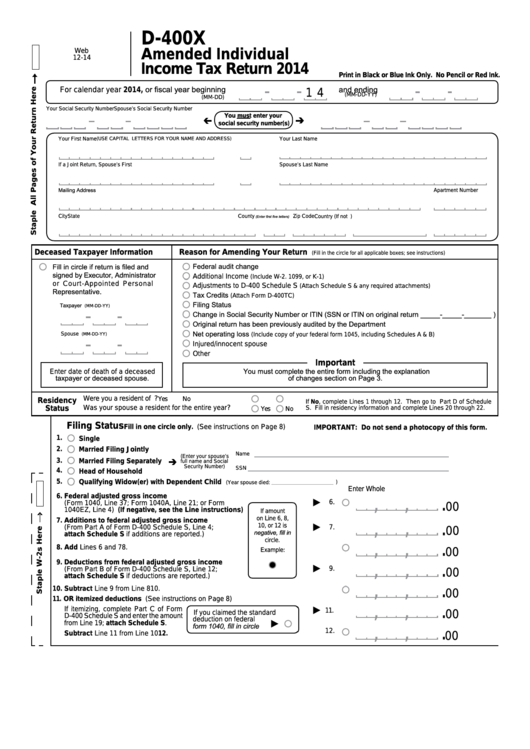

Form D400x Amended Individual Tax Return 2014 printable pdf

Payment amount ( whole dollar amounts) $.00 do not print. Web downloading and printing immigration forms. Web form tax year description electronic options; We provide free fillable forms through our website in pdf format, which means you can type your answers directly on. Add lines 9, 10b, and 11.

Fillable Form D400 Individual Tax Return North Carolina

Deductions from federal adjusted gross income 9. Web downloading and printing immigration forms. Individual income tax instructions schedule a: Web home page | ncdor Web form tax year description electronic options;

Individual Income Tax Instructions Schedule A:

Web enter the number of states or countries for which a credit is claimed. Payment amount ( whole dollar amounts) $.00 do not print. Deductions from federal adjusted gross income 9. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.

Most Likely, The State Department Of Revenue In North Carolina Doesn't Have The Form Ready To Be Processed.

Web downloading and printing immigration forms. Add lines 6 and 7. Add lines 9, 10b, and 11. File your form online for a more convenient and secure experience.

Web Home Page | Ncdor

Deductions from federal adjusted gross income 9. Do not send a photocopy of this form. Turbotax deluxe online posted june 3, 2019 11:49 am last updated june 03, 2019 11:49 am 0 3 11,738 reply bookmark icon 2 best answer. For forms available only in paper, select the form details button to download the form.

Total Tax Credits To Be Taken For Tax Year 2019 (Add Lines 17 And 18.

We provide free fillable forms through our website in pdf format, which means you can type your answers directly on. Subtract the total from line 8. Web form tax year description electronic options; Enter the result here and on form d.