Do Household Employers File Form 941

Do Household Employers File Form 941 - Instead, employers in the u.s. Connecticut, delaware, district of columbia, georgia,. Pay the amount you withhold to the irs with an additional 7.65% for your share of the taxes. If you have a household employee, like a nanny, you don’t need to file 941. An individual who has paid household employees. Web most businesses with employees have to file irs form 941 each quarter to report and calculate employment taxes. Web you must file form 941 unless you: Web home forms and instructions about publication 926, household employer's tax guide publication 926 will help you decide whether you have a household employee and, if. It only needs to be filed for years where payroll was processed for employees of a. Web you must file irs form 941 if you operate a business and have employees working for you.

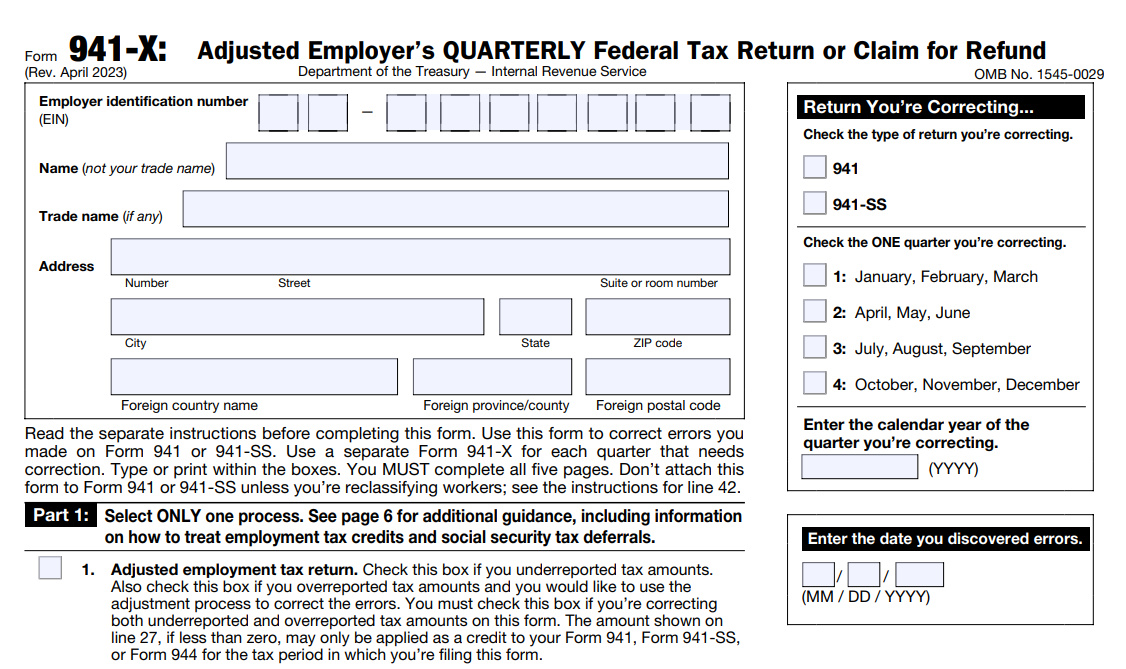

Web form 940 is used once per year to remit federal unemployment insurance taxes. Territories will file form 941,. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Connecticut, delaware, district of columbia, georgia,. Web you must file irs form 941 if you operate a business and have employees working for you. Some states have analogs to form 941 that you. It only needs to be filed for years where payroll was processed for employees of a. Web you must file form 941 unless you: Web mailing addresses for forms 941. Web the irs states that form 941 should not be used for reporting taxes withheld and wages paid to household employees.

Web in publication 926, household employer's tax guide. Web each calendar quarter almost all employers who pay wages subject to tax withholding must file form 941, employer's quarterly federal tax return, unless you receive an irs. Web you must file irs form 941 if you operate a business and have employees working for you. Employ a household employee (e.g., nanny) have farm employees (e.g.,. Web the irs states that form 941 should not be used for reporting taxes withheld and wages paid to household employees. Web the following employers don’t need to file form 941: Web businesses that hire farm workers or household employees, such as a maid, also don’t need to file form 941 (but do need to file schedule h from form 1040 ). Web of household workers you pay $2,600 or more in cash wages in 2023. Web form 940 is used once per year to remit federal unemployment insurance taxes. Web home forms and instructions about publication 926, household employer's tax guide publication 926 will help you decide whether you have a household employee and, if.

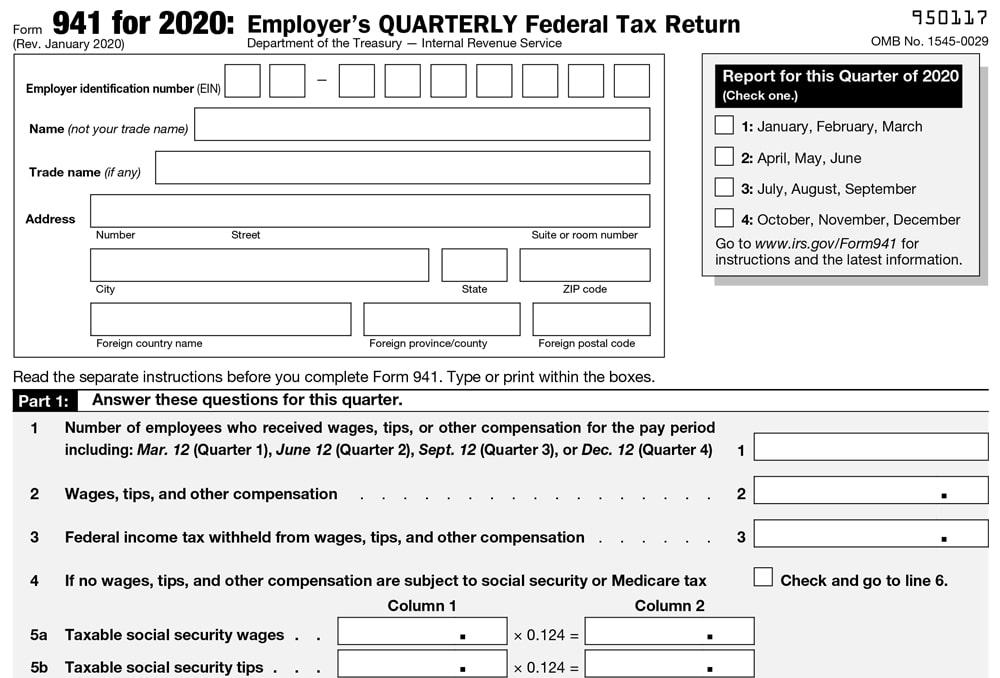

File 941 Online Efile 941 for 4.95 Form 941 for 2020

Instead, report the tax withholding annually on the. Web most businesses with employees have to file irs form 941 each quarter to report and calculate employment taxes. If you pay your employee's. Employ a household employee (e.g., nanny) have farm employees (e.g.,. Web a schedule h should be filed annually, along with the employer’s tax return.

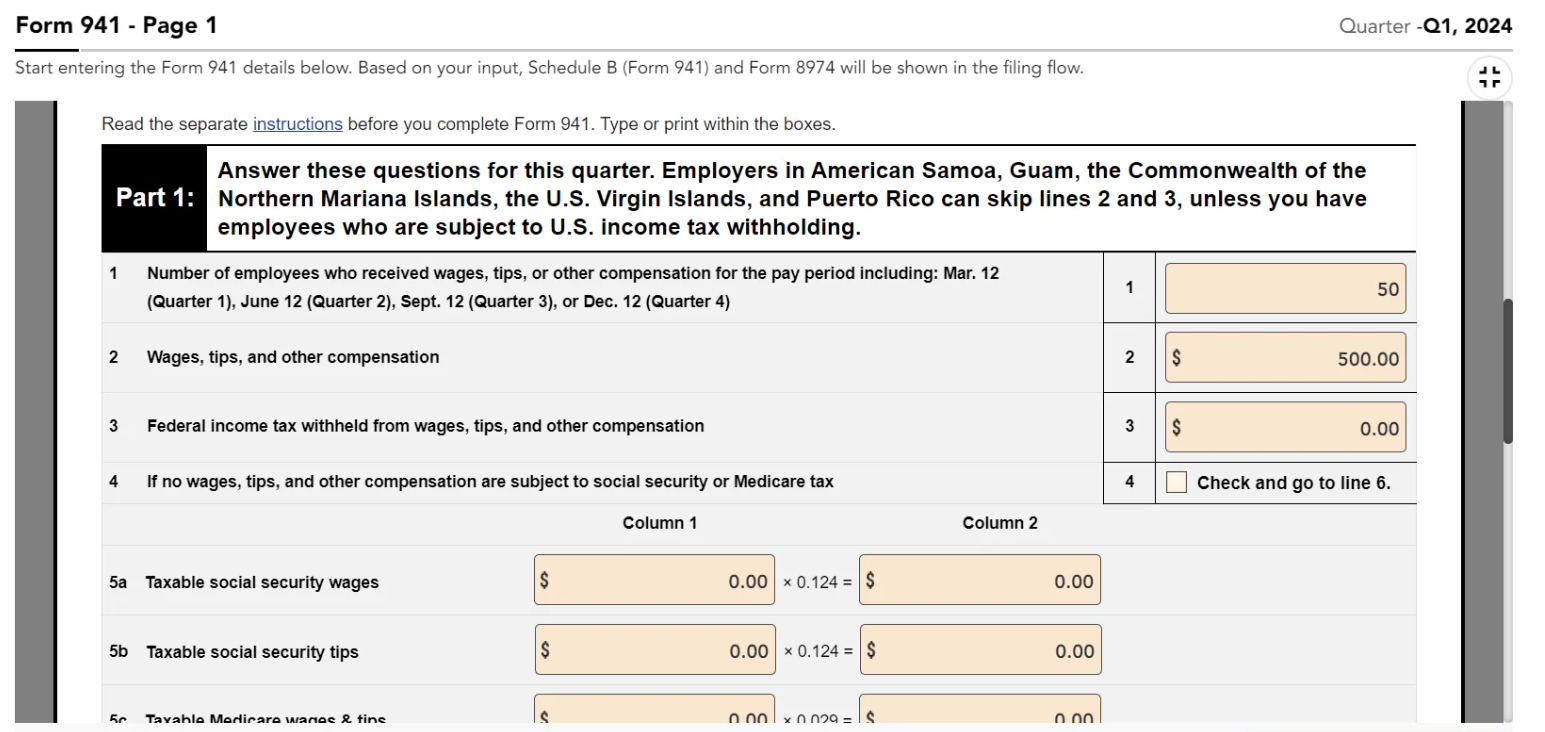

File 941 Online How to File 2023 Form 941 electronically

Web you must file irs form 941 if you operate a business and have employees working for you. Web seasonal employers do not have to file a form 941 for the quarters in which they have no tax liability. Web businesses that hire farm workers or household employees, such as a maid, also don’t need to file form 941 (but.

Efile Form 941 Online For 2023 Quarterly Form 941 Online

Web seasonal employers do not have to file a form 941 for the quarters in which they have no tax liability. If you have a household employee, like a nanny, you don’t need to file 941. If you pay your employee's. Instead, employers in the u.s. Web you must file form 941 unless you:

Efile Form 941 Online For 2023 Quarterly Form 941 Online

Web seasonal employers do not have to file a form 941 for the quarters in which they have no tax liability. Connecticut, delaware, district of columbia, georgia,. Territories will file form 941,. Employ a household employee (e.g., nanny) have farm employees (e.g.,. Web you must file form 941 unless you:

You Need To File Form 941 for 2019 Before It’s Too Late Blog TaxBandits

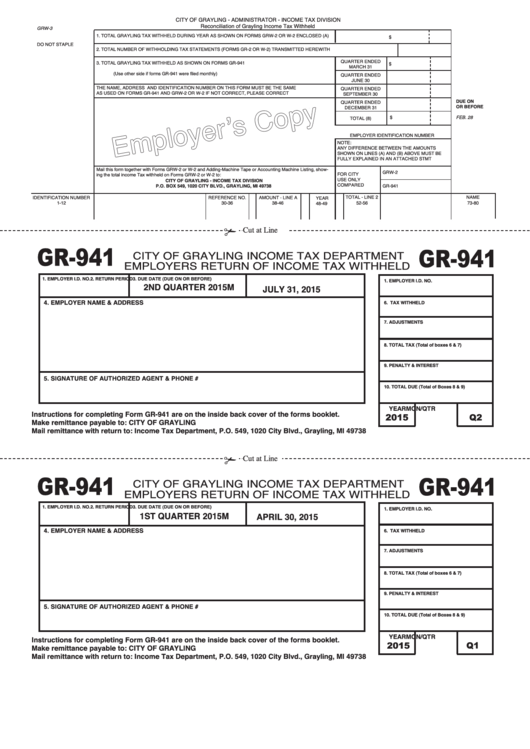

Pay the amount you withhold to the irs with an additional 7.65% for your share of the taxes. Web in publication 926, household employer's tax guide. Web each calendar quarter almost all employers who pay wages subject to tax withholding must file form 941, employer's quarterly federal tax return, unless you receive an irs. Web mailing addresses for forms 941..

How and when to file Form 941, the employer's quarterly payroll tax

Web the irs states that form 941 should not be used for reporting taxes withheld and wages paid to household employees. Web a schedule h should be filed annually, along with the employer’s tax return. Employers of household employees usually don’t file a. They don’t need to file form 941 for any quarter where they haven’t paid their. Connecticut, delaware,.

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form

Web of household workers you pay $2,600 or more in cash wages in 2023. Web you must file irs form 941 if you operate a business and have employees working for you. Web each calendar quarter almost all employers who pay wages subject to tax withholding must file form 941, employer's quarterly federal tax return, unless you receive an irs..

IRS Tax Form 941 Instructions & Information (including Mailing Info)

Employers of household employees usually don’t file a. Web the irs states that form 941 should not be used for reporting taxes withheld and wages paid to household employees. Some states have analogs to form 941 that you. Web the form requires employers to report how many employees they have, and the amounts withheld from each employee’s pay, including federal.

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form

Web you must file form 941 unless you: Web you must file irs form 941 if you operate a business and have employees working for you. If you pay your employee's. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the form requires employers to report how.

Form Gr941 Employers Return Of Tax Withheld City Of

Instead, employers in the u.s. Web of household workers you pay $2,600 or more in cash wages in 2023. Web the following employers don’t need to file form 941: Connecticut, delaware, district of columbia, georgia,. Employ a household employee (e.g., nanny) have farm employees (e.g.,.

Web The Irs States That Form 941 Should Not Be Used For Reporting Taxes Withheld And Wages Paid To Household Employees.

“families that hire household employees are also required to withhold and pay. Web form 940 is used once per year to remit federal unemployment insurance taxes. Connecticut, delaware, district of columbia, georgia,. Web you must file irs form 941 if you operate a business and have employees working for you.

Web The Following Employers Don’t Need To File Form 941:

Pay the amount you withhold to the irs with an additional 7.65% for your share of the taxes. Employers of household employees usually don’t file a. Social security and medicare taxes apply. Web mailing addresses for forms 941.

Web Seasonal Employers Do Not Have To File A Form 941 For The Quarters In Which They Have No Tax Liability.

An individual who has paid household employees. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Instead, employers in the u.s. Web businesses that hire farm workers or household employees, such as a maid, also don’t need to file form 941 (but do need to file schedule h from form 1040 ).

Web Most Businesses With Employees Have To File Irs Form 941 Each Quarter To Report And Calculate Employment Taxes.

Web in publication 926, household employer's tax guide. Web people with household employees. If you pay your employee's. It only needs to be filed for years where payroll was processed for employees of a.